A simple rule of thumb when it comes to investing in any fixed-income security or fund is the higher the yield the higher the risk.

Risk comes in many different flavors when it comes to investing but the simplest definition for most investors would be losing a lot of money.

With intermediate-term government bonds offering such paltry yields (which continue to go lower), investors have turned elsewhere in recent years in a search for yield in their portfolio.

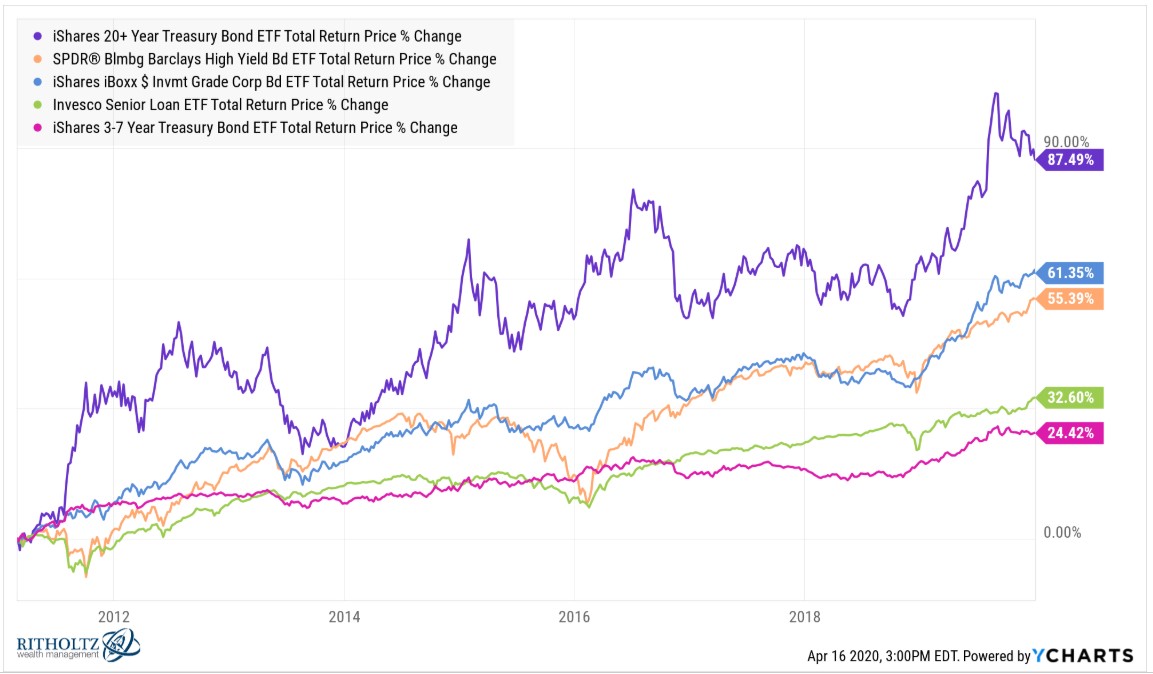

Chasing yield was actually a useful strategy during the 2010s as you can see the riskier of income assets outperformed intermediate-term treasuries:

Long-term treasuries (TLT), corporate bonds (LQD), high yield bonds (JNK) and bank loans (BKLN) all had a much better decade than 3-7 year treasuries (IEI).

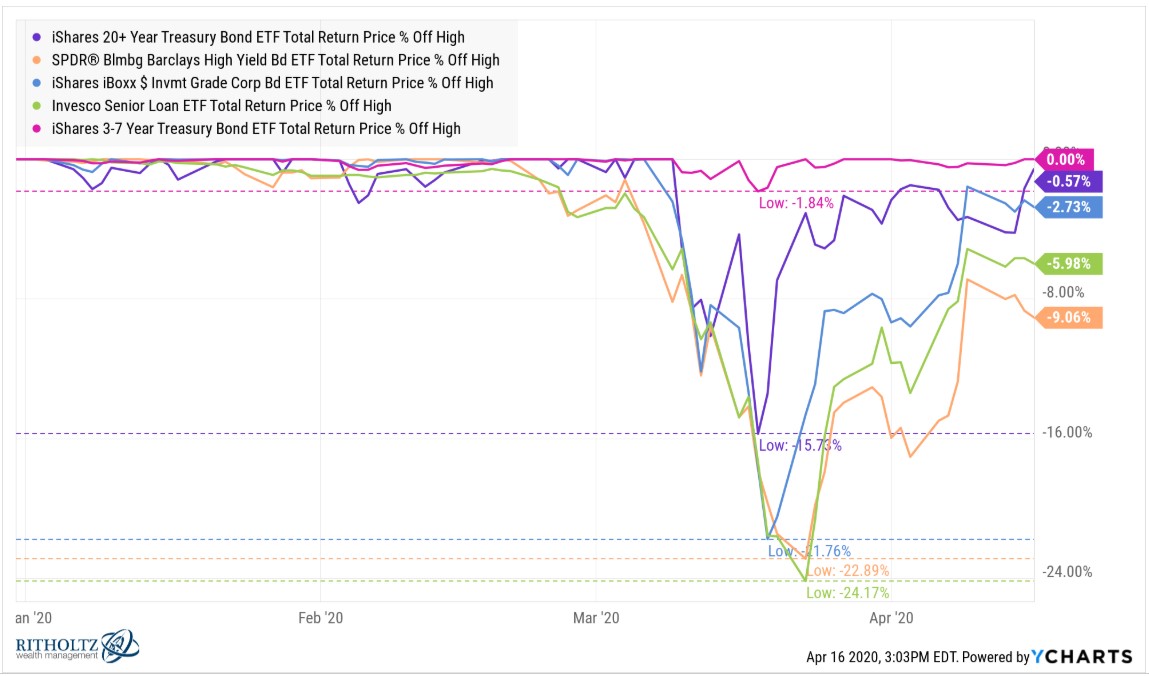

The other side of this trade is what happens when investors rush to the exits when risk rears its ugly head during a crisis:

Bank loans were off more than 24% in March at one point while high yield fell 23%, corporate bonds were down 22% and long-term treasuries dropped 16%. These funds all recovered once the Fed stepped in to shore up the credit markets but I’m sure many investors were surprised to see these levels of losses in their “safe” fixed income funds.

If you wanted to take advantage of lower stock prices in mid-to-late March and these higher-yielding bonds were your only source of dry powder, you were in for a rude awakening. It’s not very much fun to sell an asset that’s gone down a decent amount to buy another that’s done the same.

These losses likely had more to do with a mass exodus by investors who were looking to move their assets into something safer but that can happen in riskier segments of fixed-income. You should also notice that 3-7 year treasuries barely registered a loss during this sell-off.

The point here is not to make a case for or against any of these funds. The point is to help fixed-income investors understand that higher yield comes with higher risk and lower yield comes with lower returns.

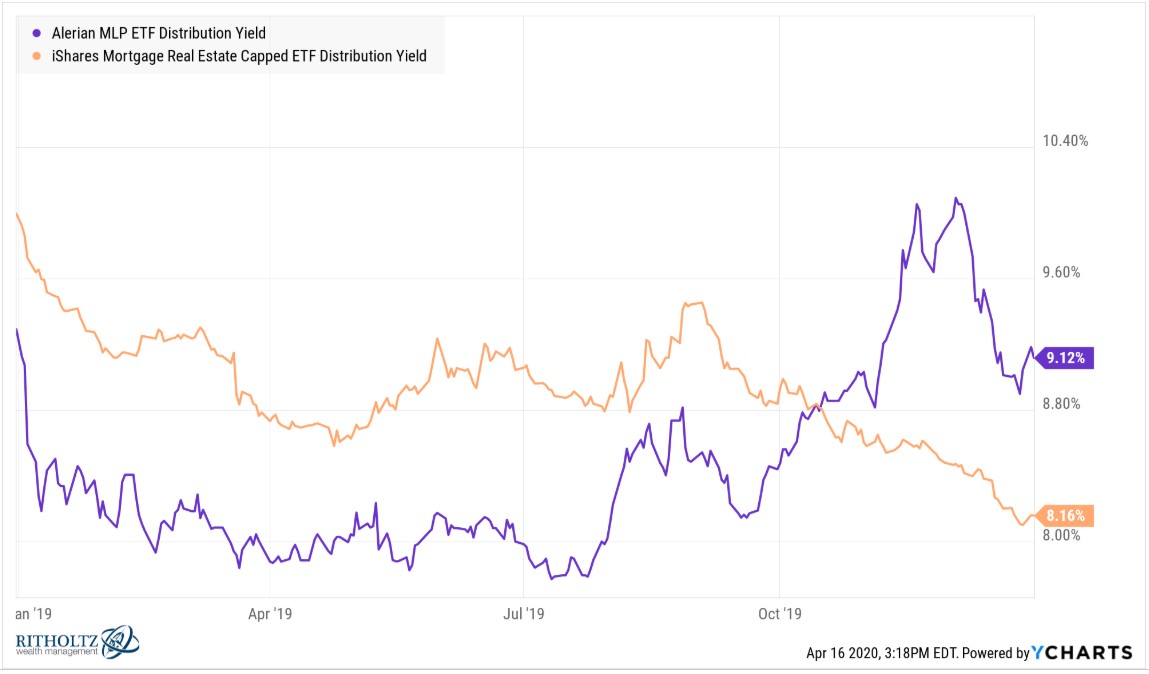

This point is even more true in the risker of income products. MLPs (AMLP) and mortgage REITs (REM) each came into the year with juicy yields:

The 3-7 year treasury fund (IEI) yielded just 2% coming into 2020 so 8% to 9% yields must have looked pretty attractive to investors in search of income.

Now take a look at the losses in these funds:

Both have gotten absolutely destroyed. Obviously, there are extenuating circumstances here. The energy sector has been in the dumps for years and the oil market crashing this year has made things even worse for MLPs. Mortgage REITs are invested in commercial real estate, a fragile sector at the moment, and they use a ton of leverage.

But these products fell 7-8x as much as their yield in less than a month!

Ouch.

There are no ironclad rules when it comes to investing. Everything has a caveat or exception.

But the closest thing to an ironclad rule I can find is risk and reward are attached at the hip.

You can’t expect to earn higher returns without accepting higher risk in one form or another.

And you can’t expect lower risk in one form or another without accepting lower returns.

Further Reading:

Why I’m More Worried About the Bond Market Than the Stock Market