Today’s Animal Spirits is brought to you by Nasdaq and Composer:

See here for daily news and insights from Nasdaq.

See here for more info on Composers’ new one-click, systematically managed portfolio

On today’s show we discuss:

- Fun stats from Nick Colas

- Distribution of household wealth in the US since 1989

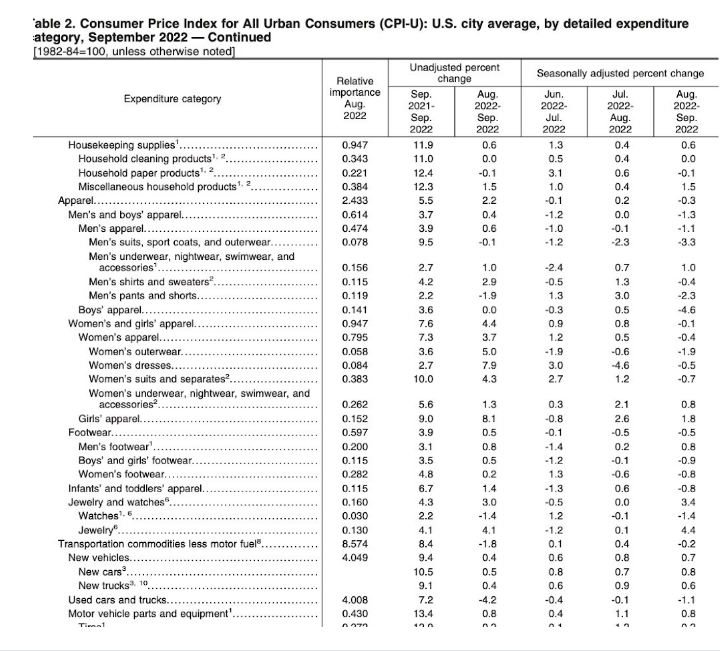

- Yardeni on S&P profit margins

- Plans for a 24-story tower in Grand Rapids canceled

- Rich millennials have lost confidence in the stock market

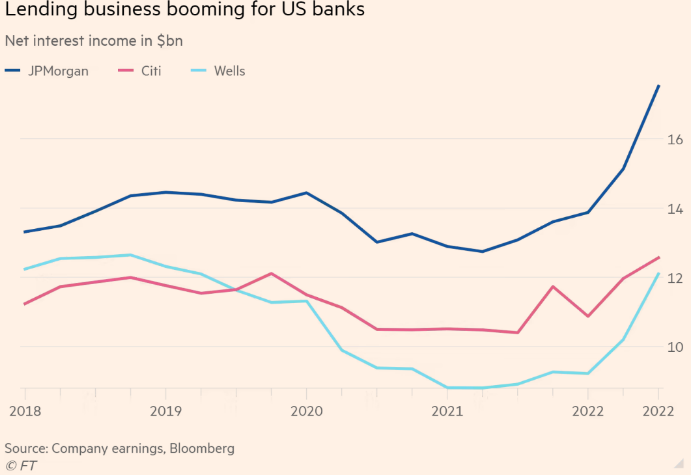

- JPM earnings

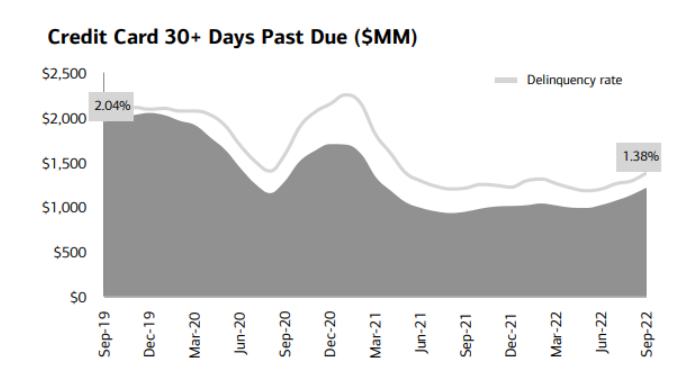

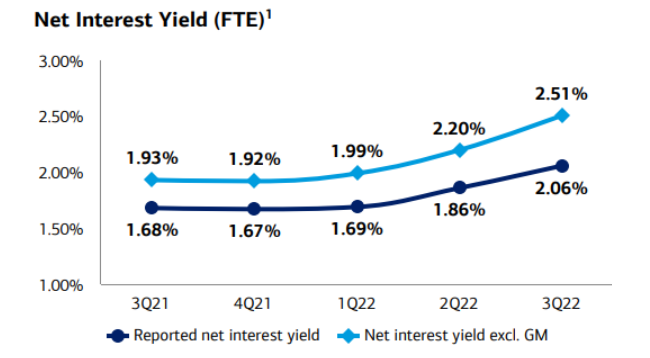

- BAC earnings

- BLK earnings

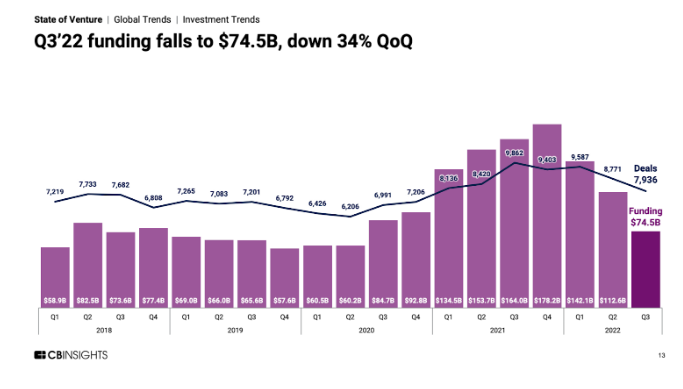

- US bank earnings

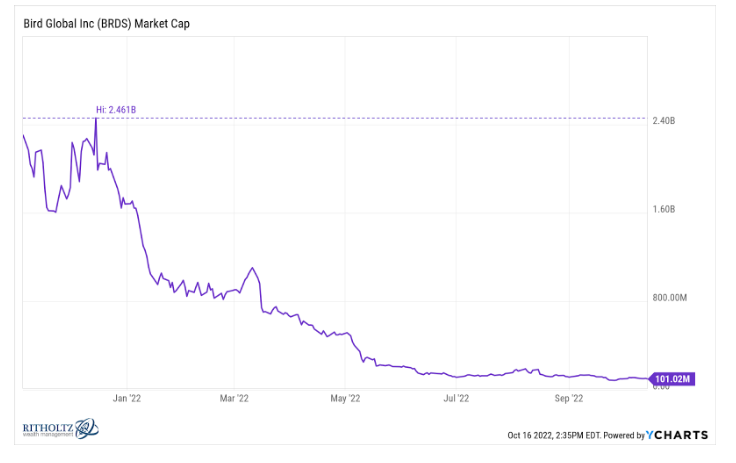

- Bird founders stake worth less than Miami mansion

- 8.7% COLA for 2023, largest increase in 40 years

Listen here:

Recommendations:

- Bad Sisters

- The Offer

- The Firm

- Haute Tension

- Naked Gun Reboot

- Halloween Ends

- Candyman

- IT

- Hellraiser

- This is Halloween lyrics

Charts:

Tweets:

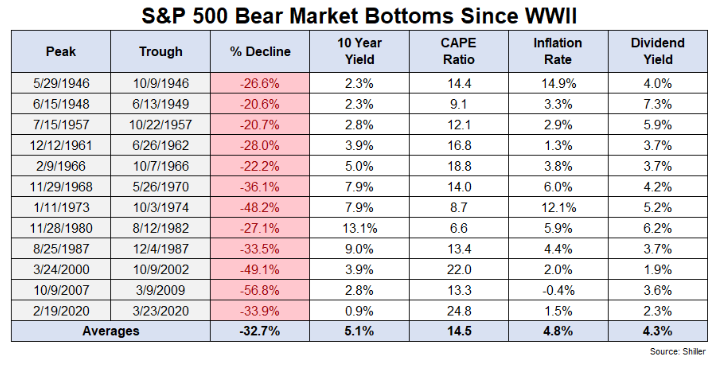

The S&P 500 is on track to open lower by more than 1%.

After 6 consecutive losses.

And at a 52-week low.

Since the inception of the futures market in 1982, only one other day matches this level of carnage: October 10, 2008.

— SentimenTrader (@sentimentrader) October 13, 2022

Ooph pic.twitter.com/532Unlzckr

— Jake (@EconomPic) October 14, 2022

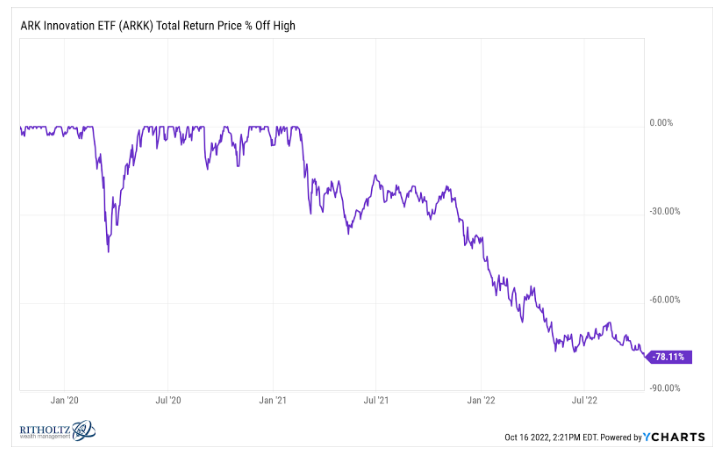

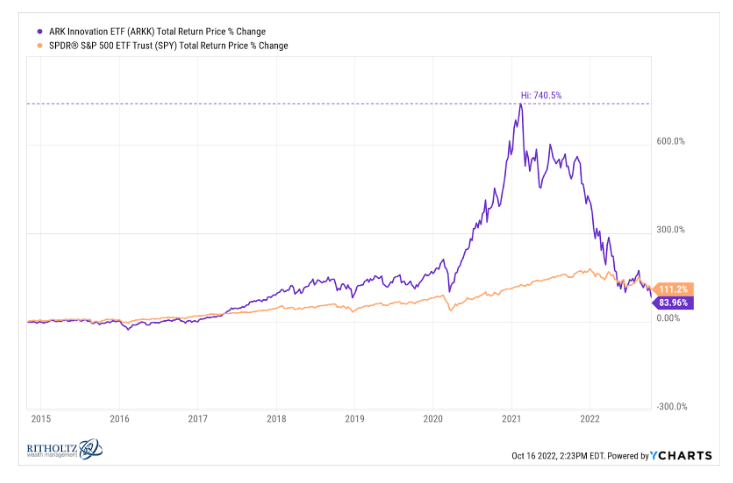

Got request for latest $ARKK flows. Brace yourself:

1mo: +$100m

6mo: +$870m

YTD: +$1.2b (Top 3% among all ETFs)

1Yr: +$320m— Eric Balchunas (@EricBalchunas) October 11, 2022

Treasury ETFs have now taken in $111b YTD, which is double the old ann record. They now account for 26% of all ETF flows despite making up 5% of the assets. All this and yet nearly every one of them is down on year AND the Fed isn't done hiking right in their face. Brutal. pic.twitter.com/HjOiPLpz7w

— Eric Balchunas (@EricBalchunas) October 17, 2022

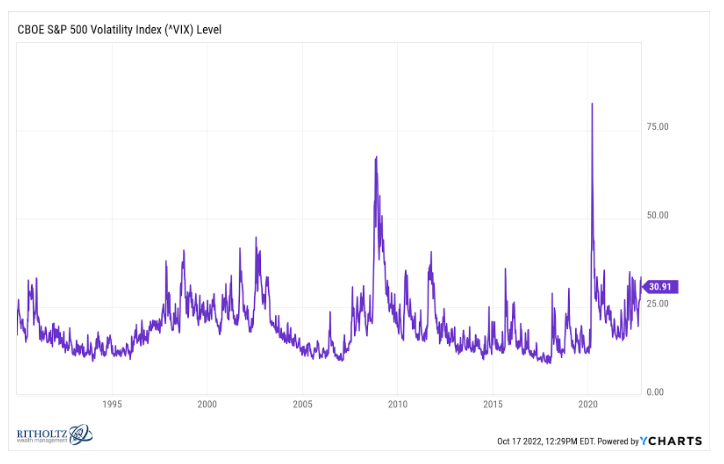

I don't think people really appreciate what's happening in the options market right now.

Last week, retail traders bought $19.9 billion worth of puts to open. They bought only $6.5 billion in calls to open.

This is the first time in history that puts were 3x calls. pic.twitter.com/GR2apNfFtb

— Jason Goepfert (@jasongoepfert) October 16, 2022

Predictions are hard, even for the Fed. pic.twitter.com/3sq76ZR5az

— Bespoke (@bespokeinvest) October 1, 2022

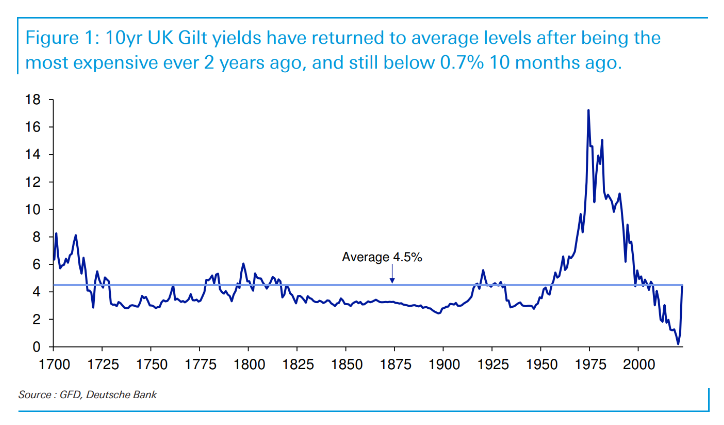

10-year Treasury yields have risen for 11 straight weeks- the longest stretch since at least **1978** – JPM pic.twitter.com/djGNEM5KLs

— Gunjan Banerji (@GunjanJS) October 15, 2022

MORGAN STANLEY: If rates fall ahead of a decline in inflation (which we expect), “it will give legs to the rally that began last Thursday .. We think 4000 is as good a guess as any and would not rule out another attempt to re-take the 200-day moving average (~4150).” [Wilson] pic.twitter.com/DSNA7KyTmb

— Carl Quintanilla (@carlquintanilla) October 17, 2022

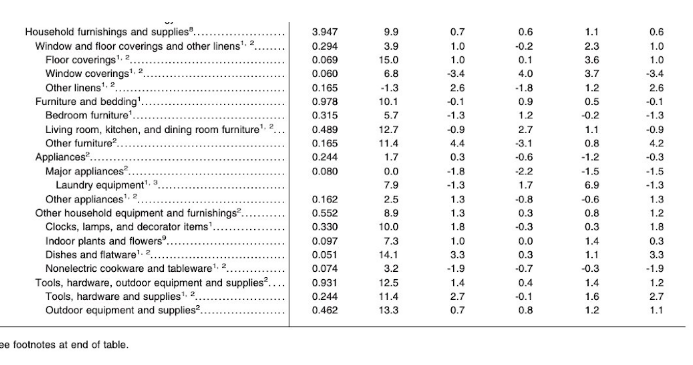

It's striking how much variance there is in the inflation trend for core goods. Significant deflation for some items (mens' suits and sportcoats, down 3.3%!), still high inflation for others (jewelry +4.4%).

Just all over the map, presumably reflecting idiosyncratic dynamics. pic.twitter.com/zGrFwg1gzT

— Neil Irwin (@Neil_Irwin) October 13, 2022

Core consumer prices in the United States increased 6.60 percent in September of 2022 over the same month in the previous year. https://t.co/fyCQEpt5lS pic.twitter.com/NF5KMsJuUS

— TRADING ECONOMICS (@tEconomics) October 13, 2022

The National Average Wage Index increased to $60,575.07 in 2021, up 8.89% from $55,628.60 in 2020 (used to calculate contribution base). This was the largest percentage increase in wages since the early '80s.

This is used to adjust the contribution base (up to $160,200 in 2023).

— Bill McBride (@calculatedrisk) October 13, 2022

There it is! But I would be cautious about over-interpreting this headline decline. It's driven by a scorching 7.4% in June rolling out of the three-month average. https://t.co/z3MN6llzK1

— Nick Bunker (@nick_bunker) October 13, 2022

Here’s my basic reasoning on why the Fed should slow or pause here. We have no idea what 7% mortgage rates will do to housing and it’s gonna take a year for that to fully filter thru.

The Fed could be creating a legitimate housing crisis here and we won’t know it for years. https://t.co/ElVrwdkHR2

— Cullen Roche (@cullenroche) October 12, 2022

6. Median deposits are decreasing in the lower income segments according to $JPM: pic.twitter.com/cw3bqkzDvf

— Quartr (@Quartr_App) October 17, 2022

"You see it in our numbers."

7. As we shared earlier today, $JPM's Jamie Dimon sees very strong consumer spending: pic.twitter.com/AkR7lrgJ4b

— Quartr (@Quartr_App) October 17, 2022

https://twitter.com/tsoh_investing/status/1582053309271093252?s=12&t=xnRuZ5B50aa9CuSzIzJ2WQ

New: Netflix’s ad supported version will launch in early November.

It will cost $6.99 a month in the U.S.

Ads will be 15 or 30 seconds.

They’ll play before and during shows.

On average, there will be 4 to 5 minutes or ads per hour.

It initially launches in 12 countries.

— Jon Erlichman (@JonErlichman) October 13, 2022

I have some thoughts… the VR headsets are coming. pic.twitter.com/6ebMWrXMNj

— Marques Brownlee (@MKBHD) October 14, 2022

I mean, this is absolutely bonkers.

A bunch of requests for products after listening to this:https://t.co/Hwd15bfq11 pic.twitter.com/eVUvJb2Cci

— Packy McCormick (@packyM) October 11, 2022

The LA Clippers are launching a streaming service — a first for the NBA.

"ClipperVision" will feature six live viewing options and cost $199.99 for 74 games this season — about $17 a month. pic.twitter.com/ED581ctHNI

— Front Office Sports (@FOS) October 17, 2022

I enjoyed HALLOWEEN ENDS. It doesn't reinvent the wheel, but it's–gasp!–surprisingly character driven.

— Stephen King (@StephenKing) October 13, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: