Not yet but it’s getting close.

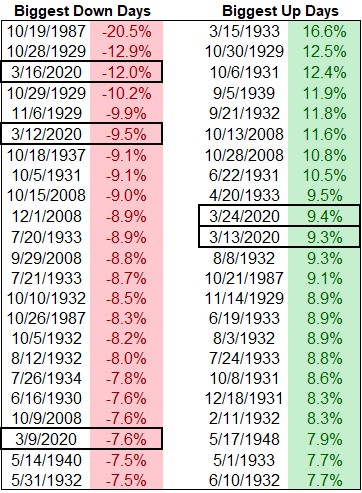

This year has 3 of the worst 25 losses and 2 of the 25 biggest gains for the S&P 500 since 1928:

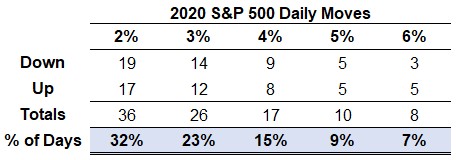

And the number of large daily moves is massive:

Yesterday’s 5.9% loss was the 10th move of plus or minus 5% or more this year already. One-third of all daily moves in the stock market have been 2% or more this year.

There have been 26 daily moves of 3% or more. In the previous 7 years, there were just 8 moves of 3% or more in total.

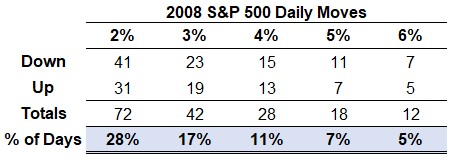

Right now we’re basically on pace with 2008 from when you look at the magnitude of the daily swings that year:

I hope we don’t keep this same pace up for the remainder of the year but it wouldn’t surprise me at this point.

You’ll notice on the table above with the best and worst days ever, an inordinate number of them come from the Great Depression era. The level of volatility that was seen in those years is unmatched.

The bursting of the dot-com bubble didn’t come close and the 1973-1974 bear market was calm by today’s standards.1

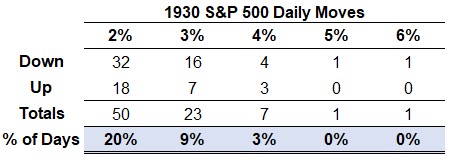

Here are the daily numbers for 1930:

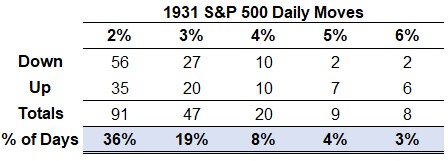

This was 1931:

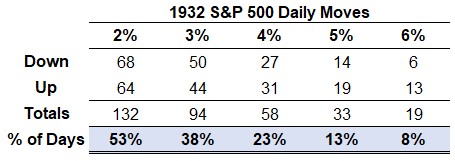

Here’s 1932:

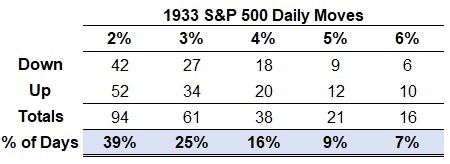

And finally 1933:

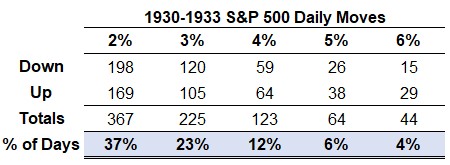

It appears 1932 is the winner (or loser). More than half of all trading days saw moves of 2% or more while nearly 1 in 10 were 6%+. It’s difficult to fathom how challenging this period was in the markets considering these volatile years went back-to-back-to-back-to-back:

That’s four years of relentless volatility.

This year has been crazy. But this is yet another reminder that this is nothing like the Great Depression when it comes to the markets.

******

It’s not only the daily swings in the market that have investors on edge but the shifts in sentiment this year have been wild to see in real-time. Michael and I discussed euphoria in the stock market on this week’s Animal Spirits just a day before stocks fell 6%:

Now here’s what I’ve been reading lately:

- Automate, automate, automate (Irrelevant Investor)

- It could’ve been me (Berknell)

- “Buy low, sell high” (I’m Late to This)

- FIRE figures (The Waiter’s Pad)

- The uncertainty of retirement planning (Morningstar)

- This is the biggest psychological experiment in history (Scientific American)

1There were just three +/- 3% days in the 1973-1974 bear market while the 2000-2002 bear market saw 12 gains or losses of 4% or more.