I wrote the following back in April of 2020 in the early days of the pandemic:

It seems bizarre to worry about inflation during the sharpest, more severe economic contraction of our lifetime.

But the sheer amount of government spending and monetary policy being instituted by the Federal Reserve means it’s something that’s on people’s mind as a potential risk in the not-too-distant future. The “worry” is once the virus is contained the economy could potentially overheat through a combination of pent up demand and government spending.

My initial read on this is if we do get inflation from all of this spending that’s a good thing — it means we beat the virus and things are back to normal (if there is such a thing).

I’m not taking a victory lap here because I certainly didn’t expect to see inflation rise to nearly 8%. I wasn’t expecting so many supply chain issues stemming from massive consumer demand.

And that piece wasn’t a macro call as much as it was trying to understand why value stocks had lagged growth stocks so badly in the years leading up to the pandemic.

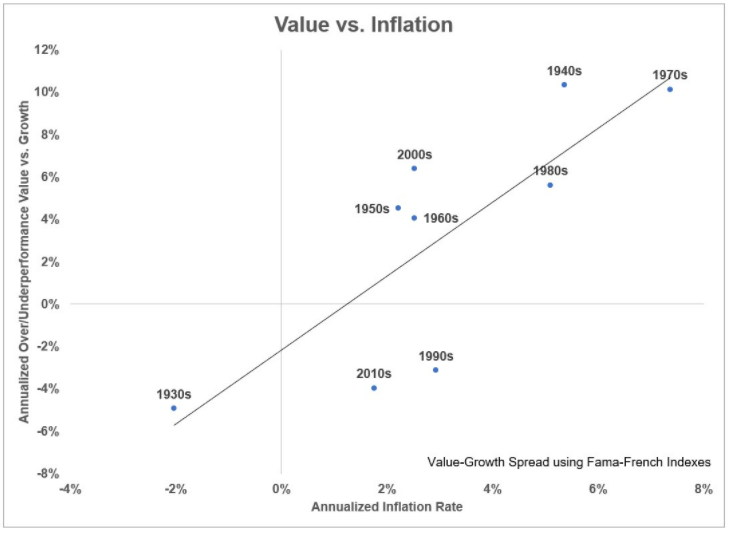

My takeaway was value stocks needed higher inflation to outperform once again. Here’s the visual:

While not a perfect relationship, value has tended to perform better during decades with above average inflation and perform worse during decades with lower inflation. This was my original explanation on the reasoning behind this:

Think about growth stocks like they are a bond. The reason inflation is such a big risk for bondholders is because the purchasing power of your fixed rate income payments is eroded over time by inflation.

The same thing is true of promised future growth in revenue or profits for growth stocks. Value stocks likely already have cash flows now that will likely decrease into the future. Thus, higher interest rates should hurt value stocks less than growth stocks since the higher hurdle rate makes future growth not worth as much.

Inflation has been increasing for more than a year now so let’s put this theory to the test.

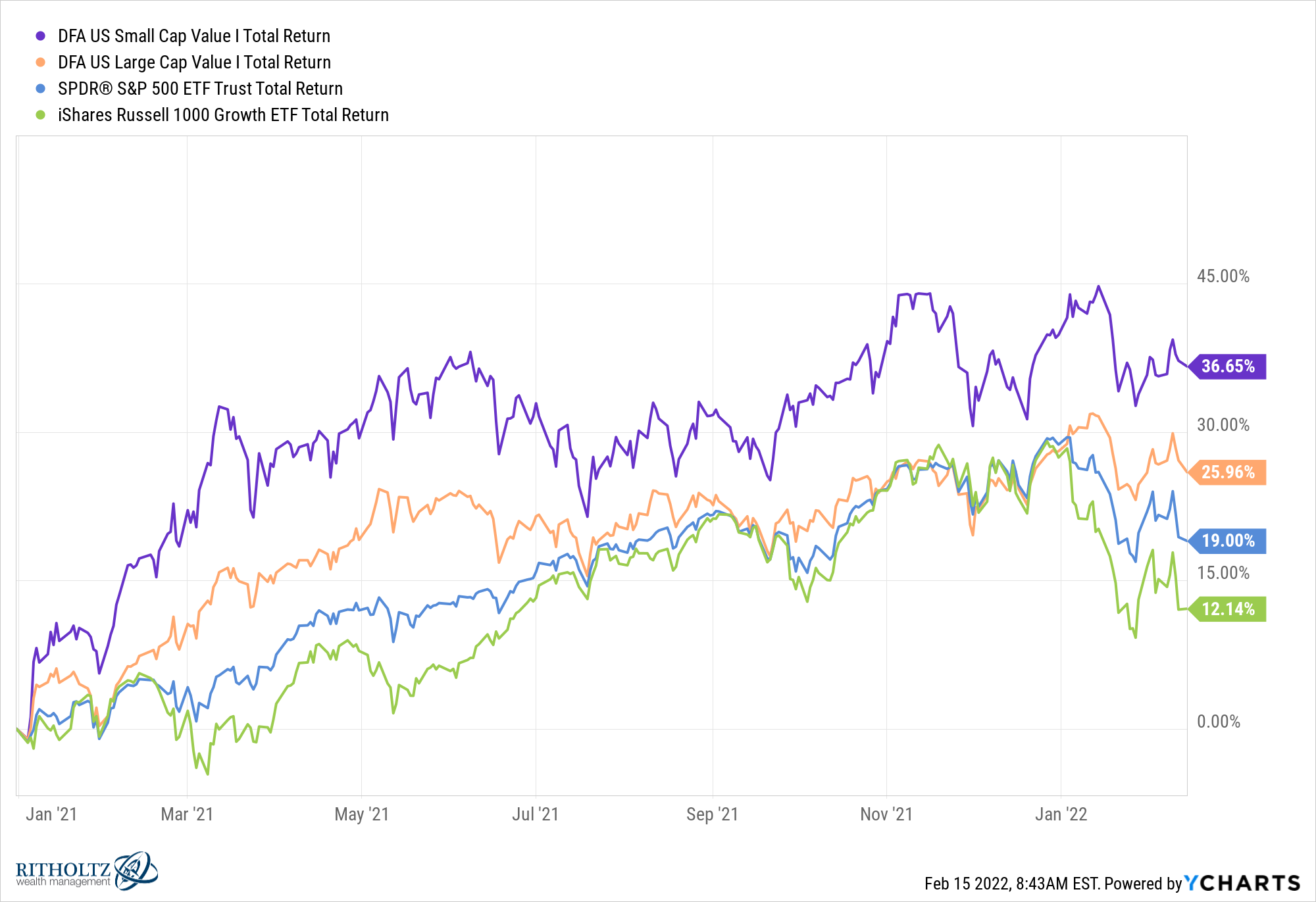

Here are the returns for the DFA small and large cap value funds1 compared to the market and growth stocks since the start of 2021 through Monday’s close:

Value stocks have outperformed by a healthy clip during this inflationary environment. So far so good.

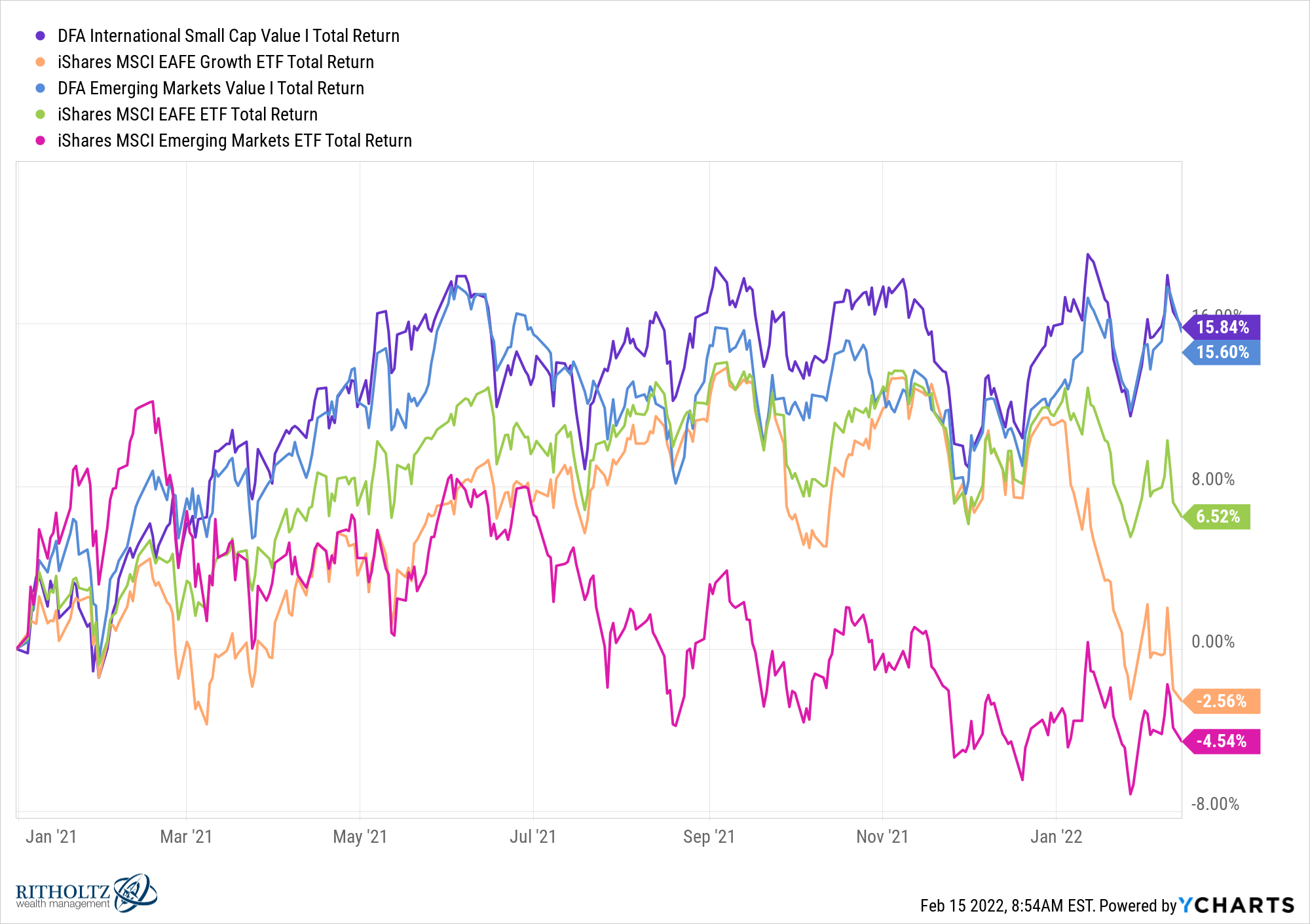

Value has tended to outperform when inflation has been higher for international stocks as well:

Obviously, it would be silly to assume inflation is the only factor driving value stocks or growth stocks. Inflation plays a role but nominal growth tends to be higher when inflation is running high as well.

And sometimes value does well because growth valuations get too out of whack with reality.

I’m not smart enough to predict whether value stocks will continue to outperform or not because I can’t predict the future path of inflation (and I’m not sure anyone else can either).

But this is a good reminder about the importance of diversifying your portfolio across different economic environments.

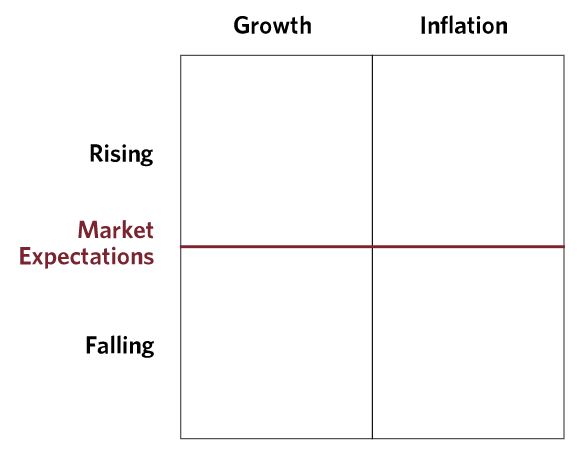

This chart from Ray Dalio’s The All Weather Story has always stuck with me since reading it a number of years ago:

The idea here is to pair investments together that work under different economic regimes because we don’t know when or why the economic environment will change.

No one was predicting a massive inflation/economic growth spike back in 2019 but that’s what we’re living through at the moment.

We haven’t dealt with a rising inflation/rising growth economy in a really long time.

Value stocks have been laggards for a while now but maybe they just needed the right environment to shine.

I’m not saying value investing is going to continue outperforming. I really don’t know.

I don’t know if high inflation is here to stay.

I don’t know how much of the inflation story is now priced in for both value and growth stocks.

I don’t know if the Fed is going to be successful in putting a lid on inflation.

I do know that creating a durable portfolio requires diversification of strategies that can work well under a number of market and economic environments.

Further Reading:

Why Value Died

1Full disclosure: My firm uses DFA funds for some client portfolios and I own some of these funds myself.