This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. If you’re looking for a new job at a fast-growing investment research firm, YCharts is hiring.

We discuss:

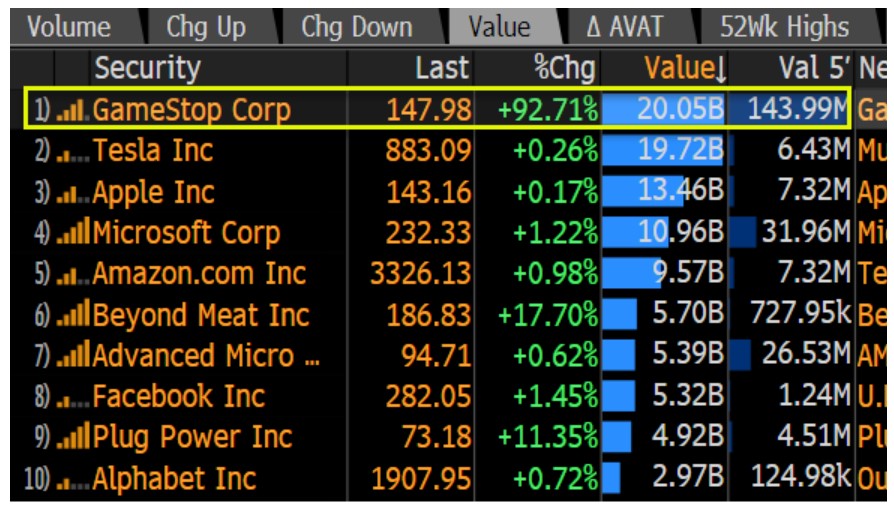

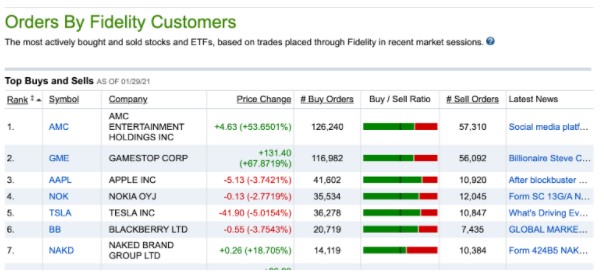

- All things Gamestop

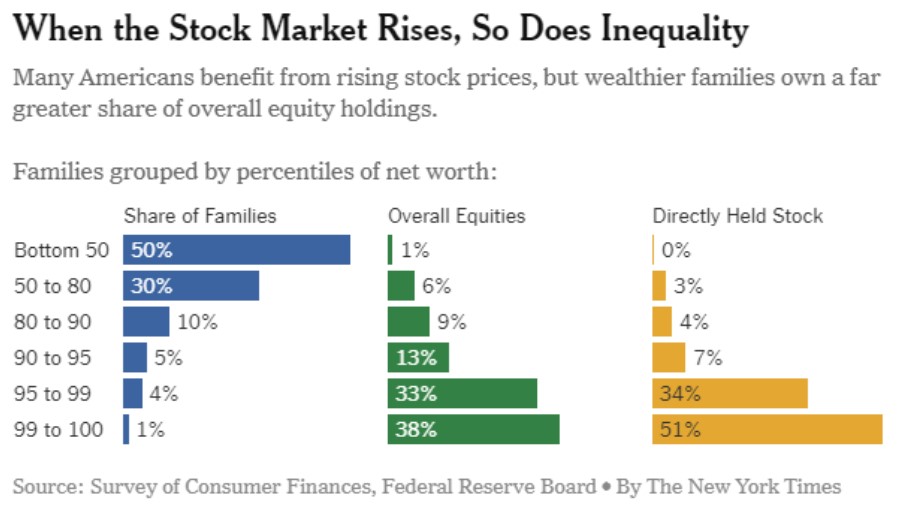

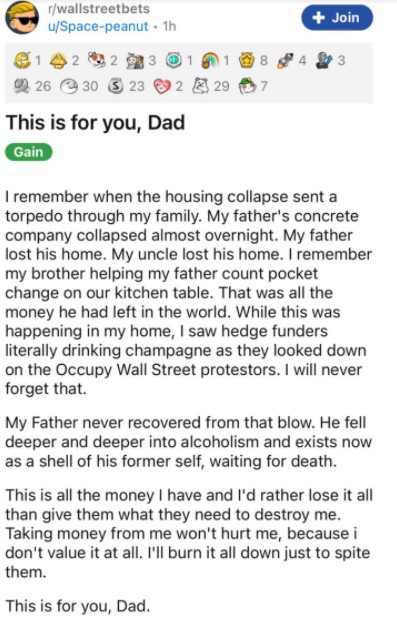

- How wealth inequality and the 2008 crisis drove last week’s outrage

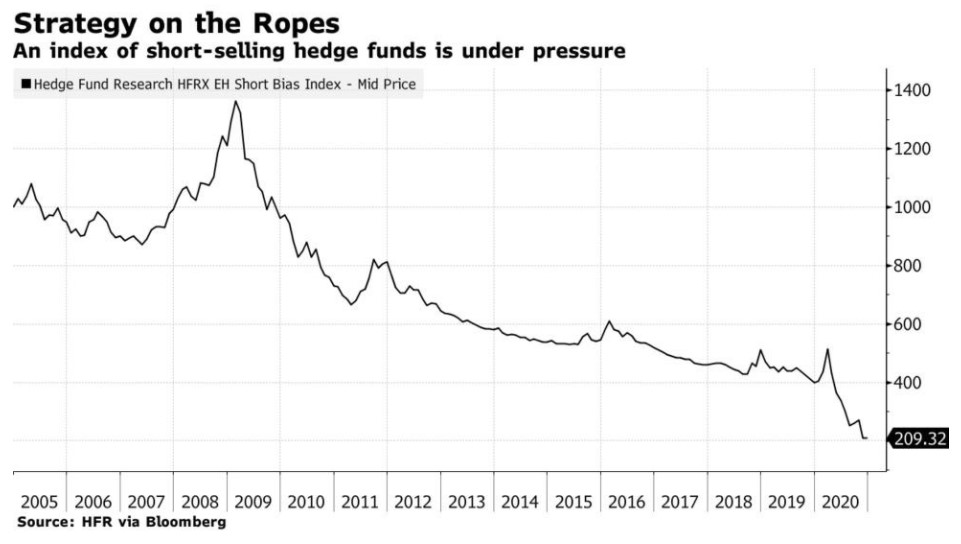

- The role of short-sellers and hedge funds

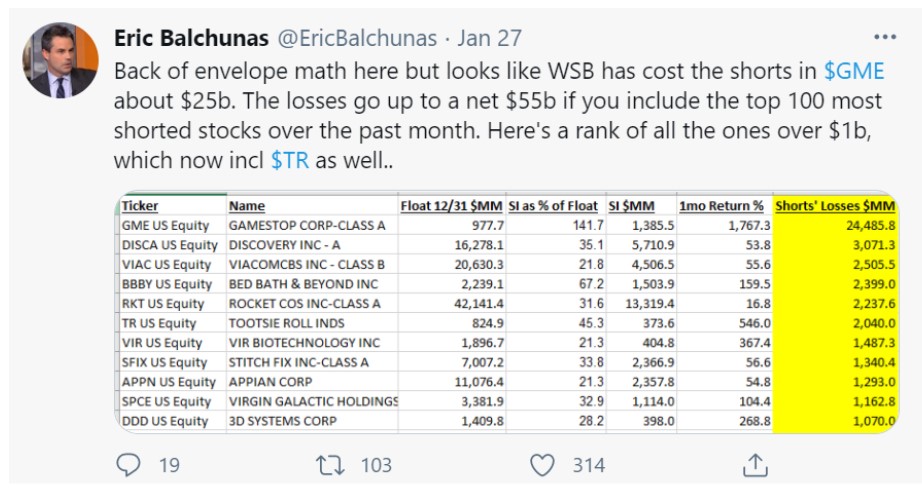

- The David vs. Goliath story of WSB vs. Melvin Capital

- Our biggest worry about this whole ordeal

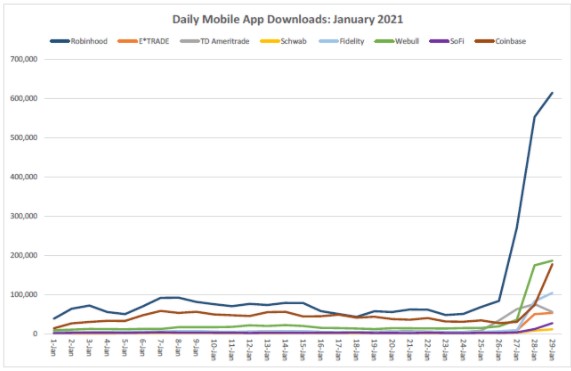

- The danger of markets becoming a pop culture phenomenon

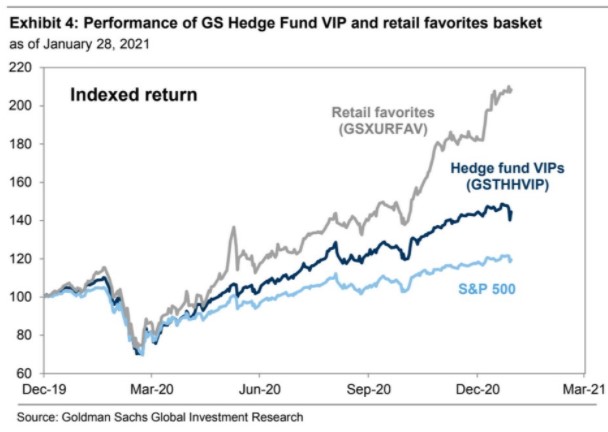

- Wall Street always gets a cut but the retail investor is now winning more often

- What really happened with Robinhood?

- Why people care more about conspiracy theories than the true boring explanation for this

- Is Robinhood the Facebook of finance?

- How did Robinhood raise $3.4 billion so quickly?

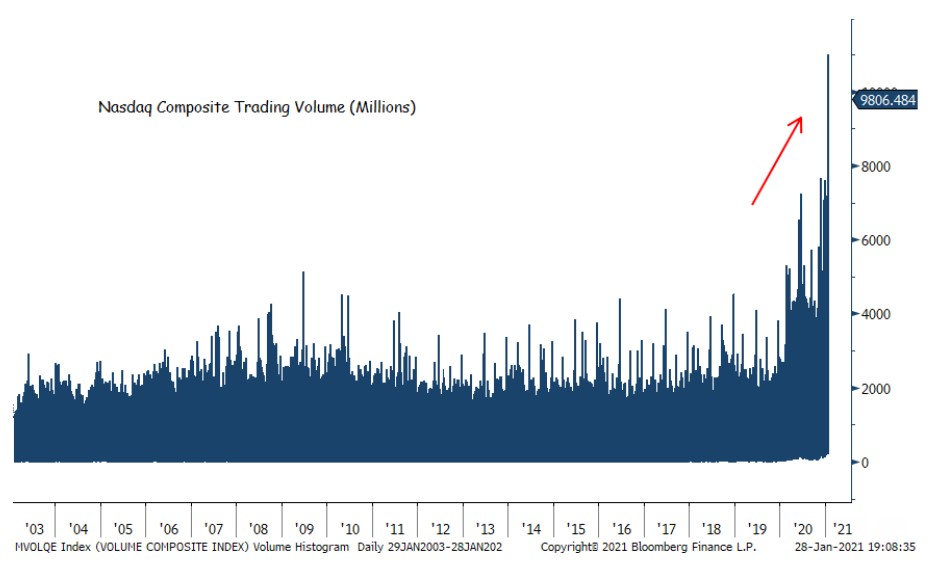

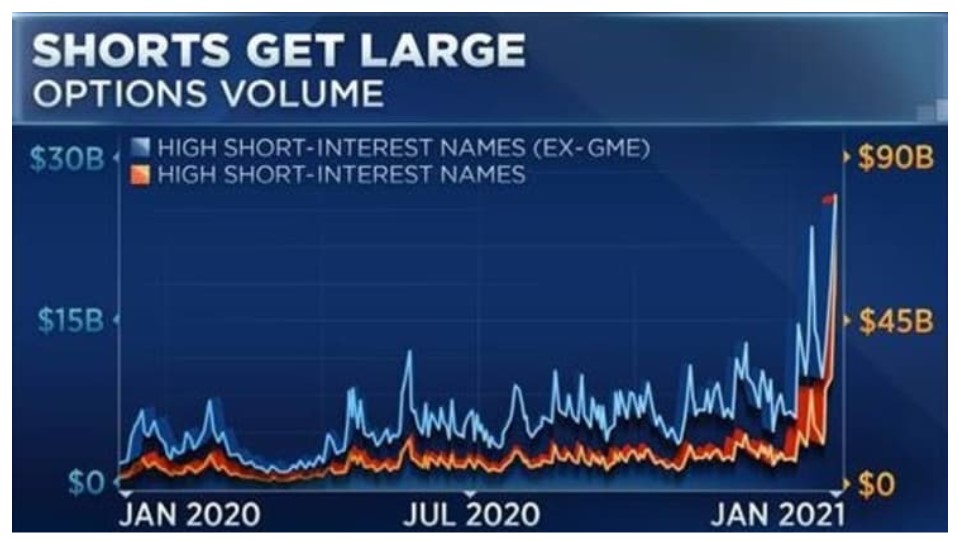

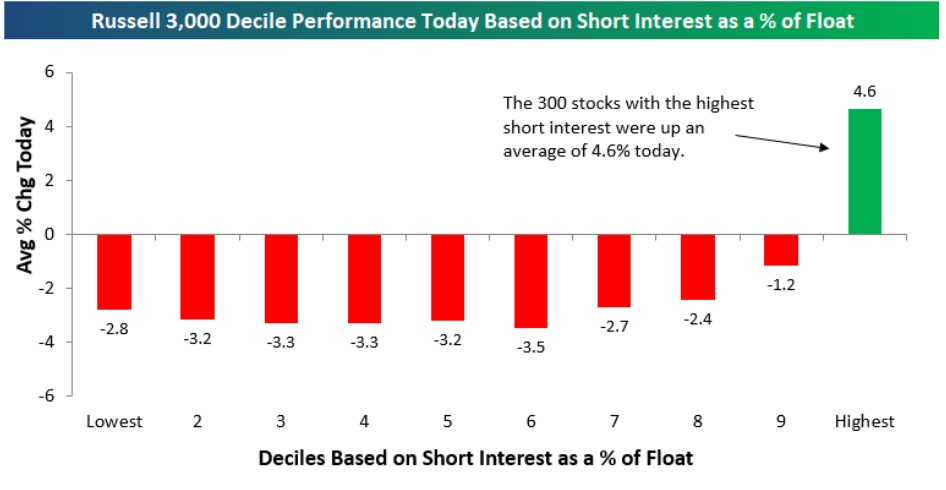

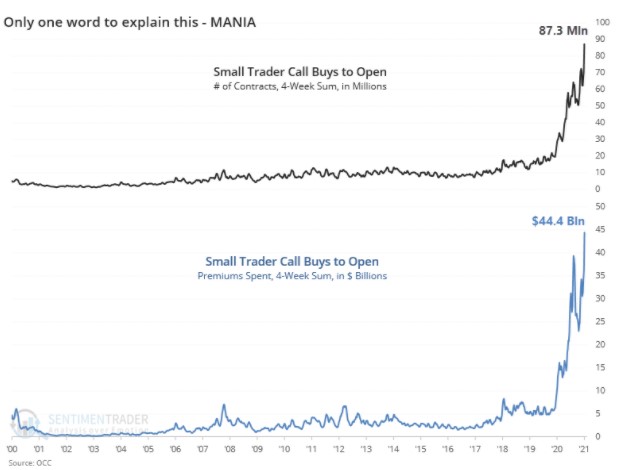

- Speculation and short-covering are red-lining

- Why didn’t the stock market flinch from this mania?

- What does this mean for the broader market?

Listen here:

Stories mentioned:

- Melvin Capital lost 53% in January

- Citron will stop publishing short research

- It’s likely going to take a constant stream of excited buyers to keep GameStop, AMC going

- My view on short selling

- Wall Street hedge funds stung by market turmoil

- Peterffy calls Robinhood decision to allow ‘limited buys’ of GameStop troubling

- Keeping customers informed through volatility

- Robinhood said to draw on credit line

- The Silicon Valley start-up that caused chaos

- What happened this week

- Robinhood raises $1 billion to meet surging cash demands

- Silver Lake cashes out after AMC rally

- Semantic destiny, algos and GameStop

- GameStop frenzy puts the spotlight on Citadel

- Webull CEO explains why trading was restricted

- AMC raises $917 million

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: