The equity risk premium is the academic definition of the idea that stocks should outperform the risk free rate over the long-term. The risk free rate to be used is up for debate, but using the 10 year treasury bond as a proxy gives us a historical equity risk premium of about 4.5% per year since the late-1920s. This means that the S&P 500 has outperformed government bonds by that amount, on average, in that time.

This premium is promised to no one. If it was there would be no risk. That means there will be both short and long-term periods that will see no premium. That historical premium is just an average so you have to expect to see it vary widely over time.

Assuming stocks do continue to earn a premium over bonds going forward, it’s worth considering whether today’s low interest rates will lead to lower stock market returns. This would make sense intuitively considering that long-term bond returns are driven almost exclusively by their starting yield. So even if stocks earn the same premium as they have historically, when added to lower bond yields it would mean lower overall stock market performance.

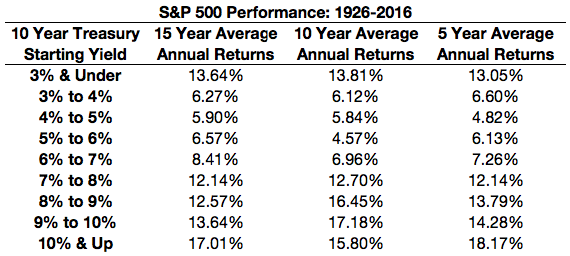

I thought it would be interesting to see how this idea has held up historically. I looked back at the starting yield on the 10 year treasury bond to see how stocks performed going forward from various interest rate levels. Here’s how this looks going back to the 1920s:

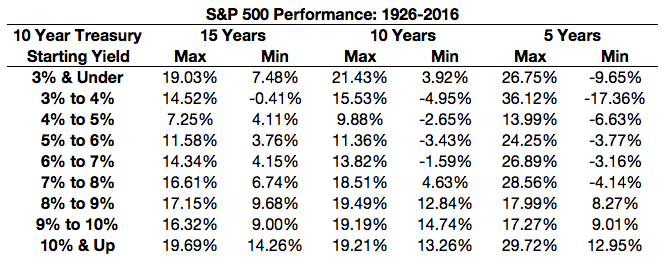

Averages don’t always tell the whole story so it makes sense to look at the historical ranges as well:

For the most part it does appear that this relationship has held up over time. In general, the higher the starting interest rate the higher the future stock market performance. This seems to work everywhere except the very lowest yield levels. It’s hard to know for sure why this is but my guess would be when rates are near their lows it means the Fed is being very accommodative with monetary policy because of a crisis situation (which would also correspond with lower stock prices and thus higher future returns).

Based on this data, people looking for a more normalized interest rate environment — if there is such a thing — should be careful what they wish for. The 3% to 6% interest rate level has actually proven to be some of the worst starting points for future stock market returns. I’m assuming the reason for this relatively poor performance at these interest rate levels is because by the time interest rates return to their normalized range the cycle is close to meeting its end. This also tends to be when many investors decide that the “coast is clear” to put some money to work in stocks.

Of course, we’re really in uncharted territory at today’s interest rate levels. The 10 year yield currently stands at 1.5% or so. In the historical numbers I looked at the 10 year was just barely below 2% for a couple months but has never really spent much time below that level until recent years. No one really knows what will happen with rates this low for this long. It’s never really happened before.

So it’s certainly possible that this relationship doesn’t hold going forward.

We live in interesting times, as always.

Further Reading:

Do Stocks Diversify Bonds?