If investing was a cocktail, it would essentially boil down to one part fundamentals and one part emotions. Fundamentals are easier than ever to capture because we now have access to more data in a single day than our ancestors would see in a lifetime.

The emotional component of investing will never be quantifiable because it’s impossible to predict how people will feel in the future.

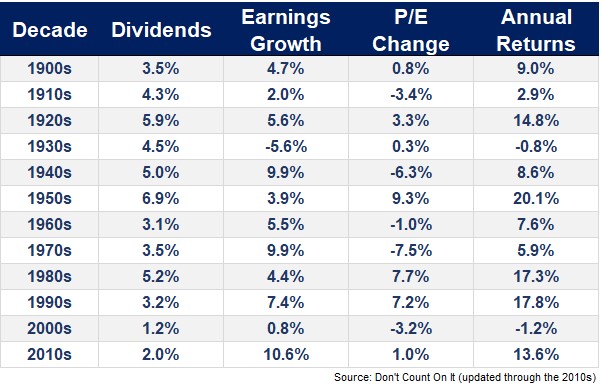

The late Jack Bogle introduced this concept in his book Don’t Count On It by breaking down expected annual returns of the U.S. stock market into the following components:

Market Returns = Dividend Yield + Earnings Growth +/- Changes in the P/E Ratio

Dividends and earnings are the fundamental portion of stock market returns while the change in the price-to-earnings (P/E) ratio is the speculative portion of returns. The change in P/E represents how much people are willing to pay for corporate fundamentals and the reason it’s considered speculative is because it can vary widely over time.

Here’s a look at how Bogle’s data looks historically with some updated numbers through the end of the last decade:

Dividends are fairly stable over time while earnings growth has had its share of ups and downs. And depending on the decade, investors have been more or less willing to pay for that earnings growth depending on how they feel about the current environment.1

Fundamentals certainly matter over the long-term but how investors feel about the present or future can have a huge impact on stock market returns over even decade-long periods.

I could give you the earnings growth for the next decade and you still might not be able to predict how well stocks will do in the 2020s because no one has a clue how people will feel about stocks over the next 10 years.

This same idea is even more pronounced with individual companies.

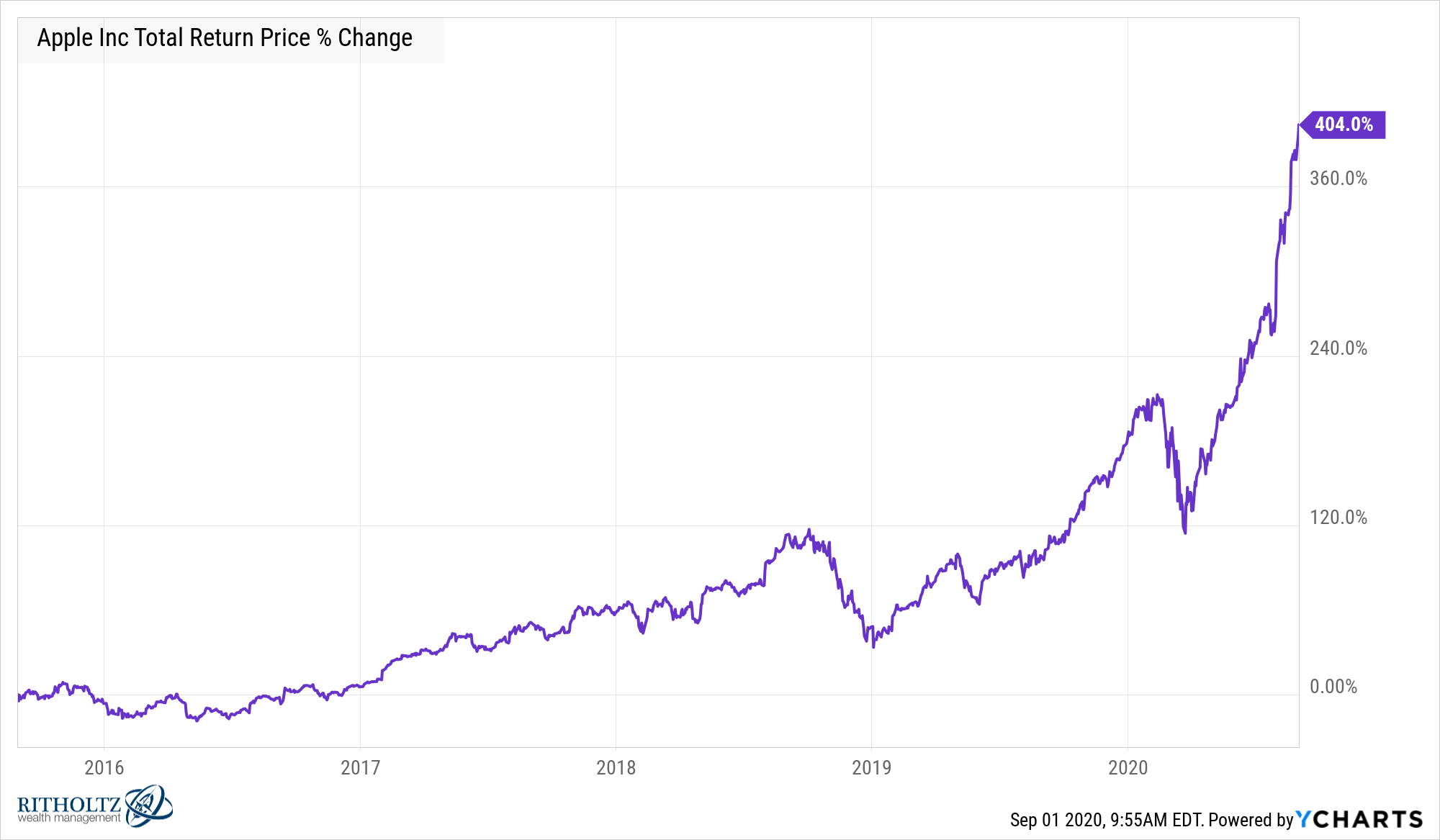

Apple is up more than 400% over the past 5 years.

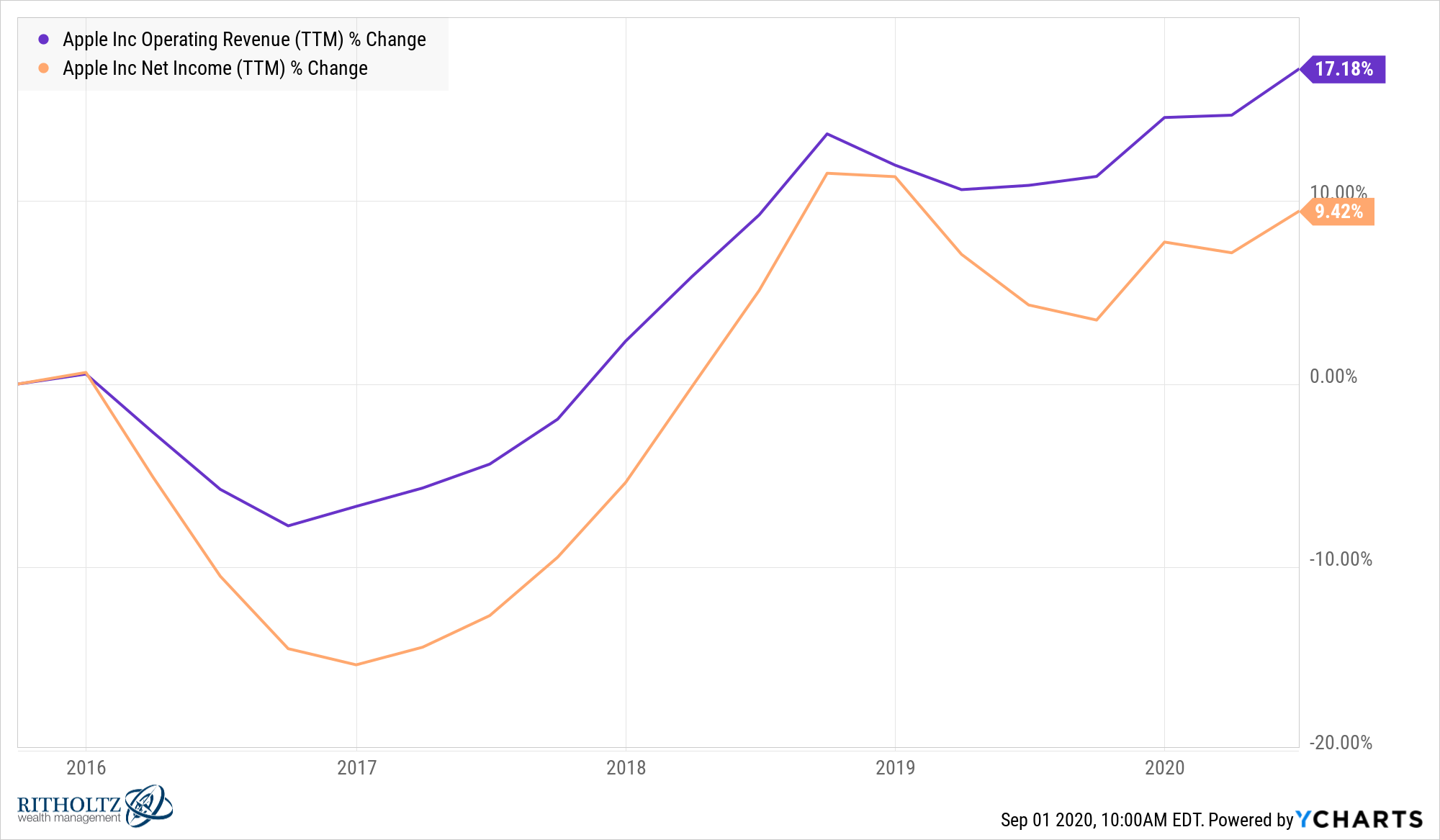

The company must have seen a surge in fundamentals as well, right? Revenue and earnings are up but certainly not in the 400% territory:

The dividend yield has also failed to keep up with the price spike:

So why is Apple up so much? It’s simple — the P/E ratio has gone nuts:

Apple was trading at 12x earnings as recently as January 2019. Today the company’s P/E is over 40.

Why did this happen? Investors changed their minds. They decided to re-rate the amount they were willing to pay for Apple’s earnings.

Obviously, it’s not just current earnings that matter for the price of a stock but future earnings. Still, you could have nailed the fundamentals from a financial statement perspective for Apple over the past 5 years but still been wildly off on how they would impact the share price.

This can put investors in an uncomfortable position because it shows there is an element completely outside of your control when it comes to valuing stocks or the market as a whole.

When you look at markets through the lens of fundamentals plus how people feel, it’s much harder to have certainty over the outcomes over shorter time frames.

As always, investing is hard.

Further Reading:

What I Learned From Jack Bogle

1It is worth noting that the change in P/E ratio does not necessarily mean the P/E ratio itself is moving up or down. This is measuring how the P/E has kept up with the change in fundamentals. So even though the P/E technically rose in the 2010s, it more or less kept up with the dividend yield and earnings growth.