A podcast listener asks:

Wife and I (early 30’s) bought our house in 2020 right before the pandemic for about $500k with 20% down on it. Like most, our home value has gone up considerably so looking potentially around $100k in equity + $100k in additional value if we sold. We’re in Atlanta and the potential reason we would be selling is a move to Los Angeles for my wife to continue her growth in the entertainment world in the next couple of years.

The problem is that to buy a comparable house where we want there, we’re looking at $300-400k just for a down payment and I don’t want to tap into our brokerage account and definitely none of our retirement accounts. I’m definitely not FIRE, but do save a considerable amount. So the question isn’t really “do I put my money in the market until then” like has been asked thousands of times, but rather than saving money and keeping it in a crappy “high interest” savings account yielding 0.4%, does it make sense to start throwing additional principal payments at our current mortgage (3.375%) to build up as much equity as possible as a way to optimize saving without incurring much risk?

The low yields on savings accounts and the like are forcing financial consumers to get more creative with their savings decisions.

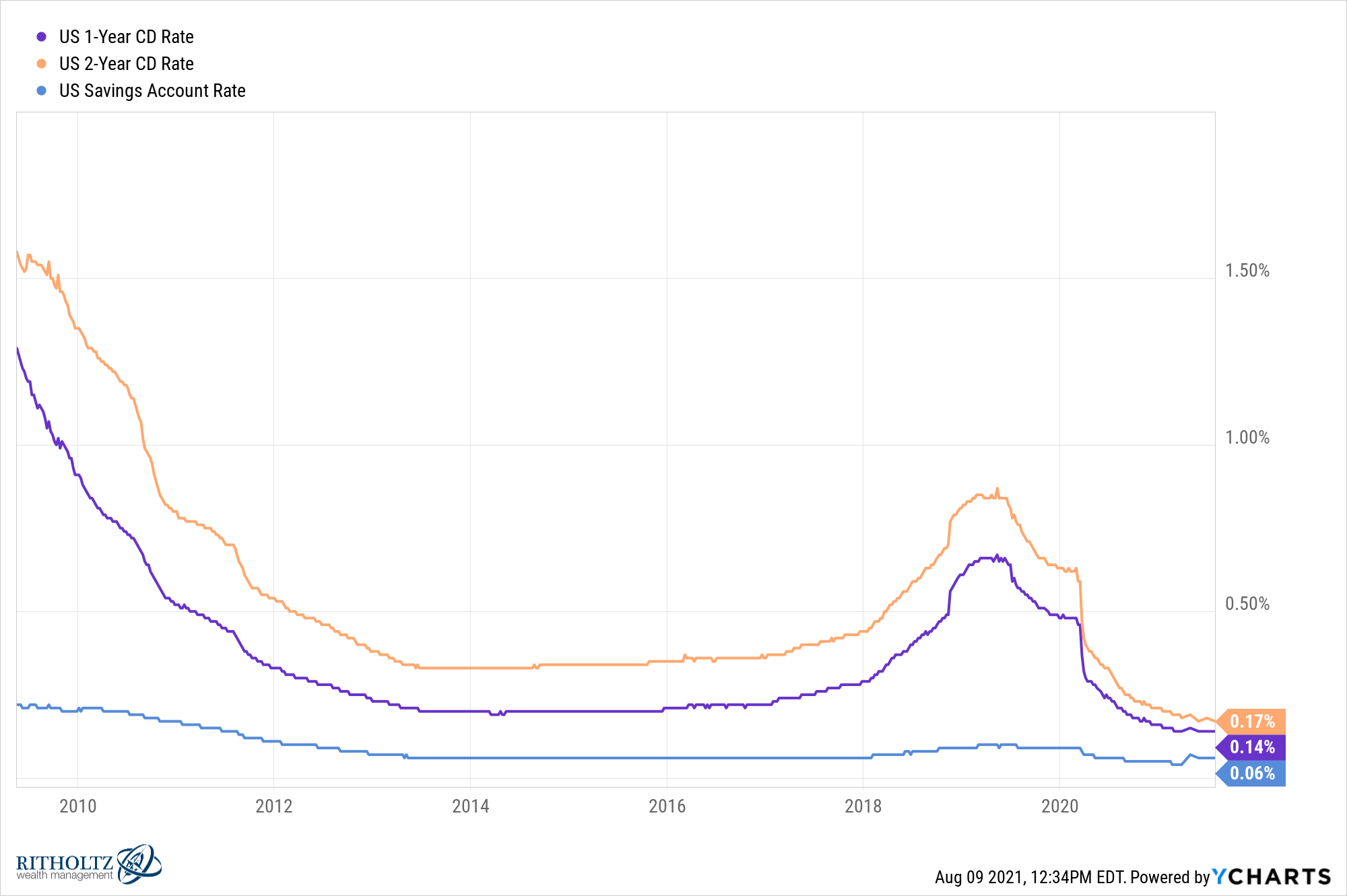

Just look at the rates on CDs and savings accounts from banks at the moment:

Can you imagine tying your capital up for two years to earn 17 basis points a year?

It is possible to earn more money on your savings elsewhere but even my “high yield” online account at Marcus is only paying 0.5% at the moment.

If you’re like this person and don’t want to take more risk with your capital, there aren’t many options at the moment.

Things weren’t always this dire for risk-averse savers.

From 1960-2007, the 3-month treasury bill, a good proxy for a short-term savings account, earned 5.5% per year. Many investors would happily lock in that rate for the stock market over the next decade or so if they could.

To be fair, that’s a nominal return. After subtracting inflation, the real return on cash drops to 1.3% annually over this 48 year period.

But contrast those numbers with the returns on cash from 2008-2020. The nominal annual returns were just 1.3% with real inflation-adjusted returns of negative 1.2% per year. And inflation over this time was relatively low. Rates remain on the floor while inflation is finally ticking up.

The current situation might be the worst ever for someone saving their money in a bank account, money market or short-term treasury vehicle.

The stock market has made up for the poor returns on cash and then some with annual returns of 9.7% from 2008-2020.1

But the stock market is not a great place to park savings you’re going to need for spending in a relatively short period of time. The stock market can crash in a hurry, without warning, as investors witnessed firsthand in March 2020.

There are a plethora of other options for where to park your cash for a down payment that require all sorts of different risks and potential rewards.

Putting more money into your home is an interesting idea.

You know the exact return you’re getting (your mortgage rate minus any tax benefits). You know exactly where the cash is going. It’s a safe bet in that you’re essentially paying yourself.

This is another one of those instances where the calculus is completely different for someone who already owns a home versus a first-time homebuyer.

There are some potential downsides to using your home as a savings account.

The biggest one is that your home is an illiquid vehicle. But that’s not a huge deal in this instance because you already know how to make this money more liquid — just sell your home. The liquidity event will happen at the same time you need the money.

I guess the problem here is you don’t really get all that much time to allow that yield difference to compound. And that cash is still tied up in your home if there is something else you need that cash for in the meantime.

Luckily, this person seems to have their finances in order so there should be plenty of other options available in a pinch.

Unfortunately, low rates could be with us for a very long time so savers are going to have to get creative when it comes to finding more yield on their cash.

Further Reading:

Why Interest Rates Have to Stay Low For a Very Long Time

1And those numbers obviously include the 2008 crash.

2If anyone has good data on this please send it my way. I’ve never seen a breakdown of how many people sell without the help of a realtor.