These were the 2020 peak-to-trough drawdowns for a number of risk assets this year:

- S&P 500 (SPY) -33.9%

- Small caps (IWM) -41.1%

- Foreign stocks (EFA) -33.9%

- Emerging market stocks (IEMG) -34.7%

- Junk bonds (JNK) -22.9%

- Long government bonds (TLT) -15.7%

- Aggregate bond market (AGG) -9.6%

- Corporate bonds (LQD) -21.8%

- Gold (GLD) -14.0%

- Bitcoin -52.4%

Despite these awful drawdowns early in the year, every one of these assets finished the year with positive returns, many of the double-digit variety:

- S&P 500 (SPY) +18.3%

- Small caps (IWM) +20.0%

- Foreign stocks (EFA) +7.6%%

- Emerging market stocks (IEMG) +17.9%

- Junk bonds (JNK) +5.0%

- Long government bonds (TLT) +18.2%

- Aggregate bond market (AGG) +7.5%%

- Corporate bonds (LQD) +11.0%

- Gold (GLD) +24.8%

- Bitcoin +304%

Basically, everything made money this year despite losing plenty of money along the way.

And getting those gains this year was not an easy feat.

Yes, there were 32 new all-time highs in the S&P 500 in 2020 but there was also an insane amount of volatility.

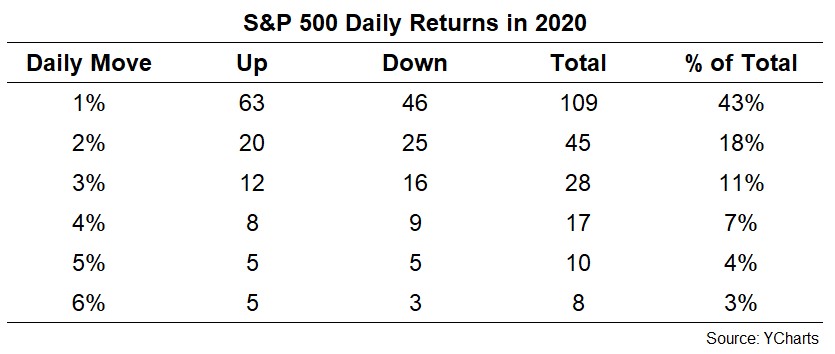

Take a look at the daily moves in the stock market this year in terms of magnitude:

For context, this is roughly double the long-term historical average for daily moves of 1% or more during a given year. And 1 out of every 10 days in 2020 saw a 3%+ gain or loss, which is more than four times the historical average.

The S&P 500 experienced daily losses of 12%, 9.5% and 7.6%. There were also daily gains of 9.4, 9.3 and 7%. These enormous moves all occurred during the intense March sell-off because volatility tends to cluster during panics.

But it is crazy the entire bear market lasted just 4 weeks from peak-to-trough and we still had one of the most volatile market environments in years.

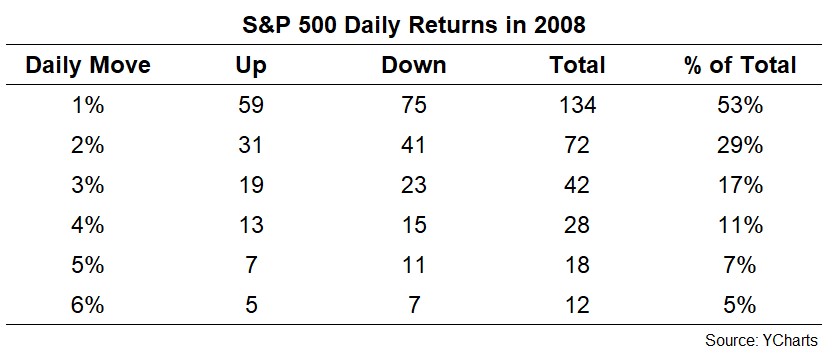

Living through the 2008 crash was my indoctrination into real market volatility so I thought it would be fitting to compare the two years. Here are the same daily stats from that year:

So 2020 wasn’t exactly 2008 but it was darn close. And the magnitude of the moves in 2020 might be even more impressive (if that’s the right word for it) considering we basically had a 4-week bear market followed by a 9-month bull market.

That 9-month bull market has been a sight to behold. These are the returns from the day the stock market bottomed on March 23rd through year-end:

- S&P 500 (SPY) +69.8%

- Small caps (IWM) +99.0%

- Foreign stocks (EFA) +60.7%%

- Emerging market stocks (IEMG) +74.9%

- Junk bonds (JNK) +34.7%

- Long government bonds (TLT) -3.9% *the only loser on the bunch

- Aggregate bond market (AGG) +6.8%%

- Corporate bonds (LQD) +23.2%

- Gold (GLD) +21.9%

- Bitcoin +332.1%

Volatility, of course, works in both directions.

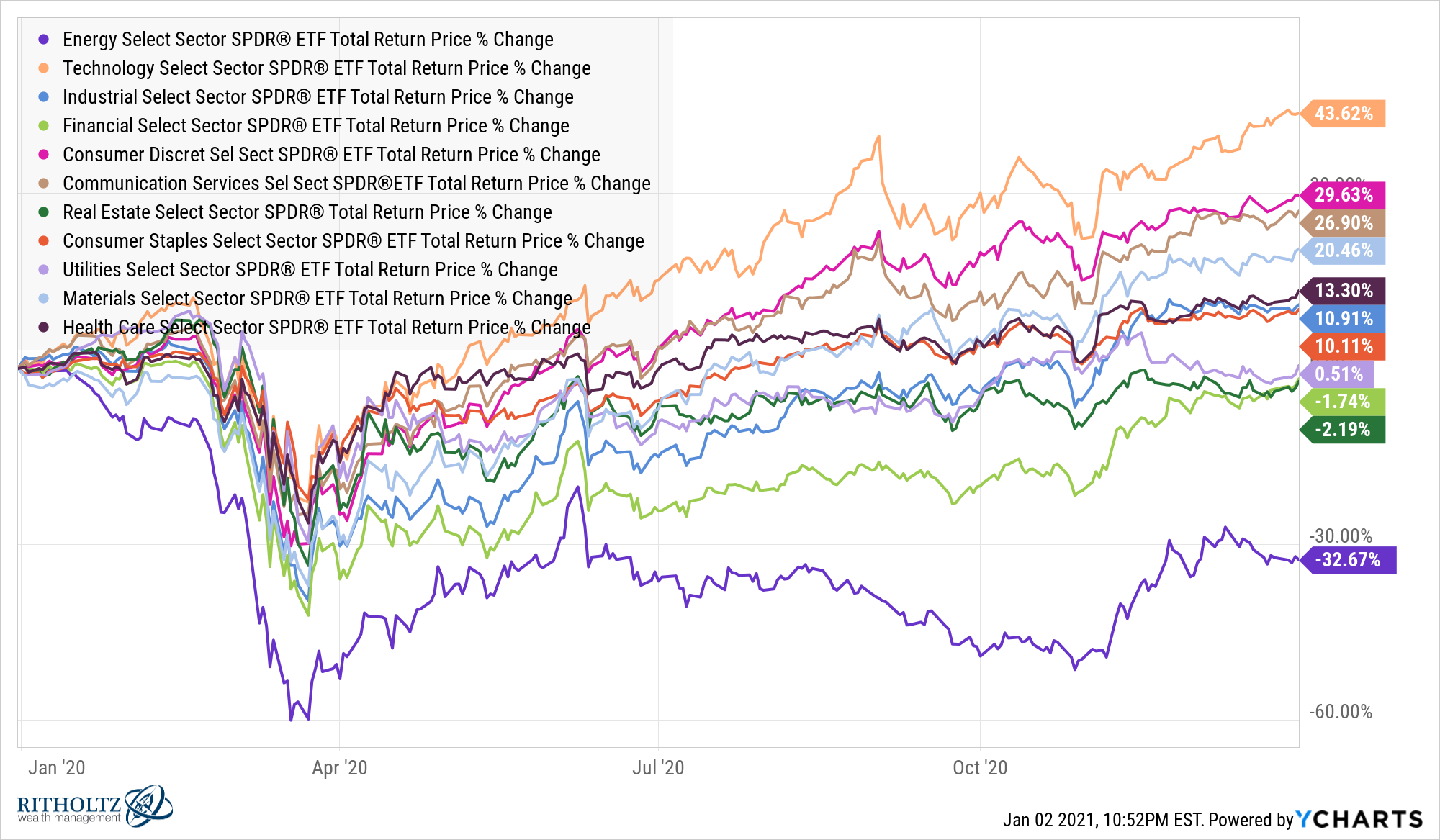

Now here comes the hard part about these numbers. There were still opportunities to underperform. Three sectors experienced losses in 2020, with energy being the biggest loser (yet again):

So while certain investors saw extreme gains this year, there were those who didn’t fare as well.

And hearing stories from those who did extremely well doesn’t help matters.

Someone timed the bottom perfectly by sheer luck. Or they profited off options trading or bought the right stocks for 2020 or owned an inordinate amount of crypto or Zoom or Peloton or whatever else worked this year.

Most of us didn’t time the bottom perfectly or navigate this year with a surgeon’s precision.

But success in the markets doesn’t require precision, just the ability to stay in the game.

There will always be people who make more money than you in the markets or life in general.

Worrying about this fact of life is pointless because as Michael Santoli so astutely pointed out this past week:

Someone will always be richer or have better performance numbers or pick better stocks than you. Even people who seem like they don’t deserve it. Life isn’t fair nor are the markets.

It’s worth remembering what your personal goals and circumstances are when you hear so many people bragging about how much money they made or how huge their returns have been.

As long as you stayed true to your investment plan and continued making progress towards your personal and financial goals, that’s a win in my book.

2020 may look easy with the benefit of hindsight but it most certainly was not for those of us who lived through it.

If you survived 2020 as an investor without making an avoidable or unnecessary mistake, you outperformed this year.

Further Reading:

9 Questions I Have For 2021