Today’s Talk Your Book is brought to you by State Street:

We spoke with State Street’s Matt Bartolini about the various sectors in the stock market.

We discuss:

- This run-up in tech stocks is unprecedented

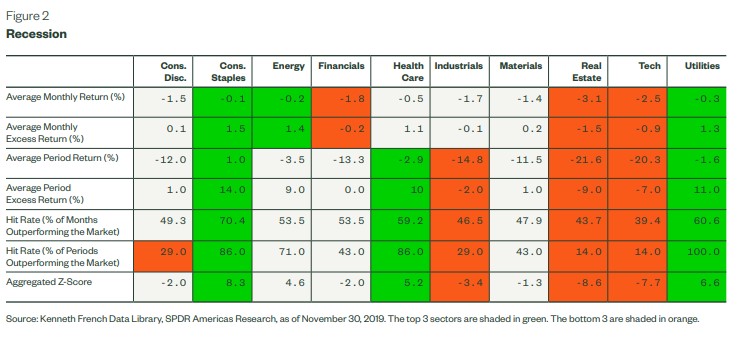

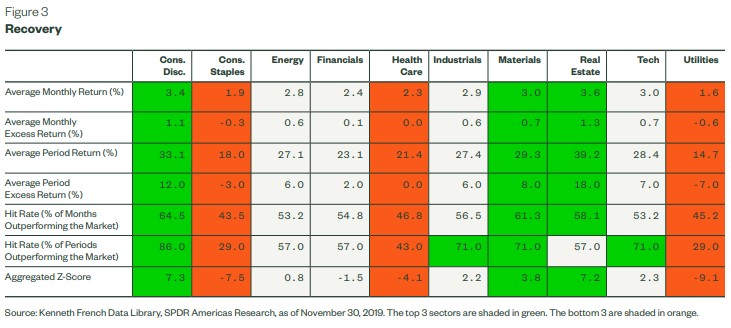

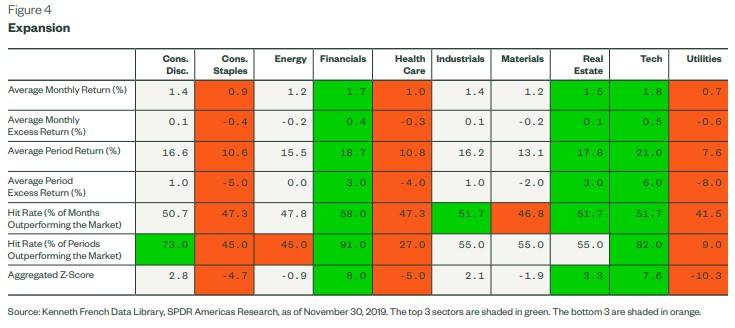

- How the different sectors have held up during recessions historically

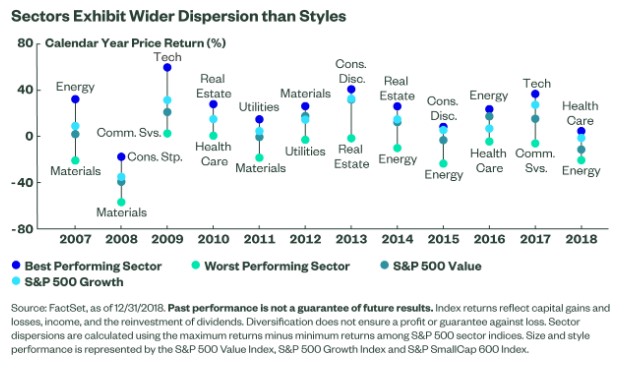

- Why there is a wider dispersion in sectors than factors

- The need to recalibrate historical sector relationships

- Are sectors acting like this is a new bull market?

- Can sectors tell us where we are in the business cycle?

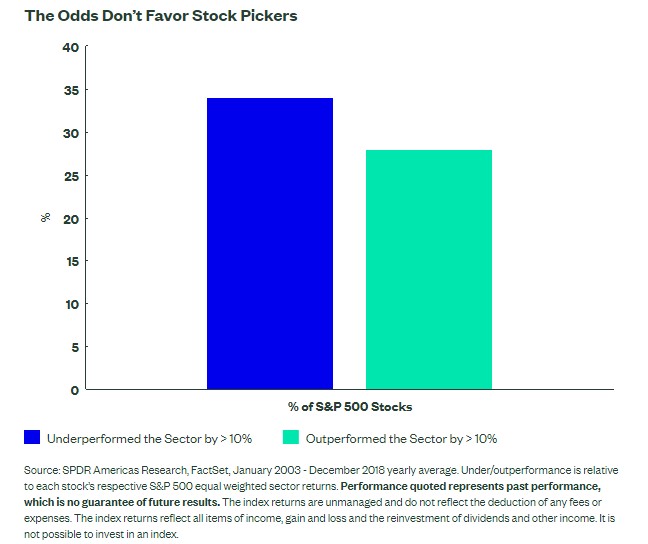

- More stocks underperform than outperform their sector

- Concentration risk in sectors

- The ability to invest thematically is a win for individual investors

- The 4 different ways to think about investing in sectors

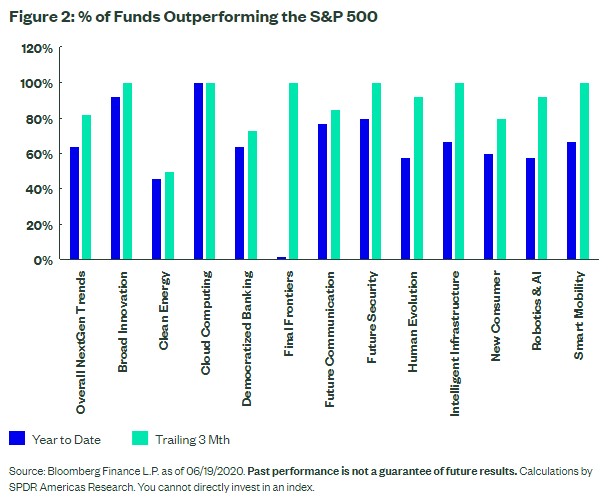

- How thematic ETFs are doing

- Why fund flows are hard to understand

- What’s next for thematic ETFs?

Listen here:

Links:

- Implementing a sector strategy

- Sectors in a changing world

- Sector business cycle analysis

- Classifying nextgen opportunities in ETFs

- Investing thematically in new economy ETFs

Charts:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: