The S&P 500 hit an all-time high on September 20, 2018.

A little more than two months later, after a shellacking on Christmas Eve, it had fallen 19.8%.

The 95 days from peak to trough was the fastest bear market since the S&P fell 19.3% in just 45 days in 1998.

Since bottoming (for the moment, at least) the day before Christmas, stocks have now risen more than 10% in just a few short weeks.

These wild whipsaws seem to be getting faster and faster. The quick downdraft, seemingly out of nowhere, that leads to a V-shaped recovery is the hallmark of the current cycle.

It certainly feels like markets are moving faster.

But are they?

Has technology and the free flow of information changed the markets? Are there air pockets in stocks that didn’t exist before you could communicate in real-time with anyone in the world? Are the algos wreaking havoc on market cycles?

It does feel like that to me but it’s probably the recency bias in action because the historical numbers don’t necessarily agree with this hypothesis.

For instance, the average bear market from peak to trough from 1950-1995 took 339 days (median 240 days) from top to bottom. After 1995, the average is 349 days (median 157 days).

If we look at just corrections1 the average from peak to trough was 127 days (median 63 days) from 1950 to 1995 and 71 days (median 91 days) from 1995 to the present.

The averages and medians more or less cancel each other out here so there’s no clear trend in between the pre-Internet days and the new information age.

Maybe drawdowns aren’t happening any faster but what about the recoveries?

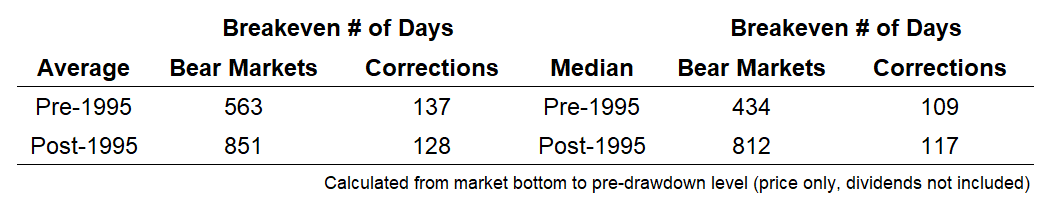

I again looked at the S&P 500 back to 1950 to see how long it took for stocks to breakeven by taking out the price level hit prior to the onset of a downturn:

Again, there doesn’t appear to be a noticeable difference in the speed of market cycles before and after technology changed how we access and share information.

The reason I showed averages and medians with all these numbers is because outliers can often skew the results.

For example, the bear market at the start of the century from the dot-com flameout lasted over two-and-a-half years to go from top to bottom. It then took more than four-and-a-half years for the S&P 500 price index to regain the high from March 2000.

On the other hand, the 19.4% drawdown in 2011 took less than 6 months from peak to trough and recovered the peak level in just 5 months.

There are similar examples in the pre-Internet age. Stocks fell 21% in just 99 days in 1957, recovering in less than a year. Then there was the bear market from 1980 to 1982 which lasted more than 20 months but broke even 83 days later.

It took 600 days to reclaim the peak in the market from August 1987 which was shortly before the Black Monday crash in 1987 that saw stocks fall 33% in less than a week.

Try as I may, I couldn’t find a discernable difference in the speed of downdrafts or recoveries between in the pre-Internet and current information age. Both environments were filled with quick market moves, drawn-out bear markets, short recoveries, brutally long sideways periods and everything in between.

Every generation assumes the current state of the world is uniquely terrible, uncertain, or special. The same seems to apply to market environments.

Index funds, algorithms, ETFs, high-frequency trading, smartphones, and interconnected global markets would all seem to provide an accelerant to market cycles.

I’ll admit I assumed that’s what the data would show. It does feel like these moves are happening faster in real time but that’s just not the case. This is why we can’t always trust our feelings when the markets are involved.

Technology makes for a nice narrative when markets see big moves, but markets have always functioned like this and probably always will.

Further Reading:

The Original Flash Crash

1When stocks fell double digits but not any further than 19% (I know 20% is the standard for bear markets but I threw in the 19% downturns since there are a lot of them. Sue me).