We’re currently sitting on the longest economic expansion in U.S. history.

It’s not the largest in magnitude but in terms of rotations around the sun, we are now a few months past the previous record expansion which lasted from 1991 to 2001.

The longest recession since WWII was the last one, clocking in at 18 months in duration. Since 1945, recessions have lasted an average of 11 months with a 2.3% average decline in GDP.

Here’s something you probably didn’t know about recessions:

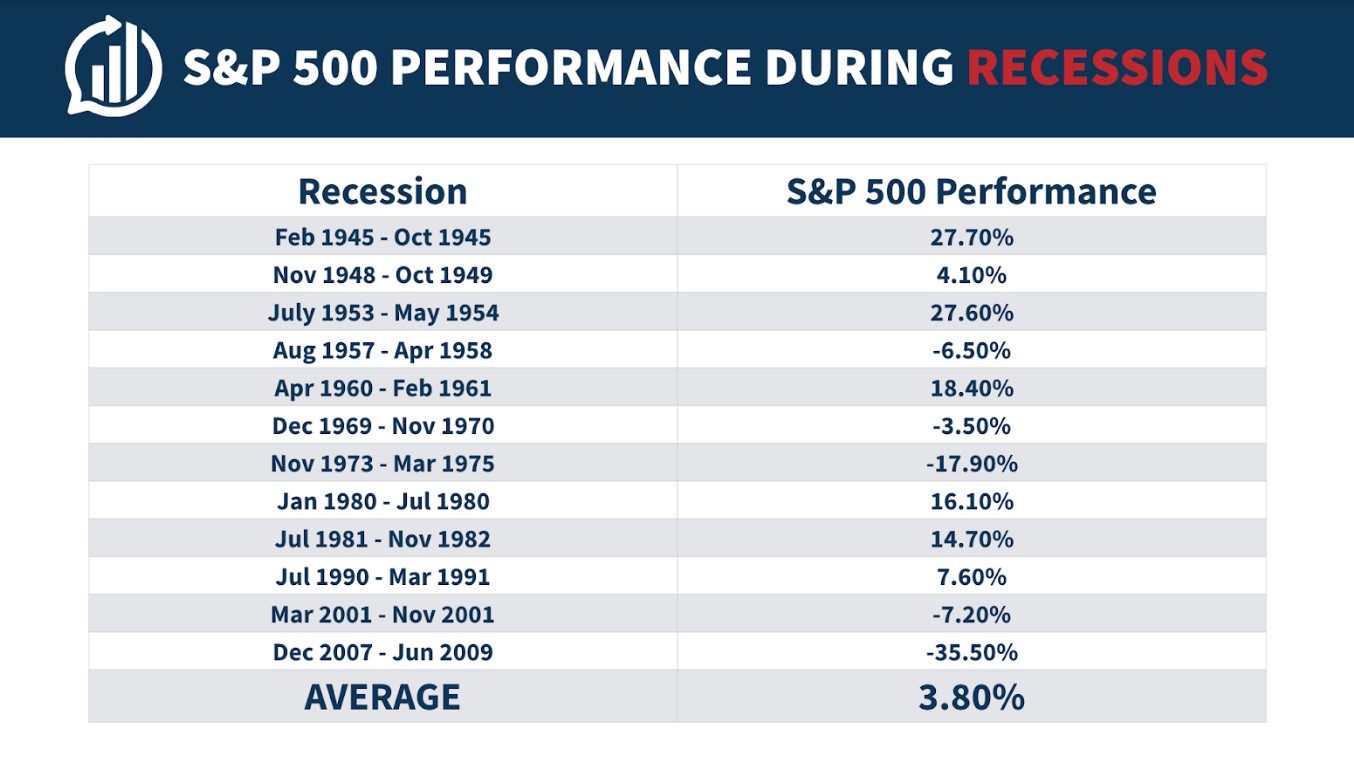

The stock market tends to perform reasonably well during the actual start of a recession until it’s officially done (as determined by the National Bureau of Economic Research). And more than 60% of the time, the S&P 500 was positive during the technical definition of a recession. You can see 5 of the past 11 recessions have seen double-digit gains while the recession was happening.

Of course, this doesn’t mean stocks don’t get crushed when the economy slows. These periods are littered with some of the worse crashes on record.

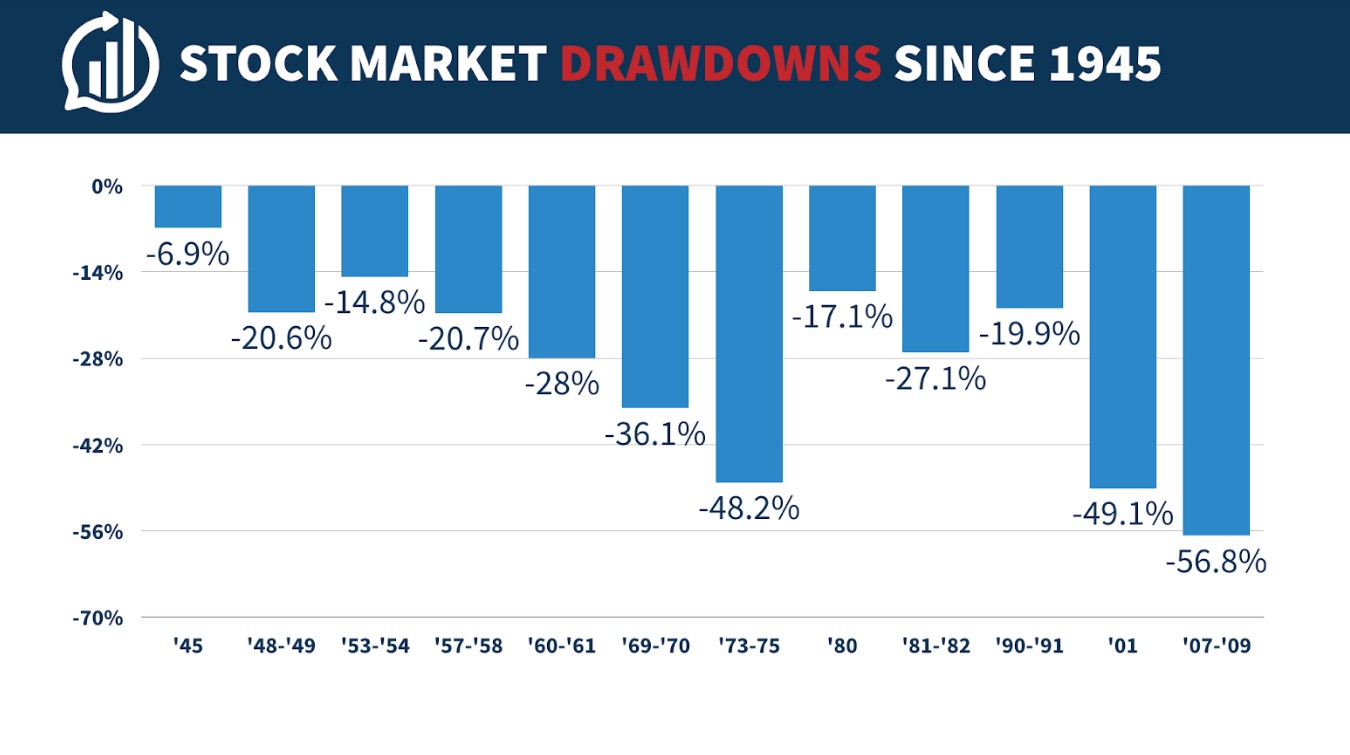

It’s just that the stock market cycle rarely lines up perfectly with the economic cycle. These are the corresponding market drawdowns in and around every recession since the 1940s:

The only time stocks didn’t fall at least 10% was in the mild recession in 1945 following the end of WWII. Not every one of these corrections was a face-ripper but there are some brutal bear markets here.

The problem with trying to time the stock market by calling a recession is that I could give you the exact start and end date of the next economic contraction and you still may not be able to profit from that information. The stock market is simultaneously forward-looking, backward-looking and maybe even sideways-looking so the fall in GDP is never going to line up perfectly with the decline in stocks.

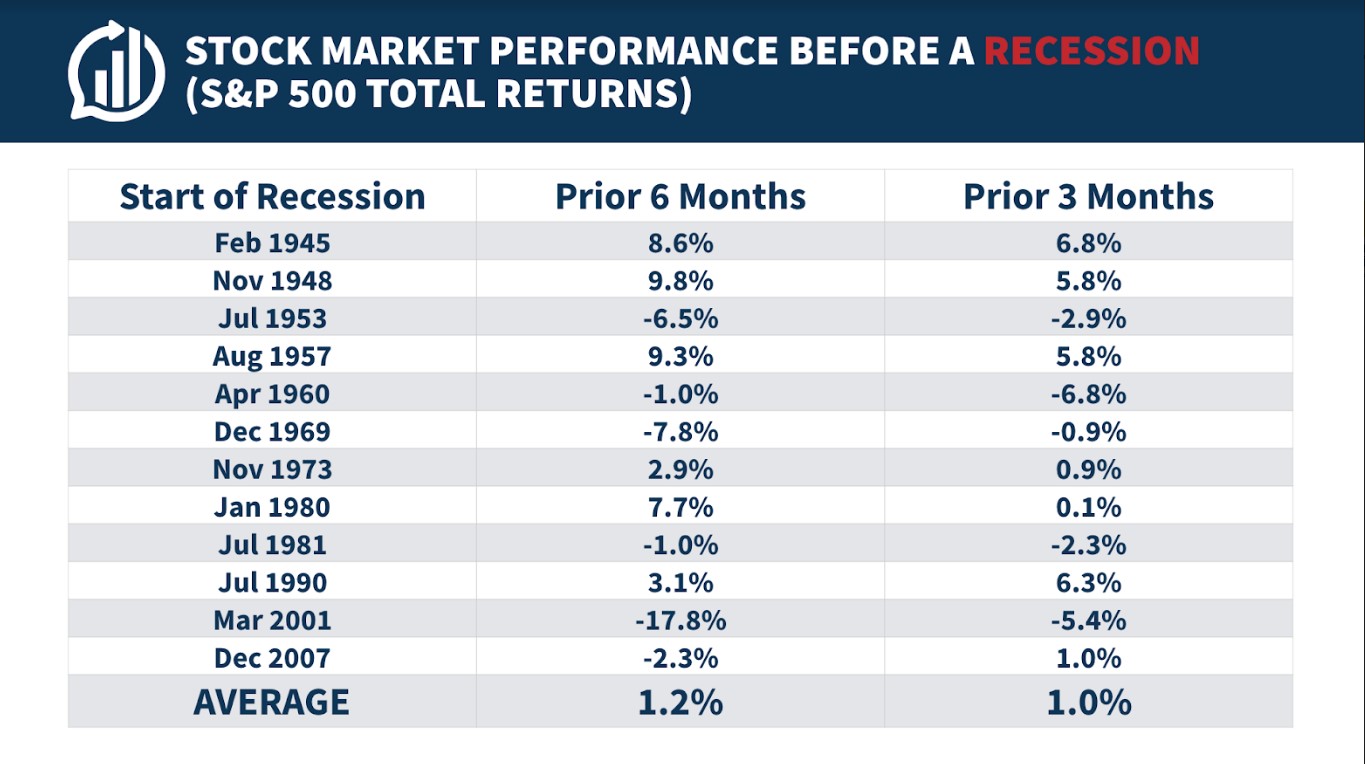

Stocks are also fairly terrible at predicting the onset of a recession as you can see from the returns leading up to the start date of a recession:

The S&P isn’t exactly screaming sell, sell, sell in advance of most recessions.

And waiting for the dust to settle is harder than it sounds. The economy can remain sluggish in the aftermath of a recession but the stock market may still be rocketing higher in anticipation of relative improvements.

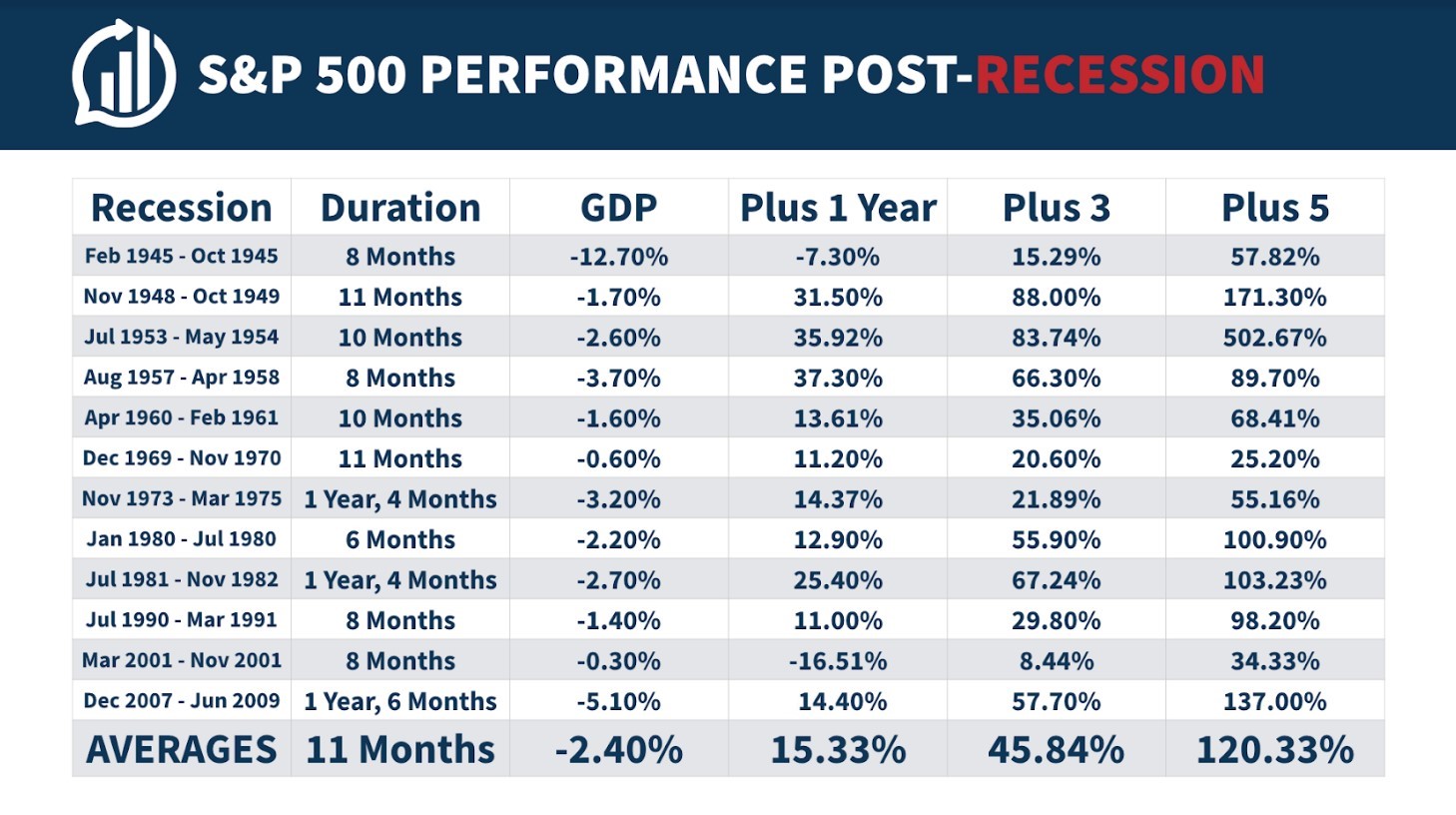

And although it’s impossible to predict exactly when a recession will begin and end, stock market returns following a recession tend to be lights out most of the time. Here are the one, three, and five year returns following the end of recessions over the past 75 years or so:

There wasn’t a single 3 or 5 year period following a recession where stocks weren’t up and 5 out of the past 11 recessions saw the S&P rise triple-digits over the ensuing 5 years.

Buying stocks during a recession will always feel like a lay-up in the rearview mirror but it can be extremely difficult at the time.

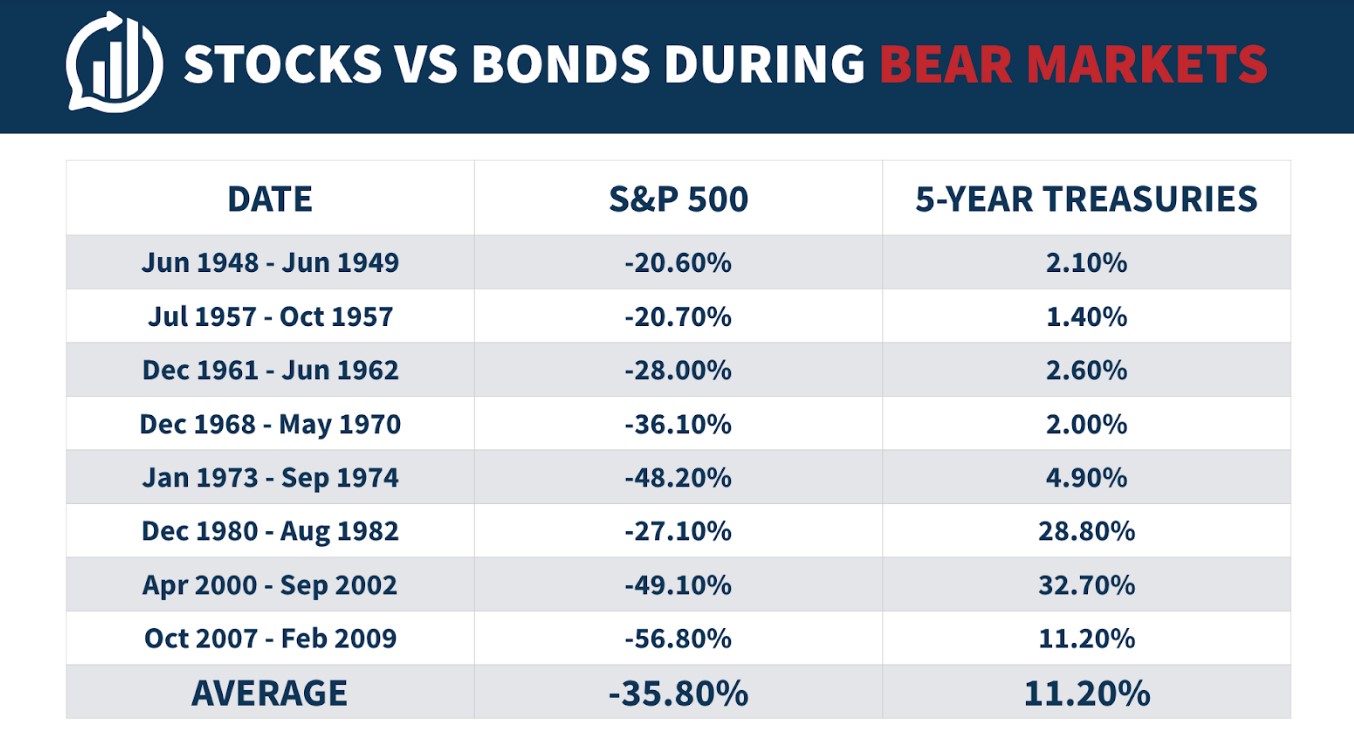

This is one of the reasons bonds can still provide value from a diversification perspective even at low interest rate levels. Here’s how 5 year treasuries have performed during every bear market associated with a recession since the 1940s:

U.S. government bonds have never been down during a bear market in this time. So while rates may not provide the performance boost they once did, it’s hard to envision a scenario where bonds don’t at least provide stability when stocks are getting crushed.

U.S. government bonds have never been down during a bear market in this time. So while rates may not provide the performance boost they once did, it’s hard to envision a scenario where bonds don’t at least provide stability when stocks are getting crushed.

That stabilizer can be used for either dry powder to rebalance into the pain and buy stocks at lower prices or for your spending needs to allow you to leave your stocks alone so you’re not selling while they’re down.

During an economic expansion the unemployment rate in the U.S. has bottomed at an average of 4% during economic expansions since WWII (the lowest unemployment rate on record during this time was 2.5% in the 1950s). On the flip side, the unemployment rate has peaked at roughly 8% during the ensuing recession.

Assuming that average 4% increase in the unemployment rate holds true, that would mean an increase in unemployed workers of nearly 6.5 million people (from the estimated labor force of 160 million people in the U.S.).

So count yourself lucky if your biggest concern during the next recession is that you wish you had a 50/50 portfolio instead of a 70/30 portfolio. If that’s your biggest worry coming out of the next recession, you’re winning on a relative basis.

Not many people assume going into a recession that they’ll be the ones to get the ax so having your personal finances in order is often even more important than having your investment portfolio under control going into a recession.

Josh, Michael and I recorded a video on this which goes into much more detail on all things recessions:

Subscribe here so you never miss one of our videos.