There was a story in CNN Money last week about a 60-something part-time writer/librarian who cashed out all of the money she had in the stock market. Here’s what she did with it along with her reasoning behind the decision:

Now all my money is stashed in U.S. Treasuries, Treasury Inflation-Protected Securities (or TIPS bonds), and laddered CDs, which, in the years to come, I can count on to earn me essentially nada.

Why would I do this?

I once figured out exactly how much money I would need to live on — not lavishly, but comfortably — for the rest of my life. I promised myself that once I had that amount, I would actually do just that — take my money out of the market and live on it for the rest of my life.

Last week, I reached that goal.

It’s nice to see a feel-good retirement story every once and a while. The majority of what gets reported focuses on the crisis in retirement savings and how everyone will be living off bread and water for their remaining days upon retiring at age 86.

She did mention that it’s not a foregone conclusion she’ll be out of stocks forever. The markets are constantly tempting us but it sounds like she has the right attitude:

But if the market totally tanks tomorrow, you ask, and stocks become such a crazy bargain that I’d be a fool not to put at least some of my money back into that mutual fund that served me so well, wouldn’t I?

Of course I would! I’m no fool. Plus, the one thing I’ve learned about the market over the past three decades is “what goes down, eventually comes back up.” But until that happens, I’m staying put. And if it never happens? I’m still set.

I hate to nitpick but I guess that’s sort of my job as a financial blogger, so here goes…

I’m glad she’s given herself peace of mind with this decision. Once you’ve won the game, what’s the point of still playing? Investing in stocks is hard on the psyche from the periodic volatility and losses. I can see the appeal of getting out.

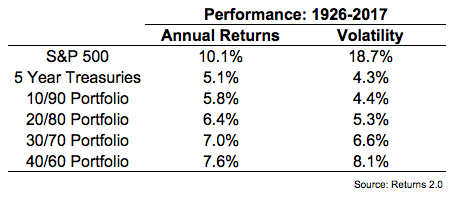

But my feeling has always been the more diversification you can give yourself as an investor the better. Even a small allocation to stocks can help in a number of ways. First, it can improve your results without impacting the volatility all that much:

This table shows how adding 10%, 20%, 30% and 40% in stocks would have looked against and all bond portfolio of intermediate duration bonds since the mid-1920s. You can safely ignore the absolute performance numbers in bonds. 5% per year in Treasuries is not happening from current interest rate levels. Instead, focus on the relative increase in returns and minor change in the volatility profile from adding just 10% or 20% in stocks.

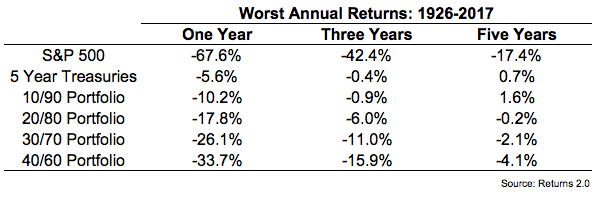

Of course, volatility is not a risk in and of itself. Most investors are more worried about losing money, especially retirees. Here are the worst case scenarios (most of which occurred during the Great Depression) for these same allocations:

Again, adding even a 10% slice of stocks doesn’t make much of a difference from a risk profile perspective.

Of course, these returns are all nominal. Inflation is likely one of your biggest risks in retirement, especially when you consider that lifespans continue to increase.

One of the biggest benefits of investing in stocks is the fact that they provide a great inflation hedge. And that’s not only because stocks are the highest returning asset class. The income stream you receive from stocks is also a great tool to fight inflation. Since WWII, dividend growth has been close to double the rate of inflation.

Our retiree in this story is investing in TIPS, which will be helpful, but again, I say the more diversification the better. Diversification of income streams is a simple way to hedge your bets during retirement.

Regardless, getting to a place where you have enough money to hopefully live on for the rest of your life is obviously a good problem to have. What to do with that money is not always an easy question considering all of the unanswerables involved in retirement planning.

Source:

I took all of my money out of the stock market and it feels amazing (CNN Money)

Further Reading:

Do Stocks Diversify Bonds?