I have a confession to make.

I just can’t get myself worked up this Evergrande story.

Some markets people are comparing this Chinese property developer to Lehman Brothers or Bear Stearns.1

But if we’re being honest here 99.9% of investors had never heard of this company before they showed up in the headlines last week. And how many investors actually understand how the Chinese government is likely to handle all of the debt on this company’s books?

You can read all of the stories and listen to all of the podcast explainers but is it really going to help you become a better investor? Is this company really going to impact your ability to reach your financial goals?

Maybe I’m just over the fact that we’ve been swatting away potential canaries in coalmines for years now when the majority of them simply haven’t mattered.

Or maybe it’s just that I’ve resigned myself to the fact that market corrections can and will happen and the reason is mostly irrelevant.

If you’ve been reading this blog for an extended period of time you’ve read all of my market correction stats.

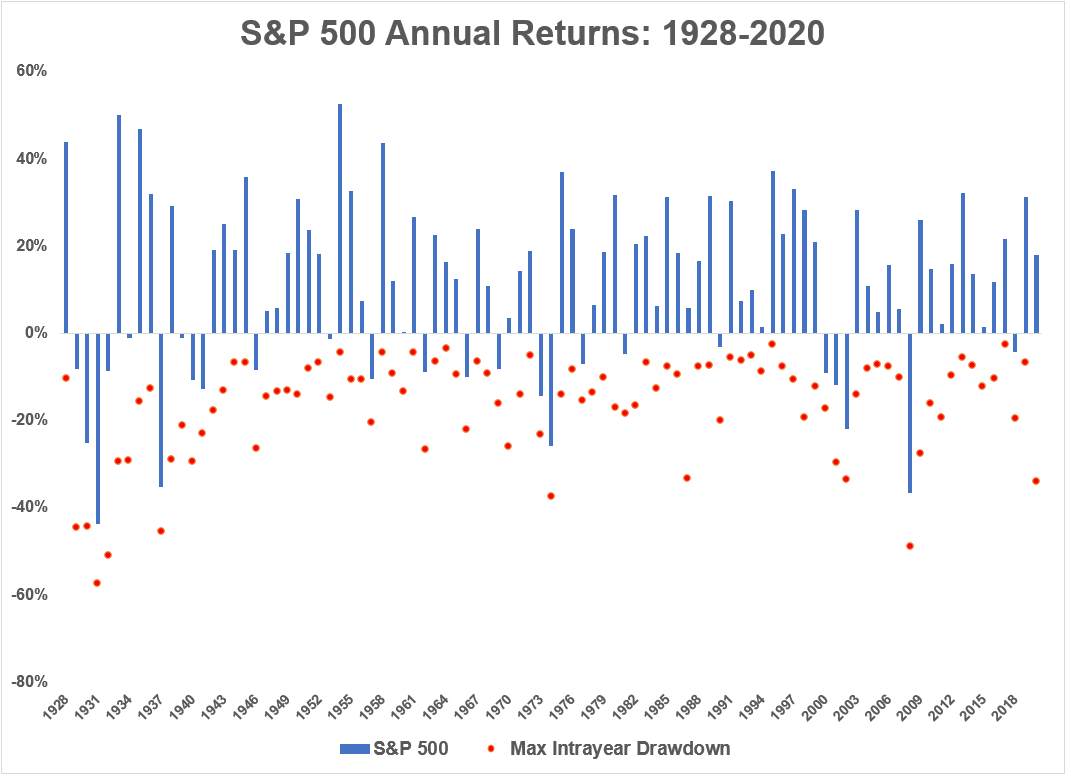

- The average peak-to-trough drawdown for the S&P 500 in a given calendar year since 1928 is around -16%.

- There have been 53 double-digit drawdowns overall in this time frame.

- The average loss for those corrections is -23%, lasting more than 200 days from peak to trough.

- Over the past 93 years the U.S. stock market has fallen 20% or worse on 21 different occasions.2 That’s once every 4-and-a-half years.

- It’s fallen 30% or worse 13 times or one out of every 7 years.

Of course, there’s a big difference between averages and reality.

The stock market fell 50% from 2000-2002. It repeated that feat just 6 short years later.

From 1940-1968, there wasn’t a single bear market in excess of 30%. Then over the next 6 years it happened twice.

There are also some years in which there are no corrections. In 34 out of the past 93 years, there was no peak-to-trough drawdown that reached double-digit levels in a calendar year period (it hasn’t come close this year just yet).

On 7 different occasions, there wasn’t even a 5% correction in a given year (most recently in 2017).

From 2007-2011, the average peak-to-trough drawdown in the S&P 500 each year was -24%. Then from 2012-2017, it was just -8%.

There are ebbs and flows to these things.

It’s also true that each time there is a correction there is a different reason.

Sometimes it’s macro-related. Sometimes it has to do with market fundamentals. Sometimes it’s geopolitical in nature. Sometimes investors are simply looking for an excuse to sell after experiencing large gains. Sometimes the downturns feel completely random.

Most of the risks investors worry about don’t occur. And even if they do occur, they don’t match up with the time frame you’re worried about them occurring.

Markets are hard.

Now, just because this Evergrande story will likely never morph into another Lehman or Bear Stearns moment doesn’t mean it won’t impact certain investors or investments. It still might lead to some damage.

The question is: Does it matter?

If you measure your time horizon in years and decades, you’re going to be dealing with many more corrections along the way. At times, a large portion of your portfolio will seemingly vanish (for a time at least).

I suppose you could try to predict every geopolitical, macro and fundamental story in the years ahead to figure out how it will impact the market. But the odds show even if you could predict the headlines, you’ll never be able to predict how investors will react to those headlines.

And even if you could predict the direction of the markets over the short-term, you’ll never be able to predict the magnitude or length of those moves.

And even if you happen to nail the timing on the next correction, you’ll likely never be able to do it again.

My point here is market corrections are going to happen whether you know the reason or not. It’s not an if, but a when.

And since no one can figure out the when with consistency, the only thing you can do is recalibrate your portfolio or expectations ahead of time.

Either you learn to live with volatility or make your portfolio durable enough to better withstand the bursts of volatility.

This is true if we’re living through the next Lehman moment or a minor dip we all forget about in 3 months.

Further Reading:

Sometimes Your Just Have to Eat Your Losses in the Markets

1There have been dozens and dozens of “Is this the next Lehman?” stories since 2008.

2It is worth noting the S&P 500 has fallen 19% and change on 5 different occasions since 1928. Oh so close to a bear market but not quite.