Generally, investing in different factors will give you a diversification benefit because certain styles tend to perform differently depending on where we are in the market or economic cycle. As with most investing rules of thumb, you can usually only bank on this relationship working out most of the time, not always.

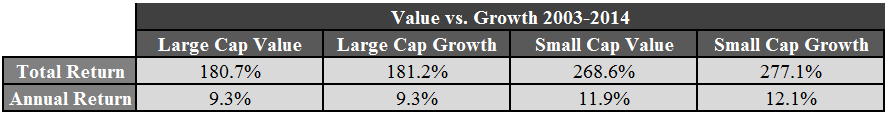

I was looking at some of the performance numbers for Vanguard recently and found some interesting results for their various growth and funds. These are the large cap and small cap growth and value fund performance numbers since 2003:

The large cap fund returns are almost identical for value and growth stocks while small cap growth is only slightly outpacing the small cap value. The similarity between the two different styles is pretty remarkable when you consider all of the ups and downs we’ve experiences in that time.

You can get an even better sense of how close these returns are by looking at a chart that shows the growth of $10,000 starting in 2003. Here are the large cap funds, which have shown little-to-no variation over the past few years:

On the small cap side, the slight outperformance by growth over value really started at the bottom of the market in 2009, but still isn’t very pronounced over the entire window:

Interestingly enough, both large cap value and growth have outperformed the S&P 500, which is up 9% a year since 2003. But the Vanguard Small Cap Index Fund has slightly outpaced both small cap value and small cap growth.

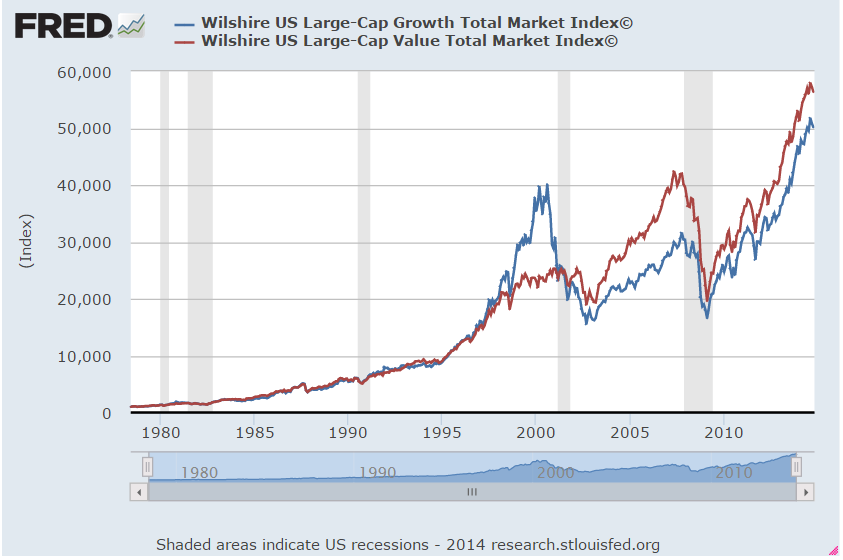

Value stocks have outperformed growth stocks historically by a fairly wide margin over the long-term, but the relationship is very cyclical. Here are the Wilshire Large Cap Growth and Value Indexes going back to 1979. You can see the how pronounced the cycles became in the late-1990s and the early 2000s as each style took its turn with outperformance:

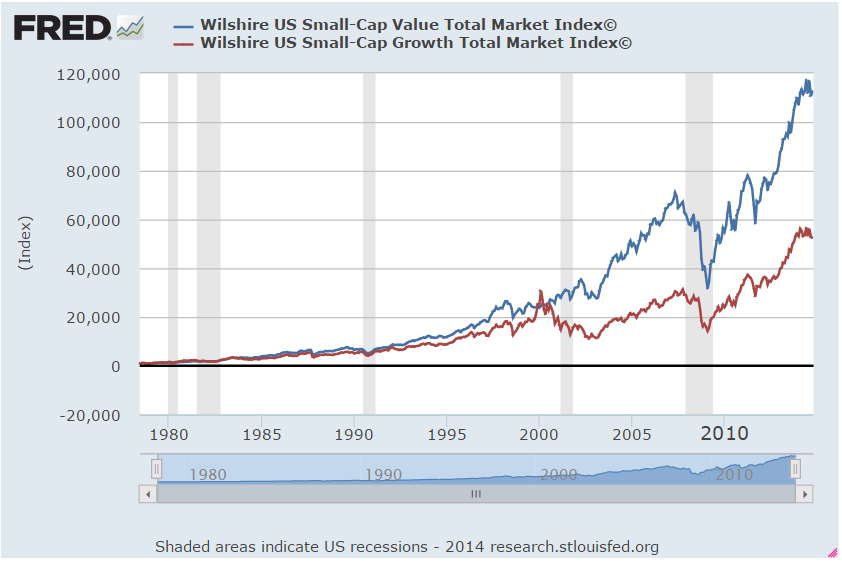

And the Wilshire Small Cap Growth and Value Indexes show their own cycles of over- and underperformance, although small cap value has been the obvious winner by a long-shot:

There are many different variations of value and growth strategies, so these funds and indexes aren’t necessarily representative of all value and growth funds. The Vanguard funds and Wilshire Indexes are very broad and generic.

Still, I found it interesting how closely these two different styles have tracked each other over the past ten plus years, considering their historical relationships. A bull market, followed by a huge crash, followed by another huge bull market has definitely led to higher correlations.

In 2014, large cap growth is up 8.2%, outperforming large cap value which is up 7.3%. Small cap growth stocks have been one of the biggest underperformers this year, with the Vanguard fund down -1.7% while the small cap value fund is up 3.6% on the year.

It will be interesting to see if either style is able to show any clear leadership in performance going forward. Everyone says the easy money has been made (although I don’t think it’s been as easy as some would have you believe). If that’s the case, maybe we’ll start to see some variation between value and growth in the coming years.

Further Reading:

Why Aren’t There More Value Funds?

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

[…] Value and Growth are Going to Matter […]

Ben,

Hope all is well, good article. Clearly highlights the need for a long-term perspective and discipline.

One issue with Vanguard Index funds is that they have tracked 3 different indexes (!!) since 2003. In the 90s/early 2000s they tracked S&P and Russell Indexes. Then they switched to MSCI indexes. A year or two ago they switched again to CRSP indexes. These moves were primarily based on the business of investing – exclusive licensing rights for ETFs, not investor interest (which would have entailed smaller and purer-style indexes with more frequent reconstitution).

I looked at DFAs U.S. large/large value and small/small value funds since 2003, which have benefitted from continual and uninterrupted application of consistent size/style sorts. Through Friday:

DFA US Large Company fund (S&P 500) = +184%

DFA US Large Value fund = +231%

DFA US Small Cap fund = +285%

DFA US Small Value fund = +301%

and similar results for non-US stocks over the same period:

DFA Large Company Int’l fund (EAFE) = +159%

DFA Int’l Value fund = +207%

DFA Int’l Small Cap fund = +301%

DFA Int’l Small Value fund = +348%

So a reasonable spread for “value” over “market”, with a significant spread for the much maligned small over large (hmmmm…)

One other point – these numbers bear out the unconventional but very profitable philosophy of not investing in EAFE-based portfolios, which are simply expensive S&P 500-like strategies. You get much higher returns and better diversification from non U.S. value/small stocks. AAMOF, despite slight non-U.S. Underperformance over this period (EAFE vs S&P 500), Int’l Small Value was the best performing asset class.

Eric

Thanks Eric.

I knew about the most recent switch but didn’t realize it had been that many in such a short period of time.

I had a few people ask me how some of the vallue strategies that aren’t as broad have performed. Very interesting that int’l small value has outperformed US small value.

Even in those Vanguard funds, though, nice to see 9% & 12% annual returns in fairly basic products. So much for the low return world so many have predicted (as you pointed out in your piece last week).

Thanks for the info.