On this week’s Animal Spirits with Michael & Ben we discuss:

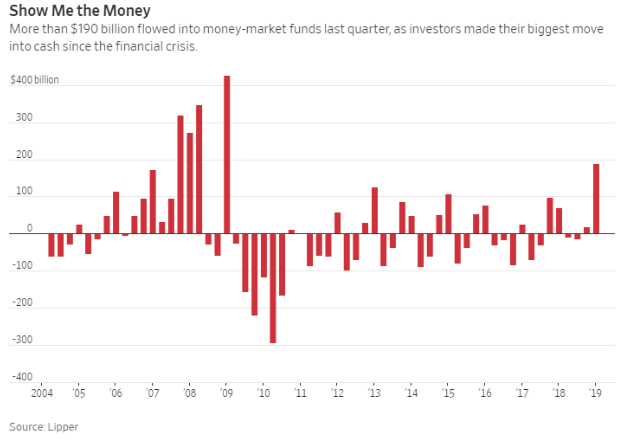

- What does all that cash moving to the sidelines tell us?

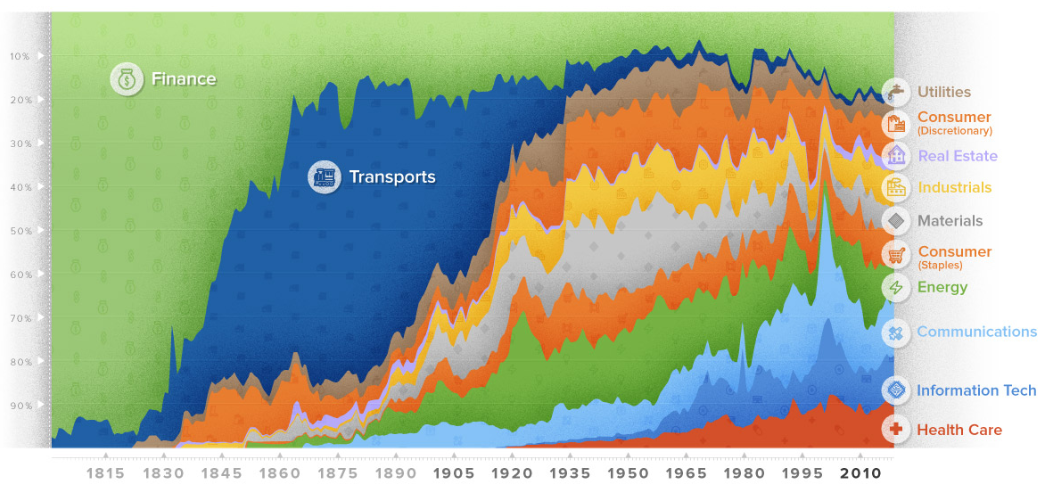

- How markets have changed since 1800.

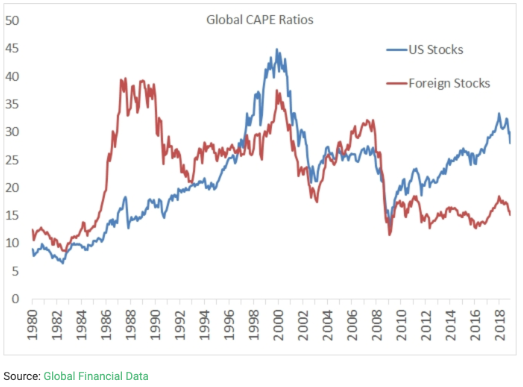

- Valuations between U.S. and foreign stocks are wider than they’ve been in 40 years.

- Does the U.S. deserve a valuation premium?

- Why are there no star fund managers under the age of 60?

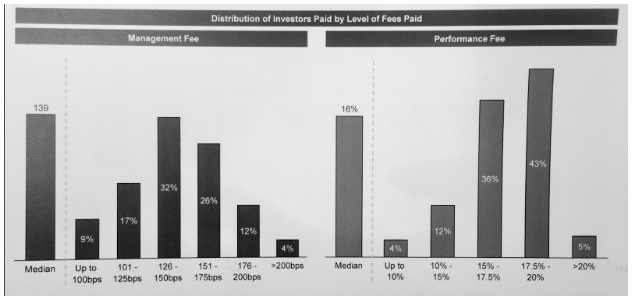

- Why does a small handful of hedge funds create all the gains?

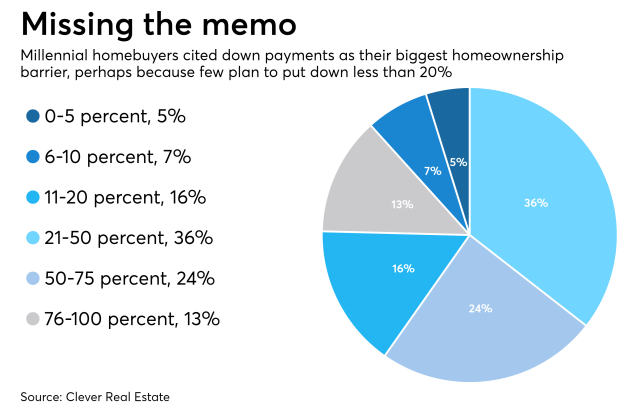

- Millennials don’t understand how down payments work.

- Michael’s experience selling a house without a realtor.

- Why we overestimate the returns on our homes.

- When buying is cheaper than renting.

- The Reddit trade of the week.

- RSUs vs. stock options.

- Taking advantage of the illiquidity premium.

- Early thoughts on True Detective and much more.

Listen here:

Stories mentioned:

- Investors’ dash for cash

- 200 years of stock market sectors

- The biggest valuation spread in 40 years?

- Einhorn explains why he lost 30% last year

- The best hedge fund manager of all-time

- Millennials don’t really get how down payments work

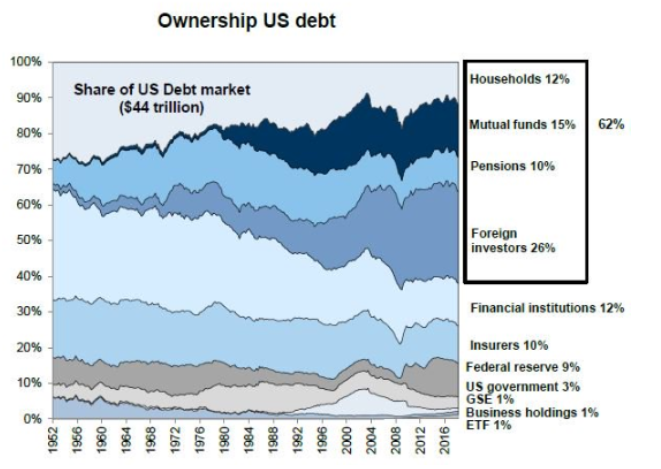

- Who owns all the stocks and bonds?

- Shifting risks in the bond market

- The most important investors of all time

Books mentioned:

Charts mentioned:

Crazy idea of the week:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: