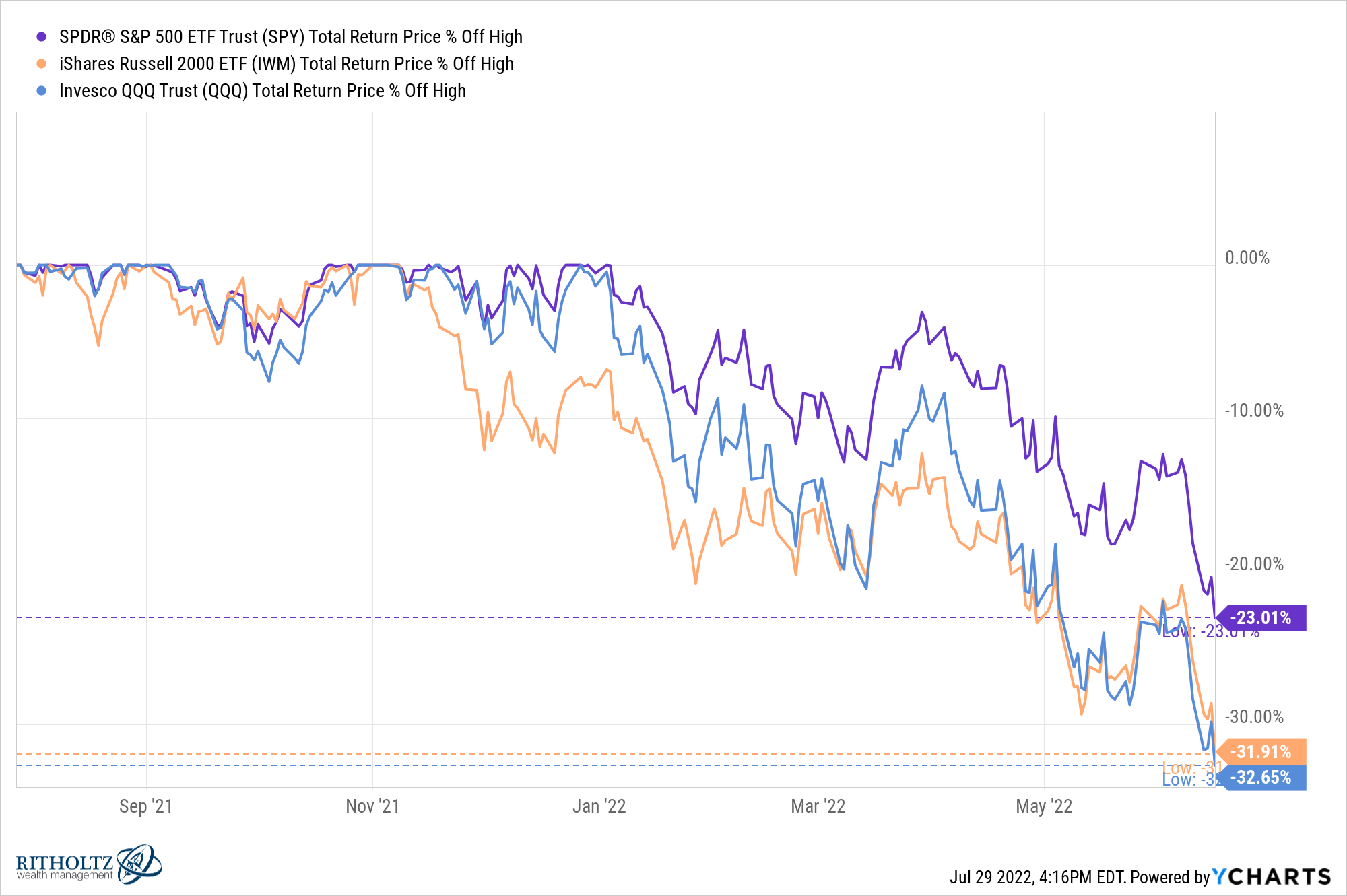

As of the close of the trading day on June 16, 2022, the S&P 500 was down 23% from its all-time highs:

The Russell 2000 Index of small cap stocks and the Nasdaq 100 were both down nearly 32% and 33%, respectively, from their highs.

That’s a pretty decent bear market.

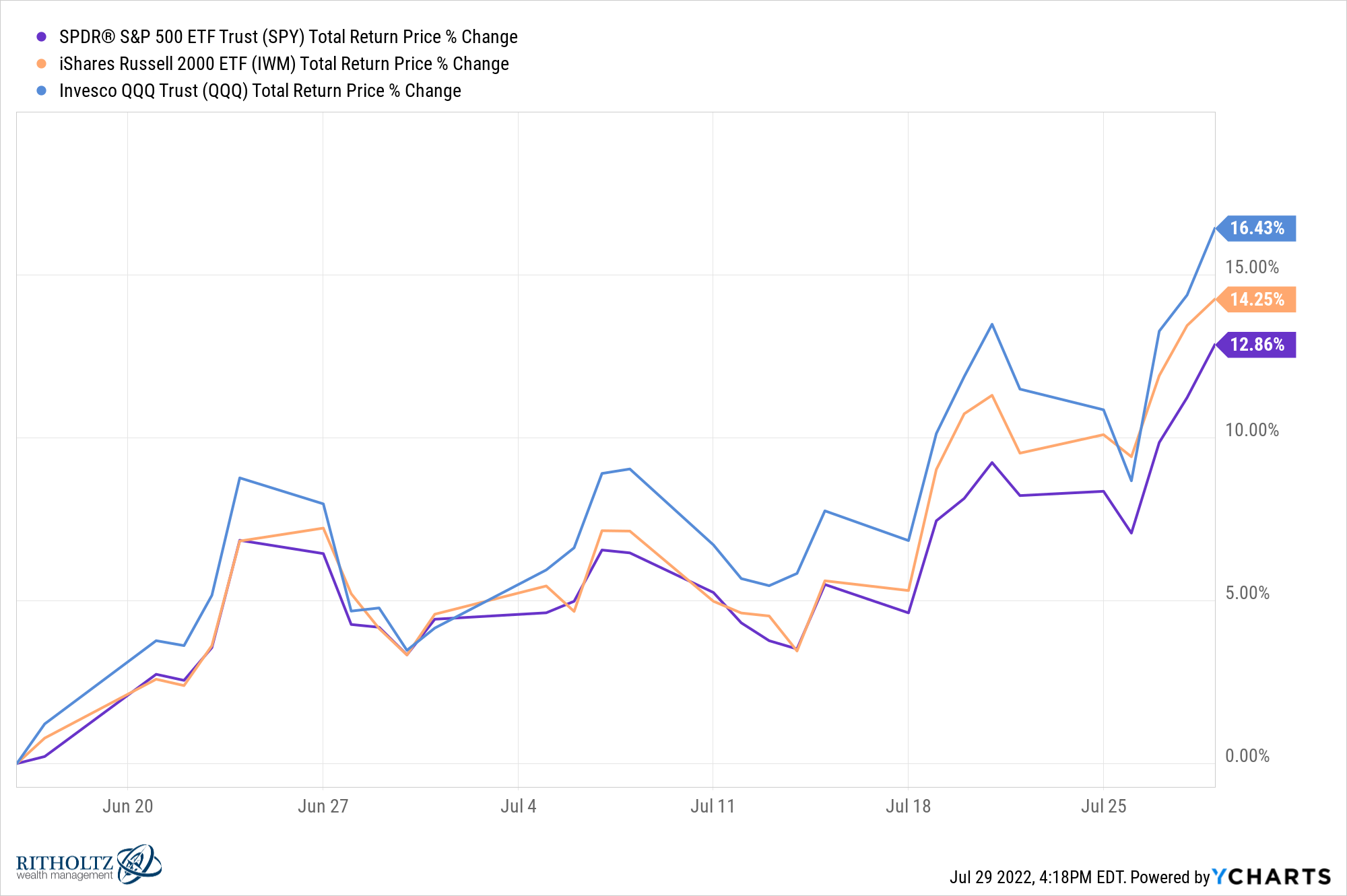

Since that day, the S&P 500 is up 13%. The Russell 2000 has shot up 14% while the Nasdaq 100 has bounced 16%.

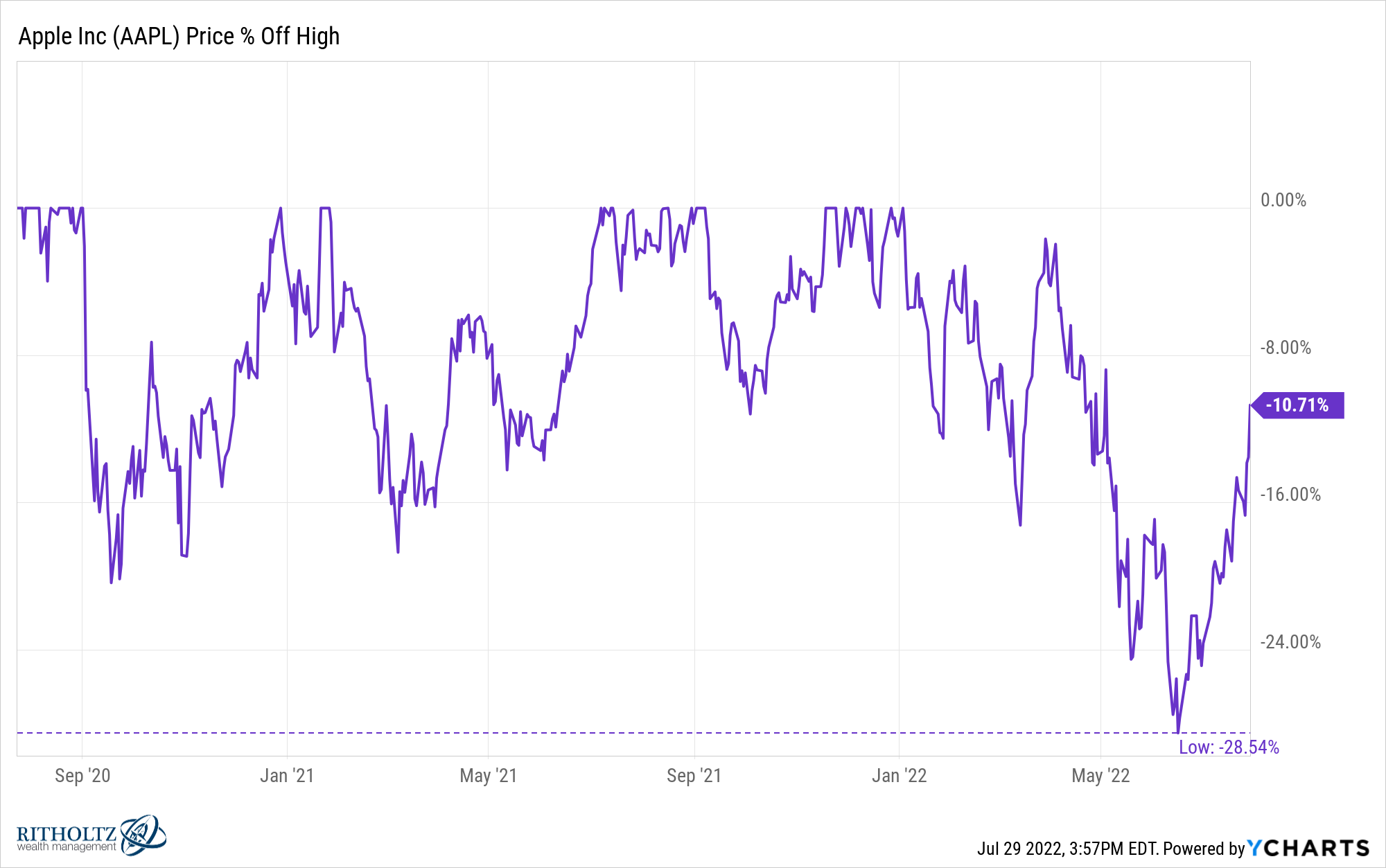

Apple, the biggest stock in the S&P 500, is now just 10% or so off its highs:

It was down almost 29% at its worst point in this sell-off. The stock is up 25% in the past 6 weeks or so.

The S&P 500 is now down 13% on the year and 6% over the past one year period, which almost feels like a win considering what investors have lived through.

There was little news or fanfare on that day which would have signaled the stock market was putting in a bottom.

So was that a bottom or THE bottom?

Let’s look at both sides of the argument here since no one knows for sure.

Here’s the argument for the middle of June marking THE bottom for this bear market:

- Maybe the stock market is pricing in peak inflation.

- Maybe it’s pricing in the Fed pulling off a soft landing or slowing the pace of interest rate hikes.

- Economic output is slowing but the labor market remains strong even in the face of four-decade high inflation.

- Earnings numbers for the biggest companies remain strong.

- Even if we are in a recession or we go into a recession in the coming months, it is likely to be mild and the stock market is forward-looking.

- The stock market has already priced in all of the risks that are now plain as day since everyone knows what they are.

Or maybe this is simply a dead cat bounce within the context of a broader bear market that has more pain to come.

Here are the talking points for the dreaded dead cat bounce that rolls over at some point:

- Even if inflation has already peaked it could be stickier than we think.

- Fiscal and monetary policy is now tighter than it’s been in years.

- The Fed could overdo it on interest rate hikes and cause more pain in the economy than they realize.

- The housing market, which makes up nearly 20% of GDP, could slow substantially from higher rates.

- The labor market is a lagging indicator that will likely slow in the coming months.

- If we do go into a recession it’s possible it becomes worse than anticipated from some exogenous shock to the system.

The prosecution and the defense each make compelling arguments.

Markets are always hard to predict but the current environment is one of the most challenging I can remember. There are so many conflicting data points, narratives and opinions right now that it’s difficult to have any clarity on the present, let alone what happens in the future.

This is likely the weirdest economy any of us have ever seen or will ever see again in our lifetimes. Covid crashed the economy, then we had all of that stimulus give us a sugar high and now comes the hangover.

We just don’t know if this is the type of hangover that simply requires some greasy food to get over or if it’s a Las Vegas hangover where you feel like crap for 3 days afterward.

Some people think higher inflation and rising rates are going to lead to a system-resetting crash. Maybe stock market investors need to suffer more to pay for the sins of the blow-off top.

Others think the Fed has already done enough to cool inflation and the effects of the pandemic are finally wearing off enough to create a softer landing than the doom and gloom crowd assumes.

I wish I had an answer for you.

I wouldn’t be surprised to see more discomfort ahead caused by a misstep from the Fed. There are no useful historical playbooks for this economic environment. The potential for a policy error has probably never been higher.

I also wouldn’t be surprised if the stock market heads back to new all-time highs next year right as the economy falls into a recession. Wouldn’t that be the icing on the cake for the weirdest, most confusing economic environment we’ve ever seen?

The only thing that really matters for the markets in the short-term is whether things are getting better or worse and how much of those changes are already priced in.

It would be nice if the stock market offered an all-clear signal that allowed investors to know when the bottom is in for real. Alas, bottoms are only known with the benefit of hindsight.

The good news is I have yet to find an investment plan where its success or failure is predicated on your ability to predict tops and bottoms in the stock market.

No one can do it on a consistent basis.

And even if you had a set of indicators that gave you confidence your ability to predict the future based on the past, the current environment is unlike anything we’ve ever seen before.

Investing is an inherently risky endeavor. Sometimes that risk lasts a long time and sometimes it’s over in a hurry.

Investing for the long haul requires preparation for a wide range of outcomes, to both the upside and the downside.

This is especially true during a bear market when emotions are running higher than usual.

Michael and I discussed calling bottoms and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Now here’s what I’ve been reading lately:

- What Howard Lindzon has learned from 17 years of blogging (Howard Lindzon)

- Live, work, die (Ramp Capital)

- Why this crash is worse than 2020 (Dollars and Data)

- When the money’s just too damn good (Infinite Play)

- More Hemingway, less Faulkner (Fortunes & Frictions)

- Kids are expensive (The Root of All)