“It is better to be roughly right than precisely wrong.” – John Maynard Keynes

Financial theory tells us that portfolio construction is about finding a group of assets with low correlations to one another in an attempt to find the highest return for a given level of risk. This is one of the main benefits of diversification – finding investments that zig while others zag.

This makes perfect sense in theory. The problem is when investors assume a false sense of precision when using the correlation statistic or any relationship for that matter. It would be much easier to forecast the future movements of the various asset classes and individual holdings within a portfolio if correlations were static, but they aren’t. Correlations are dynamic.

The interplay between asset classes are always changing and evolving depending on the current economic or investment cycle. And no two cycles are ever the same (see here) which keeps things interesting.

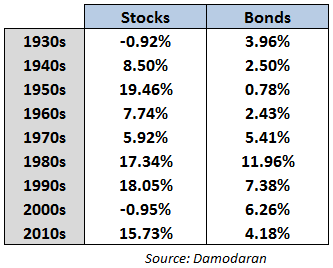

Looking back at the long-term historical performance of stocks and bonds shows how these relationships can change over time. Here are the annual returns for the S&P 500 and 10 year treasuries by decade through the end of 2013:

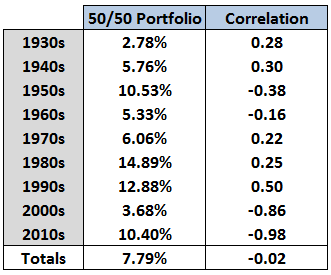

Both return series are cyclical as there were periods were both performed well, both performed poorly or only one did well. Now let’s look at a fifty-fifty portfolio split between stocks and bonds over this same time frame along with the correlations from each decade and the totals:

The fifty-fifty split smoothed out the performance, but the correlation data between stocks and bonds is the interesting takeaway here. Over the entire 80+ years there was virtually no relationship between stock and bond returns (remember a correlation of zero means no relationship while -1 is perfectly negatively correlated and +1 is perfectly positively correlated).

But breaking down the performance by different periods shows that the correlation is in a constant state of flux. At times they were positively correlated. Other times they were negatively correlated. Sometimes negative correlation led to good returns while other times it led to poor returns. The same was true of the positively correlated decades.

The problem with a focus exclusively on correlation is that stocks are up on average three out of every four years. So there isn’t an investment that perfectly offsets the risk and returns from stocks with similar performance. Correlations also tend to change when high returning strategies are discovered by the wider investing community.

This doesn’t mean that statistics such as correlation aren’t useful when considering certain strategies to implement within a portfolio. It’s just that the data doesn’t really mean anything unless it’s put into the correct context. The best investors can do is put together a group of distinct factors in a portfolio with different expected risk and return profiles.

Derek Hernquist shared a quote from Charles Wheelan in a post a few months ago that was so good I had to use it again:

Statistics cannot be smarter than the people who use them. And in some cases, they can make smart people do dumb things.

As with most investment tools, statistical relationships can be helpful to pay attention to, but investors must understand that they can change over time.

Source:

The only truth in markets is surprise (Derek Hernquist)

Now onto the stuff I’ve been reading over the past week:

- It’s impossible to predict which factor will pick the perfect portfolio of stocks (Millennial Invest)

- A history lesson in global stock market returns (Philosophical Economics)

- A simple strategy for shaking confirmation bias (Big Picture)

- The simple act of doing nothing (Wall Street Fool)

- Learning to love volatility (Rick Ferri)

- Investing lessons from the best trade in NBA history (Total Return Investor)

- Real investors root for down markets (Reformed Broker)

- A financial advisor should be there to help prevent that one big mistake from occurring (Carl Richards)

- It doesn’t get much worse than the stock market in the 2000s (Irrelevant Investor)

- Video: The stock market since 1927 seen through Time magazine covers (YouTube)

- Podcast: Michael Mauboussin with Barry Ritholtz on skill vs. luck, process vs. outcome and much more (Bloomberg View)

[…] Abandon any hope of precision you have in the investing arena. (WealthOfCommonSense) […]

[…] There’s No Such Thing As Precision When Investing (A Wealth of Common Sense) […]

[…] writes an excellent investment blog called A Wealth of Common Sense. This post looks at why there’s no such thing as precision when it comes to investing and constructing your […]

[…] I’ve pointed out before, these relationships are never static over the years as the market environment is constantly […]

[…] Reading: There’s No Such Thing As Precision When Investing […]

[…] also: There’s no such thing as precision in the markets & How often do stocks and bonds decline at the same […]

[…] Further Reading: The CFA vs. MBA Decision There’s No Such Thing as Precision in the Markets […]