On this week’s Animal Spirits with Michael & Ben we discuss:

- Some things you may not have known about index funds.

- Why average hedge fund fees are declining (and why most investors will still pay higher fees).

- Hedge funds and private equity looking to monetize the poor.

- Why pension funds don’t attract better investment talent.

- How to avoid financial fraud.

- Fact-checking the 10k baby boomers retiring everyday stat.

- The half-life of wealth.

- The enormity of the Esports business (and why is ‘sports’ in the title?).

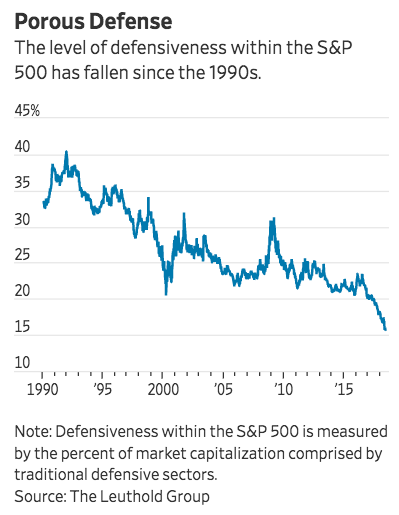

- Why there are fewer “defensive” stocks in the S&P 500.

- Mutual fund revenues still dwarf those from ETFs.

- How Dilly Dilly ads from Bud Light are making you drink more beer.

- Why Liam Neeson movies are the index fund of Hollywood and much more.

Listen here:

Stories mentioned:

- Buy high and sell low with index funds!

- Hedge fund management fees fall to record low

- Want to run a high-flying hedge fund? Don’t be cheap

- Hedge funds look to profit from personal injury suits

- How private equity profits by making loans to cash-strapped Americans

- Are payday loans really as evil as people say?

- New Jersey’s investment chief resigns

- Ex-Morgan Stanley sentences to prison for fraud

- Do 10,000 baby boomers retire every day?

- Sustaining wealth is harder than getting rich

- The myth of dynastic wealth

- Professional video gamers get their own stadium

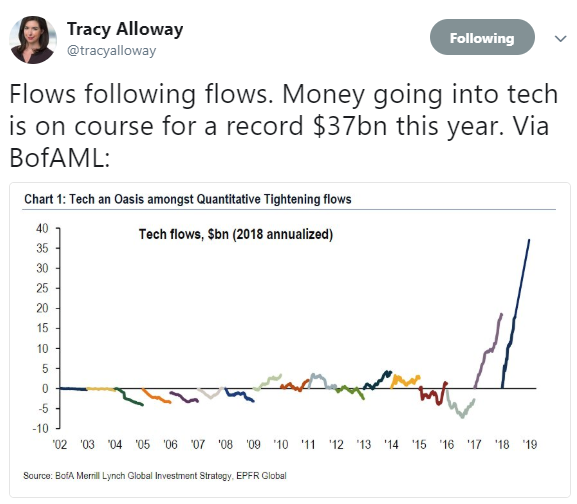

- Investors double down on tech in rocky quarter for stocks

- The past, present, and future of ETFs with Eric Balchunas

- Beer sales are rising, helped by ‘Dilly, Dilly’ ads

- Lessons from Cliff Asness

Charts mentioned:

Books mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: