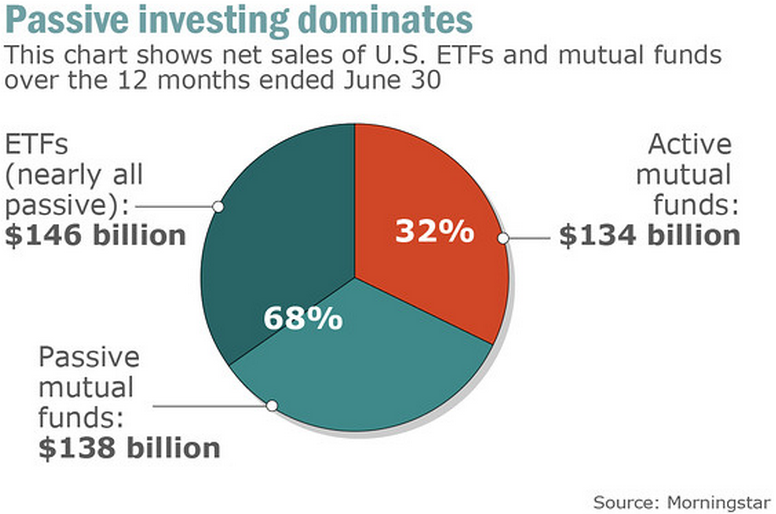

The trend towards passive investments continues to gain steam as more investors are opting for lower cost fund options. See this chart from Morningstar via Victor Reklaitis of MarketWatch:

As the money pours into passive investments some in the industry are warning that this could be dangerous for the markets and lead to instability. The problem with this line of thinking is that it assumes that all index products are being used by buy and hold investors.

As the money pours into passive investments some in the industry are warning that this could be dangerous for the markets and lead to instability. The problem with this line of thinking is that it assumes that all index products are being used by buy and hold investors.

While a long-term outlook could help the majority of investors out there today, ETFs aren’t being used exclusively for longer holding periods. The fact that ETFs trade on the major stock exchanges throughout the day makes it much easier for short-term oriented traders to use them to add broad exposure very quickly. A Reuters story from last week pointed out what’s happening to junk-bond ETFs:

Funds designed for retail investors have morphed into hedging tools that sell off too suddenly, and in too great a size, for illiquid high-yield bonds to keep up.

Hedge funds now account for almost 30% of the holdings of junk-bond ETFs, according to research by JP Morgan, more than any other kind of ETF category except emerging market equity.

And that has ended up particularly hurting retail investors, who end up taking a loss well after the fast-money hedge funds have gotten in – and out – of the market.

This doesn’t exactly sound like a buy and hold passive investment to me.

The problem is that making broad generalizations like passive and active investing completely misses the point. It’s not about index funds versus active funds. It’s about more activity versus less activity and higher costs versus lower costs. You can be a long-term investor in low-cost active strategies. Or you could use a portfolio of index ETFs to trade on a daily basis.

There are different degrees of passive and active and it doesn’t make sense to lump either term with any one type of fund or strategy. There’s nothing special about index funds and ETFs. They are systematic, low cost, low turnover and tax efficient. Active strategies can do these same things, it’s just that not many of them do quite yet.

Lower cost active ETFs are already beginning to hit the market and there’s no doubt that this trend will continue (they have no choice if they wish to attract capital). So the silly debate between active and passive will eventually get phased out as investors will be able to choose from a broad variety of low cost risk factors to build better portfolios.

The great equalizer will always be how active investors are with their decisions for the funds or securities they hold, regardless of whether they’re index funds or active funds. As Buffett’s Fourth Law of Motion states, “For investors as a whole, returns decrease as motion increases.”

Indexed investing doesn’t necessarily mean no activity just like active investing doesn’t necessarily mean tons of activity. It all depends on how an investor chooses to utilize these strategies within a broad investment plan.

Sources:

Retail investors pay price as hedge funds dominate ETFs (Reuters)

Passive investing is now the mainstream method, saysMorningstar researcher (MarketWatch)

Further Reading:

What if long-term thinking really catches on?

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

[…] Passive and Active […]

[…] The lines between active and passive are becoming increasingly blurred. (A Wealth of Common Sense) […]

[…] Blurred lines between active and passive investing by A Wealth of Common Sense […]

[…] make sense to lump either term with any one type of fund or strategy,” writes Ben Carlson at A Wealth of Common Sense blog. “Indexed investing doesn’t necessarily mean no activity just like active investing […]

[…] Further Reading: Blurred Lines Between Active and Passive Investing […]