There’s an old saying that stress is the difference between where you are and where you would like to be. If that’s the case there are a lot of people still trying to get to where they would like to be when it comes to their finances.

A new survey from Legg Mason found that people spend an average of one hour and twenty minutes a day thinking or worrying about money. That’s nine hours a week, just shy of 500 hours a year or roughly 20 days. And 10% of respondents claimed to spend two to three hours a day stressing out about money.

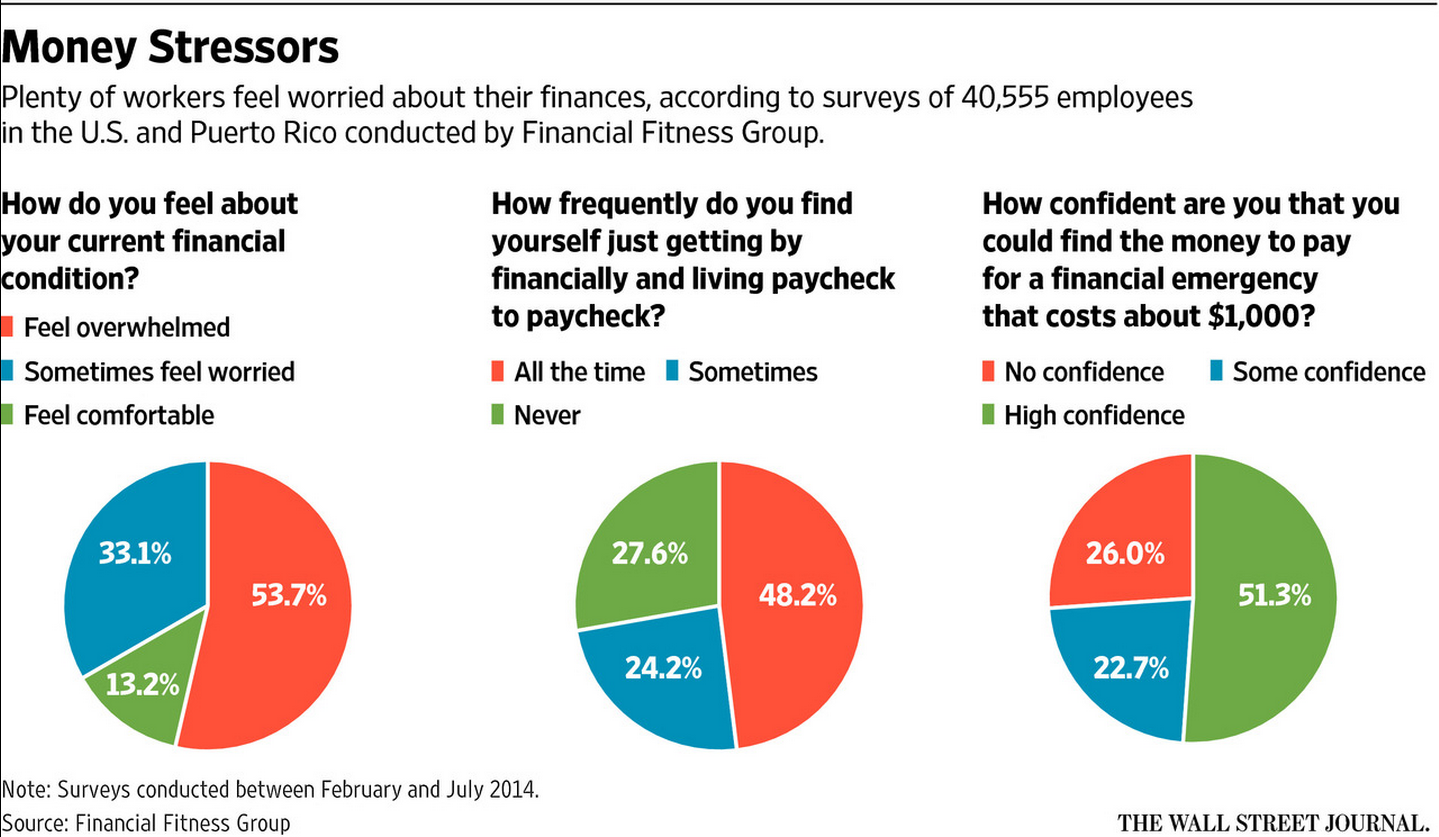

Yesterday the Wall Street Journal shared another survey, this one from a group of employees, that showed why people can find money decisions so overwhelming:

There aren’t too many people that are confident about their financial standing as over half of this group feels overwhelmed by their current financial condition and nearly half find themselves living paycheck to paycheck. Employers are starting to take notice and some are even trying to remedy the situation because financially stressed out employees can be an issue on the job:

Companies say financially stressed workers call in sick more often and may be delaying retirement. In 2013, 76% of employers said they were interested in financial-wellness programs, according to a survey by Aon Hewitt. Last year, 93% said they were planning to create or expand their efforts.

This makes sense. Employees that are stressed out about their finances will have a difficult time focusing on their job during work hours. Educating people on their personal finances and investments is a great way to make for a better working environment. In a way it’s a form of preventative care if they can stop the problems before they get out of hand.

Depending on which study you’re looking at, arguing about finances is one of the top two or three biggest reasons that couples get divorced. It still amazes me that one of the most important aspects of people’s lives — personal finance — is a subject that’s not taught in school.

I used to think that most people should be able to handle their financial situation on their own and teach themselves how to save, invest and deal with other important aspects of financial planning. My position on this has slowly changed over the years. I’m now convinced that the majority of people would be better off getting sound advice from a reasonably priced financial professional or advisor.

There are simply far too many important parts of your life that finances can affect if you don’t know what you’re doing. You’re never going to be able to save everyone from themselves, but I think there needs to be a better way to educate people about their finances. Too many people are on their own when it comes to making financial decisions.

Sources:

Can Companies Solve Workers’ Financial Problems? (WSJ)

U.S. Investors Need $2.5 Million For Retirement (Legg Mason)

Further Reading:

Personal Finances > Portfolio Management

Investing, Basically

Is Financial Literacy a Lost Cause?

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

I wonder how much employee stress could be alleviated if employers took some of that money they’re paying their friends– err, consultants for financial wellness programs, and paid employees with it? http://www.businessinsider.com/profits-high-wages-low-7-2013

(Answer: not all stress. But would it help any?)

No. Think about those pie charts up there. Many of those people worried about money make plenty of it.

It’s possible. Studies have also shown that most people are more satisfied at work when their employer cares about them. Money is important up to a certain level, but most people just want to know that their employer appreciates them.

Companies could/should pay more but I think some of the onus has to go on employees to figure out how to negotiate better and network to move up in their career. Eventually you have to start helping yourself in the companies won’t make it easy for you.

Brandon is right on. If we want to help people with money worries teach them two things: 1) How to live within their means and 2) How to save. Very much the same thing. Once people start to save and see how capital can grow, they then can feel & see value of having a nest egg. Having $100k’s in retirement accounts is a great step to financial security in the future, but in the short term it is very empowering to know you have that nest egg, relieving the finance related anxiety discussed in this post. Cheers!

Yup, this is often the hardest thing for people to get right. I always talk about lifestyle inflation and how it can be a real killer even when people start making more money.

[…] But Ben recognizes much of the stress is due not to lack of investment planning but rather comes from a higher level–lack of personal financial planning. And that individuals can’t do it on their own: […]

[…] Stressing Out About Money (awealthofcommonsense) […]

I agree with Marcus but would add 3) Where to find low cost investment vehicles such as index funds from companies such as Fidelity and Vanguard and others. And 4) How to create a diversified stock mutual fund portfolio consisting of no more than five funds.

Luckily this is becoming easier now, but you’re right — I get questions all the time from readers about how to build a portfolio and where they should be looking for the right fund selections.

[…] https://awealthofcommonsense.com/stressing-out-about-money/ […]

[…] Sources: The White Coat Investor: Investing for Physicians (The Lange Money Hour) Why Smart People Make Big Money Mistakes and How to Correct Them […]

[…] had a conversation with an individual about the very last sentence in this Ben Carlson post Stressing Out about Money, "Too many people are on their own when it comes to making financial decisions." As […]