When I was in my late 20s I came up with a basic spreadsheet that plotted out my future savings rate, income and retirement savings based on some different market return scenarios.

The idea was to map out a range of balances in our retirement accounts to compare with the actual results by age 30, 35, 40, 45 and so on.

I still have those numbers stored as a note in my phone and I use them as a reminder that the real world doesn’t work like a retirement calculator.

No one is lucky enough to have their income rise by 3% every single year and earn 8% year in and year out in the financial markets. Life is much messier than that.

But this exercise was still worthwhile because it gave me something to benchmark my progress. I could compare actual results with the simulated results to see if I needed to make any course corrections. And then the guessing games begin anew every time I make these comparisons.

Financial experts don’t like to frame it this way but the majority of the retirement planning process is based exclusively on guesses. You have to guess what your portfolio returns are going to be, what your income trajectory will be, how much you’ll be able to save over time, how much you’ll spend and how much will be enough to live on many decades into the future.

And that’s just the financial side of the equation.

You also have to guess how your priorities and goals will change over time.

At a commencement speech a number of years ago, former Fed Chair Ben Bernanke said, “Life is amazingly unpredictable; any 22-year-old who thinks he or she knows where they will be in 10 years, much less in 30, is simply lacking imagination.”

Because of all the guesses involved this can be an overwhelming process for a lot of people. So many of us simply put it off until another day. Days turn into years and years turn into decades and plenty of people come back to this stuff in their 40s or 50s and realize they are woefully behind on ever becoming financially independent.

Ask anyone in their 50s or 60s what they wish they would have done when they were younger to plan for their future and I guarantee most people will tell you they wish they would have started saving earlier.

The problem is we don’t get a do-over with this stuff. You only get one chance at planning for retirement.

For today’s podcast, Michael and I performed a deep-dive on retirement from as many angles as possible.

We discuss:

- Why don’t scary retirement statistics make people save more?

- Why don’t people save more for retirement?

- Retirement is a relatively new concept

- Will young people be forced to take care of old people financially in retirement?

- Why personal finance matters more than investing

- When should you start saving?

- The most important thing you can do when planning for retirement

- How employers can help their employees save more

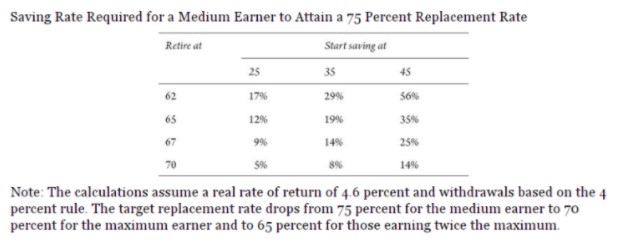

- What should your savings rate be?

- How much is enough?

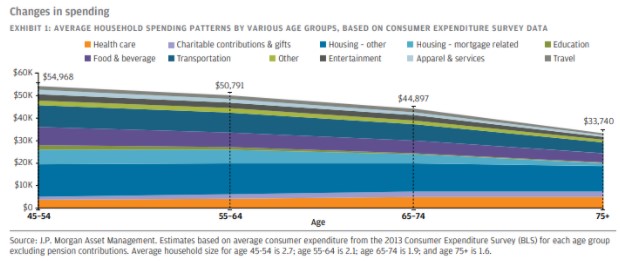

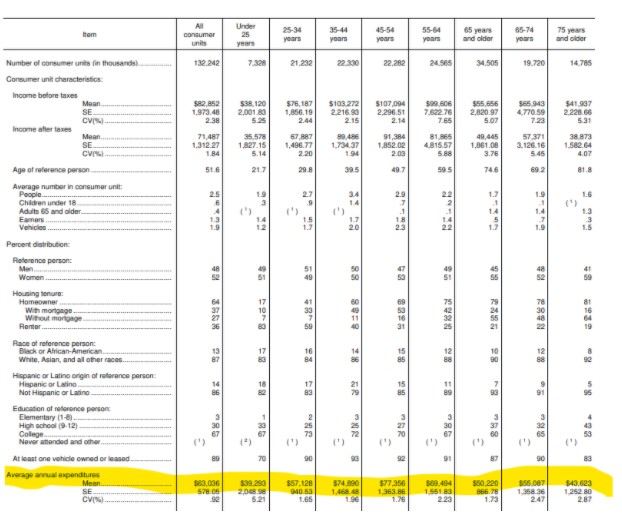

- When are your peak spending years?

- How many people can plan for retirement on their own?

- What if you got a late start to saving for retirement?

- The changing nature of retirement

- Going from a saver to a spender in retirement

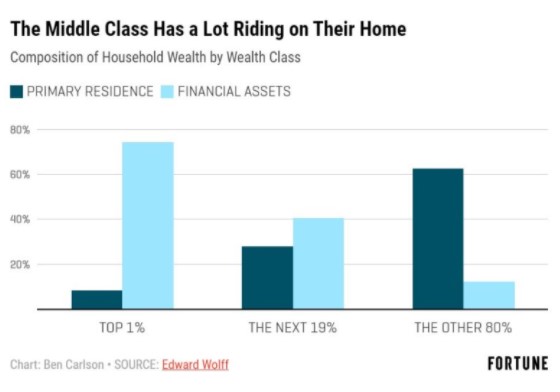

- The importance of home equity in retirement

- The coming bull market in financial advice

- Am I going to be OK?

- Retirement in a world with no yield

This episode is presented by Naviplan by Advicent:

Go to www.advicent.com/animalspirits to learn more about how their software can help with the financial planning surrounding saving for college and family financial planning.

Listen here:

Stories mentioned:

- The many uncertainties involved in retirement planning

- How America saves 2020

- Young retirement savers scorned

- Revisiting the 4% rule

- Managing sequence of return risk

Books mentioned:

- The Rise and Fall of American Growth by Robert Gordon

- Falling Short: The Coming Retirement Crisis by Charles Ellis

- I Will Teach You To Be Rich by Ramit Sethi

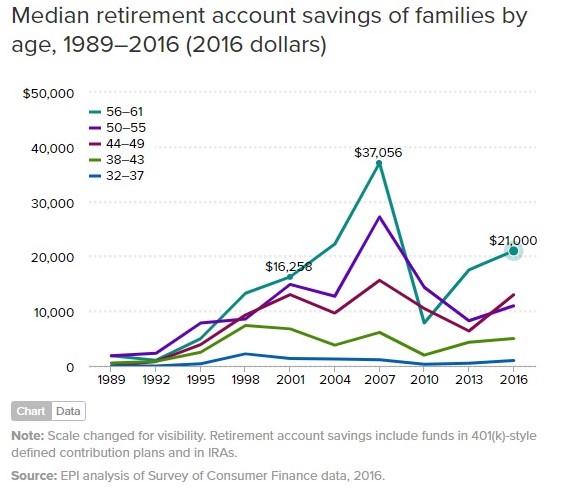

Charts mentioned:

Videos mentioned:

https://www.youtube.com/watch?v=fJiEahOfNTI&feature=youtu.be

https://www.youtube.com/watch?v=UEe2pN8oksc

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: