A reader asks:

I’ve seen a number of social media and other reports about people being upset that their tax refund was lower than in previous years. I haven’t seen any analysis around whether this was just a withholding issue or their total tax actually went up. Do you have any data on this?

I’ve seen some of the headlines on this. Here’s one from the New York Times:

And another from NPR:

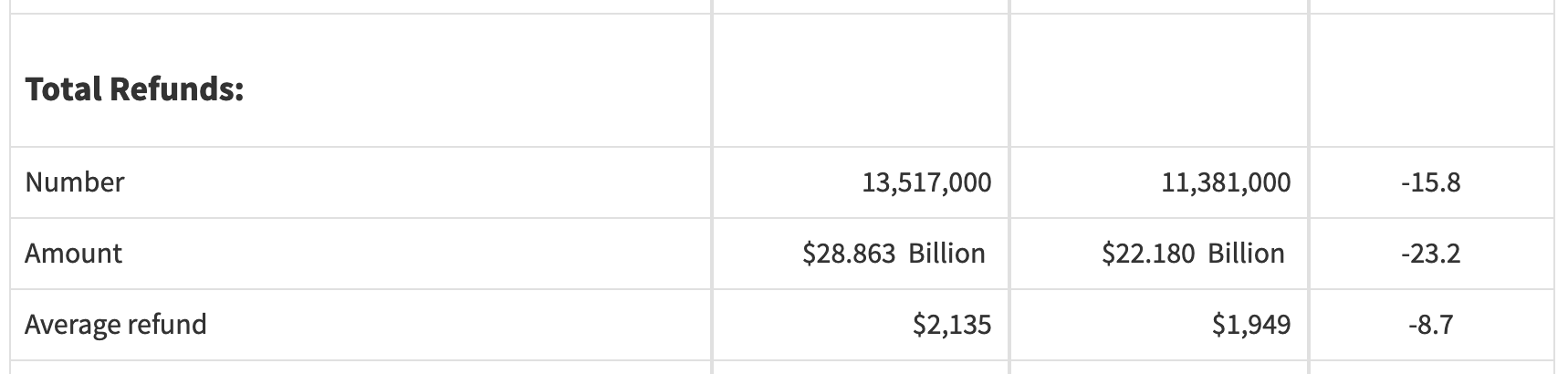

Its true refunds are smaller this year. According to the IRS, for those who have already filed their taxes, refunds are down almost 9%:

Even though tax refunds are lower that doesn’t necessarily mean you paid more in taxes.

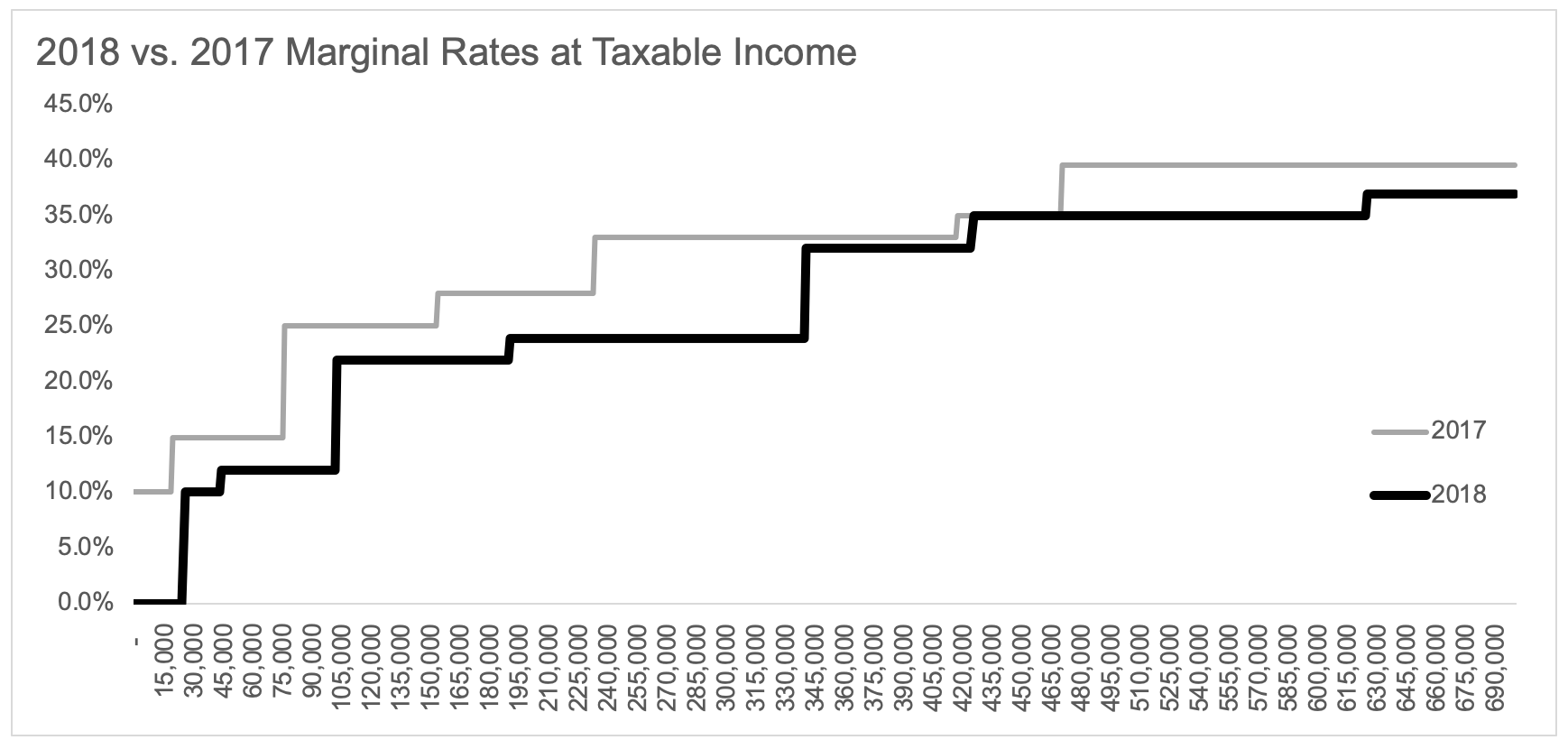

All else equal, you should have paid less under the tax provisions in 2018 than you would have in 2017 (most people anyway).

Here’s a breakdown of marginal tax rates in 2017 and 2018 (charts courtesy of our resident tax expert Bill Sweet):

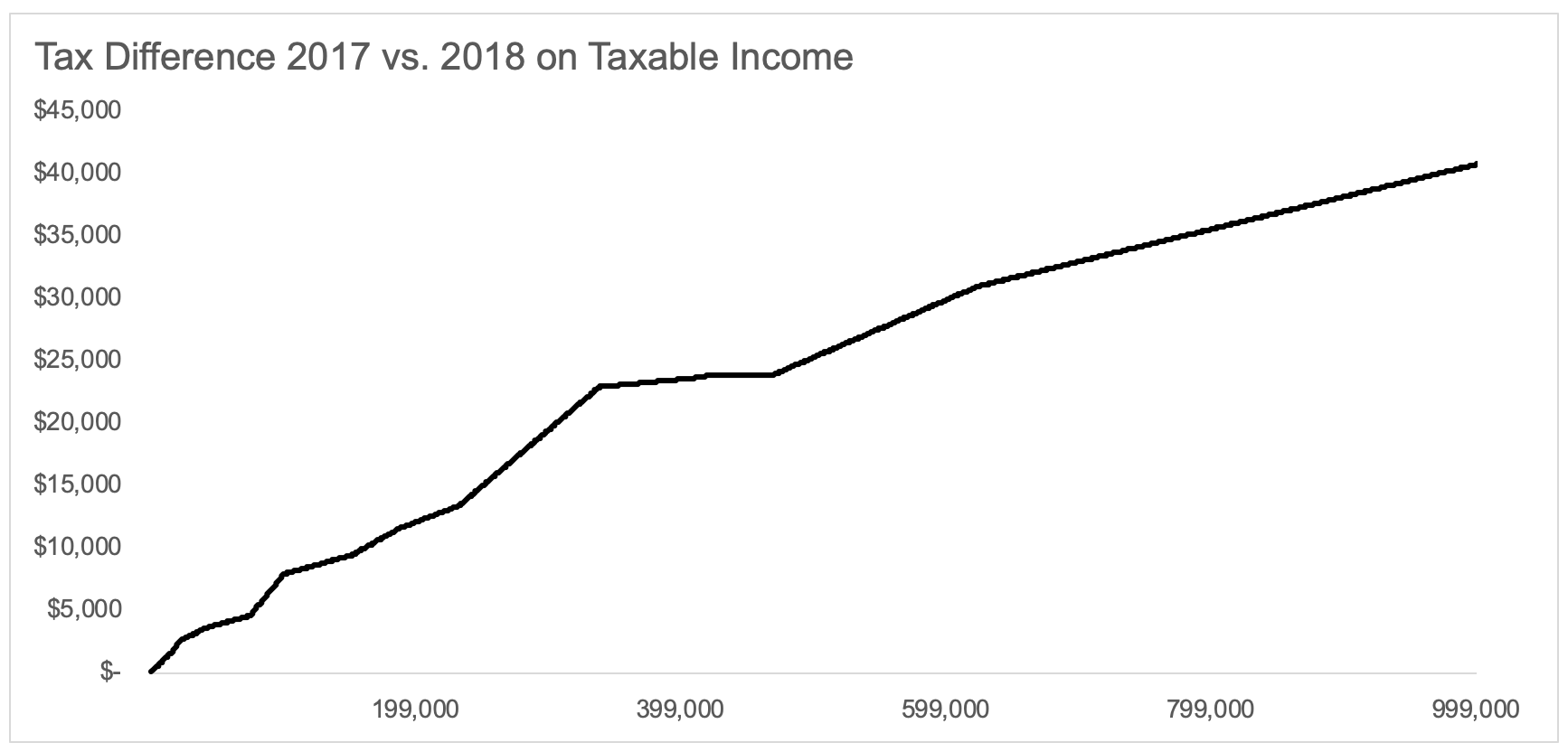

And here’s the difference in dollars at various income levels:

That’s the good news.

The bad news is many people may not have accounted for the fact that they simply got a bump in their paycheck earlier in the year when many employers began using the new IRS income tax withholding tables.

So most employees likely received a pay bump but failed to account for it in terms of what it would mean come tax time.

There were also some changes in terms of new deduction limits and some new tax breaks (that new child tax credit was nice for someone like me with 3 kids).

There are really only two options when it comes to getting a tax refund:

Option 1 is to get a smaller paycheck throughout the year to ensure yourself a larger refund come tax time.

Option 2 is to get a larger paycheck throughout the year to all but ensure yourself a smaller refund (or write a check) come tax time.

But why would you want a refund? That’s an interest-free loan to the government?

In theory, this is correct but human nature doesn’t care about theories. Some people need some sort of forced savings and for many, that’s what a tax refund ends up being.

The problem for most people is that the tax code is complicated. And changing the already complicated tax code doesn’t make it any easier on people. It’s not like they teach people how to do their taxes in high school.1

It’s tough when you’re used to receiving a certain amount in the spring and all the sudden it’s not there.

Unfortunately, unless you hire a tax professional, there is no one there to hold your hand on this stuff. You’re all on your own when it comes to understanding your own personal tax situation. So that means not blindly assuming your tax refund will be the exact same about every year.

Your tax situation will likely change over time.

The tax code will likely change over time.

Your paycheck will likely change over time.

That means you have to pay attention, even when it concerns boring subjects like taxes.

Further Reading:

Bill Sweet Explains the New QBI Tax Deduction

Now here’s what I’ve been reading lately:

- Mary Poppins and compound interest (Wealth Farmer)

- How many unique personal finance stories are there? (Abnormal Returns)

- Are we misusing our minds? (Psychology Today)

- The Robert Downey Jr. of the fund world (Albert Bridge)

- Charlie Munger is an assassin (TEBI)

- Does delaying social security really provide an 8% annual return? (Open Social Security)

- Check out the details for our new conference in September (Wealth/Stack)

- The case for permanent life insurance (Irrelevant Investor)

1I wish things like this were part of a mandatory personal finance education. My dad taught me how to fill out my first tax returns by hand in high school and that learning process helped me better understand how this stuff works.