The 60/40 portfolio has died a thousand deaths in the past decade or so but I never realized the balanced portfolio itself could be a stone-cold killer.

Paul McCulley recently told Tracy Alloway and Joe Weisenthal on their Odd Lots podcast if the 60/40 portfolio continues to work from here it would mean we’ve failed as a democracy:

“If it [the 60/40 portfolio] were to work on a secular basis for five years, 10 years, 20 years, then we have unambiguously failed as a democracy,” he said. “The reason financial markets have done well over the last 40 years is because we’ve been in a 40-year disinflationary environment.”

This is the result of a political victory by those who control capital over those who provide labor, he says. “Unambiguously, we’ve had 40 years of disinflation, and that’s because we’ve shifted power in our economy, both domestically and globally, from labor to capital.”

“We’ve had a 40-year tailwind of falling real interest rates, which will by definition increase the market value of all income streams,” he said. “That’s what capitalism is all about: Ownership claims on income streams. It’s been an incredible bull run on the valuation of financial assets. And I certainly hope, as a citizen, that is not repeated.”

McCulley makes some valid points here.

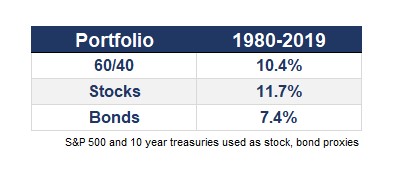

The past 40 years or so have seen an amazing run in financial markets that will likely never be duplicated, especially in fixed income. Returns have been outstanding for stocks and otherworldly for bonds, making a 60/40 portfolio in the U.S. nearly impossible to beat:

And it’s true that owners of financial assets have benefitted from these returns far more than the working class. Income disparities have spurred on wealth inequality but the fact that the wealthy own the majority of financial assets has only supercharged the difference between the haves and the have nots in the past four decades or so.

It would be nice if labor could score some victories over capital at some point because it’s been a while.

But you don’t necessarily need a disinflationary environment for financial assets to provide decent returns on your capital. Democracy doesn’t have to fail for people to earn a premium above the rate of inflation.

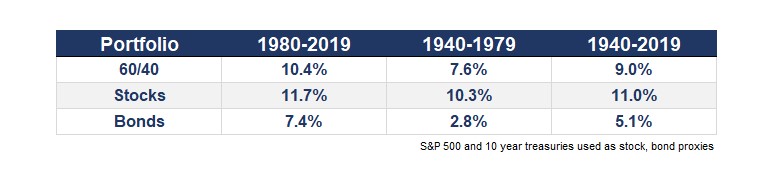

The 40 years prior to 1980 didn’t give investors nearly the same returns but they weren’t bad:

Bond returns were much lower from a combination of much lower starting yields and rising interest rates in the 1970s. But a 60/40 annual return of 7.6% is not bad. It’s not 10.4% per year but that number is going to be a historical aberration.

Inflation did run higher in the 1940-1979 period than the 1980-2019 time frame by one percent annually — 4.2% vs. 3.2%. So the biggest difference between these two 40 year periods is that bonds lost money on a real basis from 1940-1979 but beat inflation by more than 4% from 1980-2019.

A 60/40 portfolio still gave investors nearly 3.5% over the rate of inflation from 1940-1979 and inflation in that period was much higher than it is today. If we get a long-run inflation rate of 2% from here, that would give investors an immediate 1-2% boost on a real basis versus the prior 80 years which saw inflation run at more than 3-4%.

So there are a number of moving pieces involved when making historical comparisons to the present and figuring out what it means for the future.

The 10 year treasury yielded 2.2% at the outset of 1940. By the start of 1980 it was up to 10.8%. Today it’s roughly 0.7%.

The 60/40 portfolio will assuredly have lower returns over the next 40 years than it had over the last 40 years. That’s simple math based on starting yields for bonds.

But the past 40 years should never be used as a baseline expectation for returns. Unless the Fed jacks up interest rates to 20% again that period is going to be a historical anomaly.

Long-term bond returns are fairly easy to estimate because you simply take the starting yield and then subtract out defaults (which doesn’t apply to U.S. government bonds).

Inflation and stock market returns are much harder to estimate. Even the Federal Reserve can’t quite figure out how to get inflation where they would like it and the speculative nature of the stock market makes it nearly impossible to predict.

This doesn’t mean a 60/40 portfolio can’t “work” going forward though. It just means investors have to ensure their expectations are better aligned with reality.

Further Reading:

A Eulogy for the 60/40 Portfolio