Coinbase went public yesterday and everything I read about their business continues to blow me away.

From their prospectus:

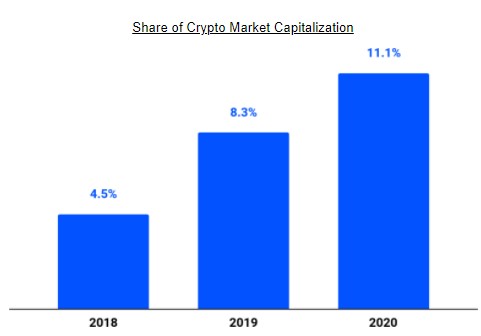

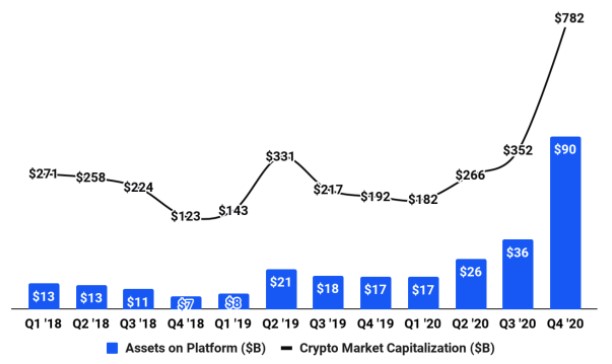

As of year-end 2020, assets on the Coinbase platform represent more than 11% of all crypto assets worldwide.

That’s $90 billion in assets (and rising) for a company that was founded in 2012.

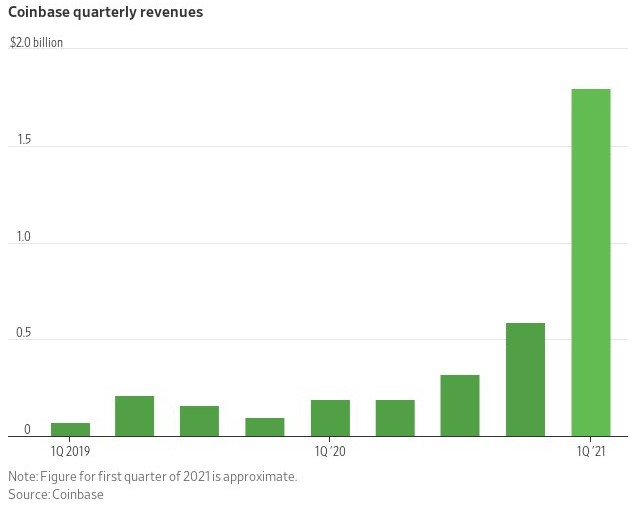

And the growth is only accelerating. In the first 3 months of this year alone, Coinbase added 13 million new customers.

Coinbase now has almost 60 million users in total.

They’re earning more than 0.5% on every trade that takes place on the platform. Traditional financial companies would kill for that kind of action for simply being the middleman. According to the Wall Street Journal, 96% of their revenue comes from transaction fees.

I can’t even imagine the number of Zoom meetings and angry phone calls that were placed after all of the other brokers and financial firms saw these Coinbase numbers.

In some ways, I’m amazed Goldman, Schwab, Fidelity, et al even allowed this to happen.

In other ways, it makes sense.

Brian Armstrong and team at Coinbase basically created a new type of firm for a new type of asset. There was a lot of risk involved in this for the more established firms. And Coinbase has obviously benefitted from the insane run in prices bitcoin has been on over the past year.

Few could have predicted in 2012 the type of user and institutional adoption we would see for a brand new asset by 2021.

Interestingly enough, the success of Coinbase makes what comes next even harder to predict.

Here are some of the analogies I heard being thrown out this week:

Coinbase is the next Blockbuster. No, no, no it’s Netflix.

Coinbase is the Goldman of Crypto. No, it’s the Charles Schwab of crypto.

Coinbase is going to end up being America Online.

The opinions are all over the place.

The bull case is Coinbase delivers the picks & shovels (investors love this analogy) to the crypto universe, they have an established brand, first-mover advantage and more crypto adoption is on the way, especially when it comes to large institutions.

The bear case is their margin is someone else’s opportunities, the fees will have to come down at some point, competition is sure to enter the space and there are few barriers to entry when it comes to administering trades.1

I have strong opinions on certain stocks and companies but not Coinbase. I was initially skeptical until I saw what a profitable business they had as the numbers were slowly released to the public in recent months.

This one falls into my ‘too hard’ pile.

I see massive risks from competition, the volatility of crypto prices in general and the potential for a misstep now that this company has a target on its back.

But there are also massive opportunities for Coinbase to diversify its services, double down on brand recognition and bring in a whole host of new customers. It’s also possible traditional financial firms will remain gun shy about going all-in on crypto.

As of this writing, Coinbase has a market cap of more than $62 billion. That’s roughly the same size as Capital One and bigger than Twitter, Waste Management, Met Life and Kraft Heinz. So at current levels, Coinbase is a big publicly traded company already.

Here are some of my questions that could help explain whether they can become even larger (or not):

- How many legacy financial firms are scrambling right now to get into crytpo when they see the massive growth in Coinbase and their juicy margins?

- How will competition impact Coinbase going forward? Will the company be able to pivot to other services if/when their fees come down?

- How much correlation will Coinbase shares have with the price of bitcoin itself? Will a crash in crypto cause a crash in Coinbase or will volatility actually help them earn higher commissions?

- How many other crypto companies will speed up the process of going public now that Coinbase has been so successful?

- Will the Coinbase IPO drive even more adoption to the space?

- Is a bitcoin ETF one of the biggest risks to the future growth prospects for Coinbase? How many institutions and individuals will find it easier to buy an ETF rather than buying crypto directly from Coinbase?

Myself, Josh, Michael and special guest Packy McCormick of Not Boring fame got together last night to discuss Coinbase and what it all means:

Subscribe here.

Further Reading:

The Best Case Scenario For Bitcoin

1And maybe the biggest bear case is a hack of their system and lost crypto on behalf of their customers. That’s also probably the biggest risk for bitcoin in general right now.