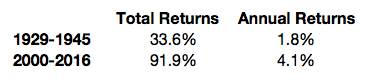

From the peak of the tech bubble in early 2000 the returns on the stock market have been underwhelming. In fact, if you line up the peak of the market in 2000 with the peak of the market in 1929 just before the stock market collapsed, the returns aren’t that far off:

Although the Great Depression was far more severe than what we experienced during the Great Recession, there are some similarities that these time frames share. There were two massive bear markets in the 1930s along with two recessions that saw stocks fall over 80% from 1929-1932 and another 50% in 1937. In the latest period, stocks were cut in half in both the 2000-2002 and 2007-2009 bear markets.

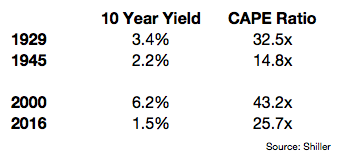

Here’s the breakdown of how government bond yields and long-term valuations changed over each period as well:

Although the market returns were close over these periods, that’s basically where the similarities end. The Great Depression saw the unemployment rate reach 25% or so, which was sandwiched in-between two world wars, the second of which had just ended in this 1945 comparison. People think things are terrible now but I just can’t imagine what it would have been like to live through the 30 year period from the start of WWI in the mid-1910s through the end of WWII in the mid-1940s.

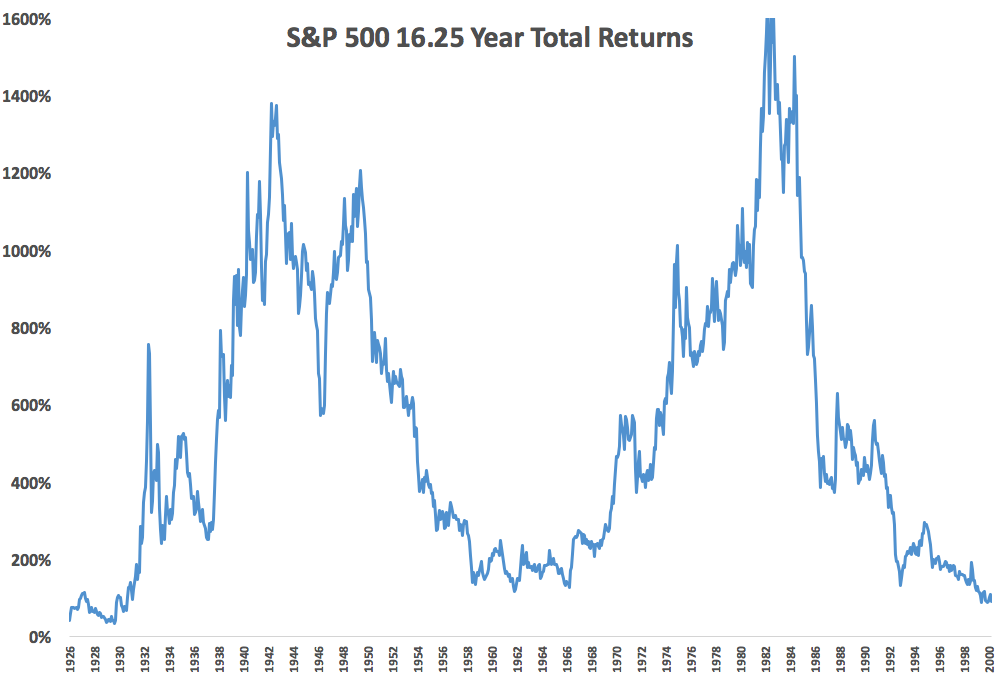

This is a completely arbitrary time horizon (aren’t they all?), but this shows how (relatively) terrible the returns have been over the past 16+ years:

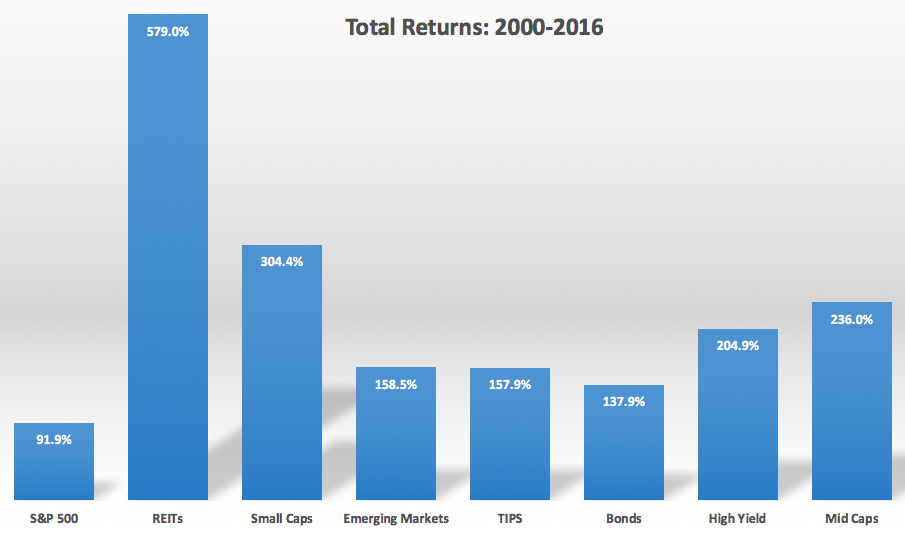

Luckily for investors the S&P 500 isn’t the only game in town:

Nearly every other asset class has outperformed the S&P 500 over this time frame.

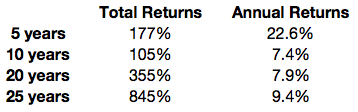

Because this is an arbitrary starting point to measure market returns you could also extend the time horizon or shorten it to see much different results through June 30th of 2016:

A few takeaways from this exercise:

- The S&P 500 has had pretty terrible returns since 2000 but that should be expected when you experience one of the worst economic downturns of the past 100 years along with two 50% crashes.

- Long-term is in the eye of the beholder when investing in stocks.

- There are going to be double-digit periods of poor returns. That’s risk for you.

- Diversification is one of the most boring, yet useful concepts in portfolio and risk management.

- And if you want to win any argument about the markets just change your time horizon.

Further Reading:

Stock Market Returns Are Lumpy