Every stock market correction is different.

There are different reasons, economic environments, interest rates, inflation levels, valuations, market leadership, magnitude of decline and duration.

There are certainly some similarities between the current decline and past markets.

Tech stocks getting hammered following the speculative orgy we saw in 2020 combined with the resurgence of value stocks is reminiscent of the bursting of the dot-com bubble in the early 2000s.

There are also people who think the high inflation rate leading to stock market weakness is going to be a repeat of the 1970s.

But this correction has its own unique flavor as well.

There are similarities to past downturns but this one is also unique in its own ways.

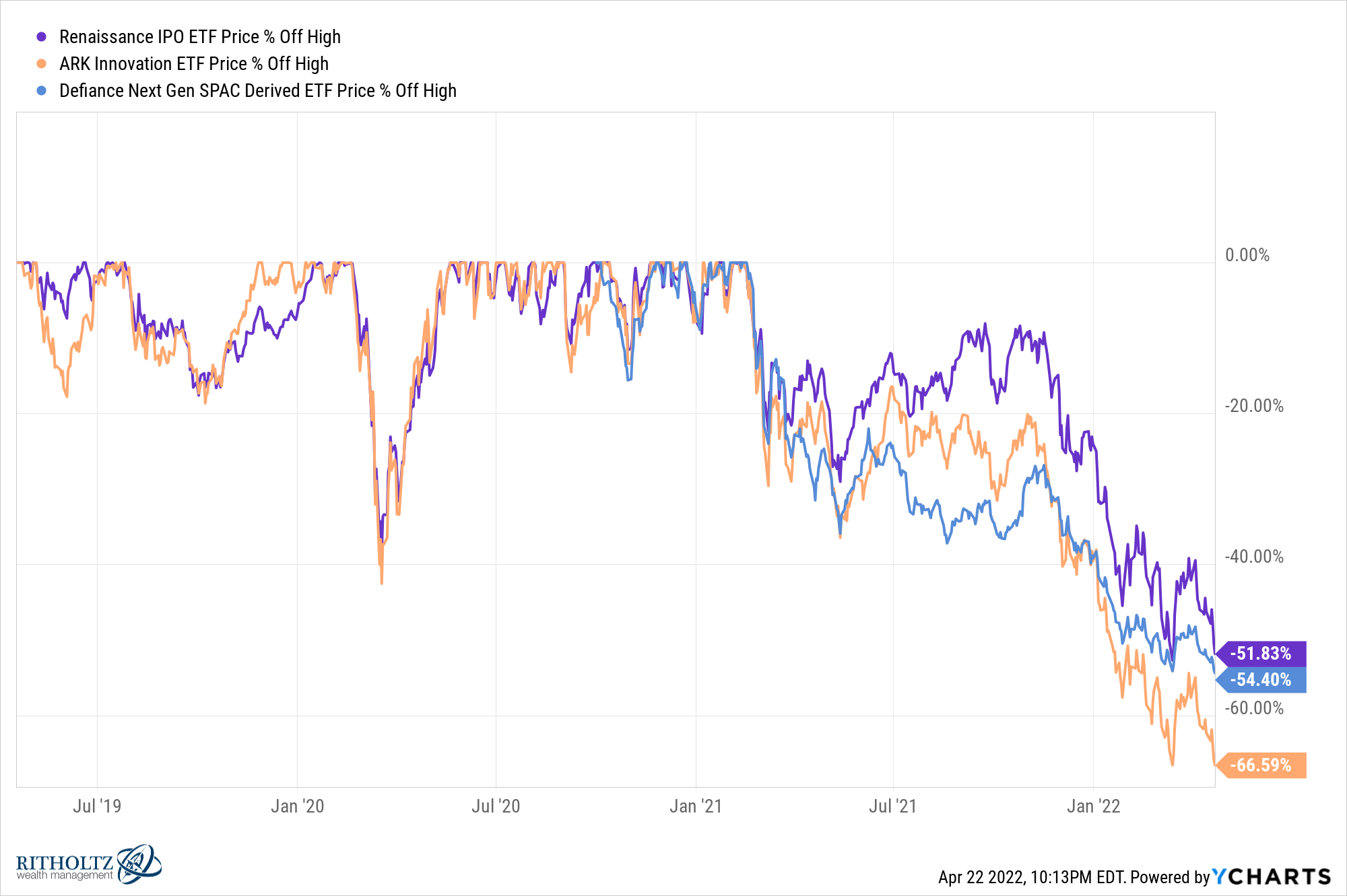

When this thing started it was the speculative stuff getting crushed. And the speculative stuff everyone loved in 2020 continues to get shellacked:

But it’s not just SPACs, IPOs and hyper-growth stocks that are getting killed right now.

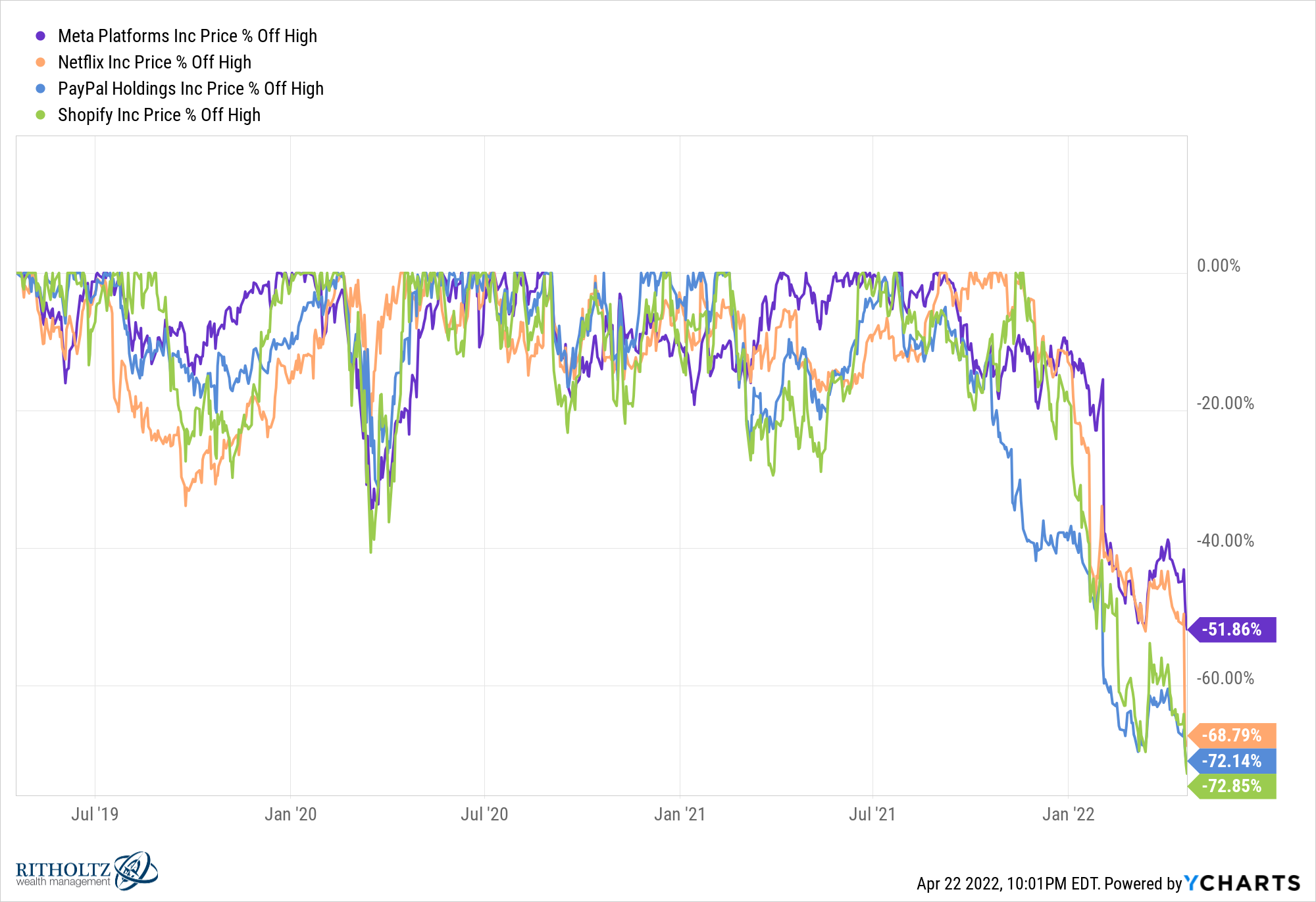

Mammoth companies like Facebook, Netflix, PayPal and Shopify are all getting taken to the woodshed:

These four companies alone have lost more than $1.2 trillion in market value in less than a year. The losses are staggering.

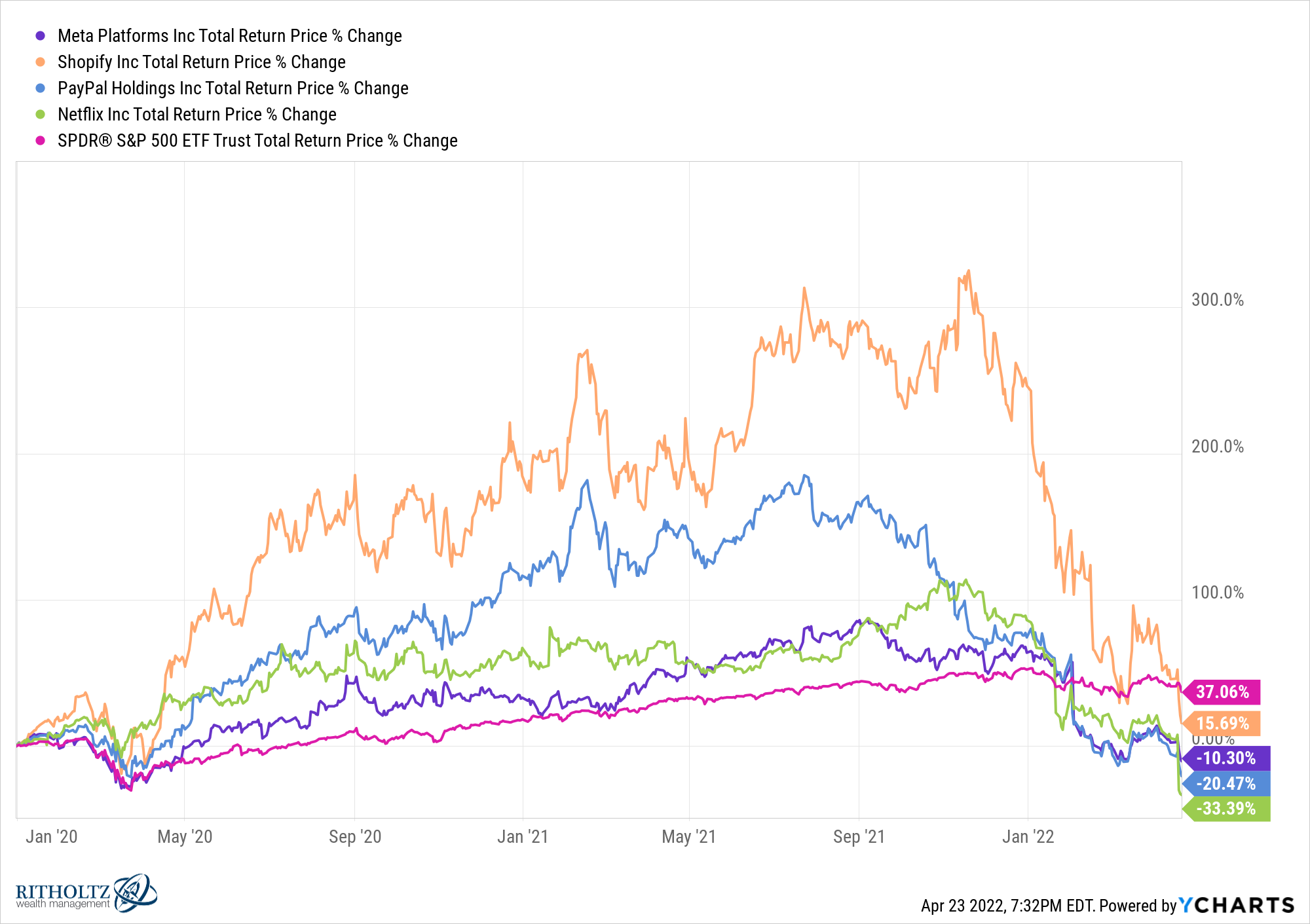

Surprisingly, each of these stocks is now underperforming the S&P 500 since the per-pandemic days at the start of 2020:

For the longest time it felt like tech stocks were the only ones worth owning. That dynamic has now completely shifted.

It makes sense the biggest winners in the upswing would end up the biggest losers in the downswing but there’s a lot more going on right now.

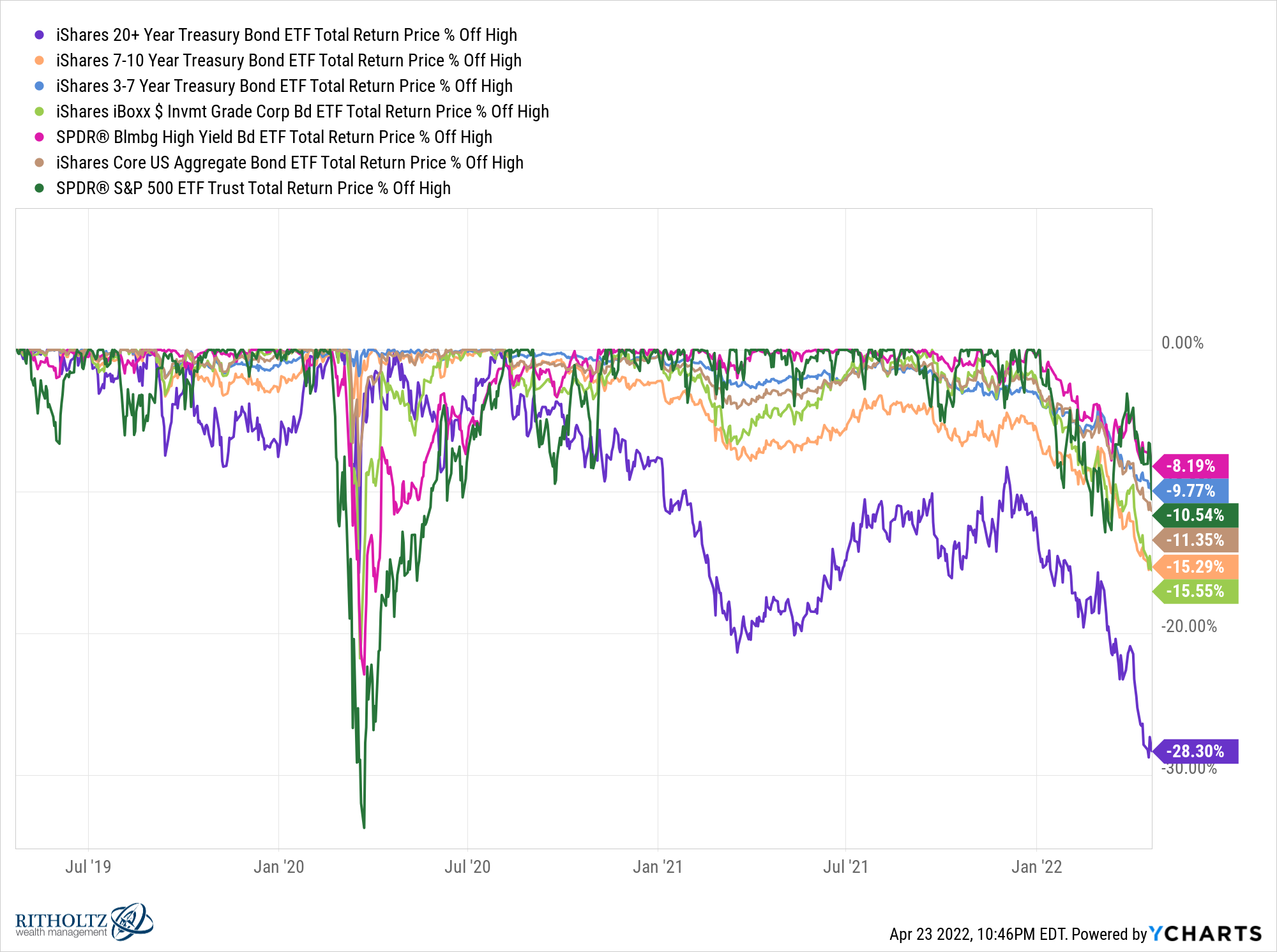

Perhaps the strangest development for investors right now is what’s happening in the bond market:

You can see almost across the board different parts of the bond market are doing even worse than the stock market (long-term treasuries, intermediate-term treasuries, corporate bonds and total bond index funds) or just about as bad as the stock market (junk bonds and short-term treasuries).

For decades investors have become accustomed to bonds acting as a safe haven when stocks falter.

The speed and magnitude of the bond market correction is something investors simply haven’t had to deal with especially at the same time stocks are in correction territory.

Speaking of the stock market being in correction territory, the S&P 500 was down 2.8% on Friday, pushing it back into double-digit losses from all-time highs at -10.6%.

When you look at the bloodbath going on in tech stocks it’s surprising the S&P isn’t down more right now.

Beyond the names mentioned earlier, you also have Amazon (-22.6%), Tesla (-18.3%), Microsoft (-20.1%) and Nvidia (-41.5%) getting whacked.

Despite tech stocks making up a bigger part of the stock market than ever before, the S&P 500 remains resilient.

How is this possible?

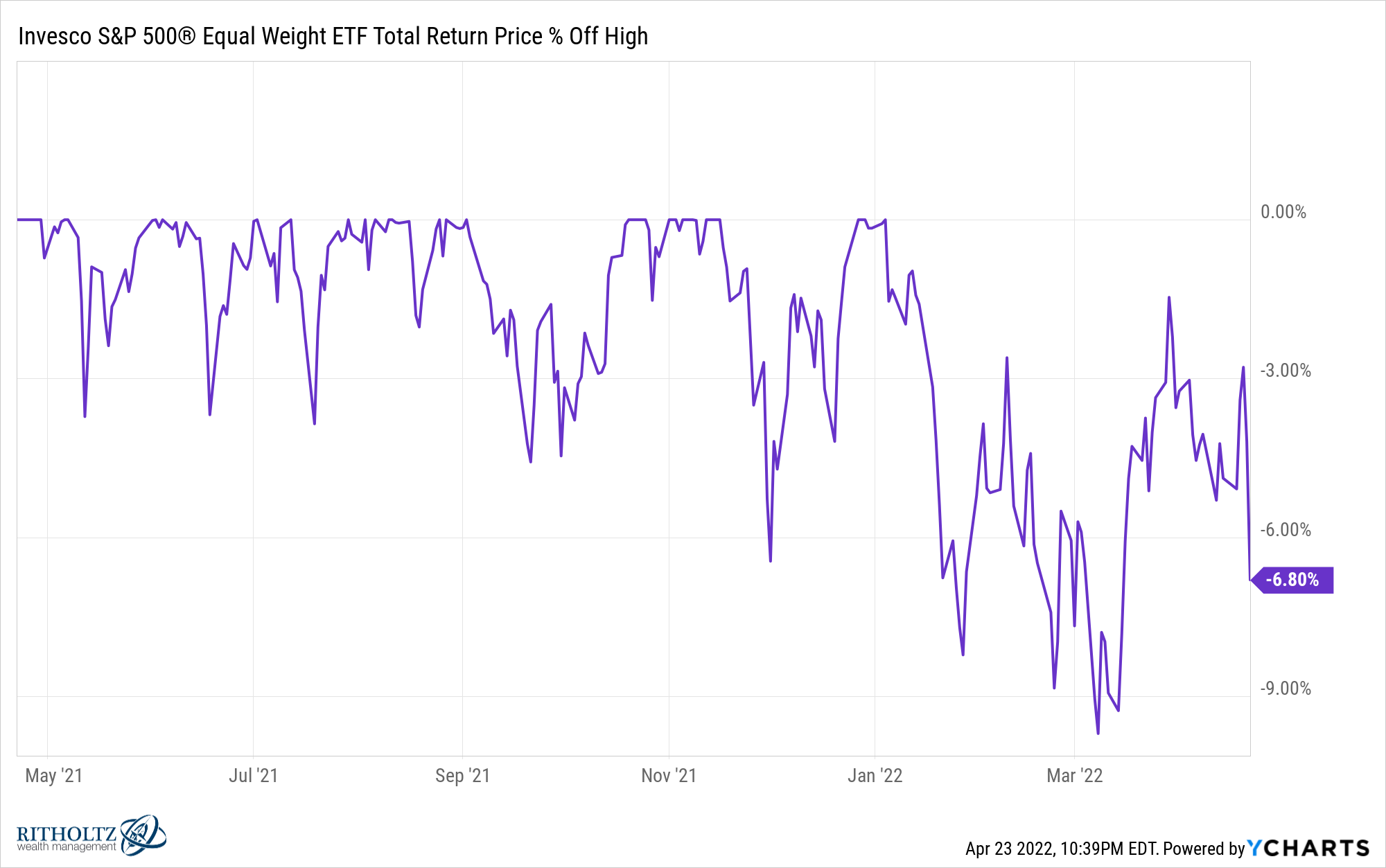

Just look at the equal-weighted version of the S&P for some clues:

It’s down just 6.8%.

Again, how is this possible?

Value stocks are finally shining.

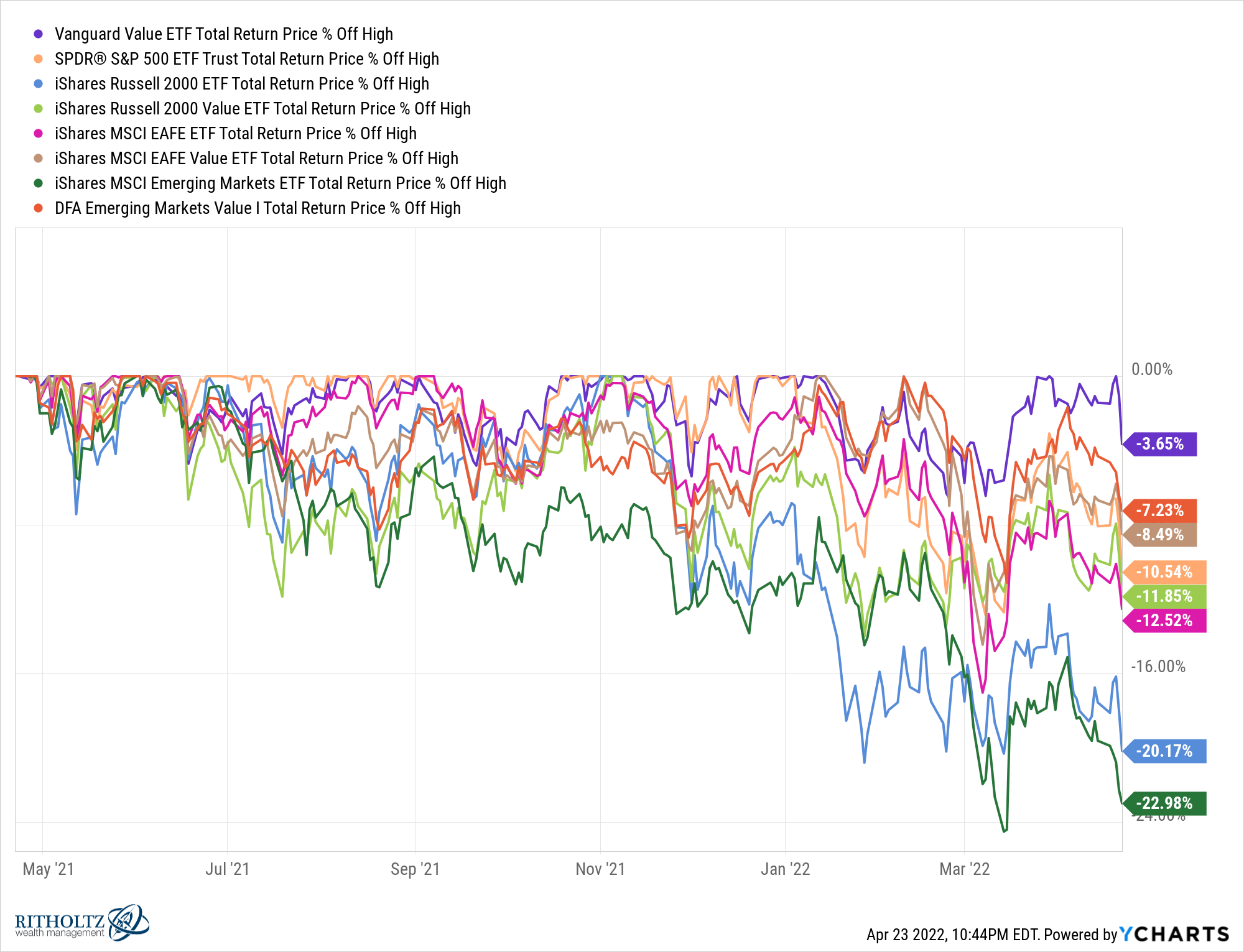

In fact, value stocks are outperforming across the board in this stock marker tumble:

Value is outperforming in large cap U.S., small cap U.S., foreign developed stocks and emerging market stocks.

Predicting the short-term movements in the markets is always impossible and that doesn’t change when things are going down.

If anything, it’s probably even more difficult to predict what’s going to happen in a correction because that’s when investors tend to grip the steering wheel even harder.

I don’t know how this one will shake out but I do have some questions:

- Will the bond market rout make stocks more attractive by comparison?

- Or will higher bond yields actually bring more money into fixed income?

- Will the rest of the market roll over at some point?

- Or will the majority of the pain be contained to tech stocks?

- If inflation remains elevated does that keep a lid on the stock market?

- Or does the stock market end up being a safe haven as fixed income is more negatively impacted by the effects of rising prices?

- At what point does something break with interest rates rising at such a fast clip?

These past few years it feels like everything in the markets is happening faster than ever. I don’t know if that means things will get out of hand or end in a hurry but this correction feels like a one-of-a-kind for investors of all levels.

I was in NYC this past week and talked about Netflix, tech stocks, bonds and more with Josh and Will Hershey on The Compound and Friends:

Further Reading:

Diversification Isn’t Undefeated But It Never Gets Blown Out