Long/short funds are one of those strategies that is wonderful in theory but very difficult to pull off successfully in practice. These funds go long the stocks they think are going to rise and go short the stocks they think are going to fall. So they should be able to make money in a wide variety of market environments because of their ability to alter their exposure to the market along with their stock-picking prowess.

The long/short pitch really began to gain steam following the excruciatingly long bear market from 2000-2002. The S&P 500 was down three straight years. These funds typically only have 40-60% long exposure to the stock market, so they are technically hedged against market losses (assuming their stock picks don’t blow-up).

This was a wonderful time to be a value investor, so funds that were shorting expensive names and going long cheap names made a killing. Institutional investors made a big push for this type of hedge fund following their outperformance during this period.

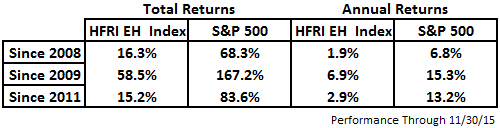

The latest cycle hasn’t been so kind. Here’s a comparison of the HFRI Equity Hedge Index (an industry benchmark) and the S&P 500 over various time frames since 2008:

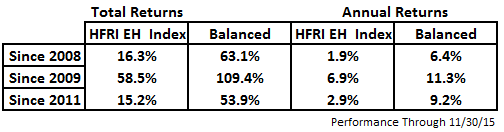

You would have expected these funds to perform better relative to the overall market, but comparing hedge funds to the stock market isn’t exactly a fair comparison. A better comp here would be a more balanced offering such as the Vanguard Balanced Fund (basically a 60/40 stock/bond portfolio) that’s not 100% exposed to the stock market:

Even against a simple balanced fund the L/S universe has gotten crushed, especially in the later stages of this bull market since 2011. No one knows for sure why L/S funds have had such a difficult time in the recent cycle, but here are some of my thoughts on the reasons for this underperformance:

Interest rates. When you short a stock — betting that it will fall in price — you get cash back in return because you are selling the stock in hopes that you will buy it back at a lower price and keep the remainder as profit. In the past hedge fund managers could earn interest on that cash as they waited for their short positions to play out. Back in the day these funds could earn 4-5% from a simple money market fund in addition to any gains they made from their short book. This isn’t the case at current interest rate levels. Plus, prime brokers are still collecting fees on the cost to borrow short stocks — called the borrow rate. It’s not discussed very often, but this spread between the cost to borrow and the interest earned on cash has hurt L/S returns.

Momentum. Most L/S portfolio managers are fundamental investors. This period, especially in the past few years, has been dominated by momentum and growth stocks. Many of these funds have actually seen their short stocks outperform their long stocks at times, which is the double whammy of painful underperformance. Shorting based on valuation is very tough in this type of environment, so many of these funds have had a difficult time with their style of investing. Long/short doesn’t work so well in a bull market, especially one in the late stages where momentum tends to outperform.

Macro. Following the Great Recession and ensuing European crisis, many of these fundamental portfolio managers have tried to become macro managers. Most are just macro tourists. That’s not something you can just pick-up on the fly and they’ve learned the hard way how hard it is to change your style. Investors have clamored for macro insights following the financial crisis but that’s not how most of these managers came up in the markets.

Competition. At this point there must be hundreds of Tiger Cub funds (proteges of legendary hedge fund manager Julian Robertson). I’m exaggerating, but there are so many fund managers and analysts who were trained in the same school of thought that it’s become harder and harder to find unique investment opportunities. There seem to be more and more hedge fund hotel stocks that get too crowded these days. Plus the fundamental shops have to compete with the quants who have their algorithms continually sorting these stocks looking for over- or under-valued names.

Index methodology. Hedge Fund indices aren’t perfect. They rely on self-reporting, have a huge survivorship bias and don’t include every fund in the industry. Of course there have been some good L/S funds during this period, but my experience with hedge funds in the institutional space has been that even the top tier funds have had a difficult time navigating the current environment. At industry conferences the L/S managers have been fairly quiet the past few years about their track records. The HFRI numbers are probably a decent representation of the average L/S fund’s performance, even if it’s not perfect.

Fees. When you add higher fees to all of these issues it becomes a huge hurdle to anything approaching outperformance. I’ll be interested to see how these funds perform once value starts to outperform growth in the future. Until then, in the current rate environment, with the current fee structure in place, it will likely take some master stock-picking for these funds to improve upon their performance.

Further Reading:

My Thoughts on Hedge Funds