I get a lot of questions from people about how they should invest their money and which specific investments they should focus on.

What should my asset allocation look like?

Which funds should I pick in my 401k?

Should I own individuals securities, mutual funds or ETFs? Which ones?

Should I change my current portfolio or stick with it?

There are no perfect answers to these questions because everyone’s circumstances are different. No one likes this answer but it’s true.

There’s never going to be a one-size-fits-all investment strategy that will cover every single person because a lot of it comes down to your financial, family, and employment situation, not to mention your personality, tolerance for risk, current needs and future objectives.

Most people have a hard time answering these questions because investing and the markets can be complicated, especially for those who don’t have the skillset, energy or resources available to devote a substantial amount of time to managing or understanding money.

The problem I see more often than any other from normal investors I interact with is that the majority of people skip the first step in the process completely. People want to know what to invest in before thinking through what they’re investing for.

Without a deep understanding of the ‘why’ when investing it’s pretty difficult to figure out the ‘what’ or ‘where’ to put your money.

My experience in the financial services industry has taught me that most people assume they need help with portfolio management — and many of them do — but most are really in need of financial advice to help figure out how to get from where they are to where they would like to be with as little stress as possible.

Bob Veres, who has been covering the financial planning profession in a number of different capacities for over three decades, seems to think the financial advisory world is heading in this direction. Veres recently sat down with Michael Kitces to discuss the past and future of the financial planning profession.

He talked about how the 1980s were all about salespeople pushing limited partnerships and insurance products on their clients while the 1990s and 2000s were strictly about investment management as people got market fever during the 1990s tech bubble.

Veres thinks the aftermath of the financial crisis has finally shifted things more towards life planning and goals-based investing:

When someone comes into a financial planner’s office here’s what the future looks like — they will present some symptoms. The advisor will do a full check-up, a financial check-up on that person and will also get a sense of what that person’s idea of personal fulfillment means so that you can sketch out a destination. You can sketch out where this journey is heading. And in order to create a map to get there, you have to know where that destination is. And that will finally start to happen.

The first service you’re giving that client is the ability to understand what fulfillment means to them. And I have to tell ya, in our society right now 99.9% of the human population has no idea. They don’t know what their goal is. They don’t have a goal. They’re being buffeted around by circumstance. And, of course, they end up wherever the wind blows them. And then wonder, “How’d I get here?”

Of course, some people will never get to this place of fulfillment. Some are never going to be ready while others need to make some mistakes before the realization kicks in that money is a means, not an end.

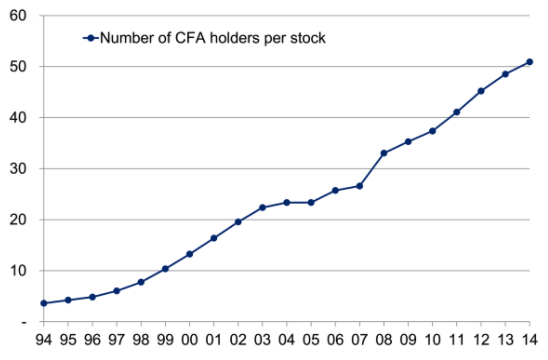

I think it’s going to take some time to get the majority of clients and the financial industry to buy into this idea. This chart from Citigroup that made the rounds a couple months ago has stuck with me:

There are now something like 120,000 CFA charterholders worldwide with an estimated 250,000 candidates hoping to attain the same status. While professional investors fret about the rise of passive investing, there is a huge glut of people in the investment management industry who are likely performing redundant, unnecessary, or overpriced tasks.

My long-term trade for the coming decades in the financial service industry would be to go long financial advisors and short old school investment analysts in terms of what people are going to need help with going forward.

It’s estimated that there are something like 300,000 to 350,000 financial advisors in the U.S. right now (depending on how you define the term) but roughly one-third of that total will be retiring in the next decade since half of this group is over the age of 55.

My hope would be that the finance industry will begin shifting resources from investment management to financial advice in the coming years to fill this gap.

People need help creating a financial map, defining what fulfillment means to them, and understanding how to get from here to wherever it is they’d like to be. Those who can help others figure these things out will have a leg up on the competition in the years ahead as more people begin to realize that financial advice goes hand-in-hand with investment management.

Source:

The Evolution and Emergence of a True Financial Planning Profession with Bob Veres (Kitces)

Further Reading:

Investment Management vs. Financial Advice

Now here’s what I’ve been reading this week in between bottles and diapers:

- Finances and fitness (Waiter’s Pad)

- The unknown-unknowns of the futures (Of Dollars and Data)

- The avocado toast advice (iwillteachyoutoberich)

- Risk literacy must come before financial literacy (A Teachable Moment)

- Scott Galloway’s advice for college grads (L2)

- The advantages of being a little underemployed (Collaborative Fund)

- American Gods (Reformed Broker)

- Behavioral finance extraordinaire Meir Statman is giving a keynote at our conference in June (Big Picture)

- Waiting for the market to crash is a terrible strategy (SVRN)

- Curiosity is better than knowledge (The Mission)

- What we’re telling clients about European stocks (TRB)

- Good luck picking the next Amazon (Irrelevant Investor)