This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service. If you’re looking for a new job at a fast-growing investment research firm, YCharts is hiring.

We discuss:

- Why food delivery is a terrible business model

- Why didn’t GameStop raise money by issuing new shares?

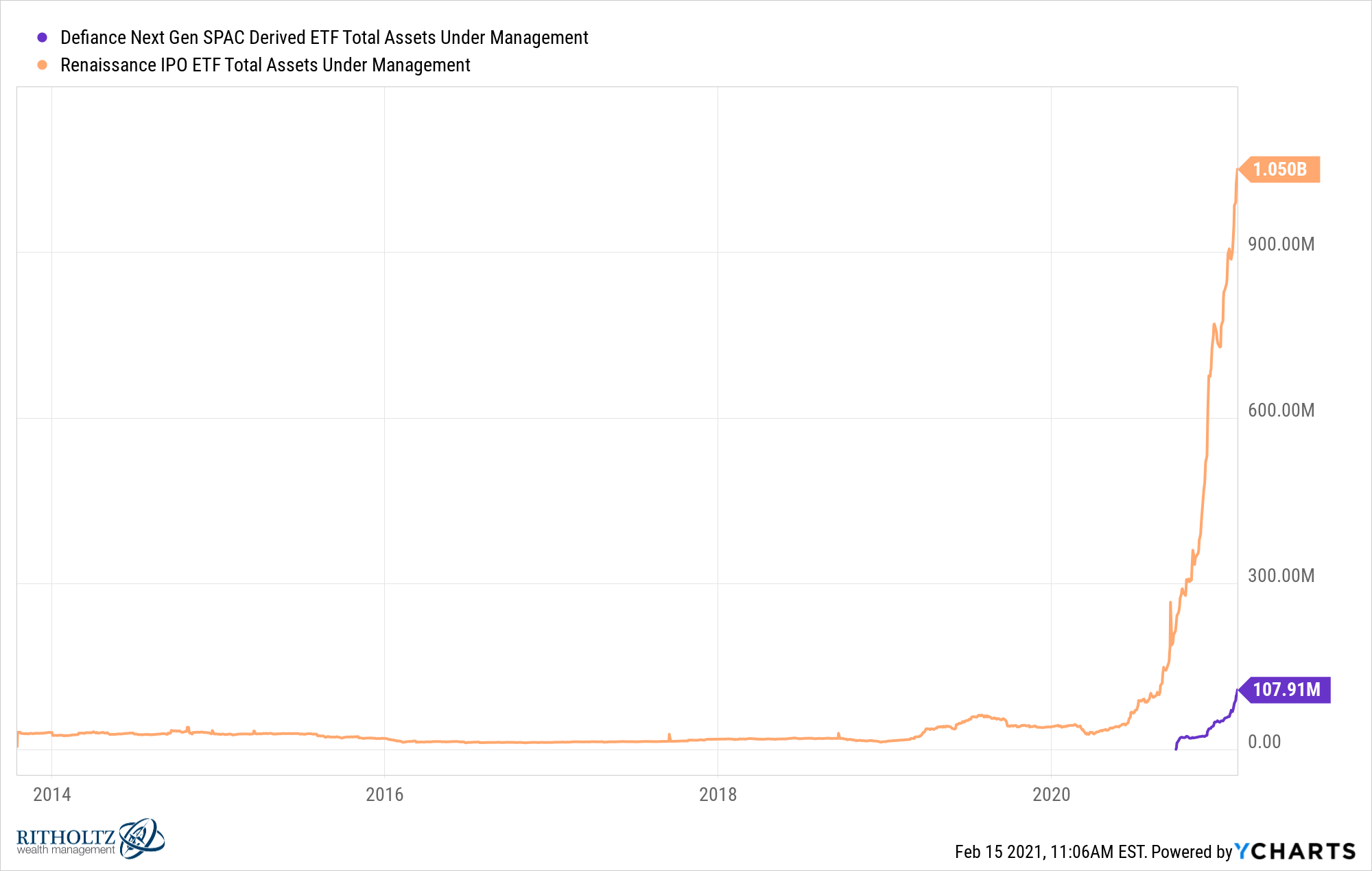

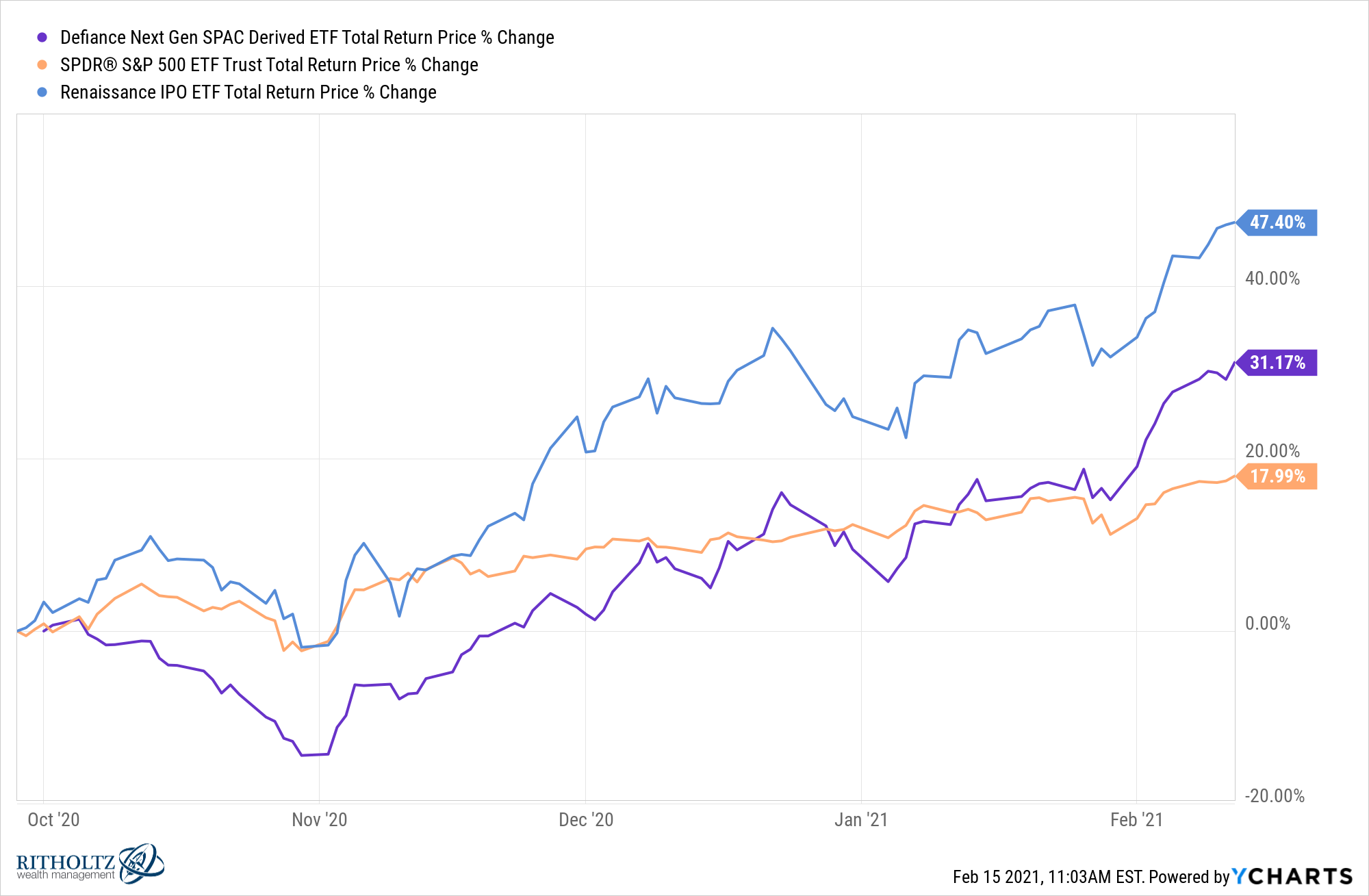

- Why SPACs are probably here to stay

- Raising money in the capital markets is almost too easy right now

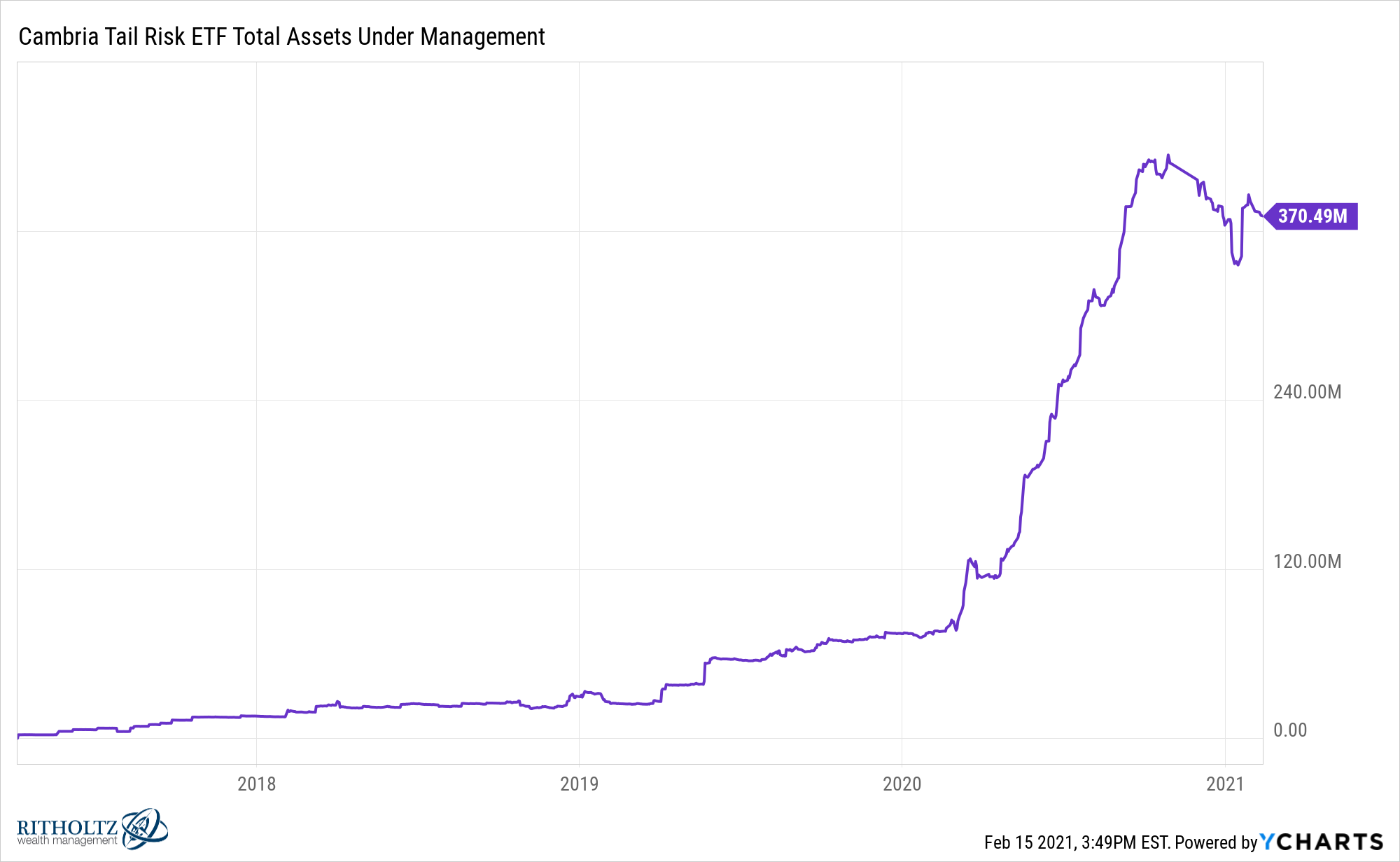

- Why investors are always fighting the last war

- Did we all underrate the Internet’s importance pre-pandemic?

- Robinhood vs. sports gambling apps

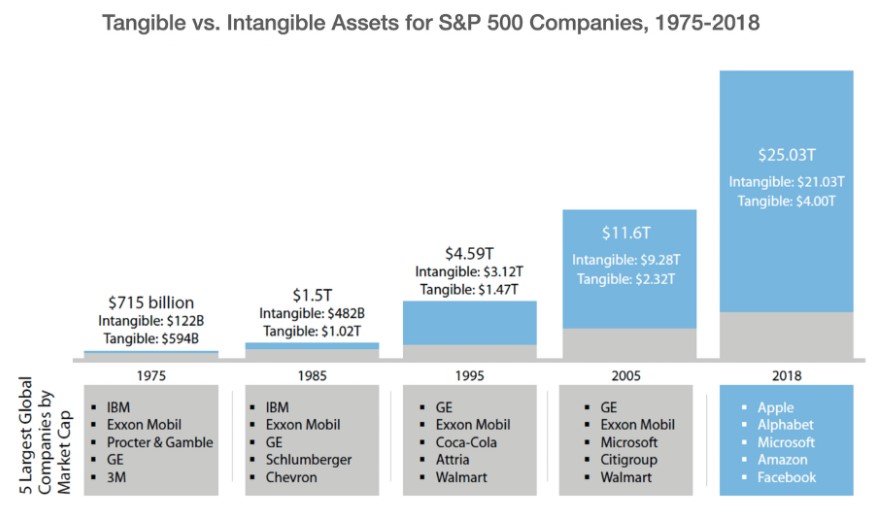

- Have big tech stocks completely changed market fundamentals?

- The anti-survey segment is back

- The housing market remains red hot

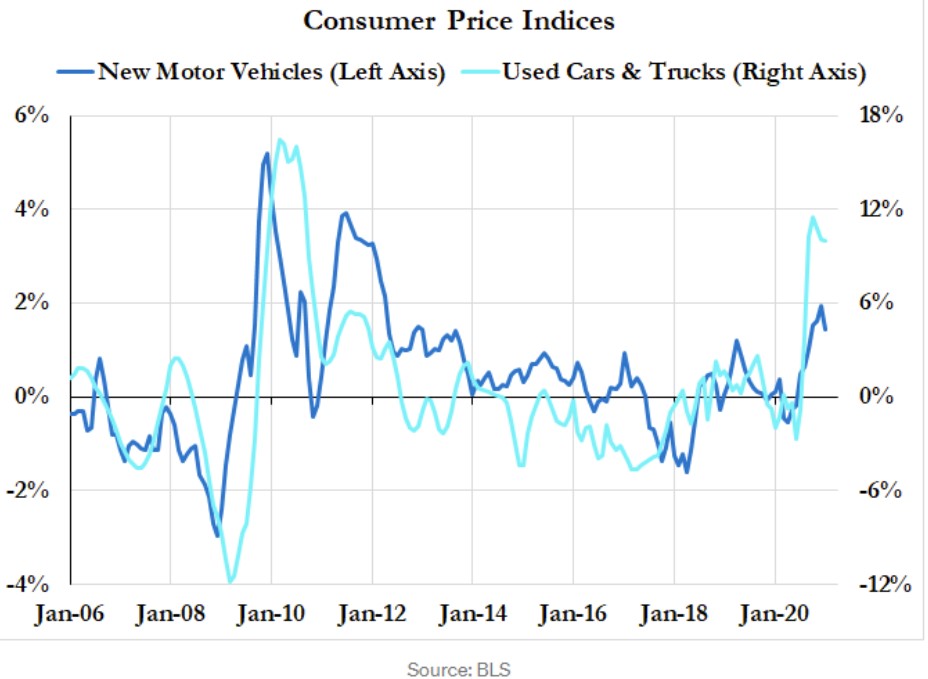

- What if we just get a short-term inflation boost and then it goes back down?

- The chart of the year (so far)

- Bryan Cranston vs. Tom Hanks and more

Listen here:

Stories mentioned:

- The beginning of the end

- The price-value feedback loop

- How GameStop missed out by capitalizing on the Reddit rally

- The SPAC boom, visualized

- How Covid brought the future back

- Bumble valued at $13 billion

- Markets are always changing

- Dreams all the way up

- The rise of intangibles

- 28% of Americans bought meme stocks

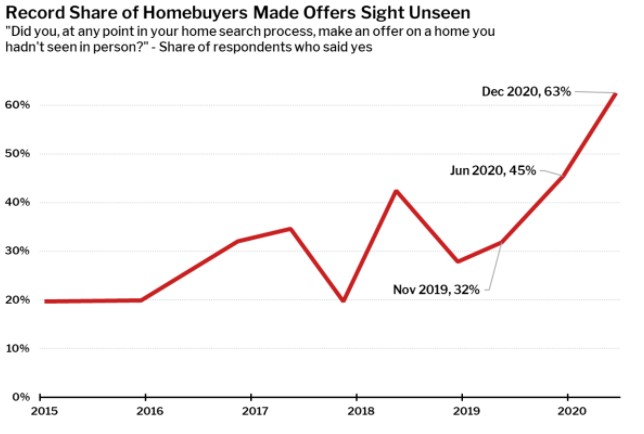

- 63% of homebuyers made offer sight unseen

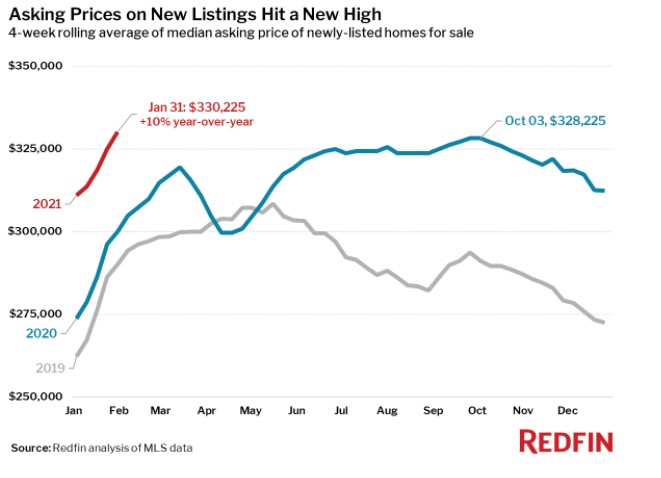

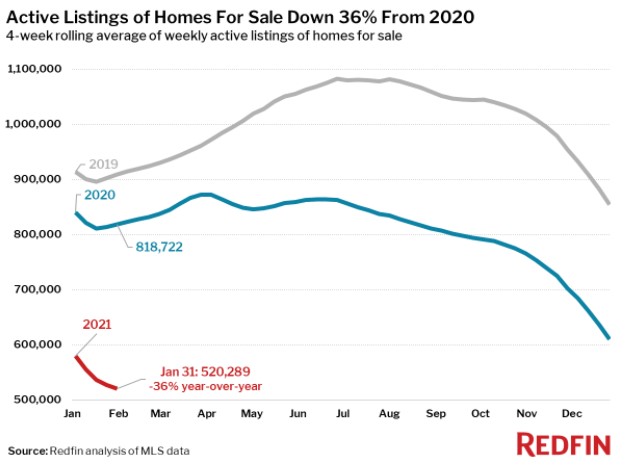

- Bidding wars are off the charts

- Housing market update

- Inflation: the good, the bad and the transitory

- Is automatic enrollment consistent with a life cycle model?

Podcasts mentioned:

- All-In with Vlad Tenev

- Masters in Business with Ben Inker

- Conan O’Brien and Bryan Cranston

- Smartless with Bryan Cranston

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on the Shuffle app.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: