On this week’s Animal Spirits with Michael & Ben we discuss:

- The story in the WSJ that brought tears of joy to Michael.

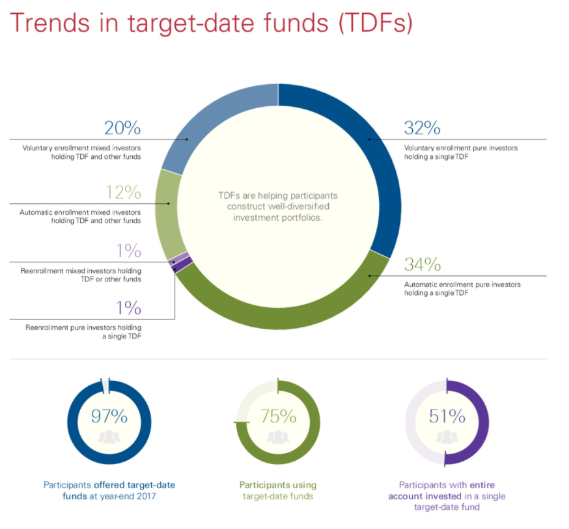

- How retirement investors are getting more intelligent.

- The growing importance of target-date funds.

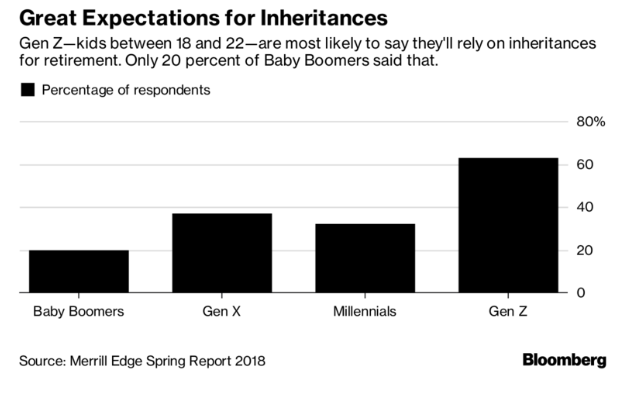

- Gen Z’s retirement plans need some work.

- Why college might not cost as much as you think.

- Most people don’t know how much they need to save for retirement.

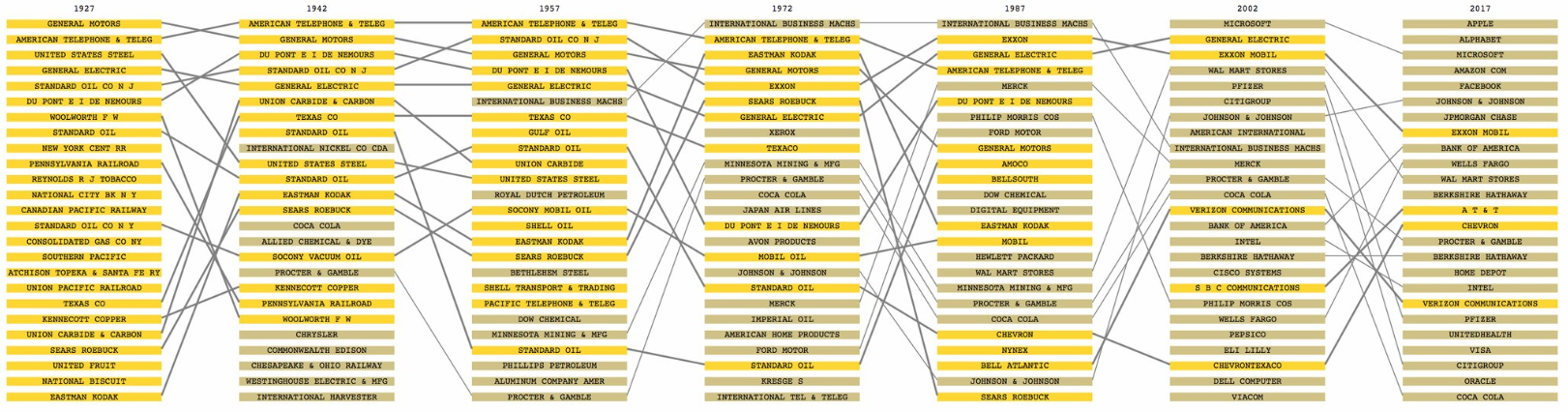

- Which huge tech firms will still be at the top of the stock market in 15 years?

- Why do stocks generally go up over the long-term?

- BREAKING NEWS: Michael’s latest trade was discovered mid-episode.

- How should Michael invest his GLD proceeds in his Roth IRA?

- Our parenting money tips and much more.

Listen here:

Stories mentioned:

- Everyone makes mistakes — even Warren Buffett

- Short-termism is harming the economy

- More than half of all Vanguard 401ks invest in a single target-date fund

- No more S&P 500 index fund for the Vanguard employee retirement plan

- Rich kids are counting on an inheritance as their retirement plan

- Top colleges are cheaper than you think

- Most people don’t know how much they need for retirement

- Betting on new S&P 500 stocks is a risky game

Books mentioned:

- The Space Barons by Christian Davenport

- Business Adventures by John Brooks

- The Opposite of Spoiled by Ron Lieber

- Secrets of the Baby Whisperer by Tracy Hogg

Charts mentioned:

https://twitter.com/ganeumann/status/1003782394049069056/photo/1

Podcasts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: