This week saw the first Bitcoin ETF become available in the United States.

I figured the fanfare for this one would be large despite the fact that it’s a fund that invests in Bitcoin futures, not the spot price (read here and here for the details on why a futures fund is suboptimal).

I wasn’t thinking big enough.

This thing blew the doors off.

The ProShares Bitcoin ETF (ticker BITO) garnered more than $1 billion in assets in its first two days of trading, making it the fastest ETF to ever reach that level.1

It’s possible we have all underestimated the demand for Bitcoin in the wealth management industry.

Just wait until a spot Bitcoin ETF comes out. It’s going to be massive.

Many people will scoff at this sentiment.

If someone wants to buy Bitcoin why not just go to Coinbase or Robinhood or BlockFi.

Here’s the problem with this statement — all of the true crypto believers are already in. They have their cold storage or wallet or crypto account set up already. These people don’t want or need an ETF to hold crypto.

The next leg of crypto adoption has to come from someone else besides young people and early tech adopters.

And guess who has most of the money in this country? Older people and those who aren’t early tech adopters.

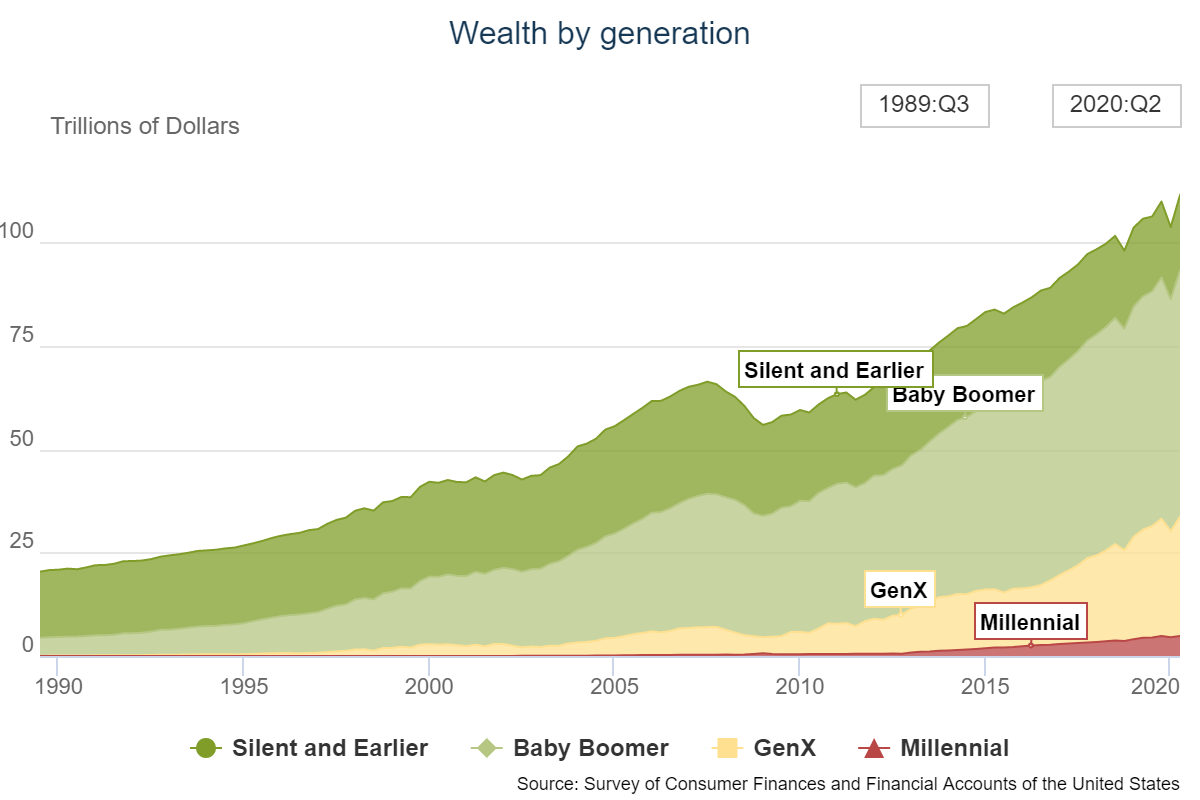

Here’s the generational wealth breakdown from the Fed:

As of the latest reading, baby boomers held close to $60 trillion of financial assets. That’s more than the combined $52 trillion held by the other three generations. And the wealthiest generation, for the most part, isn’t going to open up a Coinbase account.

This group has their money with Vanguard or Fidelity or Charles Schwab or a financial advisor. They don’t want more accounts, they want a way to integrate new assets with their current portfolios.

This is why Bitcoin ETFs are going to gather an enormous amount of assets from the wealth management sphere:

- Simplicity. Some people prefer to keep their finances simple and view all of their holdings in one account. It’s one less password to come up with, one less account to open and one less statement to worry about. An ETF makes this much easier.

- Integration. It’s much easier to integrate an ETF into an overall investment plan than crypto held elsewhere. An ETF allows you to rebalance, tax-loss harvest and view your holdings from an overall portfolio perspective. There is obviously software that allows you to do this with multiple accounts but some people prefer everything in one place for ease of access.

- Peace of mind. There is going to be a massive price war once more of these funds come out. Investors will be paying pennies on the dollar for a huge financial firm to custody their crypto, keep it safe from a security perspective and offer fair trade execution. The libertarian crypto bros want a decentralized world where they live off the grid (with functioning internet of course). Wealthy people just want to dabble in crypto without the fear of having their Bitcoin stolen or losing a password they stored on a post-it note.

- There is demand for this. Not all wealthy people will want to buy a Bitcoin ETF. Crypto is not for everyone. But there are enough people who are interested in adding a small allocation to their portfolio that advisors and brokers are going to have to make this available to certain clients. Banks and RIAs manage many trillions of dollars. It’s not going to take a huge move into this space to make a difference. Acceptance is growing by the day.

I don’t know when a spot Bitcoin ETF is going to hit the market. I can’t tell if the dam will break from this futures ETF release or if this will buy the SEC some time to hold off for a while longer (which makes no sense to me, just do it already).

I don’t know what’s priced in right now in terms of Bitcoin’s price. The futures ETF obviously wasn’t priced in because Bitcoin is now up almost 50% in the past month alone. It’s certainly possible people will underestimate a Bitcoin spot ETF if and when it comes out. There is sure to be more demand for Bitcoin when that happens.

I honestly have no idea how much of that is priced into current prices and no one else does either. This remains the most speculative of asset classes.

But that’s also what makes it enticing for the wealth management industry. Crypto is part early-stage technology, part commodity, part new financial system, part speculative vehicle and and part totally new financial asset.

Wall Street sees the writing on the wall. It wants in. The wealth management industry is coming for crypto in a big way in the years ahead.

Michael and I discussed how the wealth management will play a greater role in crypto moving forward and much more on this week’s Animal Spirits video:

Subscribe to The Compound for more of these videos.

Further Reading:

Why Do Stablecoins Offer Such High Rates of Interest?

Now here’s what I’ve been reading lately:

- The cure for FOMO (Prime Cuts)

- So you wanna trade stocks (Young Money)

- Cycling the Tibetan heartland (Banker on Wheels)

- Ignore the price, remember the dividends (Dollars and Data)

- Paying the Covid bill (The Overshoot)

- Advisor Circle, RWM announce SXSW-like Future Proof (RIA Intel)

- Q&A with Robin Powell (Abnormal Returns)

- Personal finance isn’t always personal (Acorns)

- The new fear and greed (Reformed Broker)

- On the power of writing in public (Abnormal Returns)

1Surpassing GLD which took 3 days to reach the tres comma club.