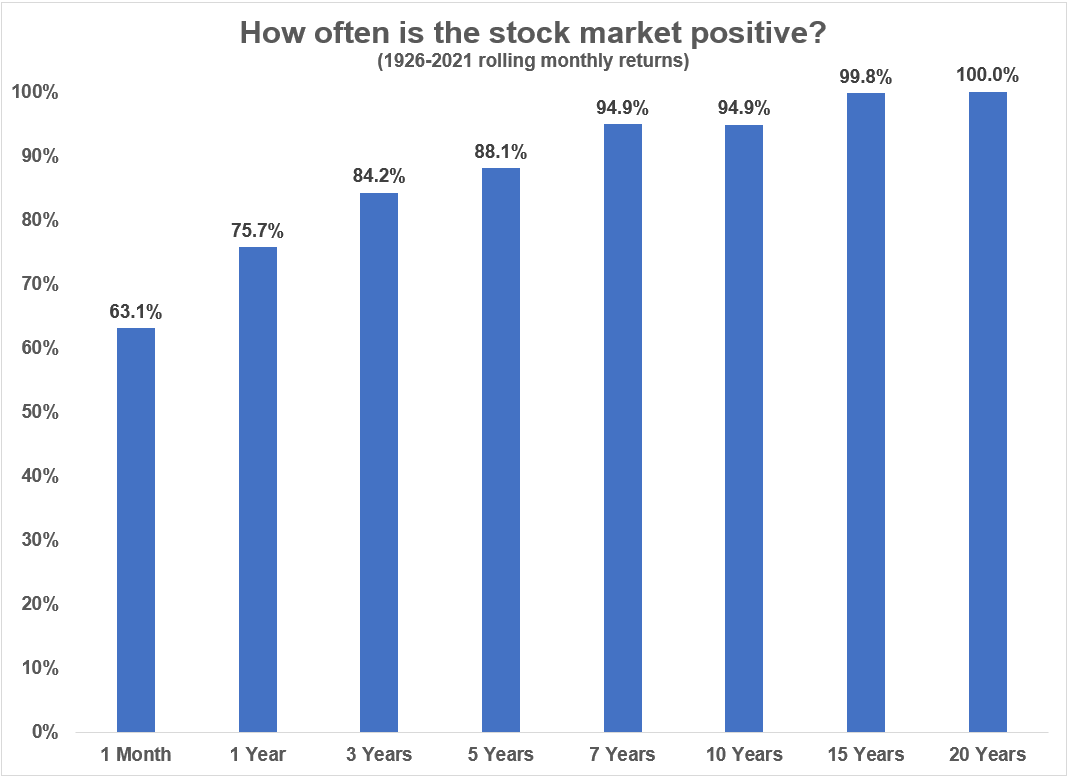

I like sharing long-term data on the stock market because it’s important to have a long-term mindset when investing.

Like the chart I shared this past week:

And every time I share this kind of data I invariably get the same response from a handful of people trying to poke holes in it.

This is great but what about other countries. What about Japan?!

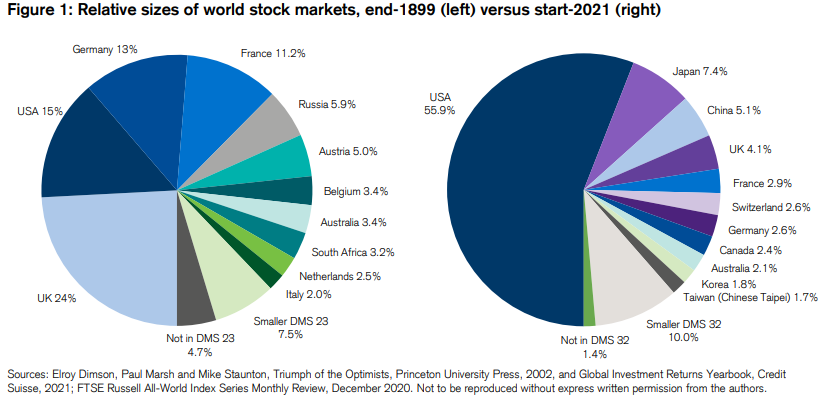

It’s true there’s some survivorship bias in this data. The winners write the history books.

It didn’t have to happen this way but the United States has swallowed up global stock markets Pac Man-style since the turn of the 20th century:

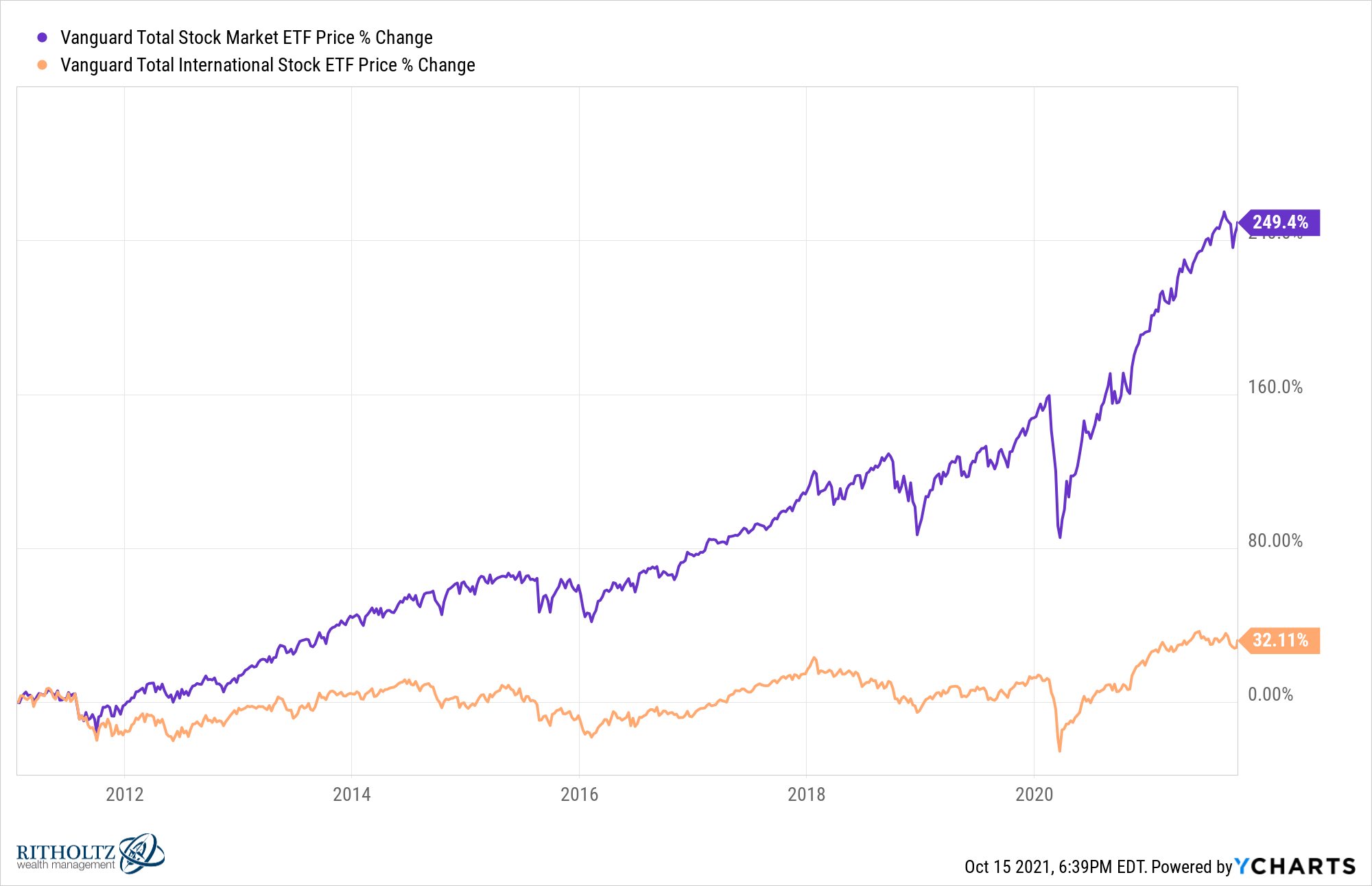

American corporations have dominated the rest of the world over the last decade and change as well:

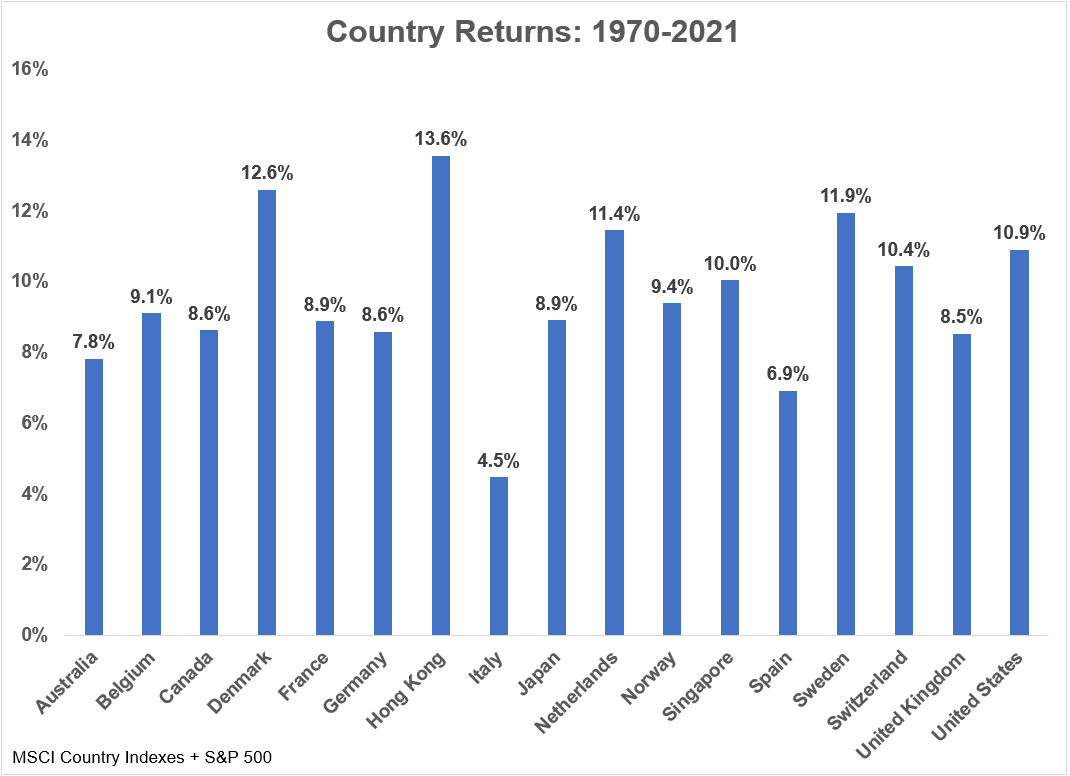

But it’s not like other countries don’t have a good long-term track record.

MSCI has developed country stock market indexes that date back to 1970. Here are the annual returns of these indexes along with the S&P 500 through the end of September:

There are certainly some differences amongst country stock returns but no complete and utter disasters.

That’s not to say disasters haven’t occurred for stock market investors in the past. Of course they have.

The Russian government confiscated financial assets — both stocks and bonds — from its citizens in 1917. The stock market ceased to exist there for many decades. A similar confiscation of assets occurred in China in 1949.

But it’s hard to kill markets.

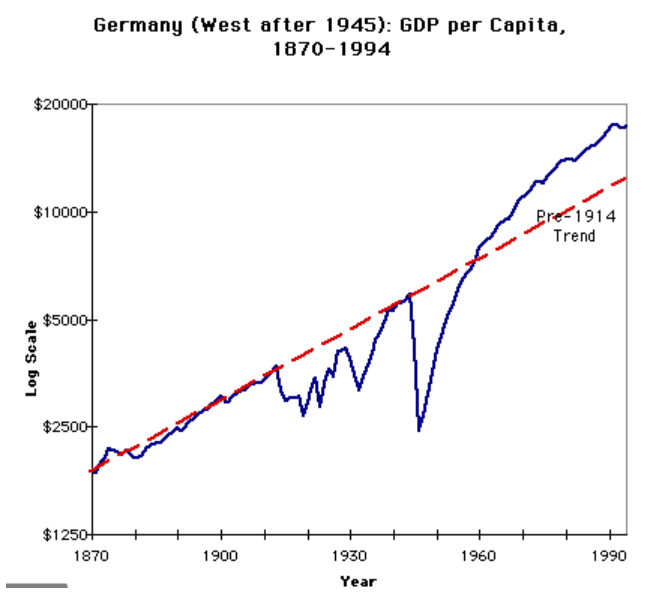

One of my favorite examples of this is what happened to Germany in the 20th century.

The country was the aggressor in two world wars, experienced severe hyperinflation and suffered what should have been a death blow to its economy from the fallout of WWII.

The economy was wrecked but quickly grew out of the ashes:

The 1950s saw the German stock market compound at nearly 25% per year.

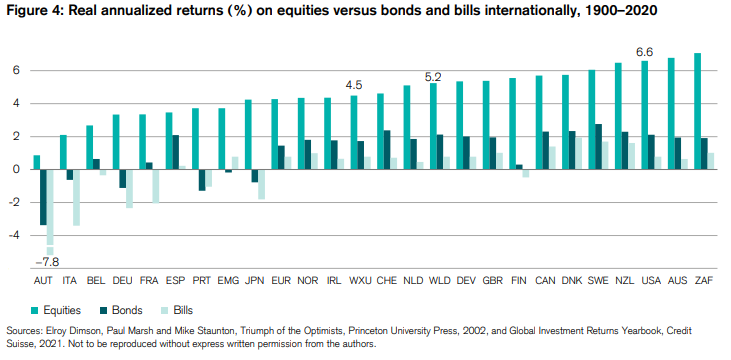

Even if we include that first half of the 20th century, a period that saw a number of depressions and two world wars, the really long-term performance of stock markets around the globe are still impressive.

These are the real annual returns for a number of countries from 1900-2020 courtesy of the Credit Suisse Yearbook:

Again, some countries are better than others but it’s not like the United States is head and shoulders above every other region around the globe.

The United States has had an extraordinary run in the stock market for many decades. We’re home to some of the biggest and best companies in the world.

The U.S. does have some advantages over other countries. We have the biggest, most diverse economy in the world. We have the biggest, most liquid financial markets. The government generally leaves most corporations alone, which is something you can’t say about every country.

But it’s not like we have a monopoly on good ideas, innovation, profits and progress. And most of our biggest and best companies sell their products or services around the globe.

It’s possible the U.S. stock market continues to dominate the rest of the globe for a time. Betting against the US of A has been a losing battle for a long time now.

I wouldn’t bet against the rest of the world either.

Further Reading:

4 Things Every Investor Needs to Know About Markets