you: haha college kids are trading TSLA stock during class. this is the top

me: had absolutely no clue about the stock market during college nor would I ever have been able to figure out how to even open up an acct

at least these kids are starting somewhere

— Ben Carlson (@awealthofcs) February 5, 2020

In a perfect world all young people looking to get involved in the markets:

- would begin saving for retirement right when they get out of school to take advantage of the many decades of compounding they have ahead of them.

- would eventually max out their 401k plan, invest mostly in stocks and then just leave that money alone.

- would learn from the mistakes of those who came before them and stand on the shoulders of giants by taking the best advice of successful people who have already figured things out.

- would keep their investment strategy as boring and long-term as possible.

We don’t live in a perfect world so most young people who get into investing must experience the pain of losing money for themselves. Sometimes you have to light your money on fire before coming to the realization that things like day-trading are next to impossible to pull off.

Some people simply aren’t hardwired to take the advice of those who came before them. They’re not ready to accept the simple building blocks of saving, prudent investing, and personal finance.

They want to follow the guy they saw on YouTube in his private plane talking about how easy it is to make millions while day-trading stocks and options.

This week a bunch of college kids have been posting about day-trading on TikTok. Here’s exhibit A:

what stage of the cycle is this @awealthofcs @michaelbatnick pic.twitter.com/rBrGyLZhKM

— G (@LVDTrades) February 4, 2020

(Source: PricelessTay)

In a perfect world, young people wouldn’t get caught up in this. They wouldn’t assume the markets are easy simply because a stock they bought went up that day. They wouldn’t look at the sexy stock du jour as their ticket to untold overnight riches.

It’s not just influencer hopefuls on TikTok trading Tesla shares this week. According to CNBC, Tesla became the top stock purchased by clients at SoFi:

Traders on SoFi Invest — a stock and ETF investing platform used mostly by millennials age 25 to 40 — bought 20 times the amount of Tesla stock this week relative to history. On Wednesday, Tesla represented the largest dollar amount of securities bought and sold in the platform’s history.

Would I prefer these young people got their start in the markets in a more prudent fashion than trying to day-trade Elon Musk’s rocket ship of a stock? In a perfect world, yes.

But we don’t live in a perfect world, so some young people need to learn these lessons the hard way.

These traders are likely going to lose most or all of their money (especially the ones who are trading options). I wish I could save them but this could be a good thing.

I look at this as a form of tuition paid to the market gods. It’s how you learn.

My friend, colleague and podcast co-host Michael wanted to be a professional trader when he was getting started in the markets and came into some money. He was trading triple leveraged bearish financials ETFs and options for tech stocks on earnings announcements.1

With the benefit of hindsight, I’m sure he looks at the opportunity costs of trying to become a full-time trader as a mistake. But going through that experience pushed him into the loving embrace of index funds, rules-based investing, and a more long-term approach.

The 1990s dot-com bubble is widely known as a period when the investing public collectively lost minds. People were quitting their day jobs to day-trade tech IPOs because all they did was go up.

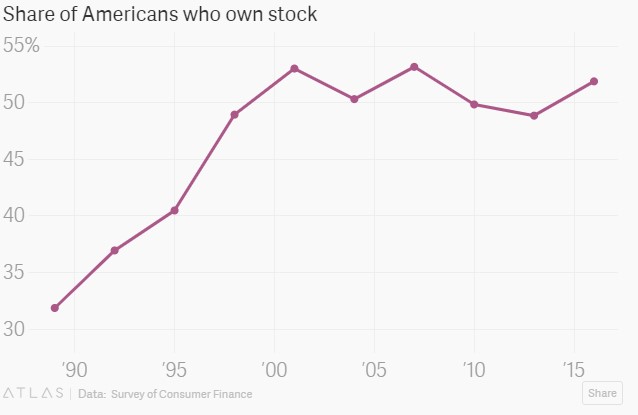

But some good came out of this insanity. The number of people investing in the stock market skyrocketed (via Allison Schrager):

By 2002, 56% of people invested in individual stocks or stock funds had purchased their first shares after 1990. Nearly one-third of stock market noobwhales made their first purchase after 1995.

Equity ownership levels have stagnated ever since. So maybe it’s a good thing on the margin that new stock owners are coming into the market even though they are going about it the wrong way?

Time will tell if they stick around after the inevitable losses. In the meantime, here’s some advice for young people going the day-trading route:

Spend some time learning about the markets. Read the book What I Learned Losing a Million Dollars by Jim Paul and Brendan Moynihan. It’s the best book I’ve ever read about overconfidence and the rollercoaster of emotions brought about by gains and losses in the markets.

Also check out If You Can: How Millennials Can Get Rich Slowly by William Bernstein once you’re ready to get off the day-trading train.

Pay attention to the underlying businesses. Stock-picking is hard and not just for aspiring day-traders. However, I do think using the process of stock-picking, especially when you’re young and don’t realize how little you actually know, can be useful from an educational perspective.

If you’re going to try your hand at picking stocks, take some time to learn about the actual companies themselves. It’s a great way to better understand the business world and how the performance of a company doesn’t always mesh with the performance of its stock price.

Pay attention to taxes. Day-trading is difficult because you’re competing against professionals and computers who are better at this than you are. But taxes present perhaps one of the biggest hurdles to a portfolio that is constantly being churned. Use this as a lesson to get to know the benefits of tax-deferred retirement accounts.

Get your personal finances in order. Investing is sexier but personal finance is where the magic happens when it comes to getting your finances in order. You could be the Jim Simons of your TikTok trading group but if you don’t save any money it doesn’t matter how good you are at investing.

Wealth-building starts with saving.

Further Reading:

Some Advice For New Investors

1More about Michael’s trading exploits and story here.