A young investor with robo-advisor Wealthfront is seeking advice based on his 2014 performance. Here’s what he posted on the Bogleheads forum:

I have aggressive profile on wealthfront (9.3 out of 10).

My return for 2014 is paltry 1.3% compared to S&P.

Wondering if I should ditch them or stay with them.

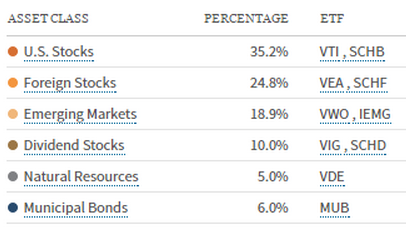

Then he shared his portfolio allocation:

The S&P 500 was up over 13% in 2014 and this guy is looking at a 1.3% gain. What gives?

First of all international stocks (VEA) were down nearly 6%. Emerging markets (VWO) were more or less flat. Dividend stocks (VIG) underperformed by nearly 3% and energy stocks (VDE) got hammered, down almost 10%. When one market, U.S. large cap stocks, dominates every broad investment class, it’s easy to feel like a sucker for having anything else in your portfolio. But this is just one year.

Our investor may have felt differently during past cycles:

2014: Why am I invested in emerging markets? They were down 3 out of the past 4 years.

2009: Why don’t I have more of my portfolio in emerging markets? They were up 75% this year.

2014: Why would I invest outside of the U.S.? U.S. stocks are up almost 22% a year since 2009 while my portfolio is only up 16.4% per year.

2002-2007: Why am I so heavily invested in U.S. stocks? My portfolio is up 21% per year, mainly from international stocks, but my U.S. shares are only up 13.8% per year.

2014: Why didn’t I hedge the U.S. dollar in my foreign stocks? The dollar led to a 10% loss in my international stocks last year.

2003-2005: Why would I ever hedge the foreign currency impact on my international stocks? The dollar is down 40% over the past three years.

You could play this game every year, but you’re never going to have the best performance with a diversified portfolio. You’ll also never have the worst. To see the other side of this story, from 2005-2007, this portfolio would have been up 16.6% per year, against an annual return for U.S. stocks of just 9%. Even extending this portfolio back a decade, which includes the financial crisis, it would have yielded an investor a 7.7% annual return. Not bad.

The point is that there will always be periods you can point to where your portfolio will trail certain markets, sectors or funds. Worrying about that type of short-term performance is never helpful. It only causes unforced errors, poor market timing decisions and unnecessary stress.

You also have to remember that when you’re young and in the accumulation stage, your performance is bound to be affected by your contributions. When the markets move higher, your returns are going to look worse if you’re making contributions throughout the year because you’re continually buying at higher prices. In the down years this will work the other way to your advantage as you buy shares at lower prices.

If you’ve decided that a diversified, low-cost asset allocation approach is right for you, you have to get used to the fact that not every year is going to be gangbusters. There are going to be certain asset classes that lag. You’ll hate at least one — and quite often more than one — of your funds or asset classes in any given year. But this is to be expected. Diversification is about the long game.

Could you quibble with this young gentleman’s portfolio allocation? Sure, you could make some changes here and there that could make a difference. But over time, by consistently making contributions to a globally diversified stock market portfolio at low costs, you can’t help but build wealth over time.

Every single year you’ll be able to play the ‘what if?’ game with your allocation no matter where you have your funds. There are always going to be parts of your portfolio that you are uncomfortable with at times. To paraphrase Keynes, it is the duty of the long-term investor to accept periodic losses and underperformance and act accordingly. You should only judge your results over the long-term, not a single year.

Source:

Bogleheads

Further Reading:

The Danger of One Year Performance Numbers

In Search of the Perfect Portfolio

The Robo-Advisor Challenge

My question regards Wealthfront’s service: How are they supporting this young investor’s decision-making process, given that he is on the path of a well-known behavioral error?

They should at least be in touch with him to keep him off the edge of an unforced error. As a ‘robo-advisor’ they should know that he is probably disappointed with his performance.

Great question. And this is just relative underperformance. People are going to get really shaken up when they see absolute losses.

I would be shocked if they didn’t try to hire actual advisors eventually. The behavioral coaching and counselling is something probably 95% of individuals need, maybe not a consistent basis, but a few times a year for sure.

“You could play this game every year.” Yes.

One of the reasons people are always so tempted to make changes to a plan, even if it’s well thought out. The grass is always greener…

“If you’ve decided that a diversified, low-cost asset allocation approach is right for you”

How does one even make that decision? And what other decision is to be made by a 20-30 something investing in IRA’s? I’ve never really consciously made that decision, but I wasn’t really aware of any other option besides paying a guy 1-2% to do the same thing for me.

Great question. First you have to figure out how hands on you’d like to be. Can you make asset allocation decisions on your own and can you stick to an investment plan for the long-term? Or do you need an adviser to pick funds for you and make sure you don’t buy and sell at the wrong times? There are now many options to either do this on your own or automate the process through a robo-advisor is you’re not comfortable paying someone to do it for you.

Maybe this is something I’ll cover in more detail in a future post.

Ben, the best advice I can give you is to never use the phrase “make sure” when it comes to advising, investing or generally anything else in life. There is no such thing, no matter what a high government official or an advisor or even your mother tells you.

Wise up. Just help people make sensible decisions and don’t try to predict the future.

I addressed your question in a post:

https://awealthofcommonsense.com/do-young-investors-need-a-financial-advisor/

Let me know what you think.

Excellent advice Ben. Thanks very much!

You got it. Thanks for the question. It’s an important one for young people to consider.

Here is a handy illustration of how asset class returns change from year to year:

http://www.blackrock.com/investing/literature/investor-education/asset-class-returns-one-pager-va-us.pdf

One of my favorite charts to keep myself honest over the years. It’s difficult to not be humbled by the markets as an investor when you look at those numbers.

also none of his ETFs / Funds had the word “dynamic” in their title.. that could have also contributed to his lagging the S&P…

That’s cruel, Joe.

But seriously, a real dynamic model that picks US or foreign stocks, based on their relative past 12 months performance, has been in US stocks since mid-2011.

Ha. Good one.

[…] Worrying about short-term performance is rarely helpful. (awealthofcommonsense) […]

[…] Reading: Advice for a Young Robo-Investor on Asset Allocation The Robo-Advisor Challenge Financial Advice For My Fellow […]

Ben – Nice piece (came across it via Nick Murray’s NL). As an independent, fee-only advisor for close to 15 years now I find it frustrating that young people cannot find good investment advice. I know it goes against the “industry grain” but we never turn anyone away, regardless of age, portfolio size, etc. Yes, there is a limit to what an advisor can do for someone with limited assets (i.e., say under $100k), but he/she can still provide solid advice (i.e., you are just starting out, put your money in these index funds and contribute to them on a regular basis). The advisor’s time commitment is minimal, so he/she should charge a minimal amount (if anything) at this point (call it goodwill, if you like). Now the new investor has a trusted advisor they can turn to (especially when the market collapses) and most importantly rely on for solid advice (if they need it in the future). This simple relationship does and will empower the new investor to continue to invest and grow their assets (which I think should be the goal for all new investors). I don’t think the robo-advisor will do this for you. Cheers! Marcus

Nice, thanks for sharing. I think it’s a missed opportunity for many advisors to help create the right habits and good clients early on that could be much larger clients later. Plus there is going to be a huge wealth transfer from the baby boombers eventually. Glad to hear you’re helping out the younger crowd. We’re in agreement that many could use the help.

I actually wrote another piece on this as a follow-up if you havent’ seen it:

https://awealthofcommonsense.com/do-young-investors-need-a-financial-advisor/

Ben – I did read that piece. Sounds like we share many of the same investing/savings beliefs. Keep up the great work! I’ll continue to follow you on twitter, etc. Cheers! Marcus