“The single greatest challenge you face as an investor is handling the truth about yourself.” – Jason Zweig

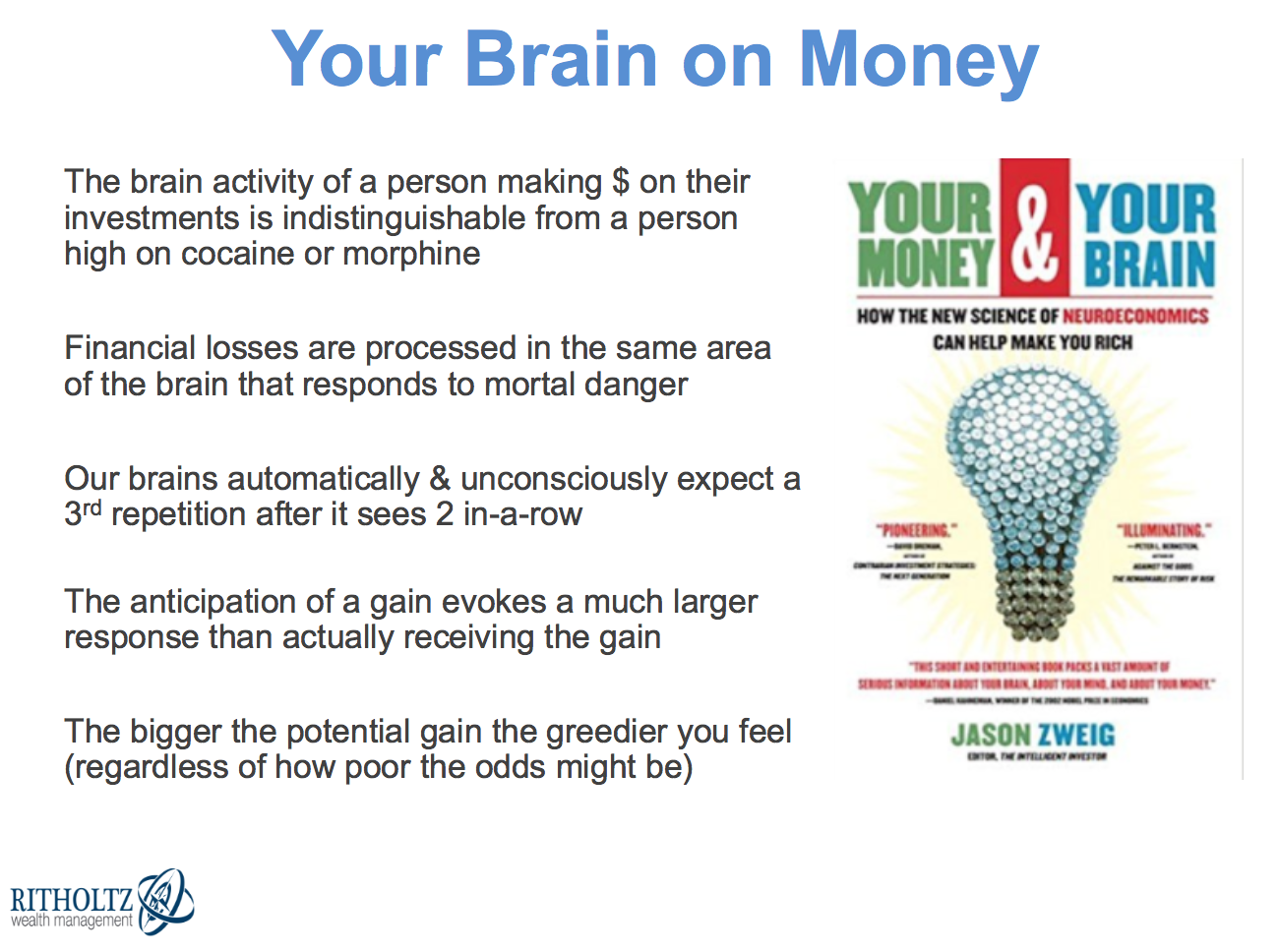

In a presentation I gave a couple weeks ago I used the following slide:

Your Money & Your Brain by Jason Zweig is my favorite book on human behavior so I’m constantly sourcing, re-reading and using material from the research. The book looks at neuroeconomics, which is research using brain activity, economics, and behavioral psychology to study how we make decisions.

The main focal point is how the brain affects financial decisions but it’s obvious the material goes beyond money matters. It’s equal parts scary and impressive how much is going on behind the scenes in our brains unconsciously that we’re unaware of.

Here are some of my favorite highlights from the book I find myself using over and over again:

- There are two parts of your brain that make decisions — one is reflexive (instinctive and emotional) and one is conscious (more deliberate and logical). The reflexive system often responds before the conscious system realizes it was supposed to respond.

- The intuitive part of your brain is so laser focused on change it makes it difficult to focus on anything that remains constant.

- Money doesn’t buy happiness as far as the brain is concerned because the anticipation of a gain and then actually receiving said gain are processed differently in the brain. Getting exactly what you planned for doesn’t do much for excitement in your brain.

- Your brain consumes 20% of your oxygen and the calories you burn when you’re resting. So when you start to think heavily it can go into overdrive and wear you out.

- People begin to get confident in their predictive abilities when they think they’ve spotted a pattern even when they’re explicitly told events are random ahead of time.

- Your brain hates uncertainty so when it is confronted with difficult questions it tends to search out easier ones instead in terms it can understand.

- Our brains can re-live financial losses while we’re sleeping.

- The brain of a cocaine addict who is expecting to get a fix and someone looking to make money on their investments is virtually the same.

- Once people assume an investment is predictable their brains freak out when the assumed pattern is broken.

- When you go on a financial hot streak the same area of the brain kicks in that is seen with people who suffer from the manic part of bipolar disorder.

- Studies of craps players show when people want to roll a high number, they shake the dice for a long time and throw them hard. When they want a low number, they give the dice a quick shake and toss them more softly. We assume we can control the outcome by how we throw them.

And finally, my favorite passage from the book on investment mistakes:

An investment mistake is like a sunburn: It results from forgetfulness, carelessness, or creeping commitment to a choice that you may never have been happy about. But after the fact there’s no mistaking it, and it can burn like hell, and you’re sorry you did it.

This is a good taste but there’s so much more in this book that it’s hard to summarize everything that’s covered. Your Money & Your Brain was the first book that made it clear to me how important it is to get out of my own way when making decisions, investing or otherwise.

I was excited to learn recently that Zweig will be speaking at our EBI Investing Conference in NYC this November to celebrate the 10 year anniversary of the book. The research and lessons are timeless so it should be useful to hear the material all over again along with any updates over the past decade.

We also have Cliff Asness, Liz Ann Sonders and Scott Galloway lined up to speak. This is going to be a fun event. For a short time we are also offering a 25% discount on ticket prices using code RWM25. More information here:

Evidence-Based Investing Conference (East)

And find a copy of Jason’s book here:

Your Money & Your Brain: How the New Science of Neuroeconomics Can Help Make You Rich