A reader asks:

Hi Ben, in your opinion do government yields still give any real signal in terms of future growth and inflation or has it been obscured by all the bond buying by the FED?

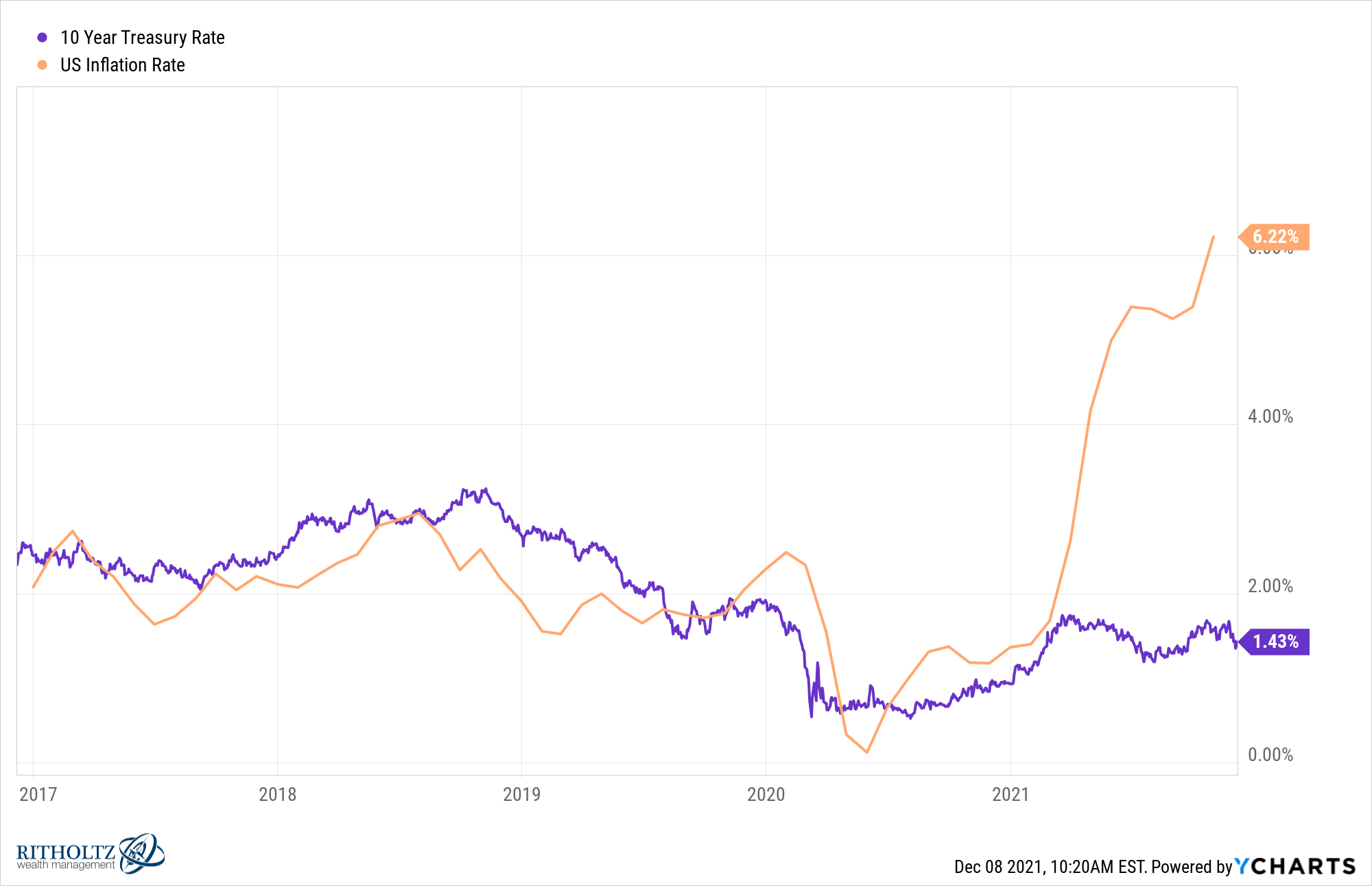

This might be my favorite chart of 2021:

How is this even possible?

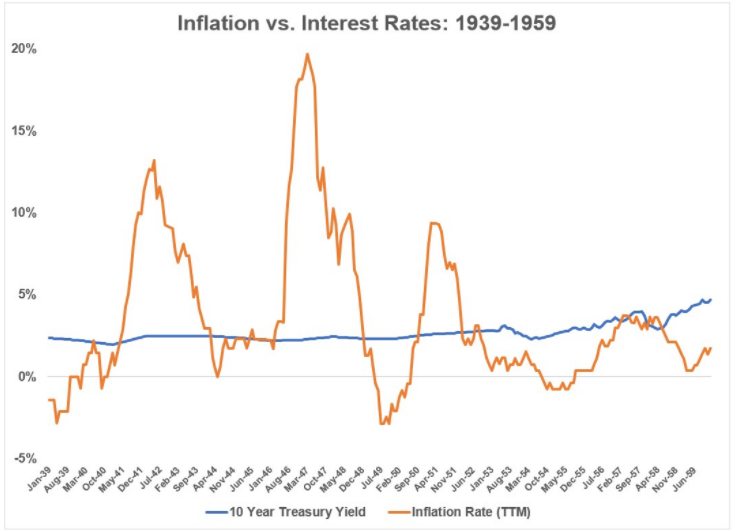

It’s actually not the first time this has happened:

There are different reasons in each instance. Back then the government basically capped rates to pay for war debts.

Now there are lots of other variables at play.

Investors are starved for safe yield so money continues to flow into bond funds. Demographics play a role here too as the baby boomers are all retiring. The Fed has been buying bonds since the start of the pandemic. It’s possible the bond market thinks this inflation isn’t here to stay. Or maybe higher growth won’t last either.

This is also a good lesson in avoiding single points of failure in your analysis. One signal is never going to be able to tell you exactly what’s going on with something as big and dynamic as the U.S. economy.

And even if you think you’ve discovered the magic bullet that will allow you to be all-knowing and all-seeing, eventually signals stop working.

The government adapts its fiscal or monetary policy. Investors change the way they react to certain data points depending on how our collective knowledge evolves. And sometimes certain economic data loses relevance.

Some numbers are more important during a recession than a recovery. Other data requires context and nuance to understand what it’s actually telling us about the state of the economy.

And sometimes the markets simply get it wrong.

Another reader asks:

This market sure doesn’t make any sense, and I was wondering what your take is on the treasury yields. Inflation is running high, money is being printed like never before and the stock market is only going up, but still the treasury yields have been falling. So what do you think will happen when the market goes down?

There are no certainties when it comes to the markets. ‘Always’ and ‘never’ tend to get you into trouble in this business.

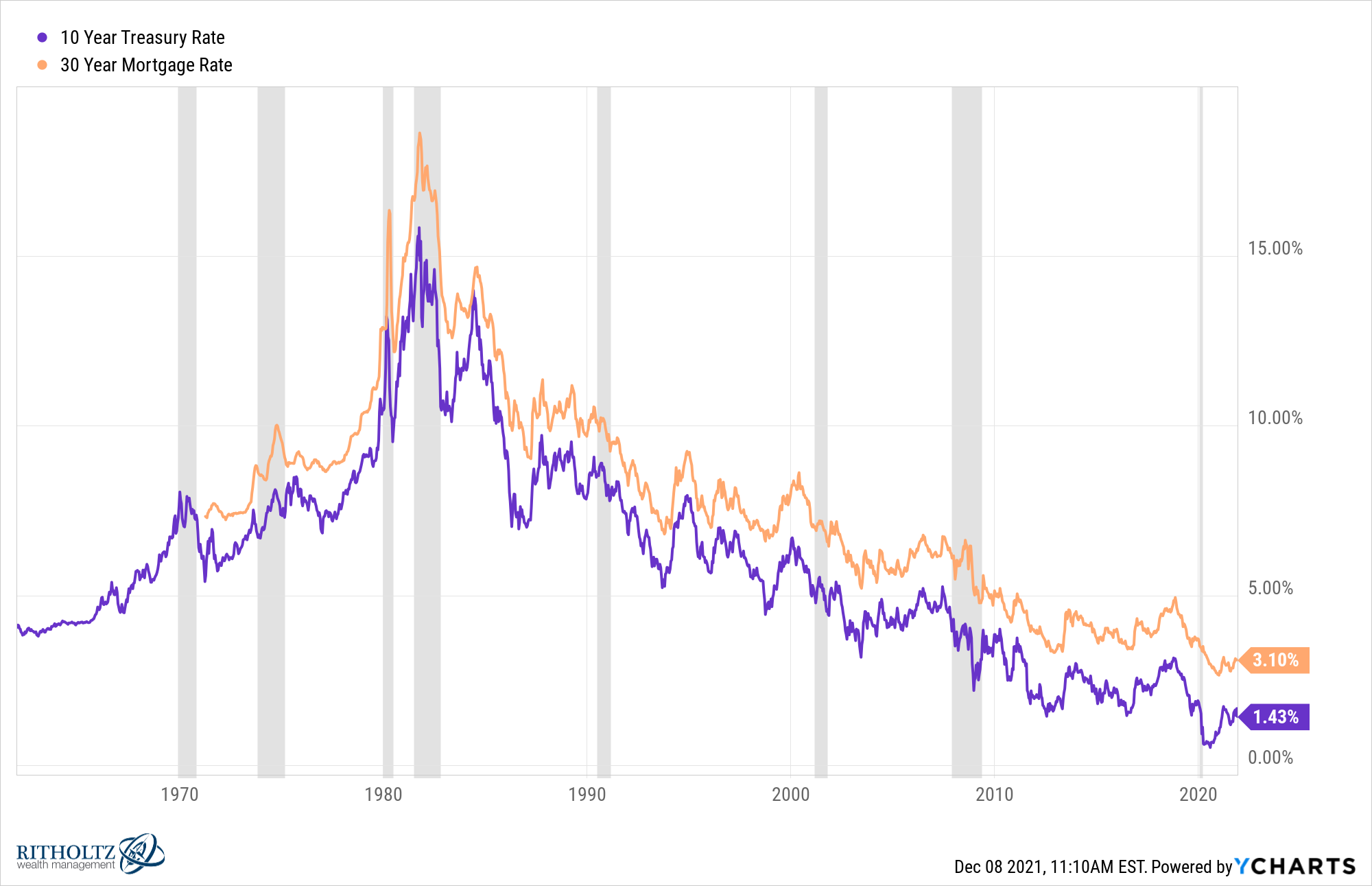

But I would be shocked if interest rates didn’t fall during the next recession. Take a look at the yields on the 10 year treasury and 30 year mortgage over time:

The gray bars on the chart are recessions. You can see in every recession yields invariably fall, even during periods where rates were rising going into the recession.

There are two main reasons for this:

(1) The Fed lowers rates to stimulate the economy.

(2) Investors move money into bonds in a flight to safety.

I don’t see why this would change going forward. The crazy thing is the floor for rates gets lower and lower during each recession.

Could we actually see negative rates during the next recession?

I had Cullen Roche on this week’s Portfolio Rescue to help me tackle these questions:

My colleague Alex Palumbo was also on the show to help me work through some questions about financial planning for a pension and borrowing against your portfolio.