On this week’s Animal Spirits with Michael & Ben we discuss:

- The new Howard Marks book.

- Do super-investors like Marks & Buffett actually do more harm than good?

- The humble beginnings of the first Vanguard index fund.

- How to call a market top without calling a market top.

- How SoftBank’s vision fund will impact the VC world.

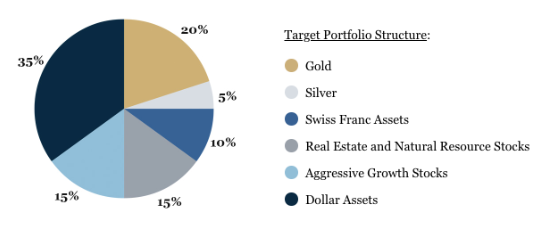

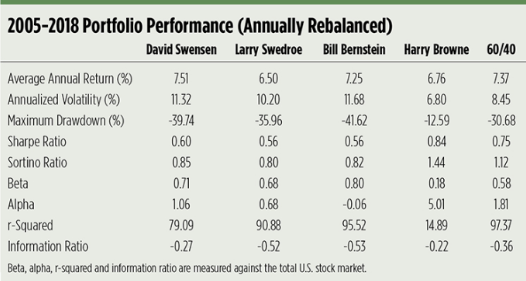

- A handful of different asset allocation models.

- The Permanent Portfolio mutual fund.

- Are we wrong to be an anti-survey podcast?

- The fraud of the week and how to spot a Ponzi scheme.

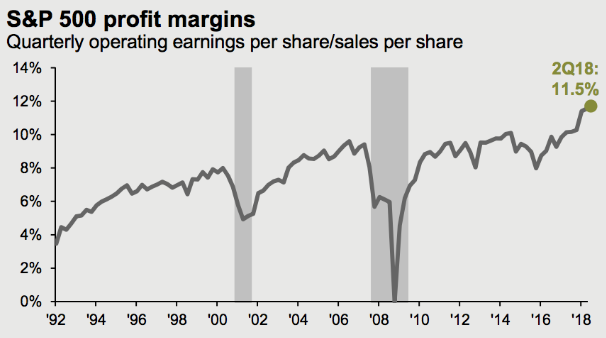

- Will profit margins ever mean revert again?

- Can you wait to buy the dip in housing prices?

- Tom Cruise with a swing and a miss.

- Some of my high school secrets and much more.

Listen here:

Stories mentioned:

- Howard Marks — how to invest with clear thinking

- Bogleheads on investing with Jack Bogle

- Blockbuster deals and stock market records are a sign of a top

- The $100 billion blitz on Sand Hill Road

- Bernstein, Swensen, Browne or Swedroe

- Ponzi scheme of the week

- Market concentration

- U.S. home price gains decelerated in July

Books mentioned:

- Born Standing Up by Steve Martin

- The Most Important Thing by Howard Marks

- Where Good Ideas Come From by Steven Johnson

- Mastering the Market Cycle by Howard Marks

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: