Investors in 2020:

Beating the stock market is easy

The stock market in 2021: pic.twitter.com/XriBR2rTBe

— Ben Carlson (@awealthofcs) March 5, 2021

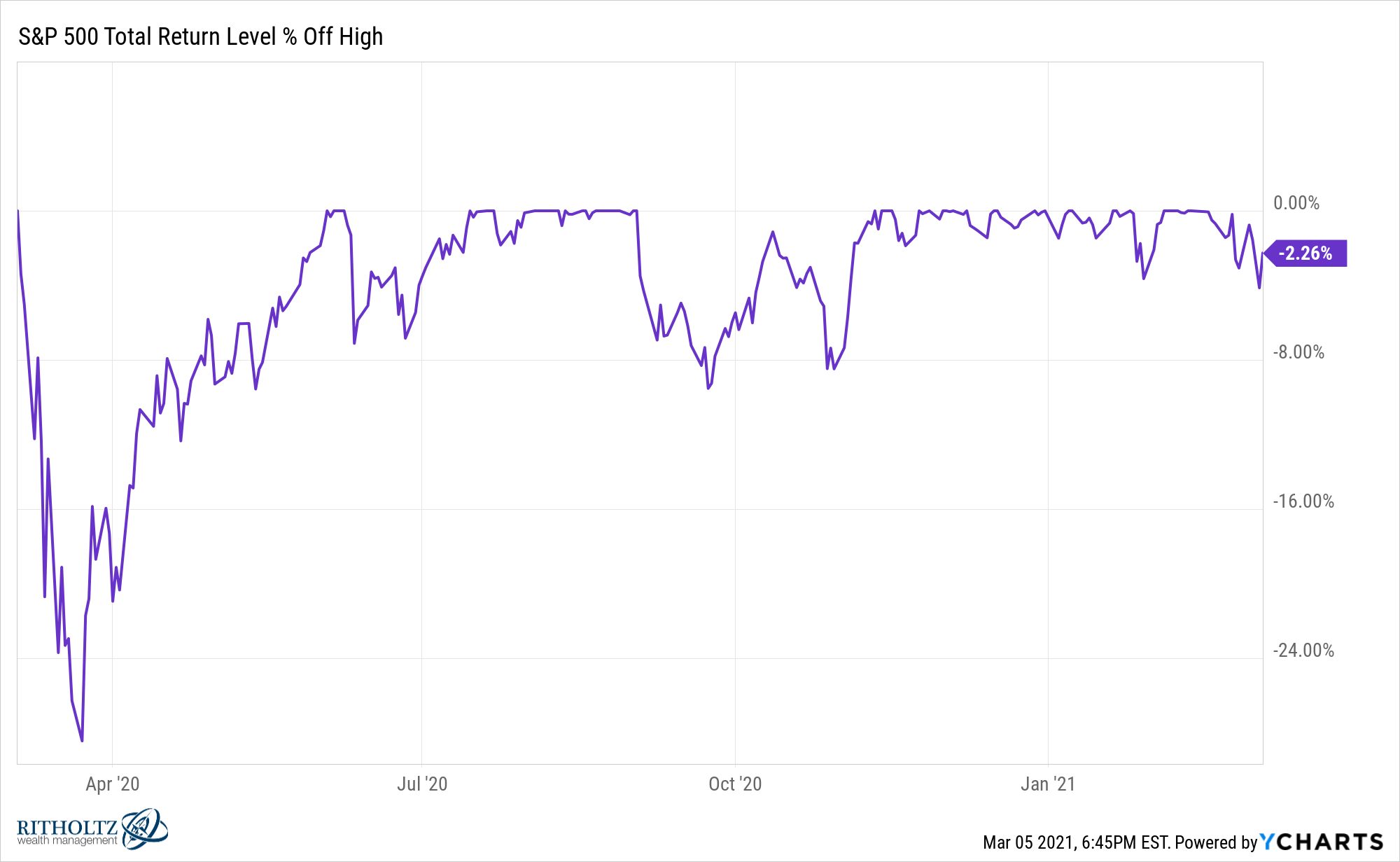

The S&P 500 is in the midst of a 2.3% drawdown. If you squint you can see it:

You should expect to see a handful of 2%+ down days in the stock market every year. This is nothing.

So why does it seem like so many investors were freaking out this past week?

Well, it depends what you own. If you own an index fund the past couple of weeks barely registered.

But if you own individual stocks, especially growth and momentum stocks, it’s been a different story.

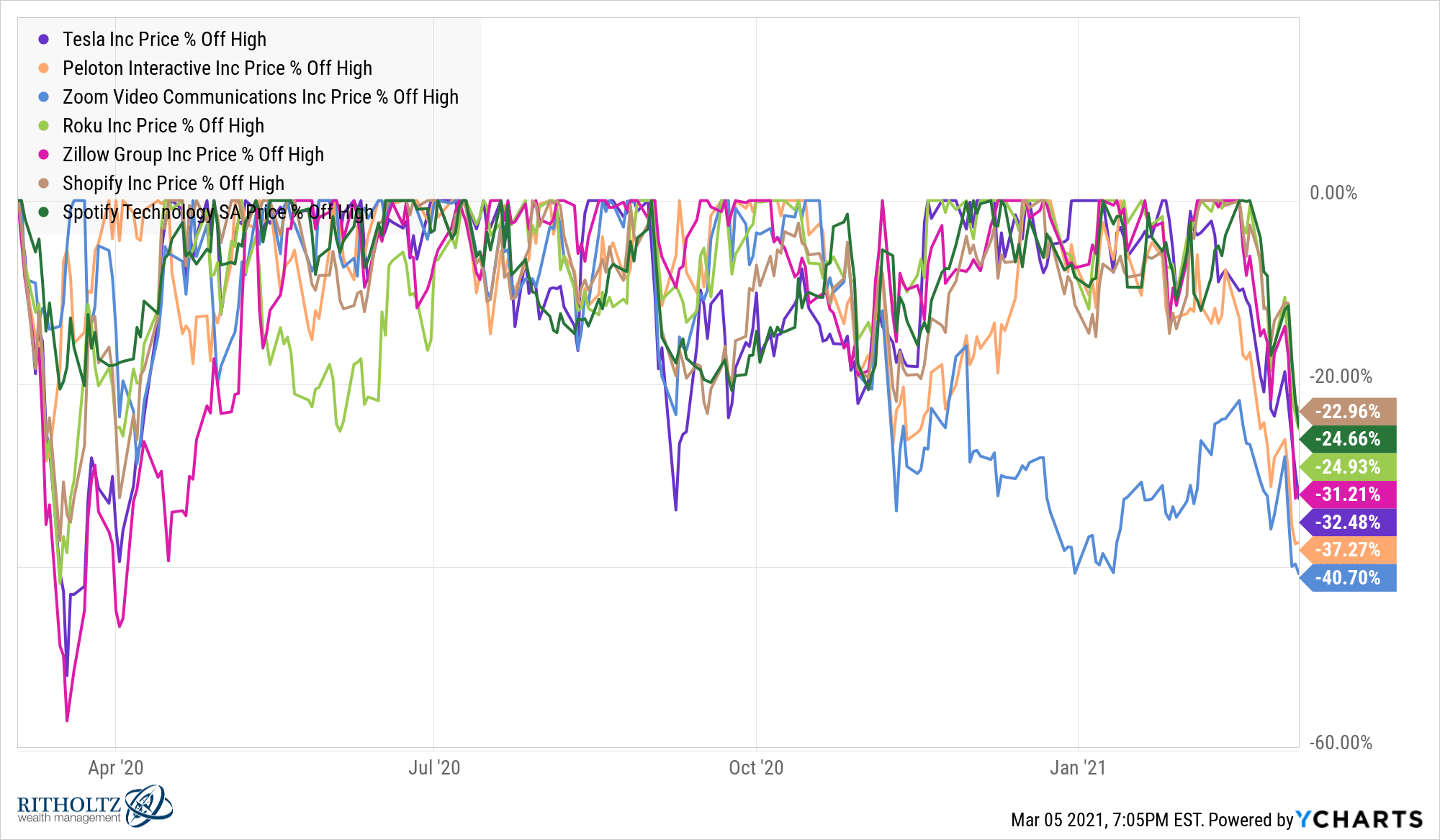

Momentum stocks have taken a nice little hit:

The Nasdaq 100 is down a little more than 8%. So certainly a correction but not the end of the world, right?

You should expect to see corrections like this, probably once every year or so, maybe every other year.

Let’s drill down even further into some popular stocks of late:

Now we’re talking. Drawdowns galore in some of the most popular names of the past year or so. Zoom is down more than 40%. Peloton is close to that. Even Amazon and Apple are down 15% a piece.

And these drawdowns came after a furious rally in the latter half of the day Friday.

I mentioned recently I own shares of Stitch Fix. As a one-time high-flier, the stock has been hit just as hard as these stocks the past couple of weeks so I was watching it Friday because I wanted to buy more. Lean into the pain, right?

At one point late in the morning on Friday the stock was down more than 11%. It finished the day up more than 5%.1

This is the stuff a backtest will never tell you. All you see is the outcome of the day, not what it took to get there. And having the ability to watch this stuff in real-time is something most investors didn’t have back in the day.

A number of stocks experienced similar losses before staging a comeback. It could have been margin calls on these once overbought stocks or capitulation but that’s quite a cycle of bust and boom all in the same day.

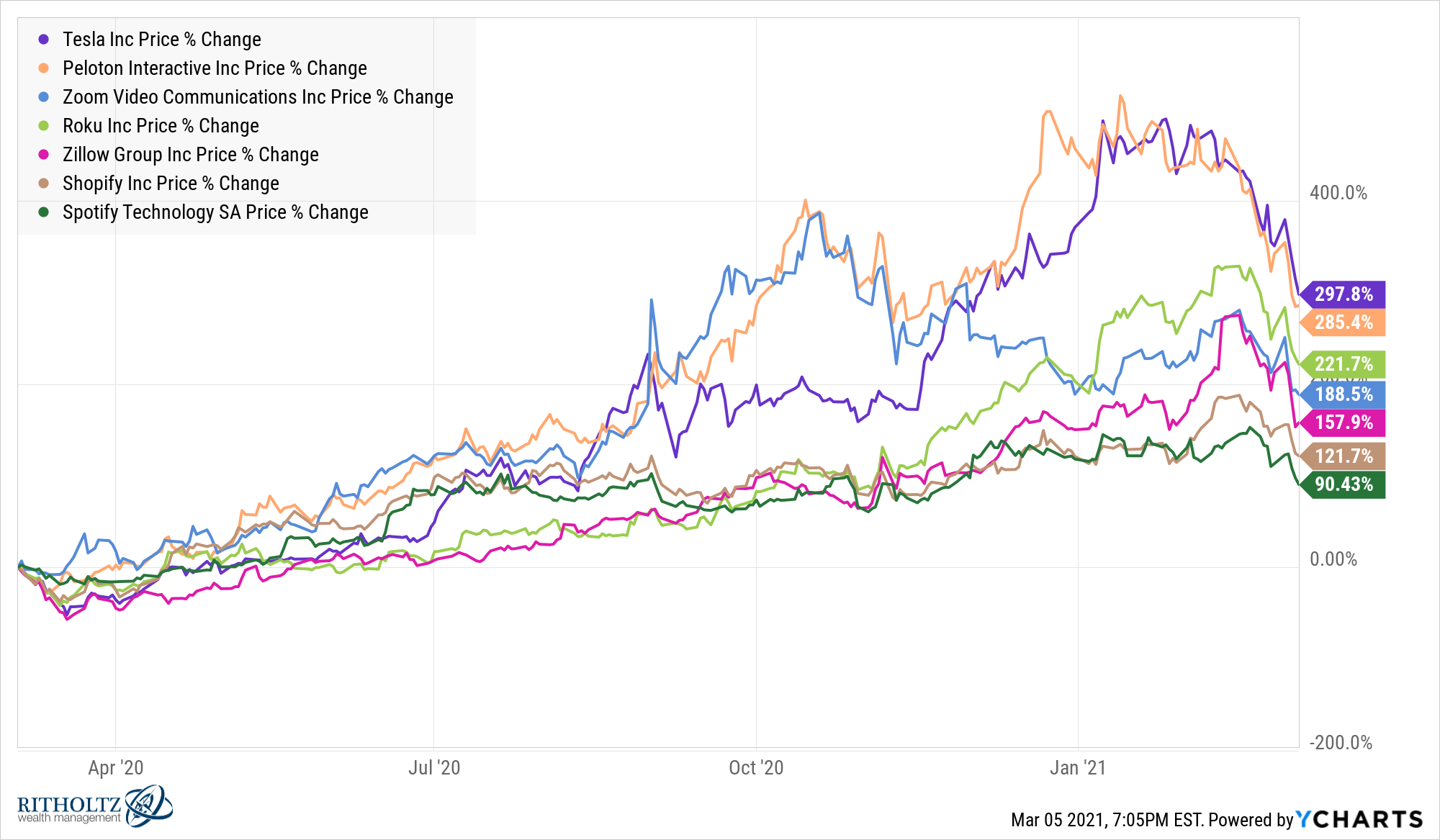

To be fair, many of these stocks with big losses right now have also experienced big gains over the past year, even after accounting for the recent swoon:

This is one of the reasons it’s so difficult to invest in individual stocks coming out of a market crash.

The large losses last February and March led to huge gains coming out of those losses. And now we have a situation where you have big losses in stocks that have seen big gains.

It’s almost impossible to avoid anchoring one way or another.

For those who don’t spend their free time reading Daniel Kahneman research papers, anchoring is a heuristic where we humans start with an initial value and adjust our beliefs using that value as a baseline.

And when there are extreme moves in the stock market in a short period of time, there are so many highs and lows to anchor to when figuring out if something is a worthwhile investment or not.

You could look at the returns from the late-March 2020 lows and assume you’ve already missed the boat. Or you could look at the recent highs and assume the 20%-40% pullbacks offer a buying opportunity.

This is why investing in individual stocks can play such head games with you.

Anchoring to the bottom makes it hard to buy more of a good stock.

And anchoring to the top makes you think you’ve found a bargain.

Both instances can be right or wrong depending on the stock and market environment.

The same thing applies when putting new money to work.

Should you buy what’s been working? Pour money into your losers? Pick new stocks altogether?

Yes, buying individual stocks offers the potential for greater gains but it also opens you up to all sorts of psychological pitfalls that don’t necessarily apply when owning the entire stock market.

Portfolio management is so much harder when picking individual stocks, especially in a concentrated manner. Wonderful gains can turn into terrifying losses in an instant, leaving you with more questions than answers.

Momentum stocks can turn into value stocks in a matter of days with the speed of market movements in the information age.

Whether you’re investing in an index fund or individual stocks and you’re still saving money, you want stocks to fall like this on occasion. If you have a steady income, and more importantly a steady savings rate, these buying opportunities are your friend.

The problem for many investors these days is they only believe in their stocks when they’re rising. If you don’t believe in those same stocks when they’re falling, you have no business owning them over the long haul.

Could these same stocks that have fallen 30-40% fall even more? Certainly. When owning individual stocks you have to expect these types of losses even more often than the overall market.

But if you don’t have the intestinal fortitude to buy your high-flying stocks when they turn into low-flying stocks, you’re probably better off just owning an index fund.

Further Reading:

One Way to Beat the Market

1I didn’t nail the bottom but I definitely bought some more. I’m not good at predicting these things but it wouldn’t surprise me if growth stocks have another leg lower. We shall see.