This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

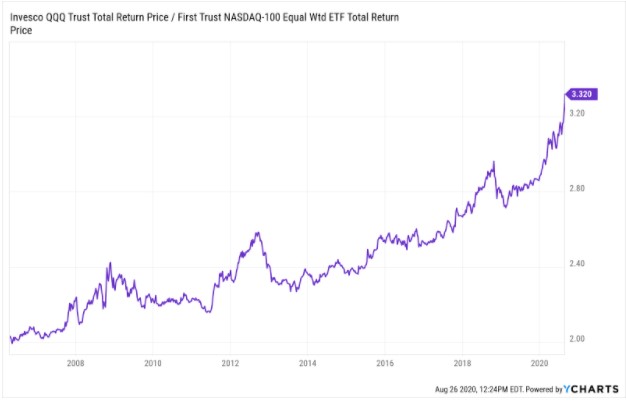

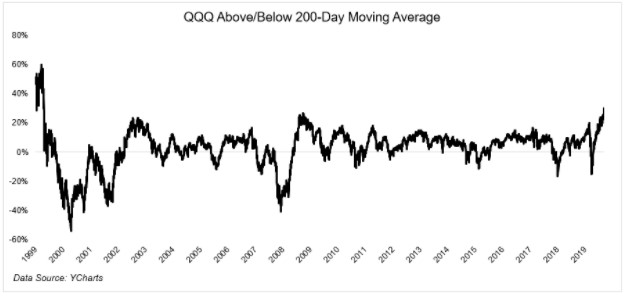

- Is there a limit to market cap growth in tech stocks?

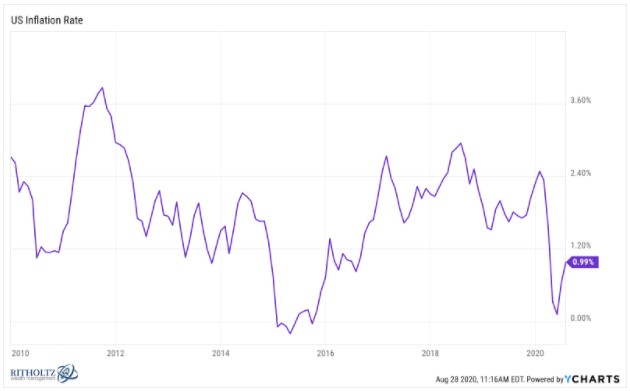

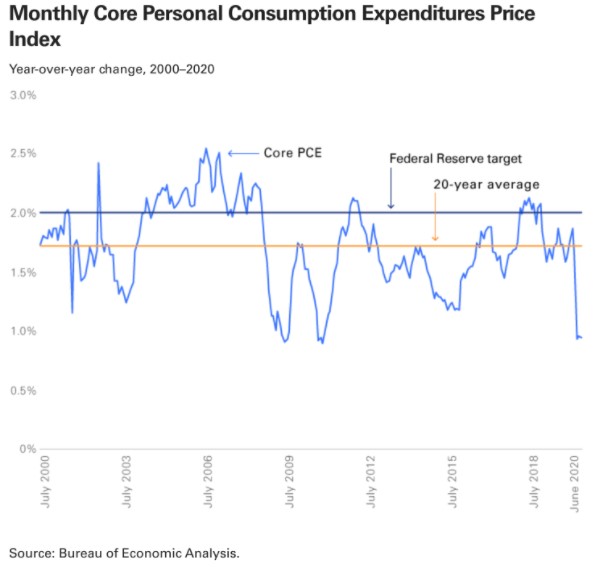

- How the Fed’s mandate has evolved over time

- How long will interest rates stay low?

- Why inflation is so difficult to track and predict

- Are we setting up for the mother of all asset bubbles?

- Doesn’t it make sense stock market valuations are elevated?

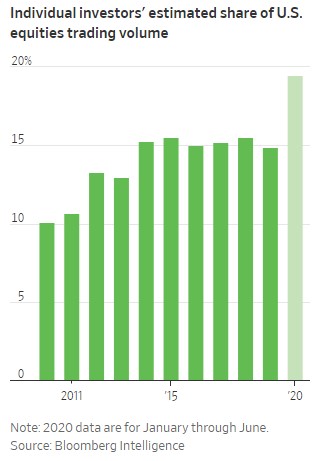

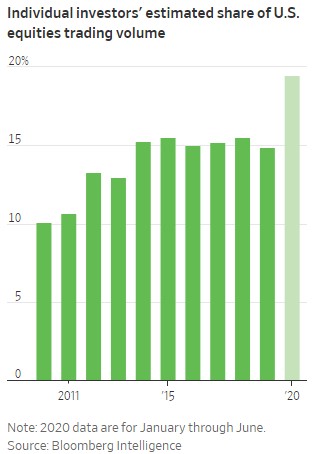

- Retail traders still don’t control the stock market in the U.S. but they do in China and South Korea

- Value is in the eye of the beholder

- What happens when technology disrupts people’s jobs?

- It’s a great time to be a car dealer but not a car buyer

- Why Michael is never setting foot in a car dealership again

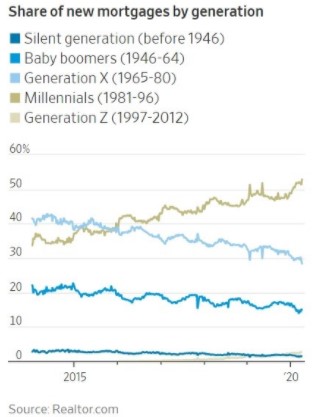

- Millennials are finally buying houses in big numbers

- How being quiet can slow the spread of Covid

- Is anything going to change about the college experience because of the pandemic?

Listen here:

Stories mentioned:

- Modern market cap theory

- Fed’s elevation of employment goal reflects a changed world

- Fed seen holding rates at zero for five years

- The median S&P stock has never been so expensive

- Individual investor boom reshapes U.S. stock market

- Amazon Go’s cashierless tech may come to Whole Foods as soon as next year

- It’s a great time to be a car dealer

- The way things were

- Millennials help power housing market rebound

- Sovereign funds rethink bet on real estate

- Mask up and shut up

- $1,000 baby bonds proposed in New Jersey

- What exactly did I save for?

Books mentioned:

Charts mentioned:

Video mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: