In a recent post I shared how the U.S. stock market is now up more than 800% since the lows of the financial crisis.

Right on schedule my Twitter replies and inbox were full of people bemoaning the fact that this entire bull market is an artifact the Federal Reserve policies.

Well yeah if you print trillions of dollars what do you expect?

Sure stocks are up but only because the Fed took away price discovery.

It’s all a house of cards.

I know I shouldn’t be surprised by these comments because they’ve been coming for well over a decade now but it is surprising how many investors really hate the Fed.

A lot of this has to do with the fact that so many people have been wrong about the market’s direction ever since the bull market began but it would be hard to ignore how intertwined the Fed has become with financial markets.

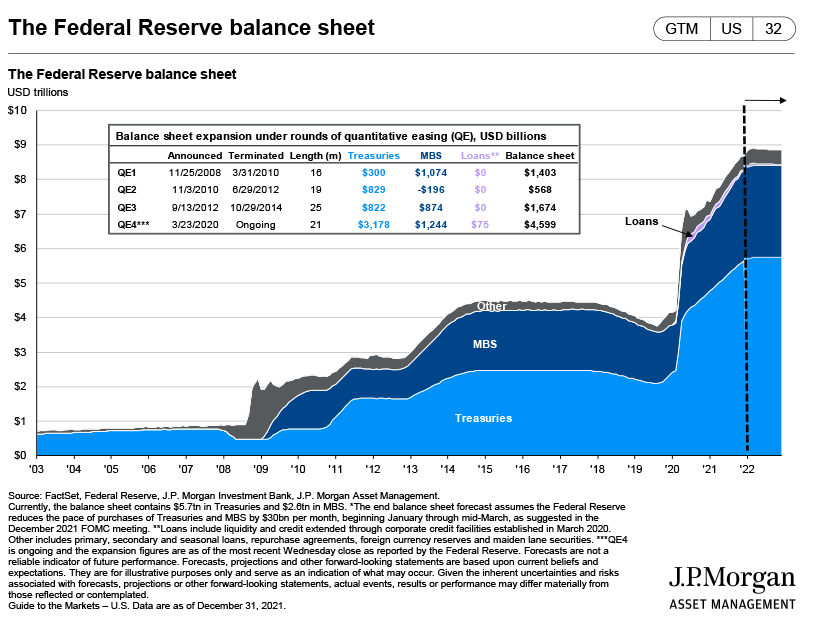

Since the 2008 financial crisis the Fed’s balance sheet has ballooned to epic proportions:

From a little less than $1 trillion in early 2008, the Fed now has nearly $9 trillion on its balance sheet.

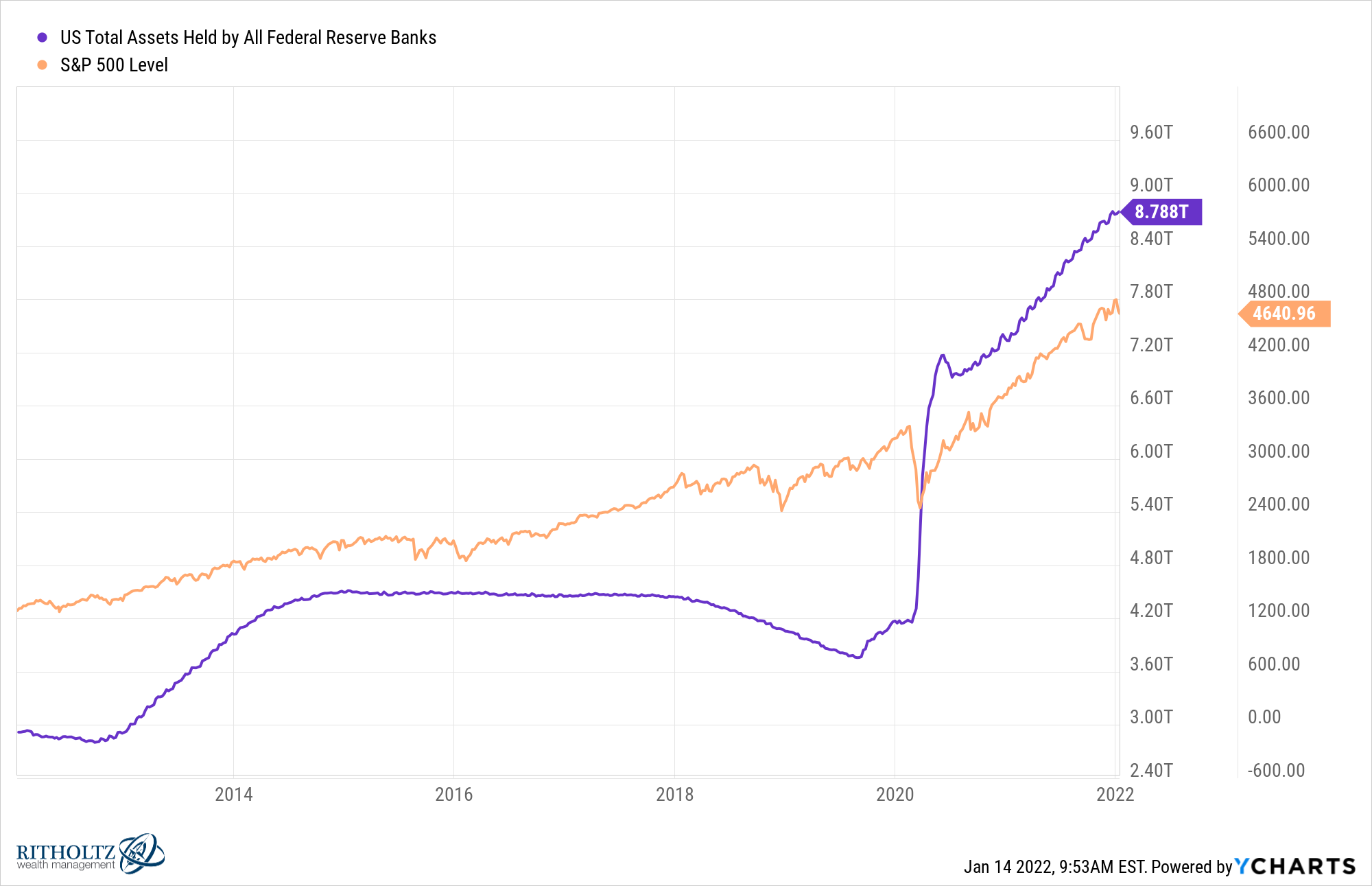

Now look at a simple chart of the S&P 500 overlaid with the Fed’s balance sheet:

They’re both much higher. Case closed right?

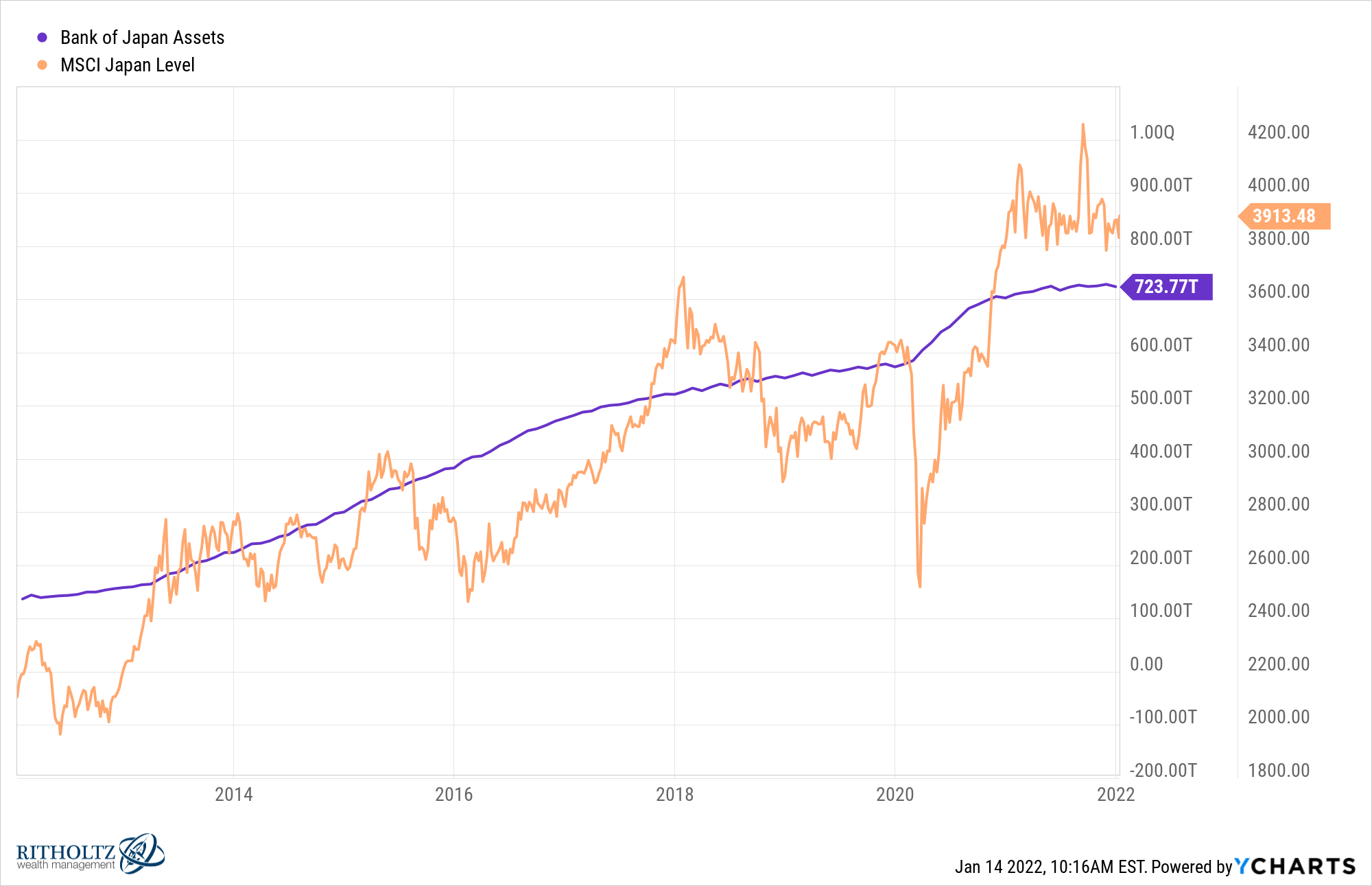

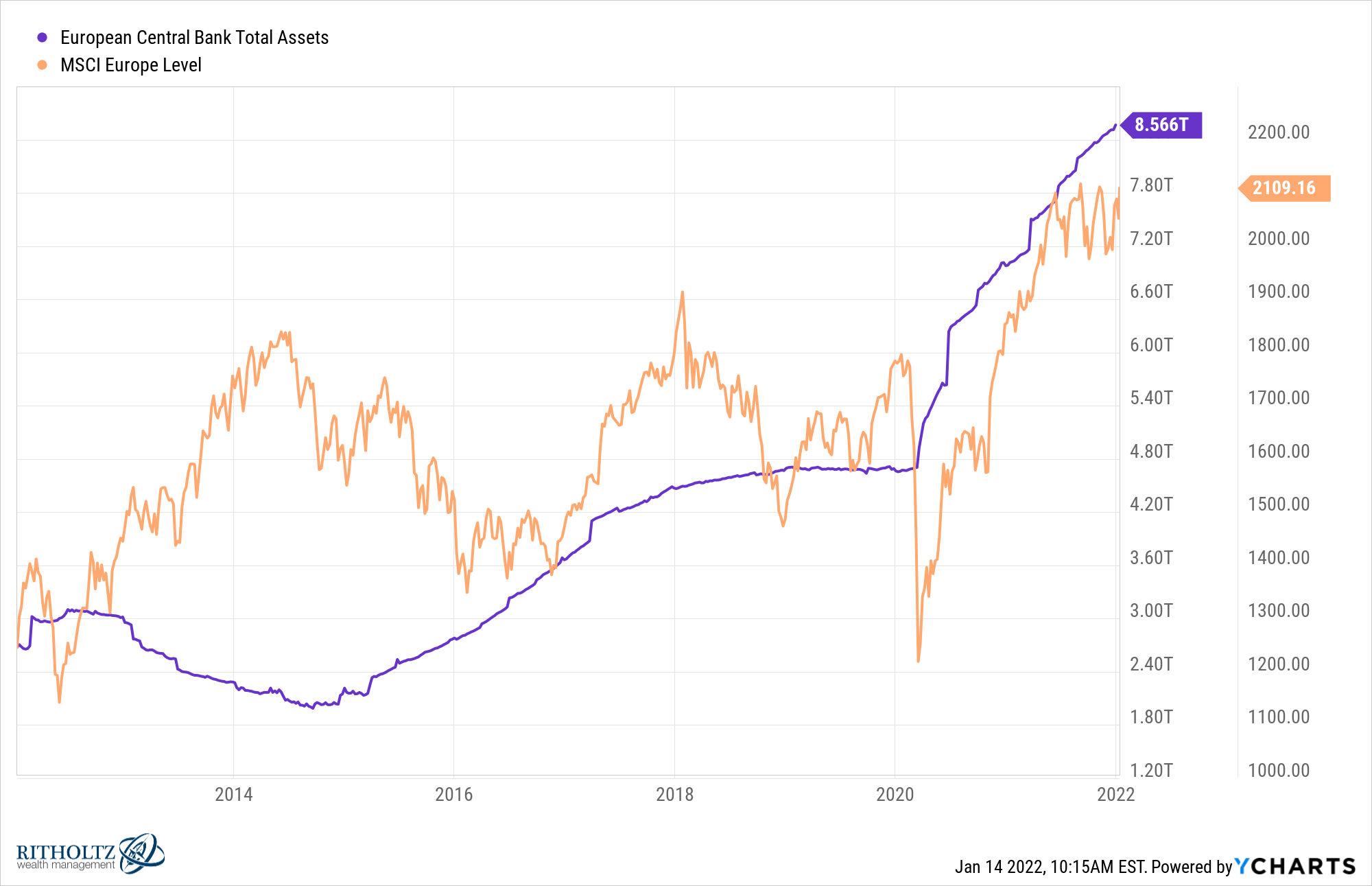

But what about Japan and Europe? Their central banks have also taken on trillions of dollars of assets on their balance sheets.

Here is the Bank of Japan’s balance sheet (this number is in Yen so it’s really more like $6-7 trillion) compared to the MSCI Japan:

And here’s the European Central Bank assets in relation to the MSCI Europe:

I mean just look at all of these charts. There are two lines heading in the same direction.

So what if the scales are off, this is clear evidence that central banks are the only reason stocks are higher, right?

At first glance this looks like an open and shut case but it’s not always this easy.

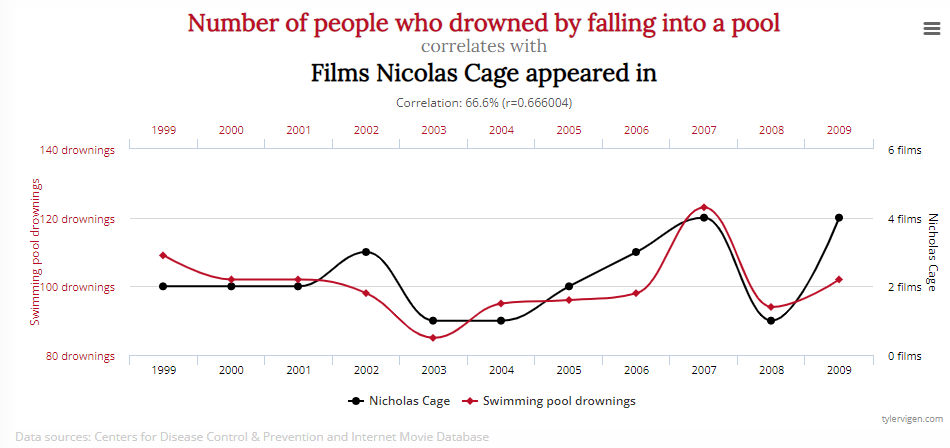

Just because two lines on a chart are going in the same direction does not mean correlation implies causation. Case in point:

Ok, this is ridiculous but you get the idea. It’s not that hard to show two datasets going in the same direction.

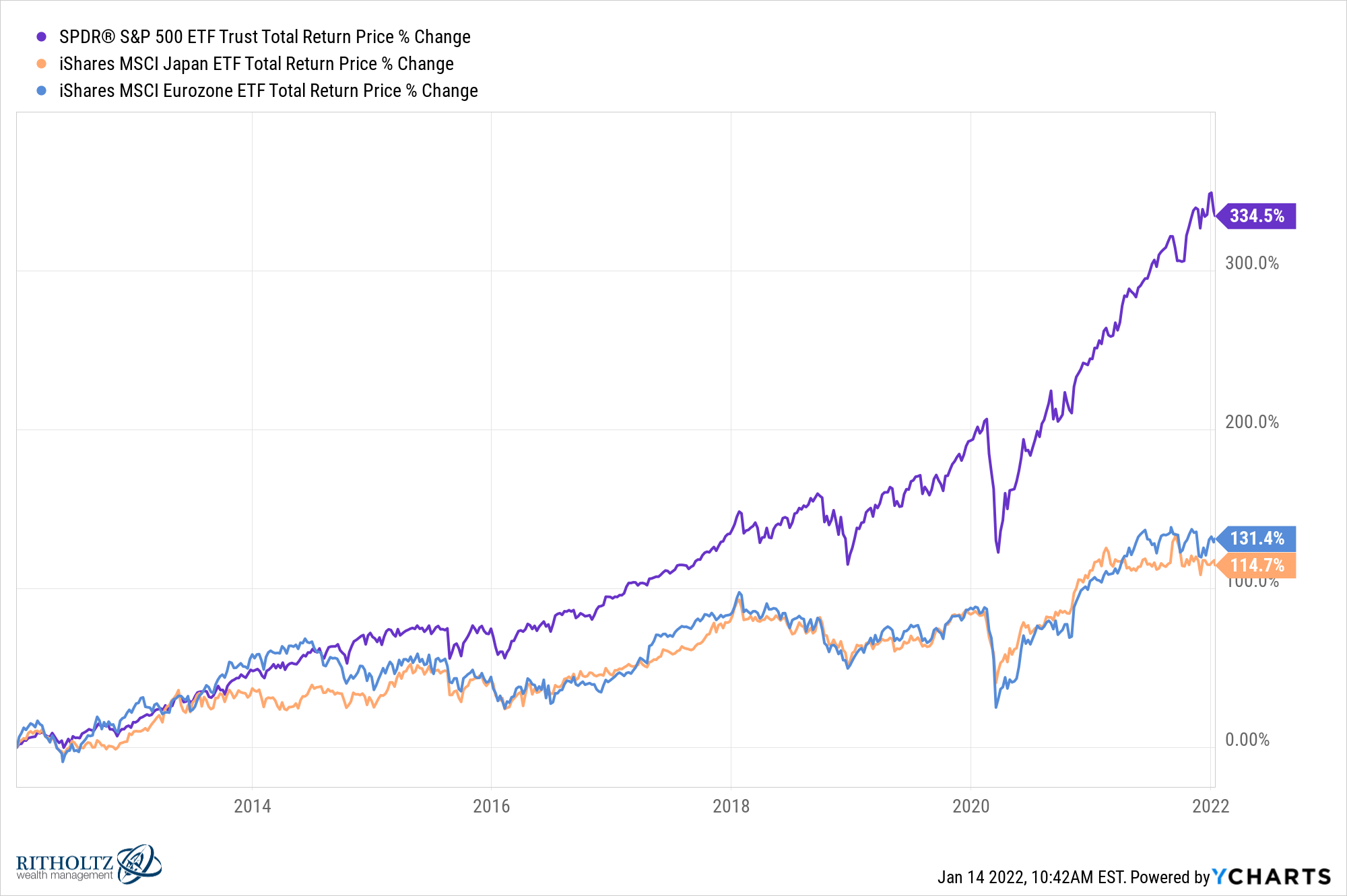

And while it looks like the returns for stocks in the U.S., Japan and Europe are all up over the past 10 years, they are not up by nearly the same magnitude:

The S&P 500 is outperforming stocks in each of these developed countries by more than 200% in total over the past decade. These countries have been providing similar levels of monetary stimulus over this time and their interest rates have been even lower than ours.

While the 10 year U.S. treasury bond currently yields around 1.7%, yields in Japan (0.1%) and Germany (-0.1%) are much lower. Why aren’t stocks exploding higher in those countries?

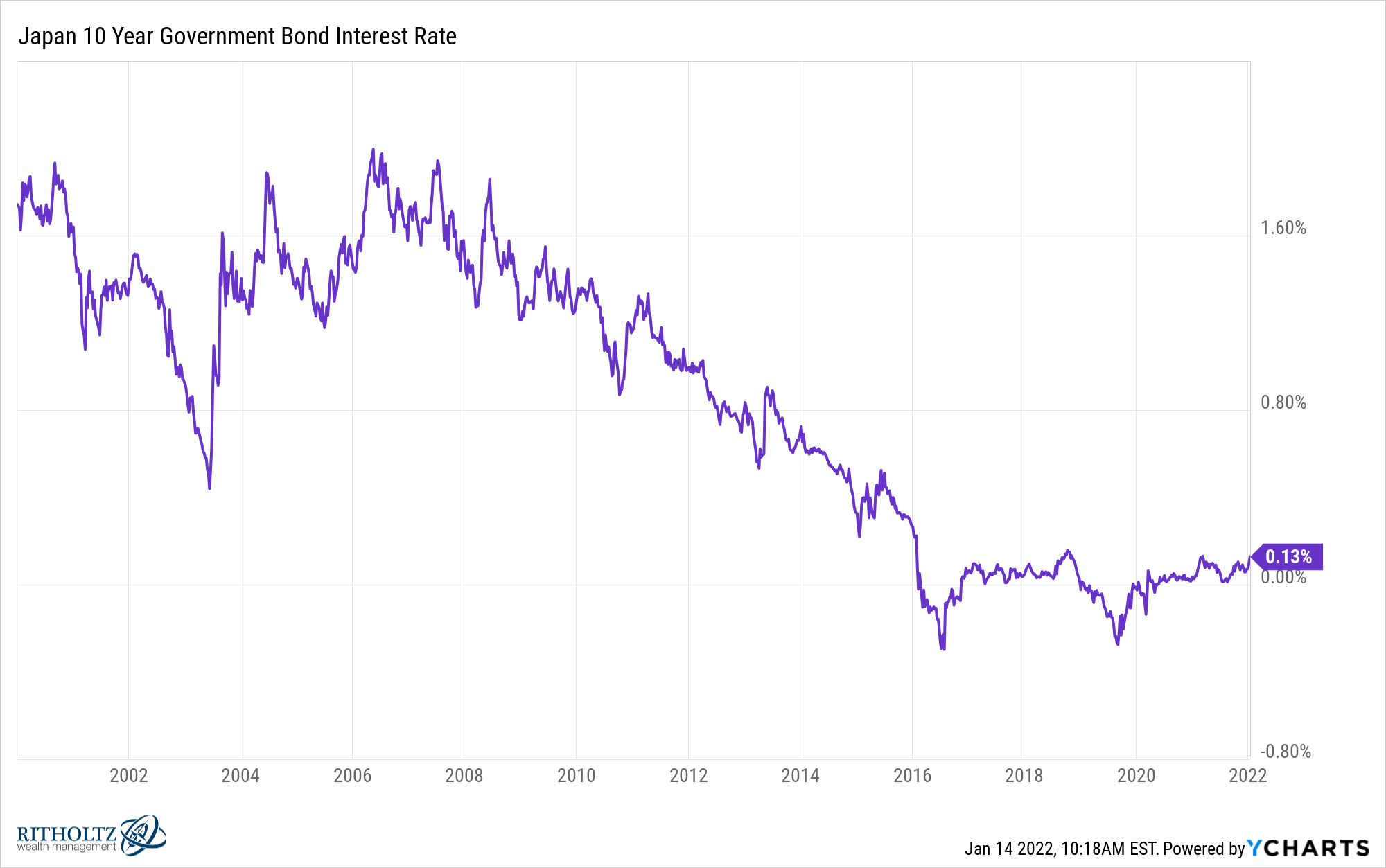

Interest rates certainly have an impact on how people allocate their capital but low interest rates alone don’t explain everything that happens in financial markets. Just look at Japan’s 10 year government bond yields going back to the turn of the century:

It’s been under 2% for the entire 21st century. This means Japan must have an enormous stock market bubble, right?

Au contraire, the MSCI Japan Index is up just 2% per year since 2000 and that number includes dividends reinvested. Stocks have basically gone nowhere despite persistently low rates.

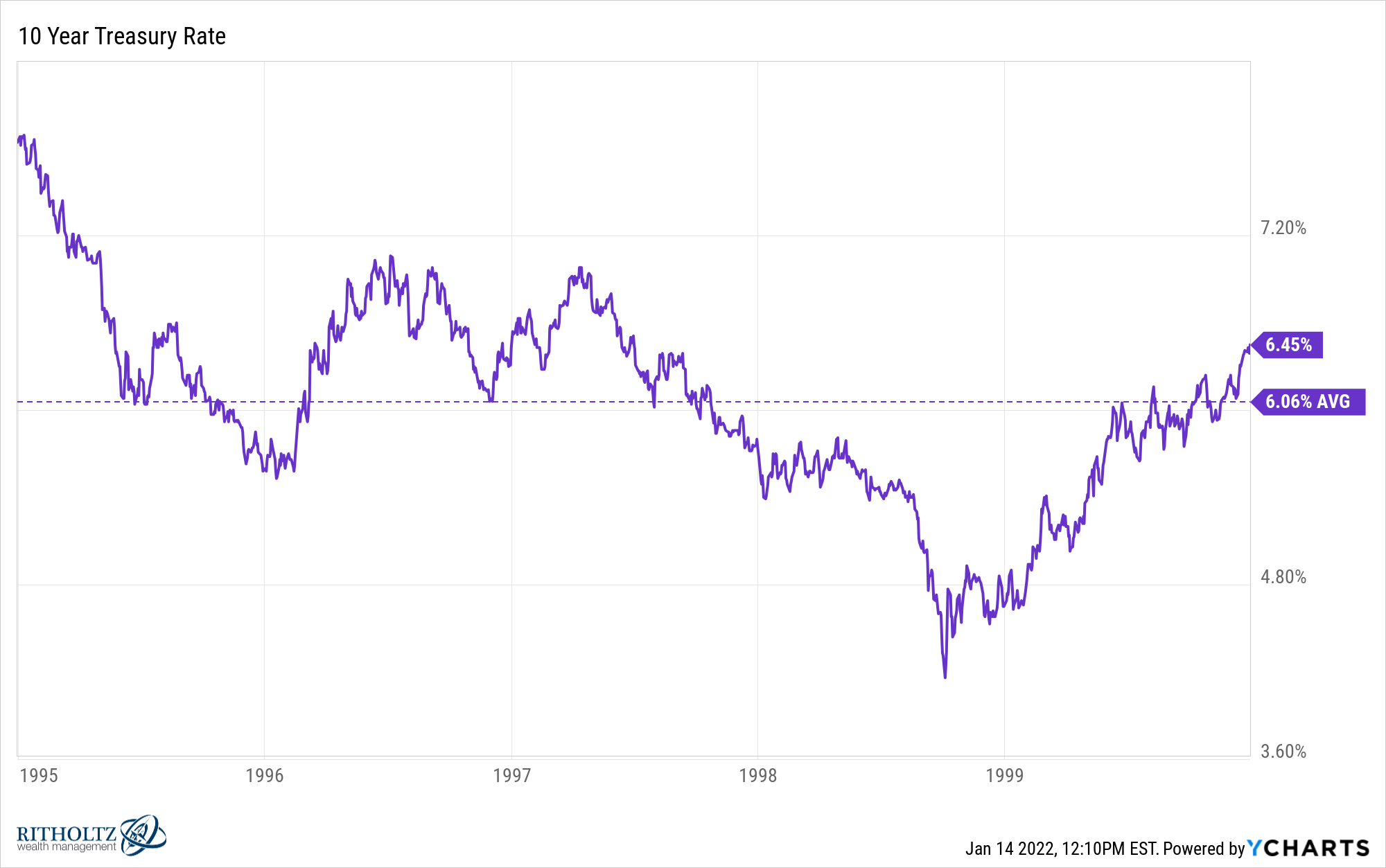

And think about where interest rates were in the United States during the last true stock market mania in the dot-com bubble of the late-1990s.

From 1995-1999, when the Nasdaq was up 450% in total (41% per year), the 10 year treasury averaged a yield of more than 6%. Interest rates have nothing on human behavior when it comes to sending markets into a frenzy.

Obviously, it would be ridiculous to say the Fed hasn’t had an impact on the markets since 2008. Without Fed intervention, the financial system may have imploded in 2008 and 2020.

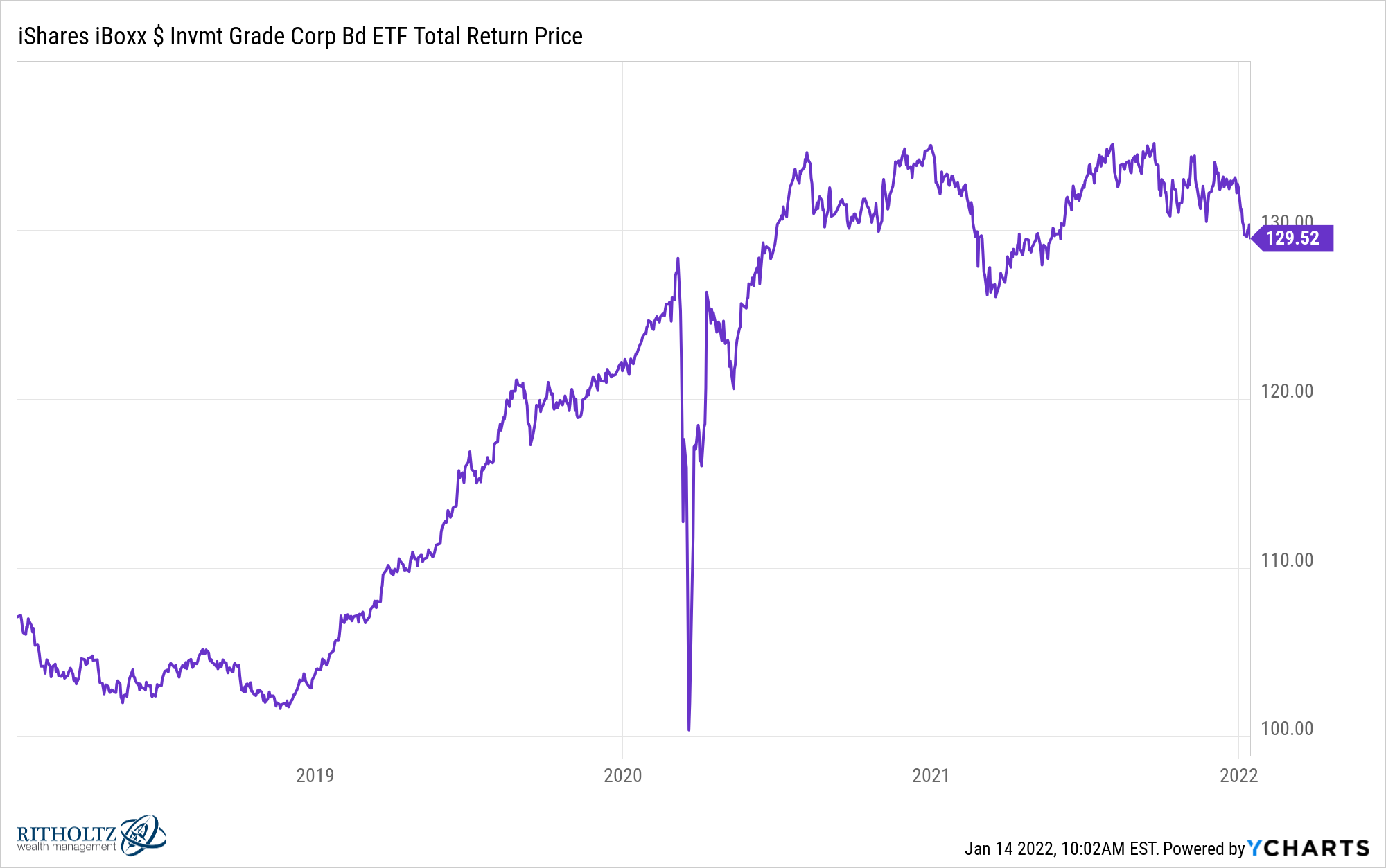

Just look at the crash and subsequent recovery in corporate bonds in March 2020:

Corporate bonds were down 22% in two weeks. They basically round-tripped that entire loss three weeks later. This doesn’t happen if the Fed doesn’t give their implicit backing to the bond market.

This makes sense though when you consider the Fed is basically the lender of last resort for the financial system. They don’t want to see a run on the banks or a repeat of the Great Depression and they have the tools to make sure that doesn’t happen.

The Fed likely also has a psychological hold over the markets now that they’re such a big player in the bond market.

I’m not going to argue with you if you claim the Fed has overstayed their welcome when it comes to buying mortgage bonds and treasuries with the recovery we’ve seen in stocks, GDP, housing, bonds and the unemployment rate (not to mention the spike in inflation).

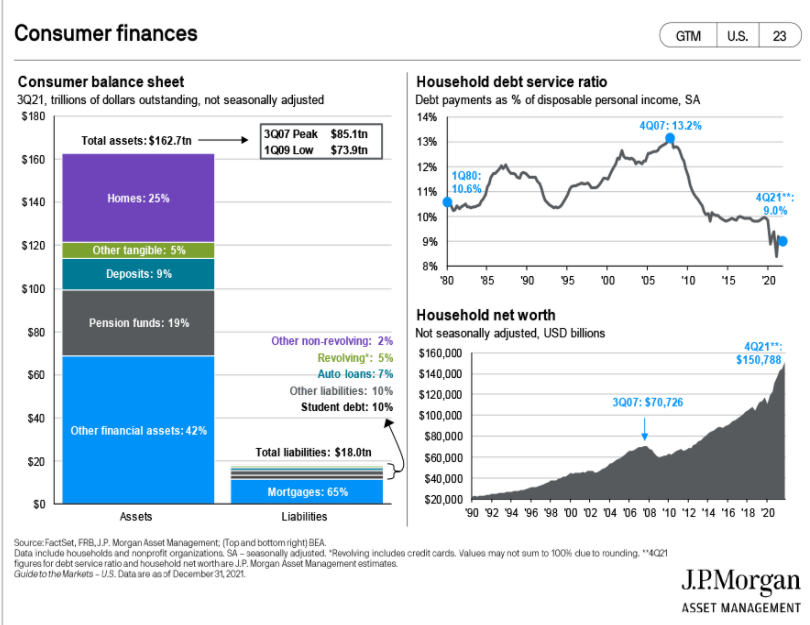

Consumer balance sheets have likely never been stronger than they are today:

If the Fed isn’t going to pump the brakes now, when will they?

If we can’t handle 4 or 5 rate hikes in this environment the Fed might as well tell us they’re never going to raise rates again.

So while the Fed has been a big player in the markets since 2008 it would be silly to assume they are the only reason for the upward trajectory of stocks.

Interest rates and bond purchases alone aren’t enough to inflate a stock market bubble. Human nature can do that all on its own.

Michael and I talked about the conundrum the Fed finds itself in and more on this week’s Animal Spirits:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Emotions Matter More than Interest Rates

Now here’s what I’ve been reading lately:

- The simple plan to solve all of America’s problems (The Atlantic)

- When should you retire? (White Coat Investor)

- Bear markets suck (Irrelevant Investor)

- The renaissance man of venture capital (Institutional Investor)

- After the Beanie Baby bubble burst (Vox)

- Living through a crash (Big Picture)