On this week’s Animal Spirits with Michael & Ben we discuss:

- Community-adjusted EBITDA.

- Elon Musk trolling Warren Buffett & Charlie Munger.

- Berkshire Hathaway underperforming the S&P 500 over the past 10 years.

- Why David Swensen thinks Buffett is wrong about college endowments.

- Why don’t more college endowments invest in index funds?

- Why owning a home is a poor investment option.

- And are homes even an investment to begin with?

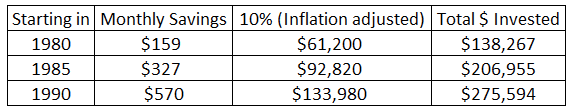

- The cost of waiting when saving for retirement.

- Argentina’s 40% short-term interest rates.

- What the next bear market means for actively managed mutual funds.

- How much would you need to be paid to give up Google for a year?

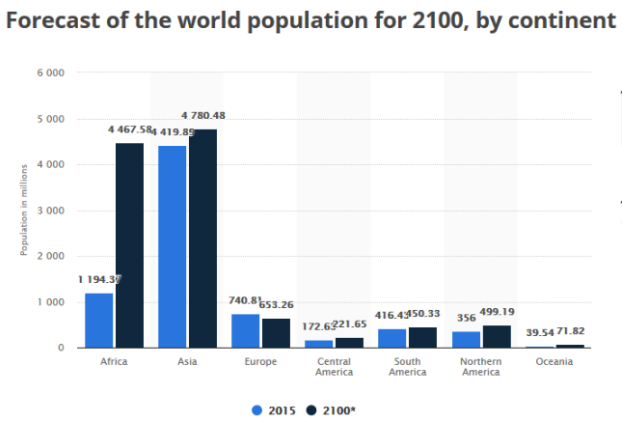

- Why Africa could be a wonderful investment opportunity in the coming decades.

- Should young people care about stock market valuations?

- Are there any good re-watchable movies these days and much more.

Listen here:

Stories mentioned:

- WeWork raises $702 million with first bond sale

- Yale 2017 endowment update

- A small college’s endowment beats Harvard with index funds

- The Vanguard endowment model?

- Why your home is a worse investment than you think

- The cost of waiting

- A huge interest rate hike

- A bear market would be a death knell for active funds

- How much would you pay to keep using Google?

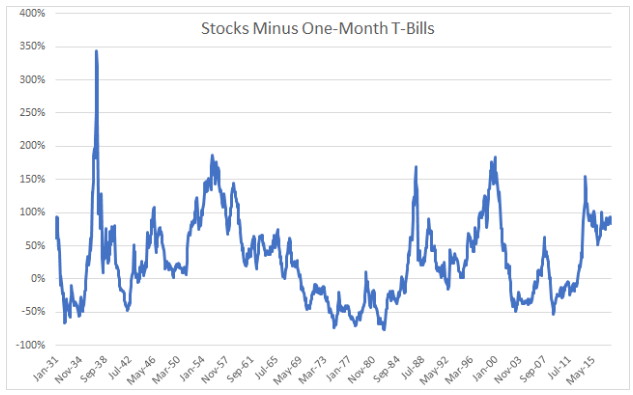

Charts mentioned:

Books mentioned:

Books mentioned:

- Two Kinds of Truth by Michael Connelly

- The Book of Basketball by Bill Simmons

- Reducing the Risk of Black Swans by Larry Swedroe & Kevin Grogan

- Enlightenment Now by Steven Pinker

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: