We discuss:

- Why I just can’t force myself to care about this Evergrande story

- People love to predict “the next Lehman Brothers”

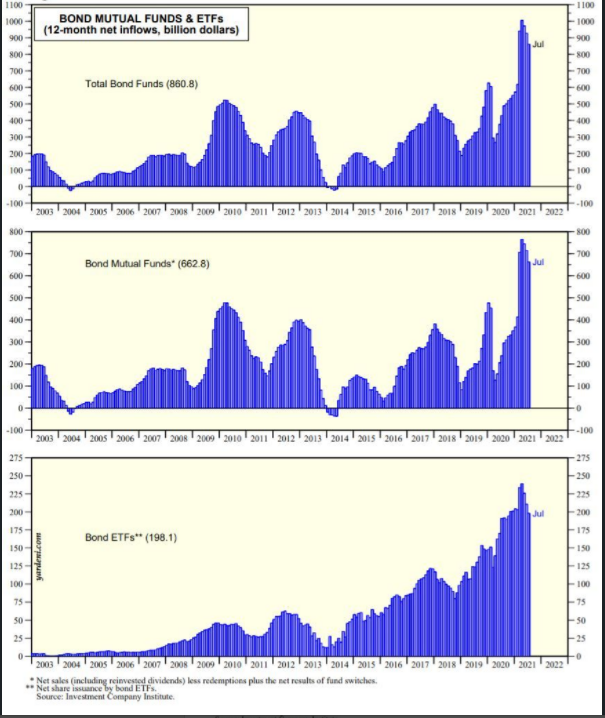

- Why is so much money flowing into bond funds?

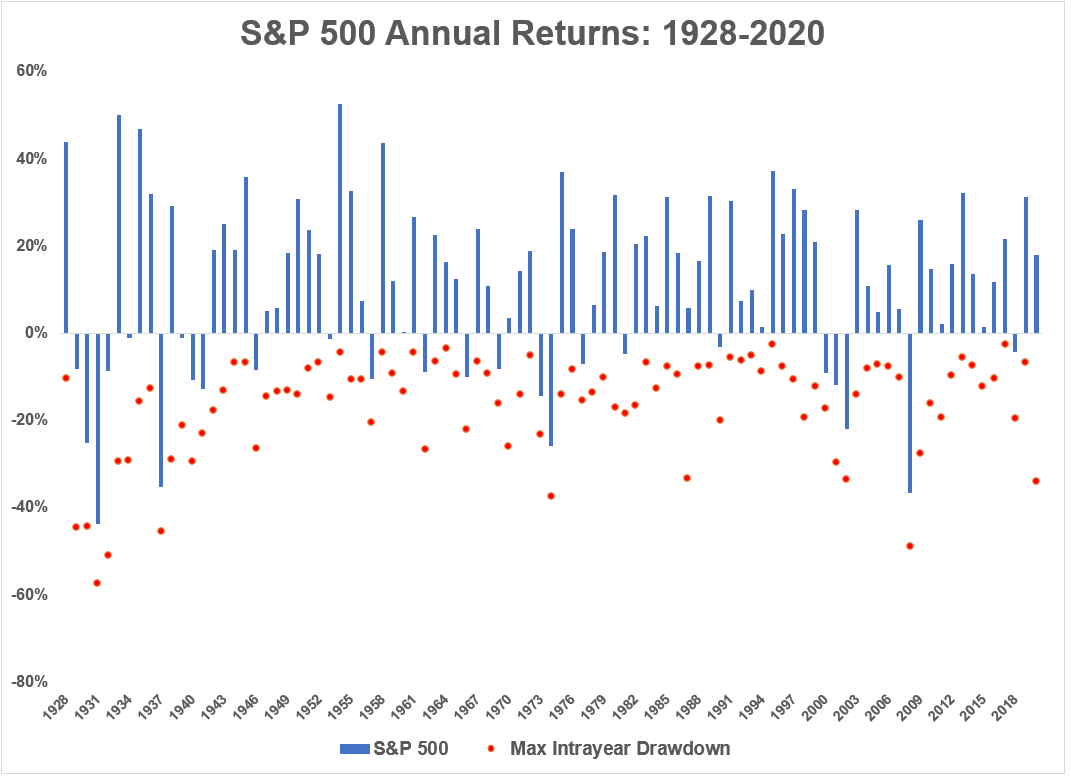

- Which is a bigger market anomaly — the 1990s or now?

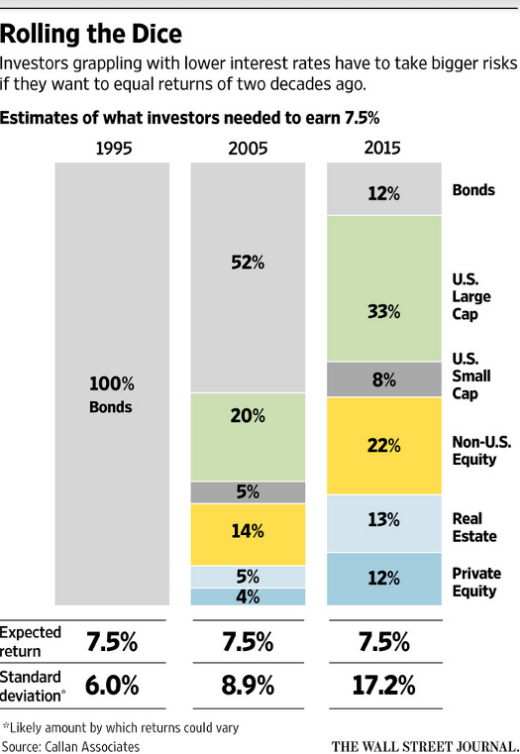

- Why are professional investors having a hard time outperforming?

- Is Robinhood running out of customers?

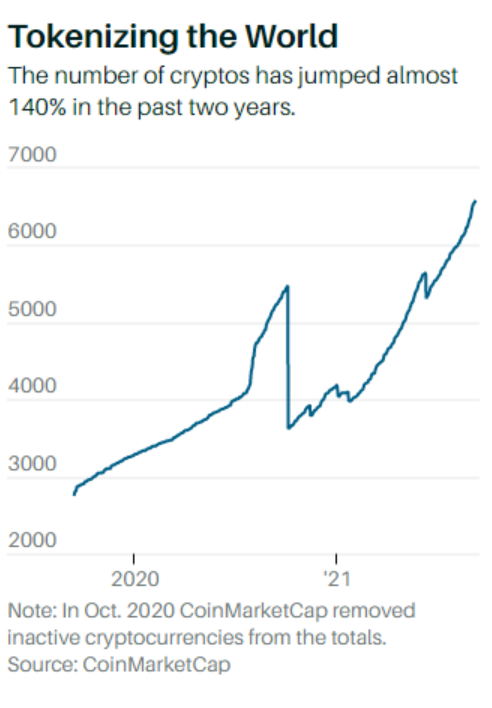

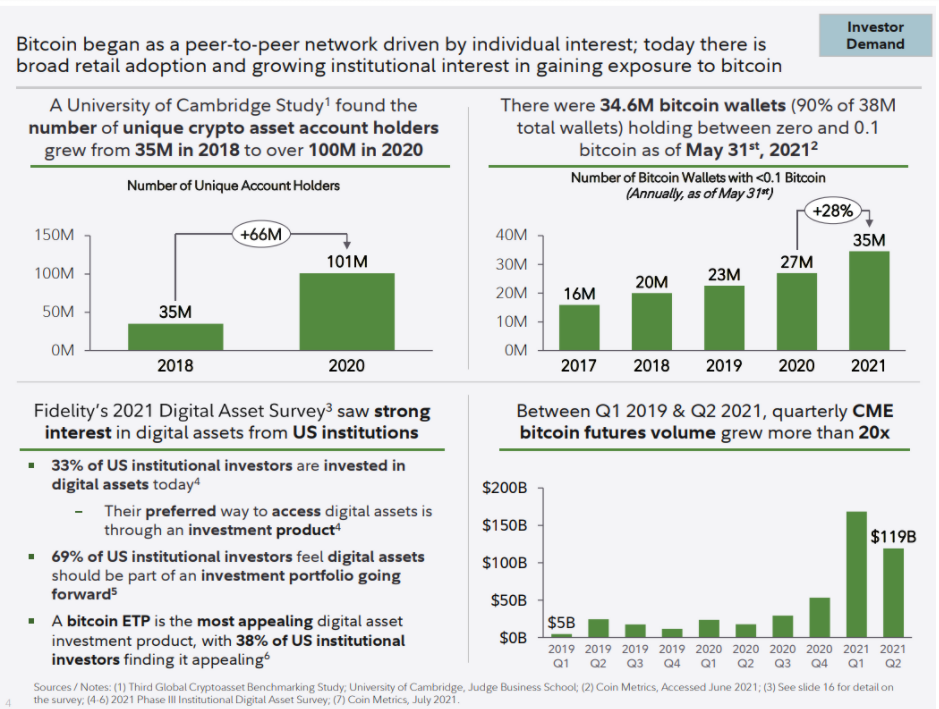

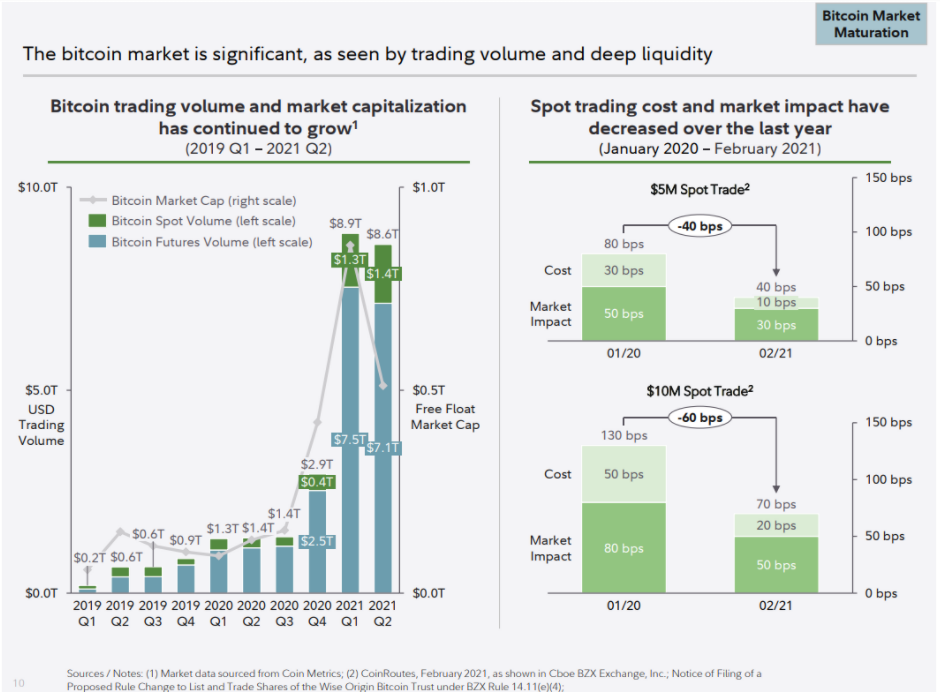

- Why are there so many different cryptocurrencies?

- Why Defi will or won’t work

- Why doesn’t Fidelity own the crypto space?

- Selling crypto to start a business?

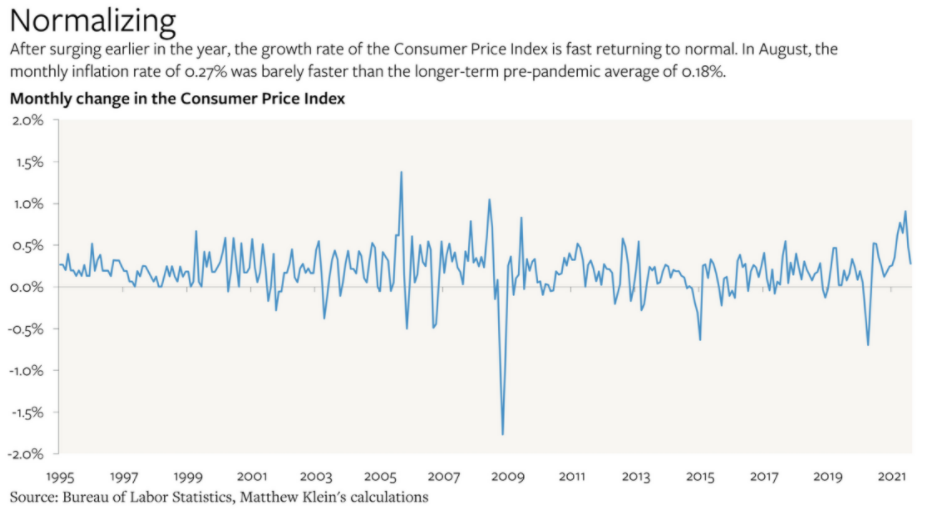

- Inflation is finally settling down

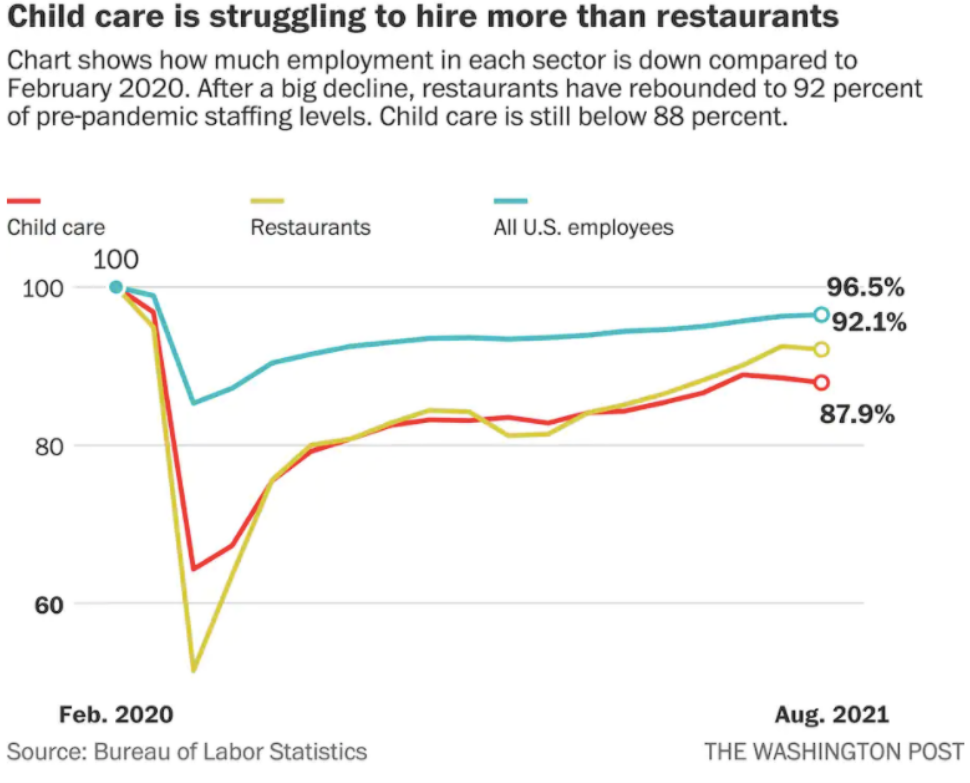

- America’s daycare crisis

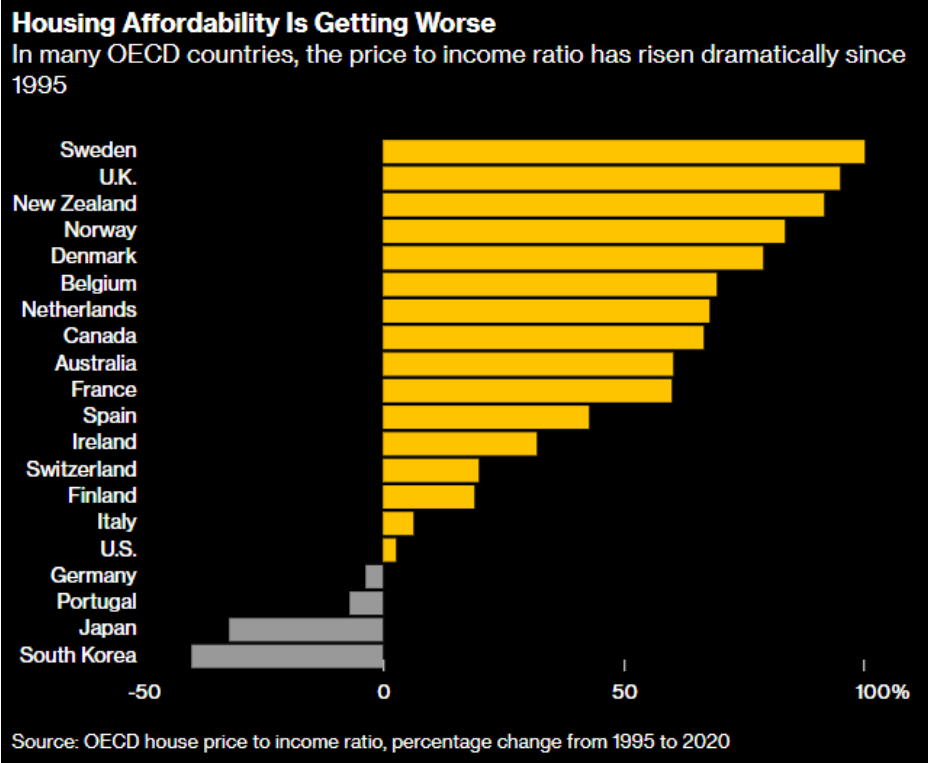

- Is US housing cheap compared to the rest of the world?

- Buying a car right now is a weird experience

Listen here:

Stories mentioned:

- Don’t buy the bad data

- Robinhood is going on a college tour

- The coming war over digital currencies

- OpenSea confirms executive was insider trading

- Fidelity met with the SEC

- America’s inflation story is entering a new phase

- Child care workers are quitting at a rapid rate

- The global housing market is broken

Books mentioned:

- Based on a True Story: Not a Memoir by Norm Macdonald

- Jesse Livermore – Boy Plunger by Tom Rubython

- Defi and the Future of Finance by Cam Harvey

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here and here.

Subscribe here: