Bloomberg’s resident ETF expert, Eric Balchunas, shared some interesting stats today on the habits of millennial investors. Their use of ETFs has exploded in recent years, up nearly 60% over the last year. Also, a greater percentage of millennials use ETFs than older generations:

- Millennials: 41%

- Gen X: 25%

- Baby Boomers: 17%

While millennials seem more accepting of ETFs than other generations, they’re not using them solely for long-term investment purposes. According to TD Ameritrade, one of the most heavily traded securities by millennials is also an ETF (technically an ETN):

UWTI utilizes leverage to allow investors to try to earn 3x the upward price move in oil. Millennials trading this thing is like driving a truck full or nitroglycerine through a match factory. This year alone it’s down over 50%. It also has over $1 billion in assets.

And if 3x long the price of crude oil doesn’t do it for you, you can always try your hand at the 3x short oil ETN (DWTI) by making a leveraged short trade on the price of oil. That fund is down almost 45% this year. It has nearly $500 million.

So while the price of oil is up marginally this year, both of these ETFs have gotten slaughtered.

It’s worth pointing out that these are trading, not investing vehicles, but I’m sure with that many assets that there have been plenty of investors who have lost money in this space. The reason these types of funds are so dangerous for long-term investors is because they offer a point-to-point trading opportunity. The leverage is reset on a daily basis, so you’re not getting a truly leveraged 3x bet over the long-term price of oil, but the price on any given day. It’s also very expensive to rebalance and roll these futures contracts so often.

But that’s just the 3x ETNs. Surely you could do better betting on the price of oil without the use of leverage. Well…

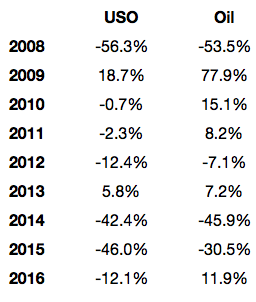

The United States Oil ETF (USO) has almost $3 billion in assets. It does a terrible job tracking the price of oil as you can see from the annual return numbers:

Again, this is a trading vehicle that I’m sure many investors have mistakenly assumed they could use as an investment vehicle to play oil as a long-term investment theme. Very few investors in these funds have any idea about the complex cost structure involved in the futures that are being used to track the underlying prices. It can be very expensive to roll into the new contracts and it’s also easy for other investors to front run their trades because of the periodic rebalancing schedule. USO can closely track the price of oil in the short-term but as a long term investment it’s not going to get the job done.

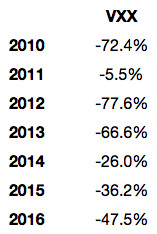

While we’re talking about some of the worst ETFs to use as investments, I would be remiss if I didn’t mention VXX, the S&P 500 VIX Short-Term Futures ETN. Following the financial crisis, the VIX volatility index started to gain more and more attention from investors who wanted to make a bet on the volatility of the market itself. It hasn’t worked out so well:

To put it lightly, this fund doesn’t do such a great job tracking the VIX index. It’s down 99% since inception:

Obviously the fact that volatility has been on the decline throughout this bull market has played a big part in some of these losses, but because of the way these futures are structured, you’re typically buying higher and selling lower when you roll into new contracts. Those costs can be as high as 40% a year or so in some cases.

VXX has nearly $1.7 billion in assets.

Again, I’m sure the majority of these assets are being used by hedge funds and other short-term traders (at least I hope that’s the case). The turnover in these funds are all off the charts. But I’m also pretty sure there have been plenty of investors who assumed they were following a well-reasoned investment thesis into oil or volatility and an ETF was the easy way to play that hunch.

The whole reason you own ETFs as an investor is to gain exposure to a specific asset class, strategy, sector or investment type at a low-cost in a tax-efficient, liquid fund structure. ETFs are one of the most efficient ways to diversify at a low cost. But their convenience is a double-edged sword that can easily lead to huge losses for those who don’t understand what they’re getting themselves into.

When buying an ETF as an investment you should typically know:

- How it’s constructed.

- The underlying index or strategy it’s tracking.

- The potential tracking error from the underlying investment idea.

- The tax and cost structure.

- The underlying liquidity.

The worst ETFs to own are the ones that:

- You don’t understand.

- You can’t get a good grasp of the all-in costs involved.

- Sound too good to be true.

- Are too costly or difficult to implement.

- Are created for trading purposes but you’re using as an investment.

Some investment strategies sound great on paper but are difficult to implement in real life. All ETFs are not created equal.

Source:

Millennials Lead the Generations in ETF Adoption (Bloomberg)

Further Reading:

How Institutional Investors Use ETFs