Today’s Animal Spirits is presented by Masterworks:

Go to Masterworks.io to learn more about investing in the art market.

We discuss:

- Will supply chains ruin Christmas?

- Investors have been spoiled of late

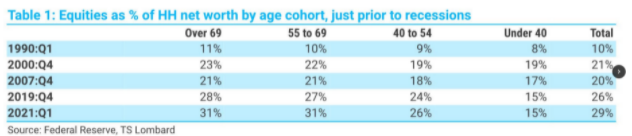

- Why do investors own way more stocks than they did in the past

- Why do so many rich old investors call for market crashes?

- Why were endowment returns so high over the last year?

- There has never been a better time to be a start-up

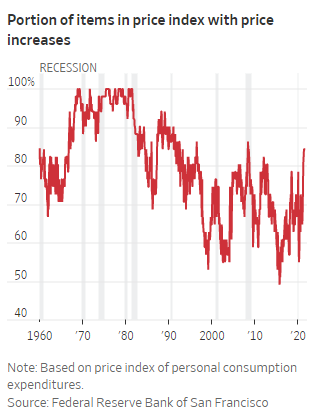

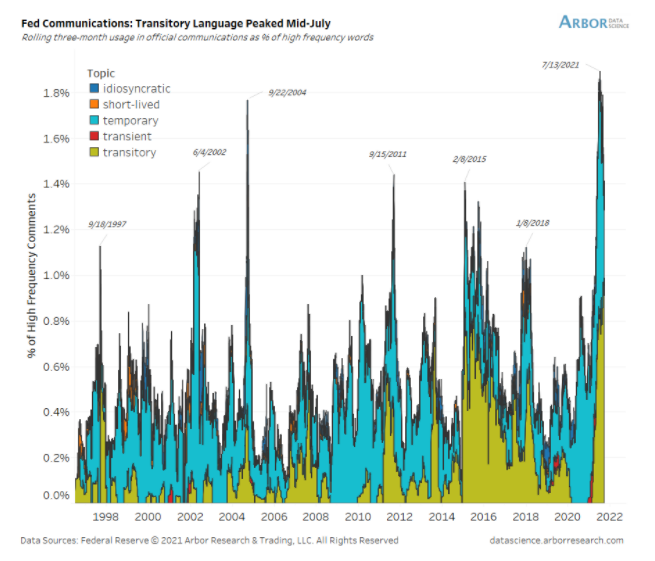

- Does progress lead to inflation?

- Why is inflation better than deflation?

- What good is price when there is no supply?

- Is Zillow driving up home prices?

- The danger of relying on anecdotes

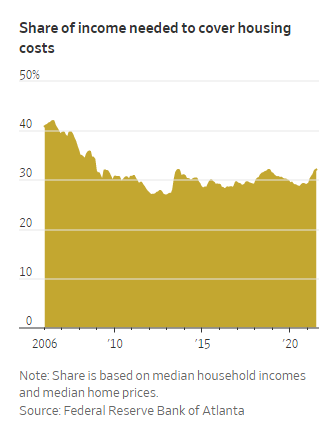

- Is housing in the U.S. becoming too unaffordable?

- Does it make sense to pay off your mortgage anymore with rates so low?

- Why is it so difficult to refinance right now?

- Why household budgets can trigger you

- Are people getting sick of their Pelotons?

Listen here:

Transcript here:

Stories mentioned:

- Why global supply chains won’t ruin the holidays

- Battered 60/40 strategy

- University endowments mint billions

- AngelList stack

- Broader inflation pressures begin to show

- What does price mean where there’s no supply?

- Zillow isn’t buying all of the homes on your block

- Mortgage payments are getting more and more unaffordable

- Clarida traded into stocks on eve of Powell’s comments

- As BNPL surges, borrowers fall behind on payments

- Peloton fatigue

- Is culture stuck?

Books mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here and here.

Subscribe here: