Bill Bengen rolled out the 4% rule at the Journal of Financial Planning in 1994 in a research piece entitled Determining Withdrawal Rates Using Historical Data.

If you read the report you’ll notice he never actually called it the 4% rule but that’s what people took from his research so the name stuck. Rules of thumb can be a powerful storytelling device.

The idea was to find a safe withdrawal rate over a 30 year period for retirement to avoid the biggest risk of all in your later years — running out of money.

Bengen’s research sought to find an annual burn rate from a 50/50 stock/bond portfolio such that you take a percentage of your portfolio in year one and increase that dollar amount each year by the rate of inflation.

This was the main takeaway:

For a client just beginning retirement, determine first the “safe” withdrawal rate. Do so by computing the shortest portfolio life acceptable to the client (generally the client’s life expectancy plus 5 or 10 years, depending on the conservatism of the client). Next, using the charts for a 50/50 stock/bond allocation, determine the highest withdrawal rate that satisfies the desired minimum portfolio life. For a client of age 60-65, this will usually be about 4 percent.

Here are some of Bengen’s original findings:

- An “absolutely safe” withdrawal rate based on historical market returns came out to 3% given that it ensured portfolio longevity was never less than 50 years.

- An initial withdrawal rate of 4% was considered safe because it never resulted in a portfolio being exhausted in less than 33 years.

- The worst-case for a 4.25% withdrawal rate was 28 years.

- Having too much in stocks during retirement is just as risky as having too little in stocks. An allocation in the 50-75% range was the sweet spot.

- A 4% withdrawal rate was not the baseline but the worst-case scenario.

Of course, things are much different today than they were in 1994. In 1994 you could get treasury yields of 7-8%. Today they’re under 1%.

What does this mean for the safe withdrawal rate for 2020?

Here’s what Bengen told Michael Kitces on a recent episode of the Financial Advisor Success podcast:

Bill: Yes, I think people have to realize that when they use the 4.5% rule, as you mentioned, it’s a worst-case scenario. It was in an inflationary environment. And based on what I know now, in a very low inflation environment like we have now, if we had modest stocks, I wouldn’t be recommending 4.5%, I’d probably be recommending 5.25%, 5.5%, something like that, which is even going to enrage people even more because it’s higher than the 4.5%. But that’s what history has demonstrated.

Whether our current environment is going to cause such low returns that’ll undermine that whole structure, I don’t know. But people have to keep in mind that inflation is equally important as returns in this analysis. And that when you have a low inflation environment, your withdrawals are also going up much more slowly. So there’s an offset to the lower returns that you can’t ignore.

It may surprise you to see Bengen suggest the safe withdrawal rate might be higher than 4% because bond yields are so low these days. I’ve seen article after article claiming 4% couldn’t possibly work anymore.

There was even one piece suggesting 0.5% was the new safe withdrawal rate because bond yields are so low. A rate this low would suggest you have 200 year’s worth of annual spending in your portfolio. I’d say that’s a tad conservative.

When Bengen originally wrote his piece the inflation rate over the previous 25 years was 5.7% per year. The inflation rate over the past 25 years has been 2.2% per year. It’s possible it will be even lower than this going forward.

Obviously, your personal inflation rate matters more than what CPI says but it’s also important to remember that spending in retirement is rarely static. No one actually spends the same amount each year adjusted by the rate of inflation.

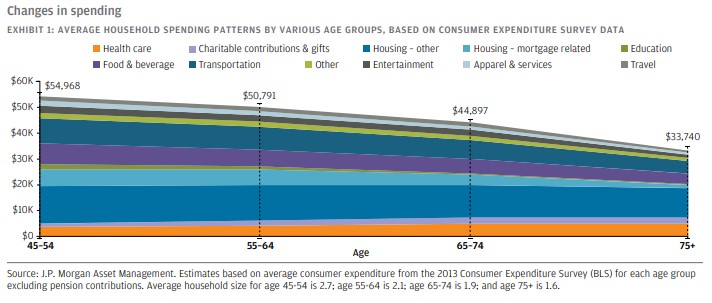

In fact, you can probably expect your spending to fall as you age. JP Morgan found spending tends to peak some time in your mid-40s to mid-50s and actually declines from there:

It’s always possible Bengen’s 4-5% rule will prove to be too optimistic in the years ahead. The worst-case scenario of the future could always trump the worst-case scenario of the past in regards to stock market returns.

And predicting the inflation rate is just as difficult as predicting financial market returns. No one knows what inflation or the stock market will do in the coming decades.

You also have to consider no one actually lives their life in a spreadsheet. Something like the 4% rule is a rough guide that assumes a fairly linear path of spending. Every financial plan should be open-ended because the whole point of the planning process is making corrections as reality meets your built-in expectations.

And who knows, maybe we don’t see the worst-case scenario in the decades ahead. Kitces looked at the other side of this equation to see what happens when markets surprise to the upside. He found the odds of running out of money are the same as the odds of seeing your portfolio value explode higher:

After all, at a 4% initial withdrawal rate, the odds of nearly depleting the portfolio are equal to the odds of growing it by more than 800%(!), and even at a 5% withdrawal rate, the odds of depleting the portfolio early are equal to the odds of tripling the retiree’s starting principal on top of taking an initial withdrawal rate of 5% with 30 years of annual inflation adjustments.

I wouldn’t bet on enormous upside surprises with rates where they are these days but even muted long-term growth of your portfolio can help offset withdrawals from your account if you’re intelligent about where and when you take money out for spending purposes.

Further Reading:

What If You Retire At a Stock Market Peak?