The following comes from the Los Angeles Times about CalPERS, the nation’s largest public pension plan:

The California Public Employees’ Retirement System said its fund returned just 2.4% on its investments for the year ended June 30, a huge miss from its 7.5% investment target and a worrisome result for California taxpayers who must make up for any shortfalls in funding pensions.

CalPERS has some well-documented process-related issues in how they manage their enormous pension fund. They have far too many outside managers, which makes tracking and monitoring cumbersome, expensive and probably impossible. They don’t have a good handle on the costs of their portfolio, which is causing many to question their transparency and oversight of the fund. They’re also going through something of an identity crisis in terms of what types of investments they’ll hold in the portfolio.

But having a single fiscal year that ends with a below average return number is not something they should be taking heat for. Last year the fund returned nearly 19%. The year before that it was up over 13%. This report makes it sound like investors should be able to set a long-term return target and reach said target every single year (whether that target is realistic or not is a whole other topic for discussion).

You can’t expect to earn out-sized gains in the financial markets without accepting some lumpiness in the results. The assumption that you can create a portfolio of risk assets that will have steady returns year in and year out is what causes so many problems for many professional and individual investors alike. That portfolio doesn’t exist.

CalPERS can’t control the reaction from the media based on their meaningless one year return numbers, but they do need to set realistic expectations for the performance of the markets and their own portfolio for planning purposes when it comes to the future liabilities they’re tasked with meeting.

Judging your portfolio based on one year’s worth of results is a great way to over-react, make unnecessary changes, take avoidable risks or abandon a legitimate process. In a diversified portfolio, one year returns are meaningless. It’s the long-term that you need to worry about in terms of performance.

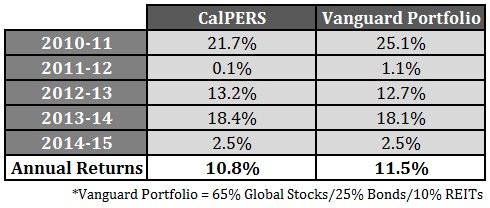

On that end CalPERS is doing okay, although not great for as much attention as they receive from the media. I looked at their asset allocation and tried to come up with a reasonable proxy using a very simple, low-cost Vanguard mutual fund portfolio for comparison purposes. Here are those results over the past 5 years through June 30 (CalPERS runs on a June 30 fiscal year end):

It’s difficult to make perfect apples-to-apples portfolio comparisons without knowing the specifics of how a fund is managed. But it is worth noting that the Vanguard portfolio requires no leverage, has daily liquidity, offers transparency of holdings and the best part of all — it’s extremely simple and easy to understand. You know exactly what you’re getting in the simple portfolio. Voters and trustees don’t complain about index fund fees.

The past five years have seen a relentless bull market in U.S. stocks, so it’s no surprise that CalPERS would underperform an indexed portfolio. But it should come as no surprise to anyone that a $300 billion dollar fund would either underperform or closely track a market benchmark. When a fund is that large it becomes nearly impossible to outperform the market by choosing outside money managers. Shouldn’t a simple index fund portfolio be the default approach for CalPERS? It would save them many of the PR issues they’ve been dealing with over the years.

Portfolio management is not just about selecting professional money managers in hopes that they will outperform a pre-determined benchmark, as some in the industry would have you believe. Running a fund of that size is no joke. Investment management is just one of the jobs that a good portfolio management team performs for a pool of assets such as this. Not only do you have to manage the investments and cash flows on a day-to-day basis, but you also have to pay attention to liquidity constraints and deal with the political pressures that come along with managing the largest pension fund in the nation. Communication of your process is one of the most important aspects of running money for someone else and they’ve dropped the ball over the years in this regard.

Over the past couple of years CalPERS has spent a lot of time in the press discussing their strategy for getting rid of hedge funds or defending the fact that they don’t have a proper accounting of their private equity fees. These PR campaigns are nothing more than a distraction from the most important aspects of portfolio management that they should be focusing their time on — namely asset allocation, risk management, portfolio construction, liquidity management, defining and implementing their overall investment process and achieving their stated goal of meeting the future pension liabilities for their fund members.

Source:

CalPERS misses its target return by a wide margin (LA Times)

Further Reading:

The Danger of One Year Performance Numbers

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.

If people choose pension funds over Social Security if they have tough years the tax payer should not be responsible to make up the short fall after all we are not asking those same folks to SHARE their profits when we have a short fall so why should the tax payer be their back up? The people who choose to pay into their pension and forgo SS should have the same risk as anyone who gives their money into an investment vehicle. They are collecting a much larger amount than SS –double, triple or more and they want safeguards from the taxpayer. INSANE—

It is insane. But this is the new quasi-socialist America and public sector jobs pay better with better fringe benefits than do private sector jobs. Politicians see private sector as the bad guys and want to keep the votes coming in from public sector employees. As you know, when you can vote yourself money and various benefits, you will until it is not there anymore.

I am not against some social services it’s needed but this one where you choose to leave SS for a pension should be totally out of the Tax payer’s liabilities. We can’t be everyone’s backup.

Mark, Many public jobs are more difficult and require more education than private. Plus, public jobs don’t typically include extra pay each year. I understand but if the private sector employees would flood the public job market for better pay, wages would not go up!

‘Shouldn’t a simple index fund portfolio be the default approach for CalPERS?’

This is a question every investor should ask themselves. If you can’t beat a simple 3-component mix of stocks, bonds and REITs, why are you actively managing?

Later this year I’ll be unveiling a system using these same three components (stocks, bonds and REITs), but with a couple of momentum-based sub-choices within the three asset classes. Simple is good!

That’s a very true statement. I agree and this includes both individuals and institutions.

Keep me posted on your new system. I’d love to take a look.

[…] Does Calpers need a simpler approach? (awealthofcommonsense) […]

[…] Further Reading: My Thoughts on Hedge Funds Does CalPERS Need a Simpler Approach? […]