I spend a ton of time reading and most of it ends up falling in the interesting, but not very useful category. And that’s okay — not everything you read is going to be groundbreaking.

This week I did come across two research pieces that I thought were very useful and wanted to share some takeaways.

The first comes from Jeff Ptak at Morningstar, who did a deep dive on after-tax returns on equity mutual funds. As everyone knows by now, index funds have beaten the majority of actively managed funds over a wide range of time frames. There are, of course, actively managed funds that beat the indexes, but very few investors bother to look at the tax implications from investing in actively managed funds.

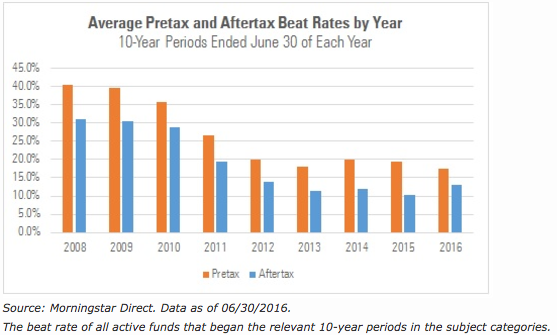

Jeff looked at the long-term data for wide array of fund categories — emerging markets, large caps, mid caps, small caps, value and growth — and showed both the pre- and after-tax beat rates for each against a comparable Vanguard index fund. Here is the composite for all of these fund categories:

You can see that pre-tax beat rates have been fairly low, but the hurdle rate is even more substantial when you include the impact of taxes on your performance.

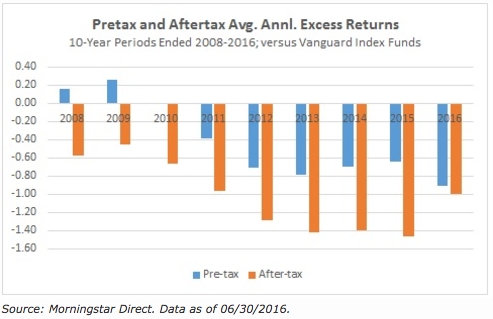

He also showed that while active funds, on average, tend to trail Vanguard funds by 0.50%-1.00% before taxes, those spreads were much wider after taxes were taken into account:

A couple of simple, but important lessons here:

- If you plan on holding actively managed funds, it’s not a good idea to do so in a taxable account.

- Asset location can be just as important as asset allocation for certain fund types.

- It’s not what you earn, but what you keep that matters.

Keep reading for more from Jeff on this:

Investing Taxable Money in Active Stock Funds? A Bad Idea (Morningstar)

*******

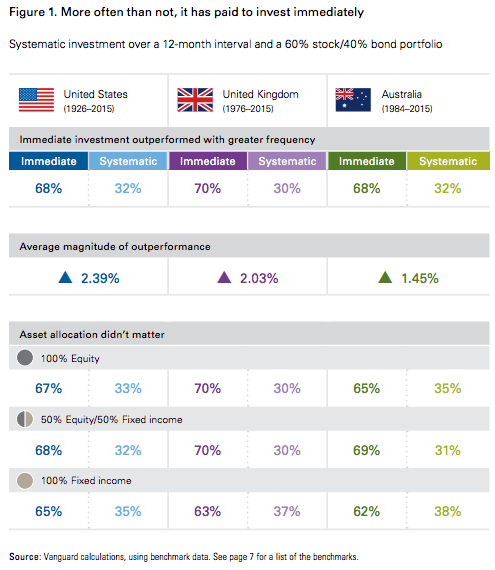

The other piece that caught my attention came from Vanguard themselves. One of the issues that comes up frequently with investors I talk to is what to do about a lump sum of cash that needs to be invested. Should you invest immediately or slowly dollar cost average in over time?

There’s no right or wrong answer to this question but Vanguard ran the numbers to see which strategy tends to work better. Here are the results from a simple 60/40 portfolio in a few different markets:

The results are all fairly similar. The majority of the time it has made sense to invest immediately.

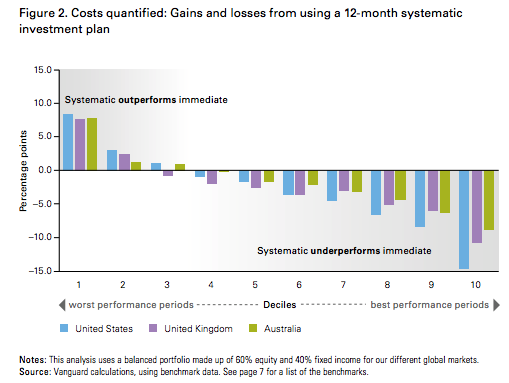

They also looked at the best and worst returns from each approach to give you a sense of the range of historical outcomes:

Again you can see that more often than not an immediate investment beats a systematic one. And this makes sense when you consider the fact that markets rise roughly 3 out of every 4 years.

Investing a lump sum can be a nerve-wracking experience for investors because there’s always a chance that you’ll invest right before a bear market or hold off and miss further market upside.

I like to say that investing is an exercise in regret minimization, so people have to figure out a strategy that they’re comfortable and stick with it. You don’t want to be second-guessing yourself all the time with something like this. You’ll never nail the timing perfectly.

Check out the entire report here:

Invest Now or Temporarily Hold Your Cash (Vanguard)

And have a safe and happy Thanksgiving!