A reader asks:

My wife and I recently had a retirement and inheritance discussion with her parents. During our conversation it was mentioned how much they plan to leave for inheritance. We’re already on track to retire in our early 60s. However, I’m curious if I should try to incorporate the additional inheritance, it’s a significant amount but I don’t expect, nor do I want to receive this money well into our retirement. What I’d really like to do is tell them to keep the money but pay for my kids’ college and that would free up significant money now that I could direct other places.

This is obviously a good problem to have and it’s one people in the financial services industry have been harping on for years. There have been endless think pieces and presentations given about the coming $30 trillion wealth transfer from baby boomers to the next generation.

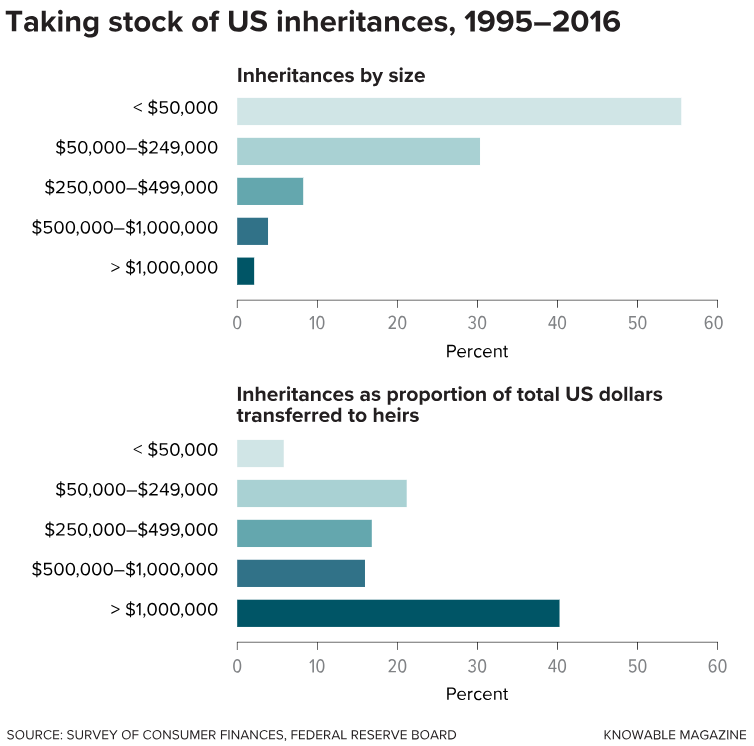

Like most things in the world of finance, if this money is someday transferred to the next gen, it will likely benefit people at the top of the wealth scale the most:

You can see from 1995-2016 the bulk of inheritances were of the $250,000 and under variety but the majority of the total money handed down was $1 million or more.

There are a few variables that make it difficult to account for an inheritance in your own financial plan:

(1) Money is a taboo subject for most families.

(2) Market returns, spending levels, healthcare costs, and life span all impact the eventual size of the nest egg being passed down.

(3) People are living longer.

Variables (2) and (3) are related. This is sort of morbid to think about, but unless you get an early inheritance, the timing is impossible to pinpoint.

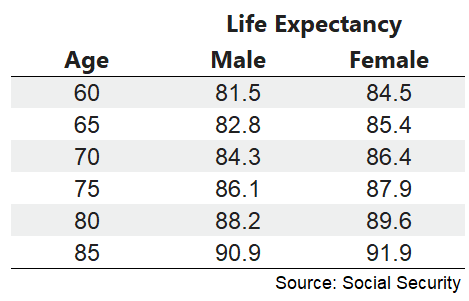

Here are the life expectancies from various ages for men and women who are in or near retirement age:

This is going to sound blatantly obvious, but it’s true that your life expectancy increases as your age increases. If your parents are just entering their retirement years, they could still have a long time to either grow or blow through their portfolio (and therefore your inheritance).

The good news for this reader’s situation is they’ve already dealt with the money taboo hurdle. Simply having these conversations in advance is often one of the hardest parts for most families because so many of us are uncomfortable talking about money. Since you’ve already had that conversation I don’t see a problem with discussing how you think it could best be used.

I’m of the opinion that the grandparents would find more joy helping now than waiting to give it all away on their deathbed.

Unfortunately, even after those conversations occur, people aren’t always on the same page but just getting it out in the open is helpful for all parties involved.

Now let’s discuss how to think about coming into an inheritance as it relates to your finances…

Another reader asks:

Basically, I will be receiving an inheritance from a loved one soon. About $175,000. I’m contemplating putting $50-100k into some Marijuana stocks for capital appreciation gains, then once (hopefully) it goes up, recoup the principal, and let the rest ride for a bit.

I’ve never been good about giving individual stock or sector advice to perfect strangers for the simple fact that (a) it’s impossible to offer specific advice without specific knowledge about a person’s circumstances and (b) predicting the outcomes for individual stocks and sectors is exceedingly difficult.

Having said that, hoping to score a quick gain with your newfound money and playing with house money is not so much a strategy as it is a gamble.

- What if your timing is off?

- How will you know if your positioning in weed stocks was wrong?

- What’s your plan if losses begin piling up?

- When will you begin selling if you do make some gains?

- What happens if you lose all the money you use to “let the rest ride for a bit”?

There are never any perfect answers for what to invest in whether we’re talking about an inheritance or normal savings. But the only variable that stays constant is you must have a plan in both scenarios.

Even a bad plan is better than no plan at all but if you’re going to go through the planning process you may as well be thoughtful about it.

Here are some thoughts about getting a bonus in one form or another:

- Use it as an opportunity to get your finances in order. Everyone has pain points in their financial life. It’s no fun to pay down debts or build up your emergency fund but using inheritance or a bonus is a perfect time to fill in the potholes of your personal finances.

- Don’t blow it. You don’t have to be a hero just because you came into some new money. Making money decisions when you’re excited about a new opportunity is rarely a good idea. Feel free to let it simmer for a while so you can think about how you’d like to allocate your newfound money before rushing into any rash decisions.

- Figure out a bonus allocation. Asset allocation has a place in personal finances. When I come into extra income or a bonus I have different buckets I’ll put that money in to spread things out. That could mean breaking the money up into things like saving, investing, retirement, travel, taxes, etc.

- Set aside some fun money. The other bucket I always leave some room for is for guilt-free spending. You need a release valve every once and a while to allow yourself to have some fun with your money. Otherwise, what’s the point of saving in the first place?

If you are one of the lucky ones gets an inheritance just remember that you’ll likely adjust to your newfound money fairly quickly. Walt Disney’s granddaughter, Abigail Disney, who herself came into a boatload of family money, shared an interesting data point in a recent interview:

They did a study at the Chronicle of Philanthropy years ago where they asked people who inherited money, “What amount of money would you need to feel totally secure?” And every single one of them, no matter what they had, named a number that was roughly twice what they inherited. So that’s what you need to know about money, right? If that is your primary measure of success or value in life, then good luck with that, because it will never feel good.

Money is always relative so try not to let an inheritance cloud your judgment.

Further Reading:

Financial Superpowers