Stocks just had one of their worst months on record with the S&P falling 8.2% on a total return basis.1

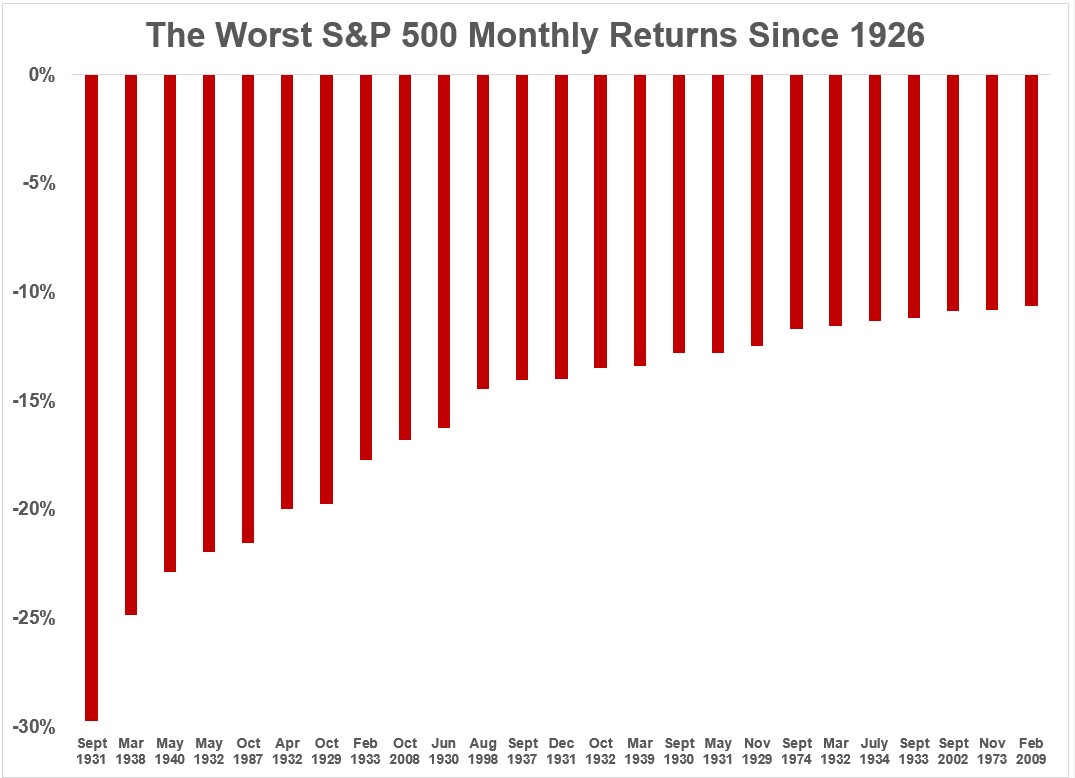

These are the worst monthly declines on the S&P going back to 1926:

You can see plenty of these massive down months have occurred in and around some of the worst market crashes in history — the Great Depression, the 1973-74 bear (we need a name for this one), black Monday in 1987 and the Great Financial Crisis.

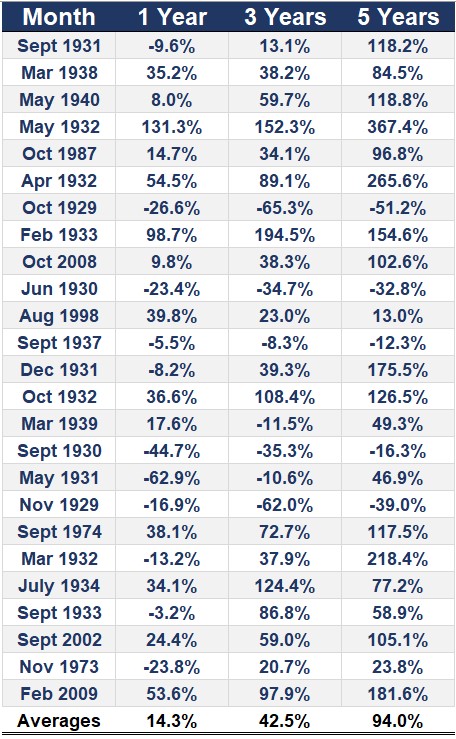

Here’s the good news about huge monthly losses from the past:

56% of the time stocks were higher one year later. 72% of the time they were higher 3 years later. and they were higher 80% of the time 5 years later.

There are, of course, some outliers.

The majority of these big losses occurred during the vicious Great Depression crash. In fact, 9 of the 11 times stocks were down one year later following a large monthly loss occurred during the 1929-1933 time frame. So let’s say as long as we don’t have another Great Depression, the track record of seeing stocks higher 1, 3, and 5 years later following a huge down month in the stock market is pretty good.

The worst monthly returns ranged from -10.7% in February 2009 to -29.7% in September 1931. This past month wasn’t quite so bad.

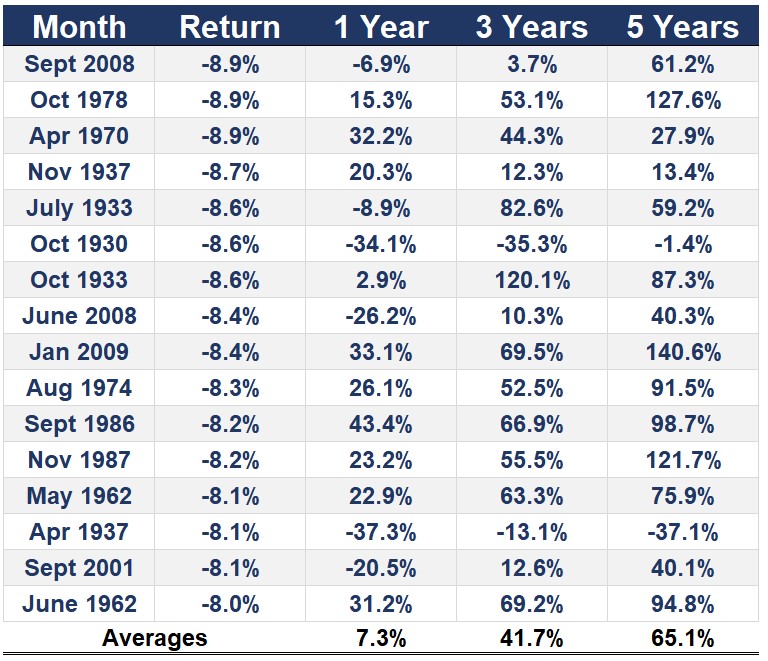

So I also looked at every month since 1926 with losses in the 8-9% range along with forward returns after those losses:

Average forward returns again were pretty good, on average.

Stocks were higher 59%, 82% and 82% of the time respectively 1, 3 and 5 years later.

Each of these markets come from different starting points with various valuations, interest rates, economic environments, etc.

It’s certainly possible stocks have another leg down coming. Maybe this one lasts for much longer than the previous downturns since 2009. We’ve had losses since then but they’ve basically been Airbnb stays not long-term tenants.

Buying stocks when they’re rising is easier because every purchase makes you feel like an investing genius.

Buying stocks when they’re falling is harder because almost every purchase makes you feel like an investing fool.

Buying stocks when they’re seriously falling, as they are now, rarely feels like the right move.

Every investor is told to buy low and sell high. But most don’t realize that buy low typically works out to buy low, then buy lower, then buy even lower, and once you really hate yourself, buy lower than you thought was possible.

This is the low part of buy low. We’re in it. I don’t know how many pegs lower we have to go (if any). No one does.

The (potentially) good news is the lower we go the higher the expected returns should be.

Further Reading:

Buying When Stocks Are Down Big

1The peak-to-trough drawdown of 12.7% is worse because stocks were up on the month before falling over the past week.